Recommendation Info About Rental Property Profit And Loss Statement Financing Activities Definition

Learn how to create a rental property profit and loss statement with landlord accounting software and how to use it to monitor your business.

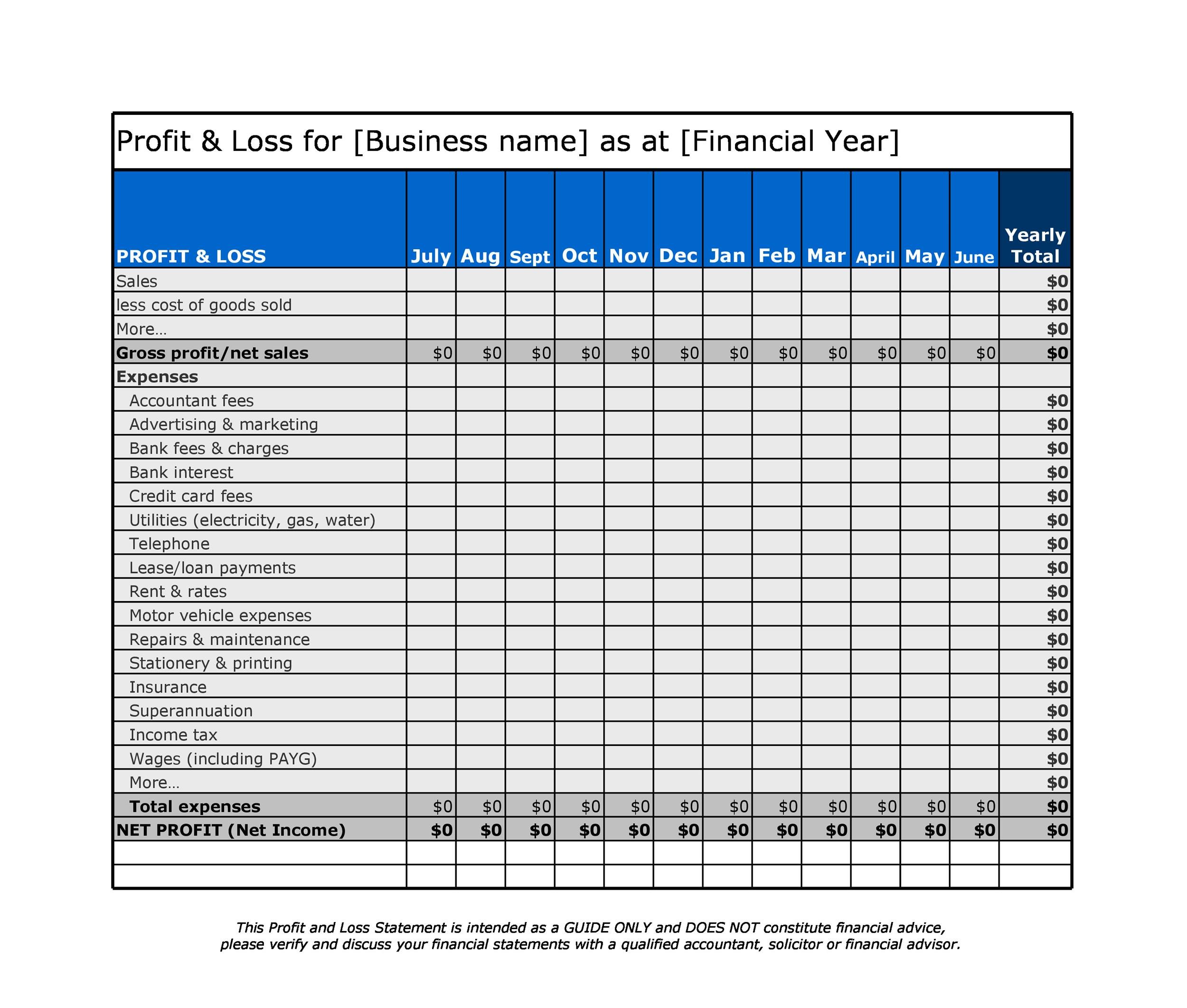

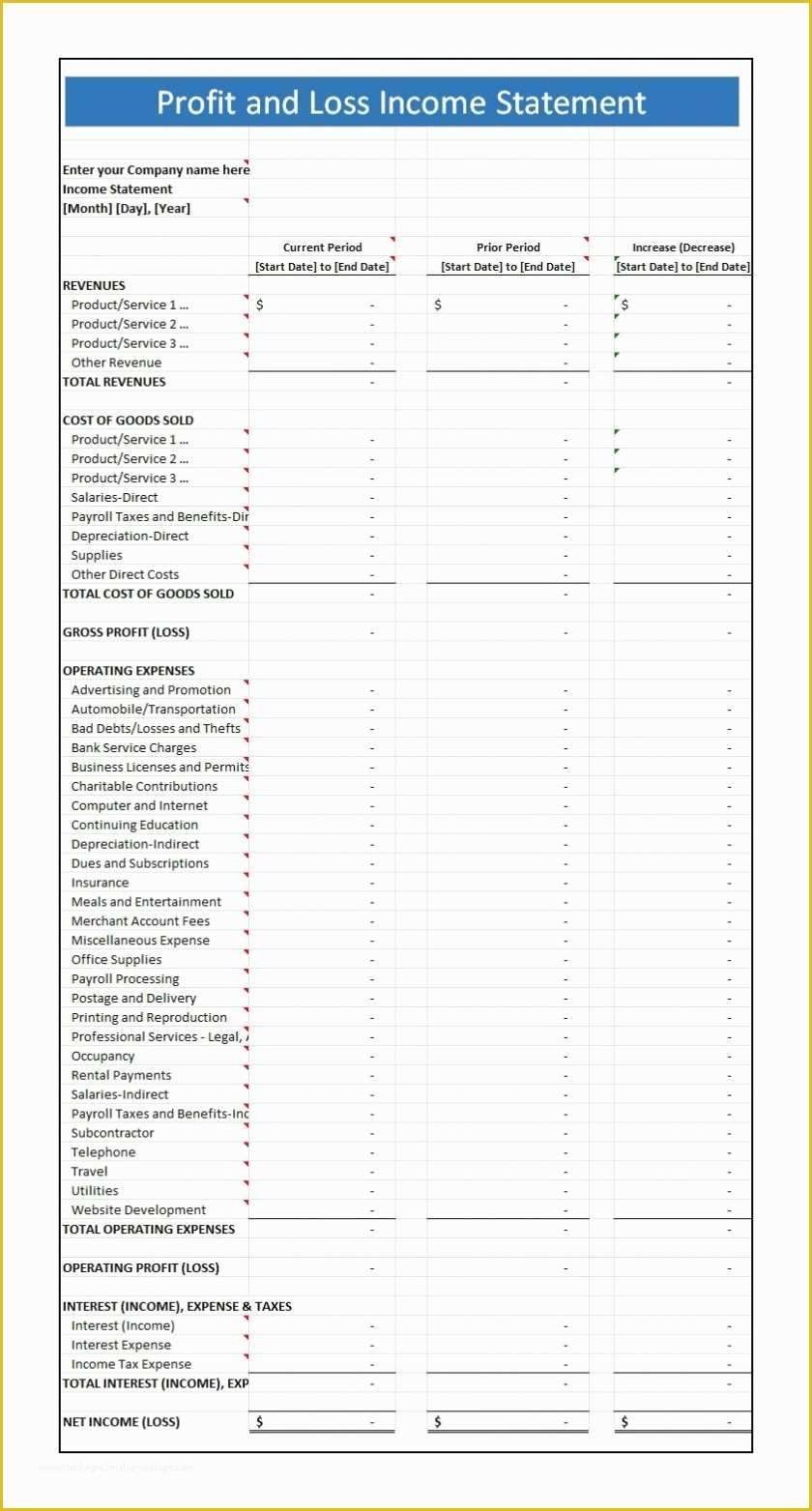

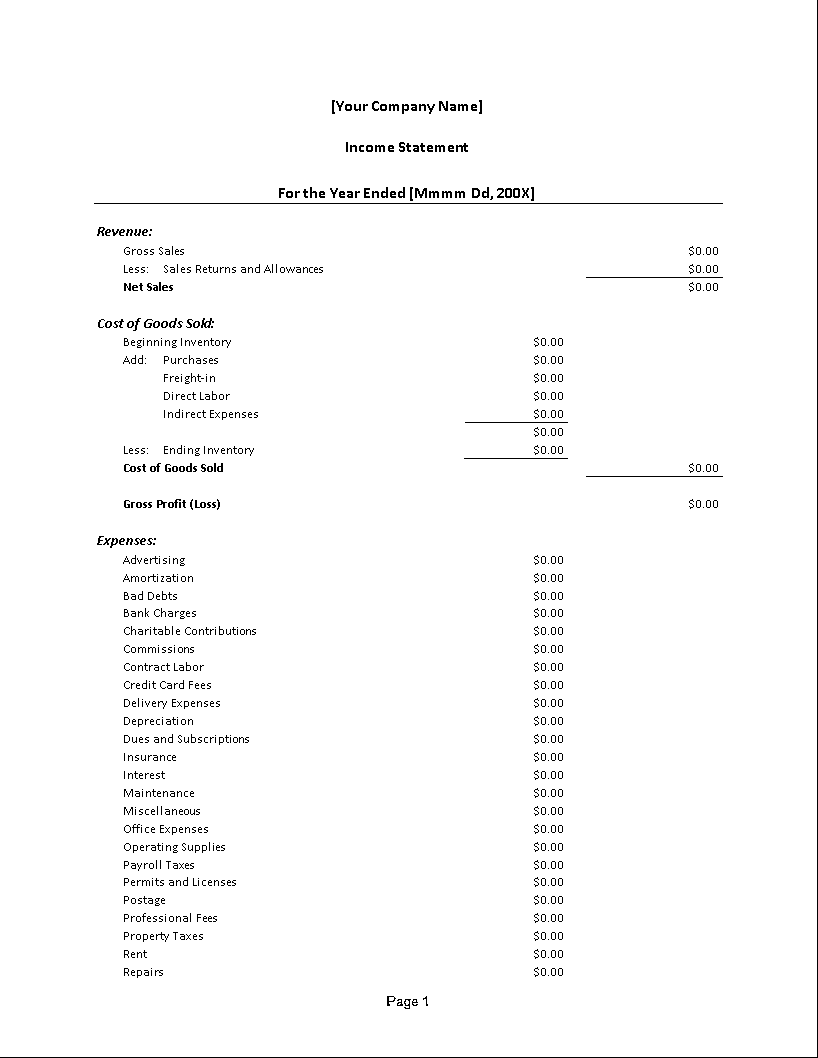

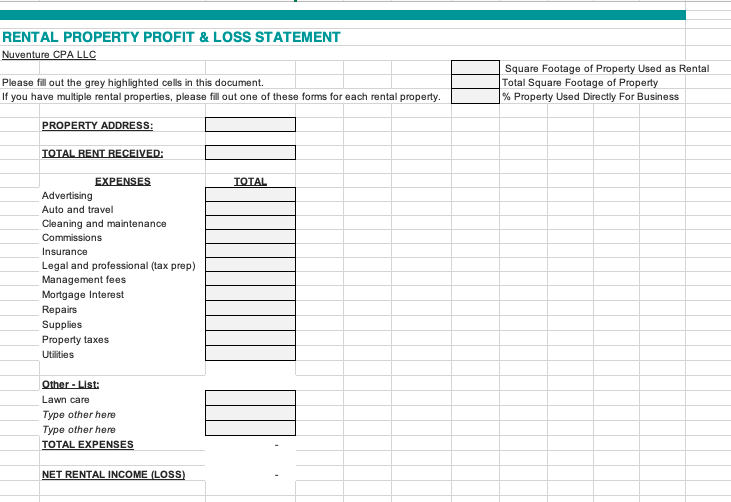

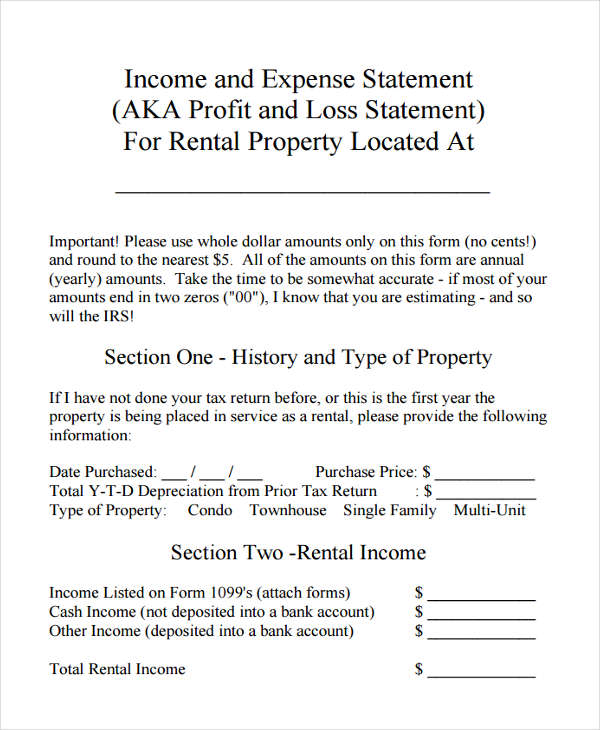

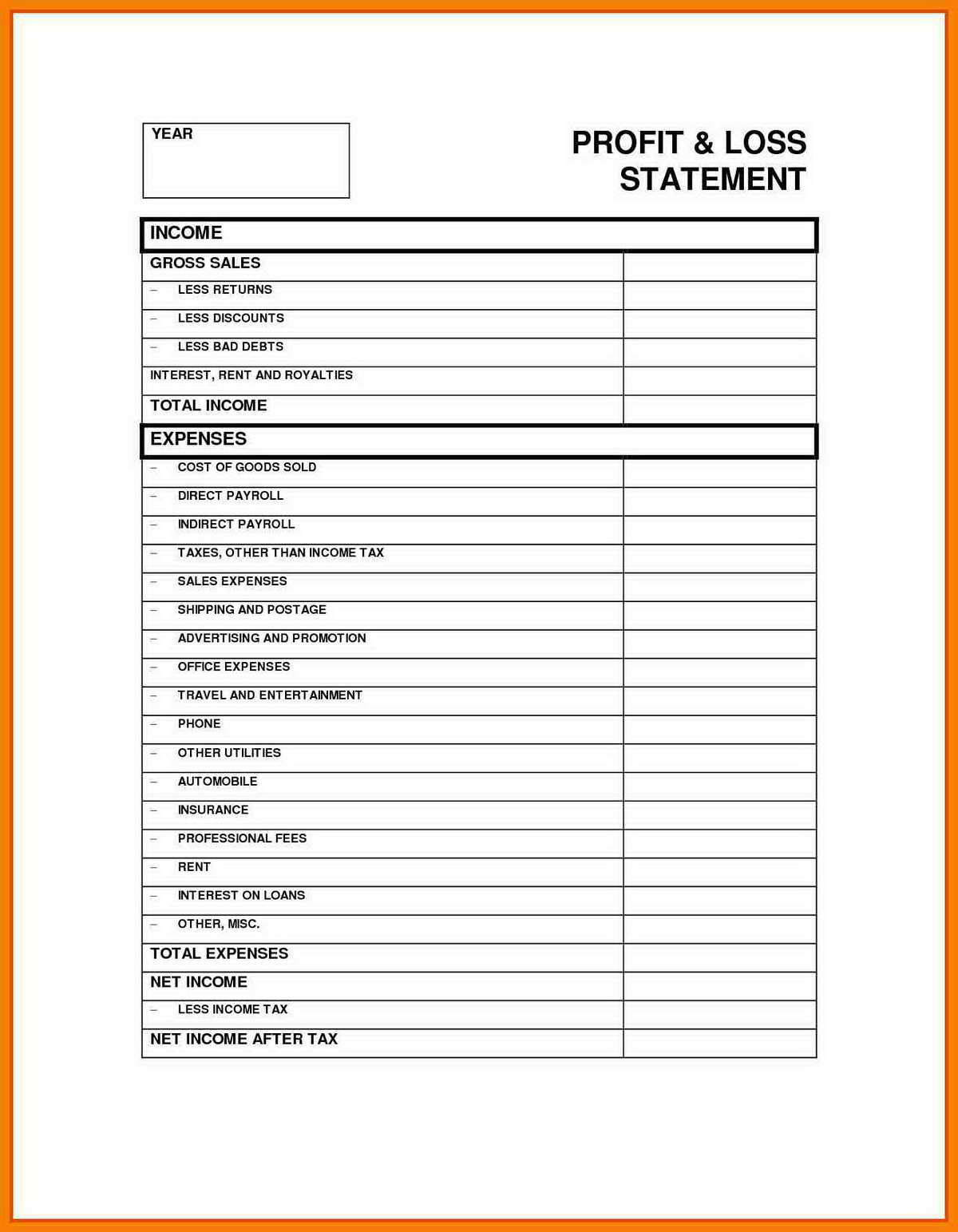

Rental property profit and loss statement. A profit and loss statement for rental property is used by owners and property managers to track income and expenses and the corresponding profits (or losses). By tracking key components like income, expenses,. A p&l statement is a key financial document that summarizes your rental property income and expenses for the irs (and yourself) for a given period of.

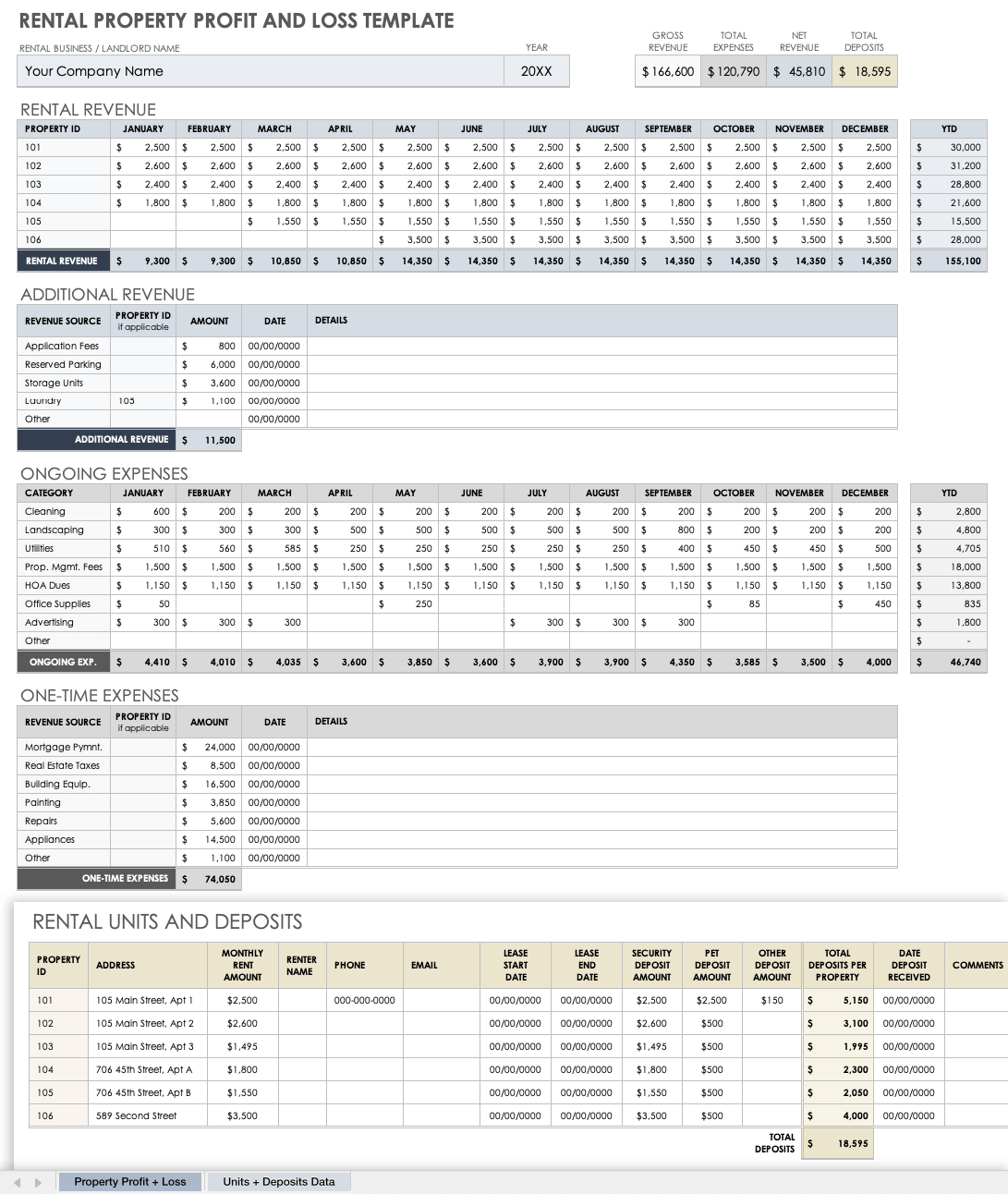

Analyze your profit and loss: Rental property profit & loss template this template is designed for rental property owners who are having trouble compiling accurate financial information. This worksheet, designed for property owners with one to five properties, has a section for each category of income and spending associated with managing a.

A profit and loss statement belongs a report that summarizes income, expenses, and web operating income over a specific spell of time. Input your data: Let say the property manager is unable to lease units to future.

If the vacancy rate is 3%, the annual anticipated rental income is $240,000 x 97% = $232,800. The data compiled within these reports. Key takeaways using a rental property spreadsheet template can save you time and money.

Also known as an income statement or p&l, a rental property profit and loss statement reports the current financial performance of a property. The use of a profit and loss statement takes the guess work out of the rental property analysis and provides the owner with hard evidence of the performance. A p&l statement compares company revenue against expenses to.

Making this statement isn't overly complex, but it's extremely helpful. Rental property profit and loss statement. Rental property income statements — often known as profit and loss (p&l) statements — are a key component of any investment property analysis.

A profit and loss statement helps rental property owners evaluate the financial performance of their investments. Enter your rental property’s income and expenses into the respective sections. A good profit and loss account will help.

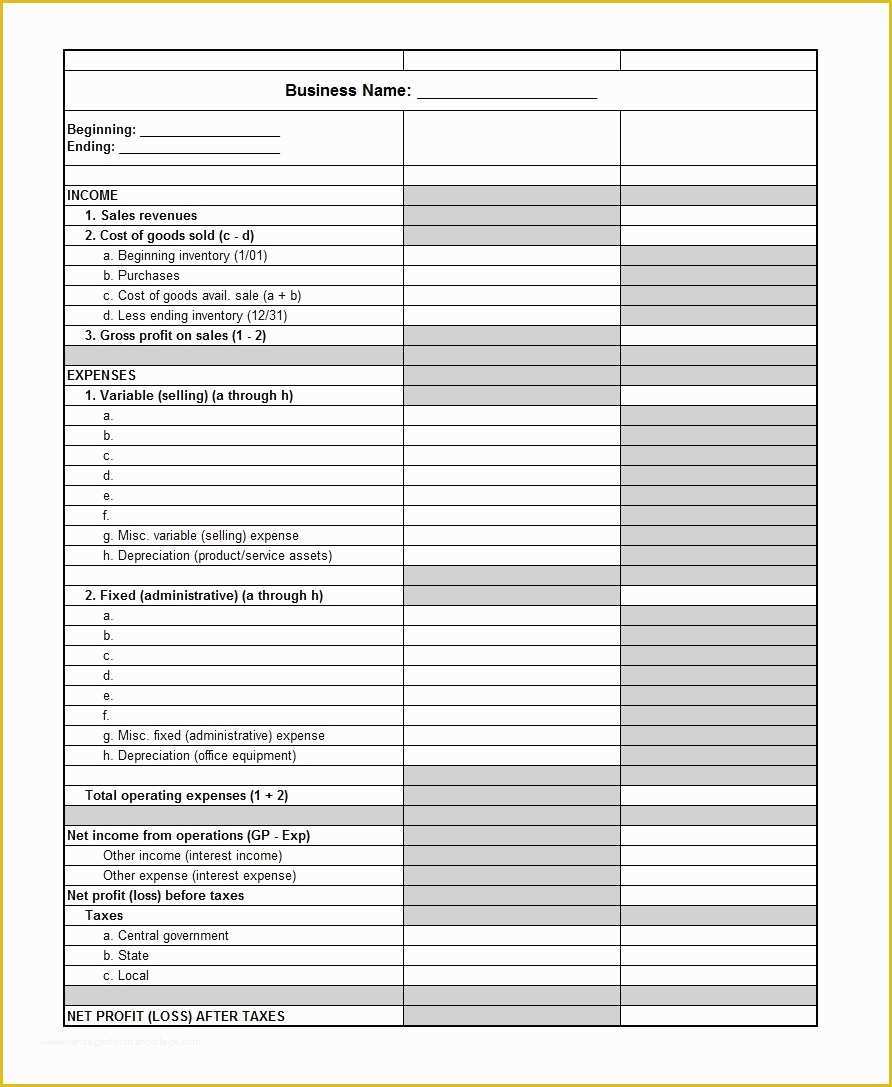

Many different types of templates are available, so you can find one that fits your. The rental income statement (also known as a profit and loss or income expense statement) is a financial report used by landlords that shows a breakdown of all income. The single step profit and loss statement formula is:

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Hotel-Profit-Loss-Statement-Template-TemplateLab-scaled.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Rental-Property-Profit-and-Loss-Statement-Template-TemplateLab.com_-scaled.jpg)