Beautiful Tips About A Financial Statement Limited Company Balance Sheet Format Aat Of Position

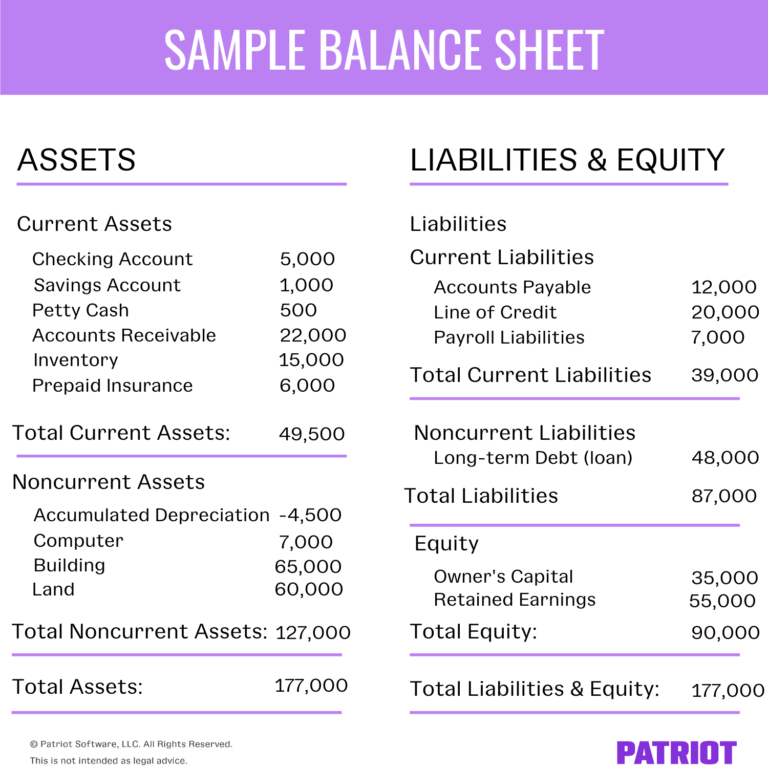

What your business owns (assets).

A financial statement limited company balance sheet format. It reports a company’s assets, liabilities, and equity at a single moment in time. Presented in a structured format, these reports are usually prepared by your accountant or finance team. In other words, it lists the resources, obligations, and ownership details of a company on a specific day.

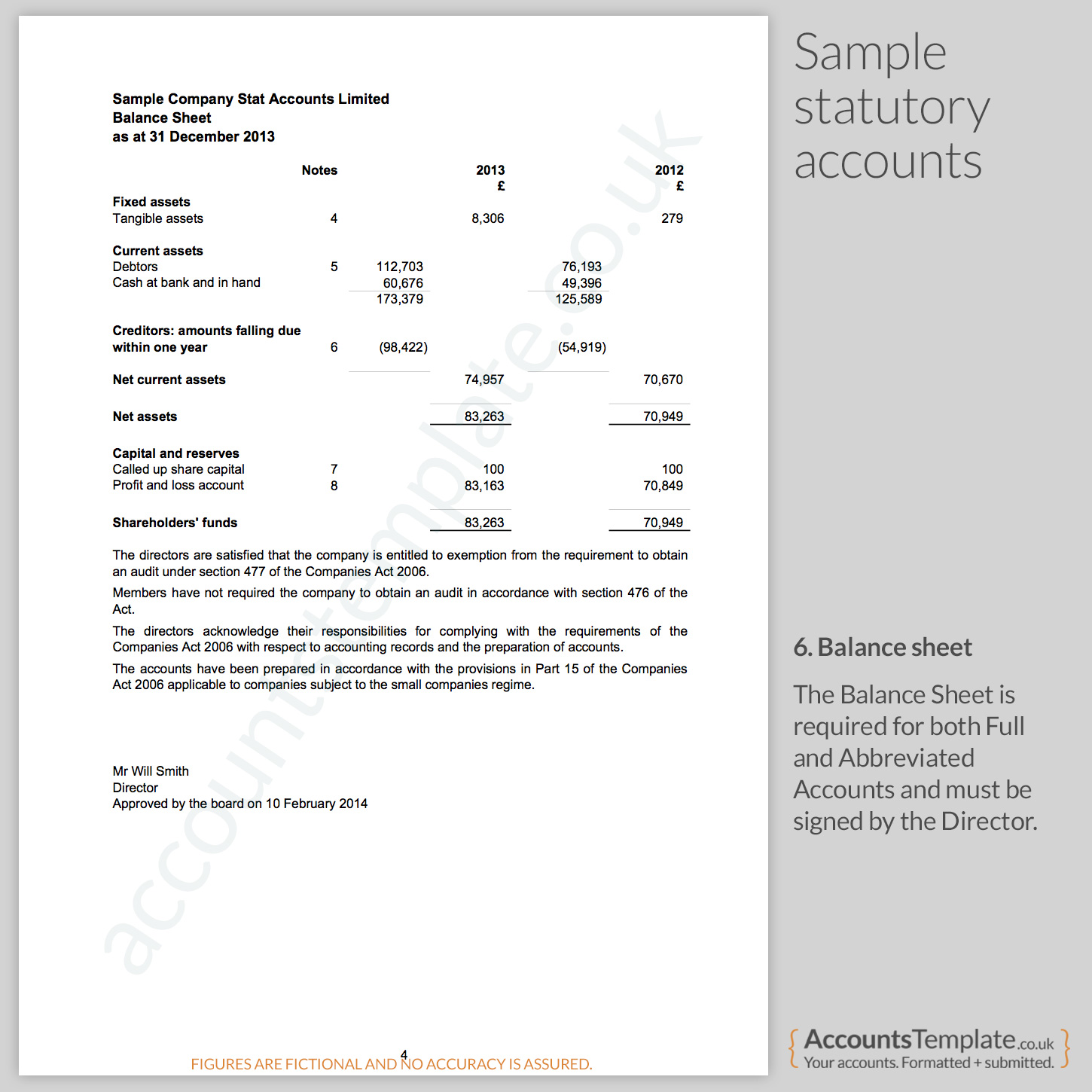

If you run a limited company, your balance sheet forms part of your annual (statutory) accounts. We will look at the relationship between the profit and loss account and the balance sheet and provide an introduction to the relationship between profit (or loss) and cash flow. The statement of financial position, often called the balance sheet, is a financial statement that reports the assets, liabilities, and equity of a company on a given date.

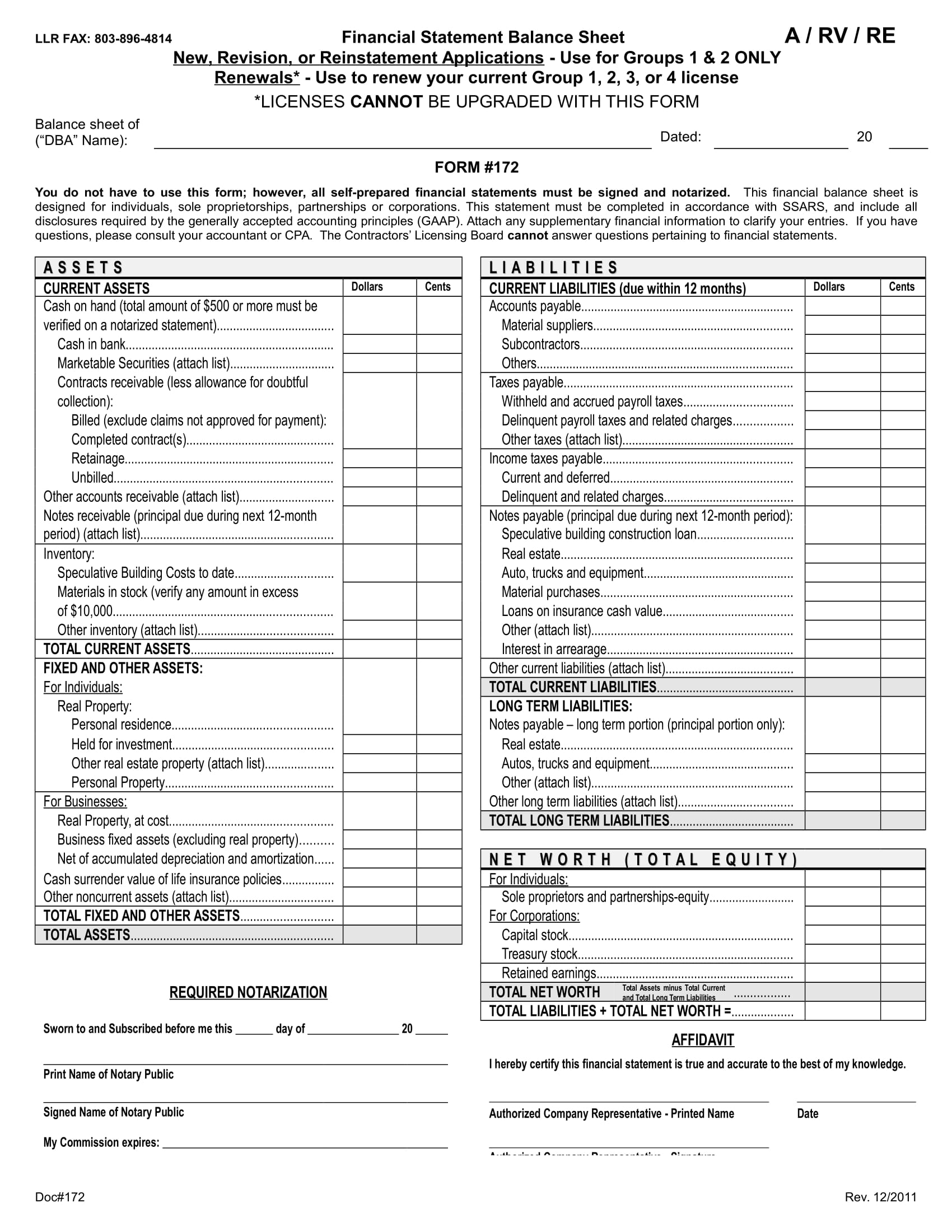

This is to ensure that the financial report adheres to the generally accepted accounting principles. A ‘balance sheet’, which shows the value of everything the company owns, owes and is owed on the last day of the financial year. The financial statements generally include two statements:

For a small company's balance sheet, the organization may use the simple financial statement format as described above. Assets = liabilities + equity. We then go on to look at the cash flow statement and the statement of total recognised gains and losses, which are required by accounting standards.

As fixed assets age, they begin to lose their value. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Limited companies are legally required to produce financial statements (both a balance sheet and profit and loss account) when they file their company accounts at the end of the financial year.

Balance sheet and statement of profit and loss which are required for external reporting and also for internal needs of the management like. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. The balance sheet is based on the fundamental equation:

For a larger company, the business often will break it down to current and. You can think of this like a snapshot of what the company looked. Assets = liabilities + equity.

(ii) a profit and loss account , or in case of company carrying out activity The balance sheet shows the value of assets, liabilities, and capital funds at the end of the accounting year of the organisation on a particular date. Financial statements 2021’ (‘example financial statements’).

An example of a statement of financial position. Format of the balance sheet. A balance sheet of a company is the summary of the company’s assets and liabilities.

Below is the balance sheet formula. A balance sheet is a financial statement that shows: The assets are listed on the left hand side whereas both liabilities and owners’ equity.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)