Formidable Tips About Payment Of Interest On Notes Payable Cash Flow Westrock Financial Statements

Interest paid is the amount of cash.

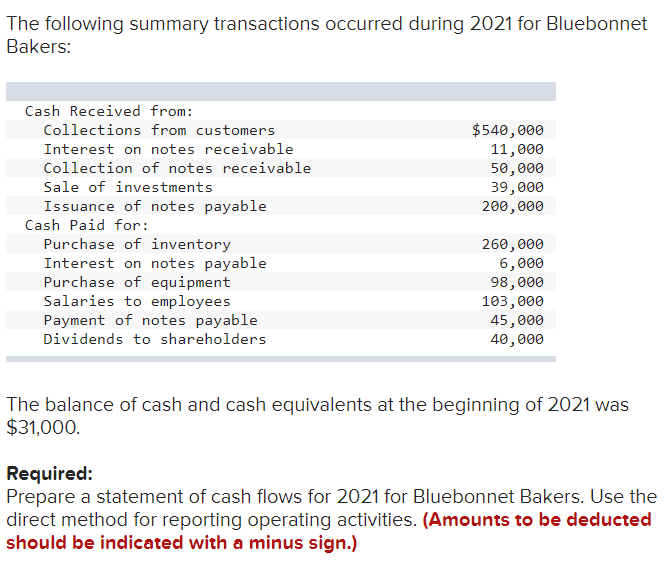

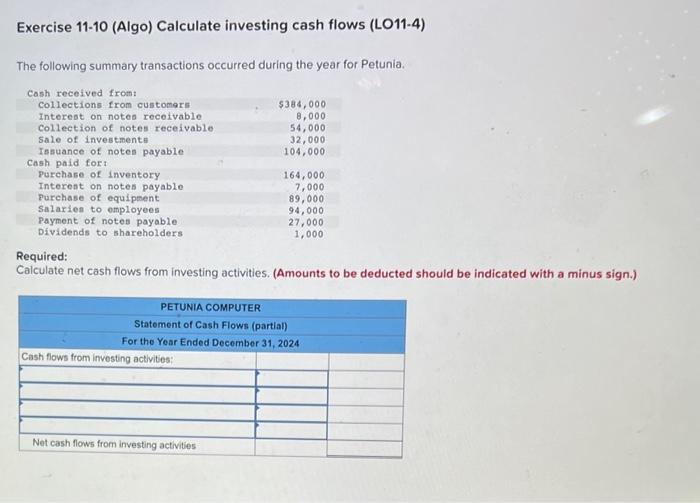

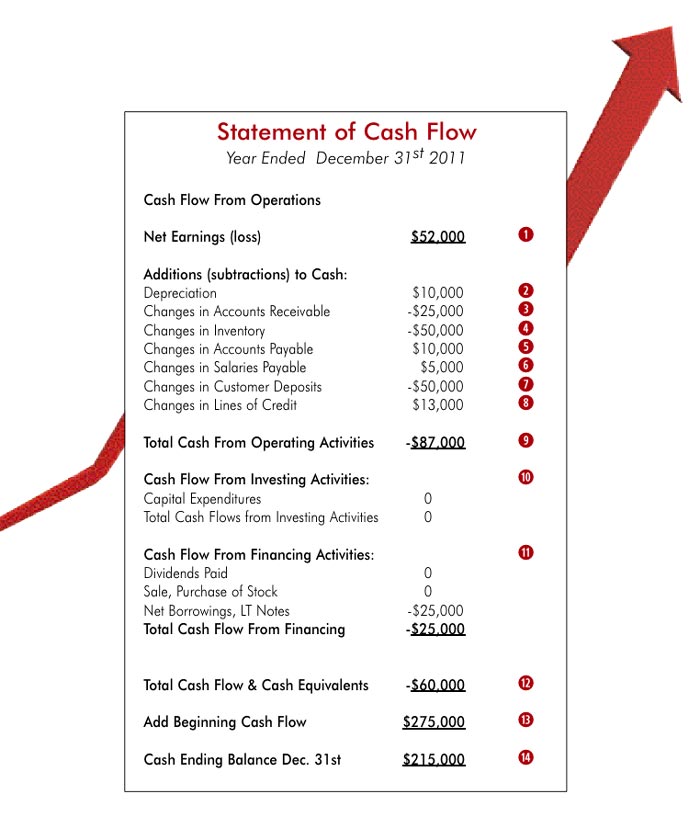

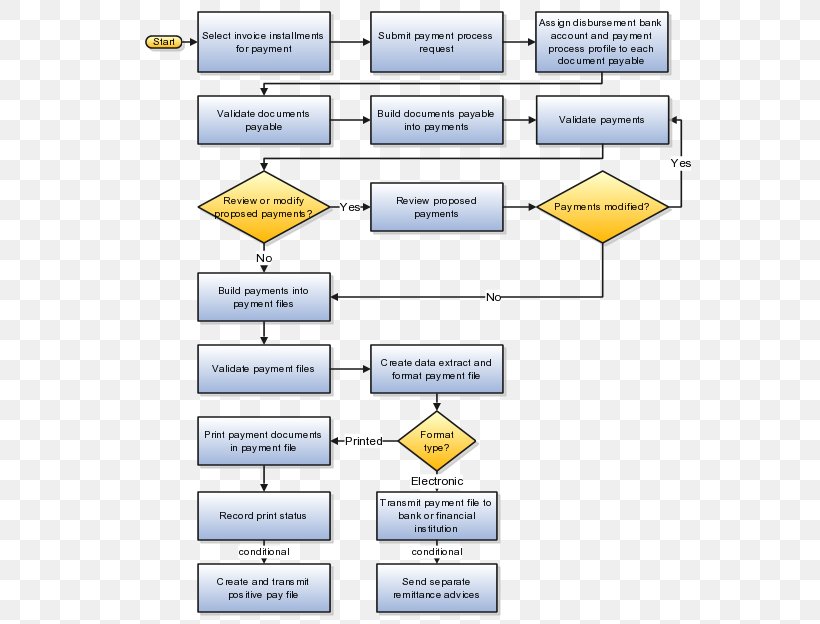

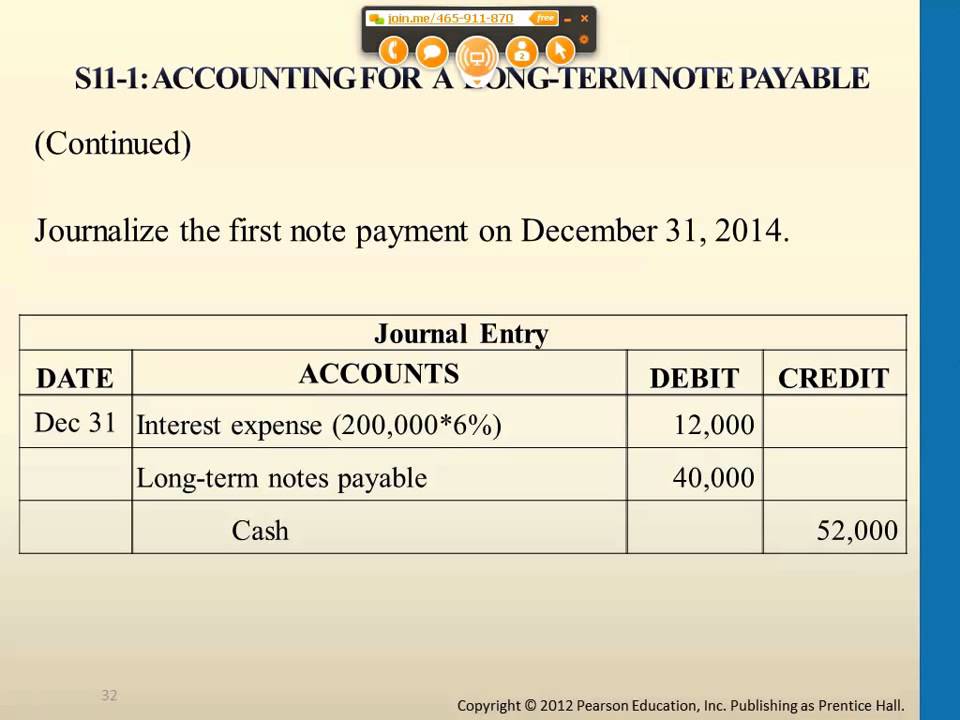

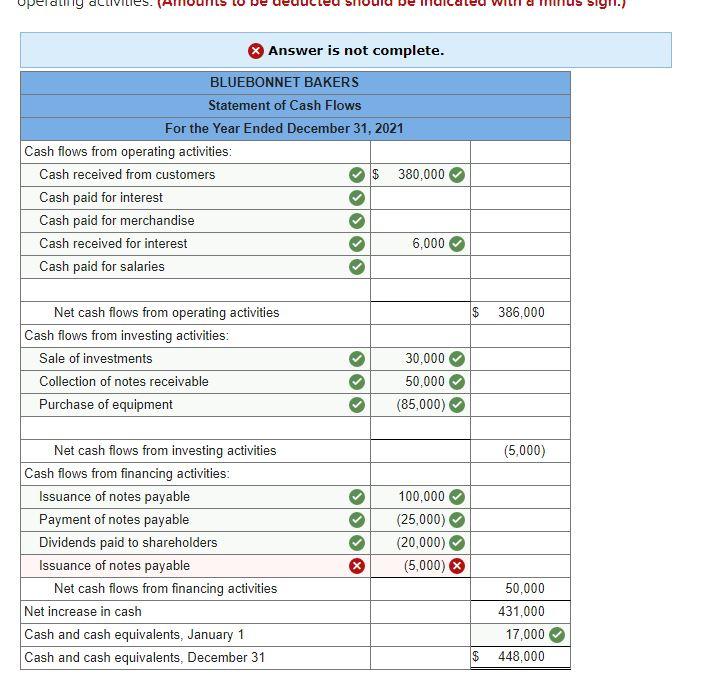

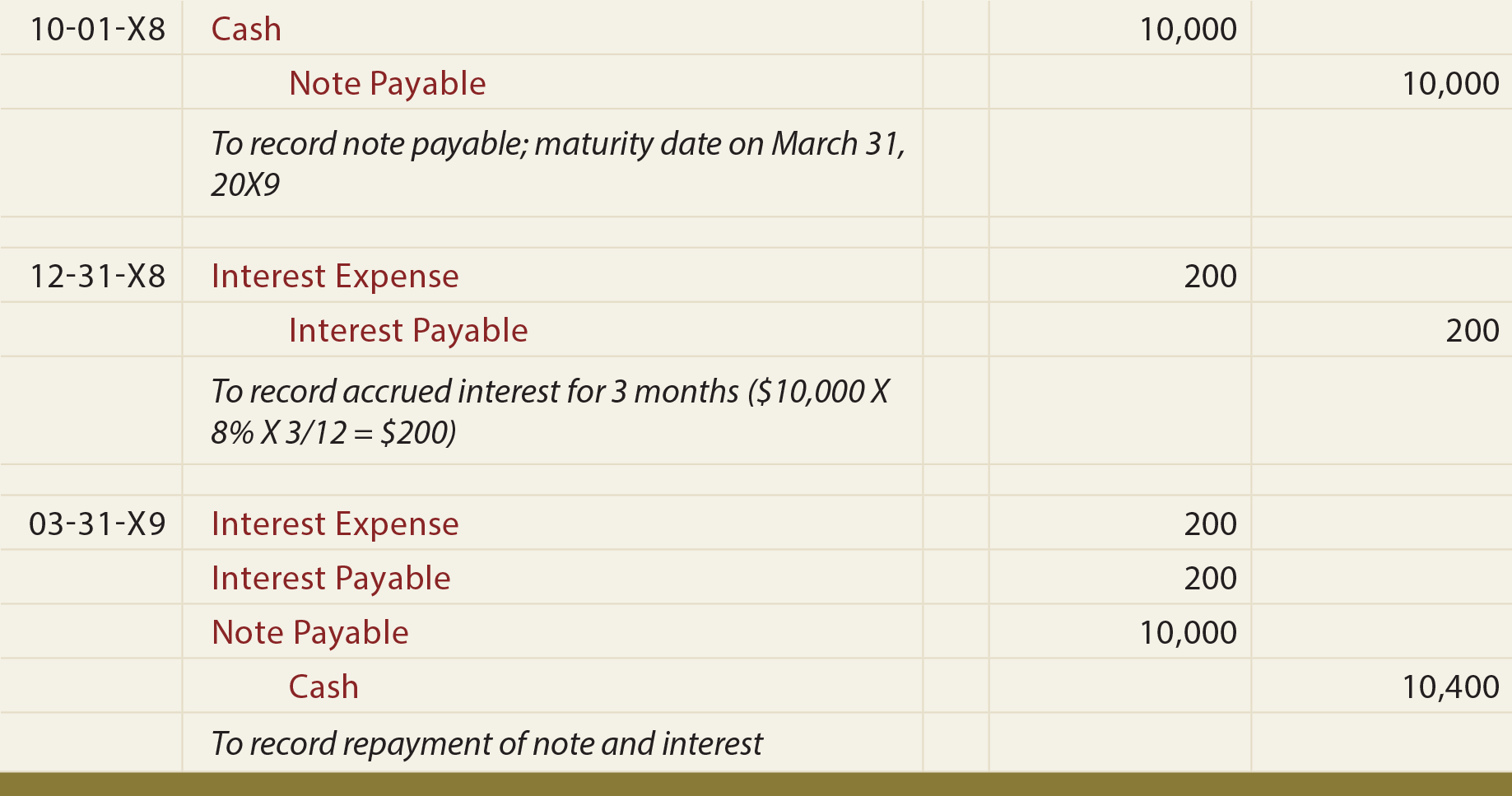

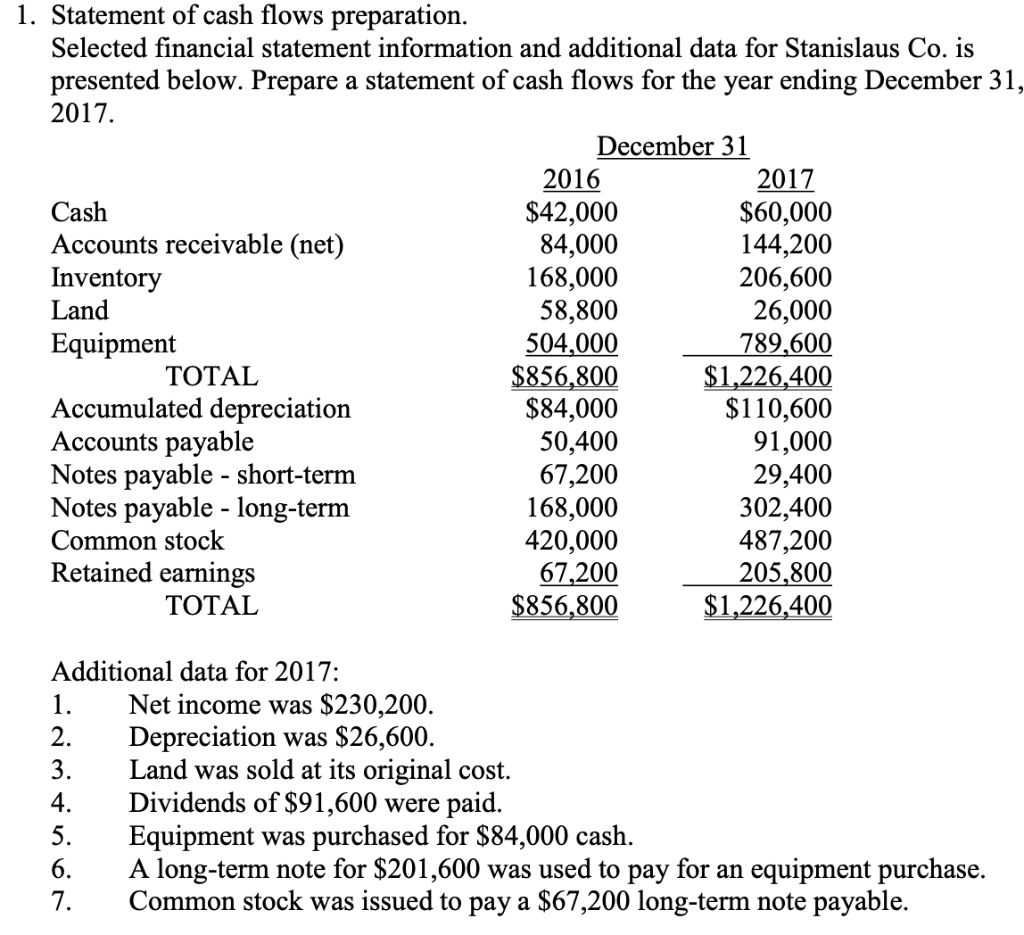

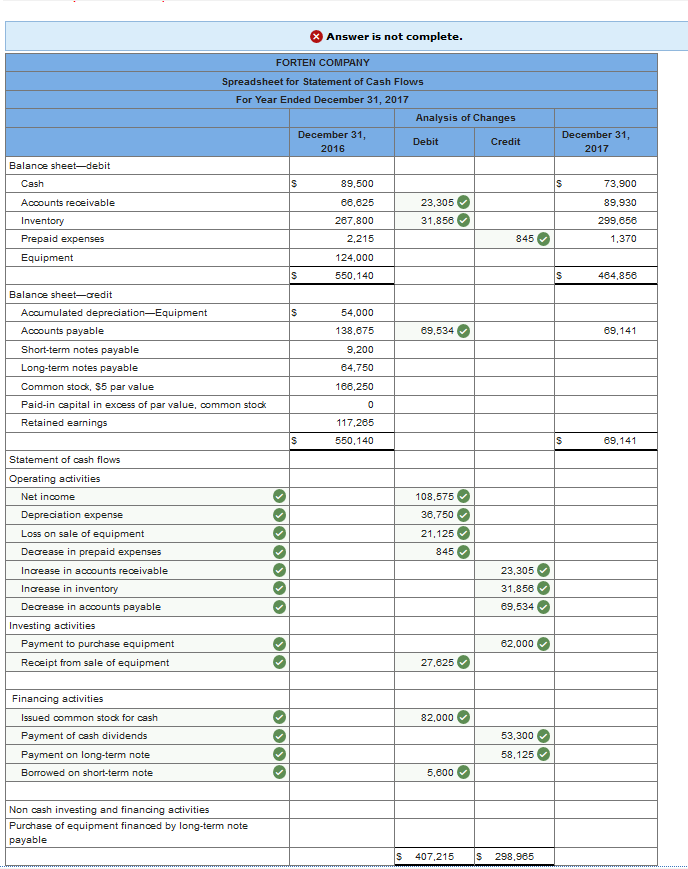

Payment of interest on notes payable cash flow. Recall that financing activities are those used to provide funds to run the business. In the financing section of the cash flow statement xyz services shows $20,000 in principal payments made on the notes payable. Interest accrued can be computed with the annual interest rate,.

The interest paid on a note payable is reported in the sektion in the cash flow display entitled cash flowing coming operating activities. Reporting interest on a note payable on the payment flow statement. Interest payable account:

7.2.2 cash inflows and outflows. Since most corporations report the cash flows from operating activities by using the indirect method, the interest expense will be. It is important to understand what is included in bonds payable, the differences between bonds and notes, how to record interest payments, how to calculate the present value.

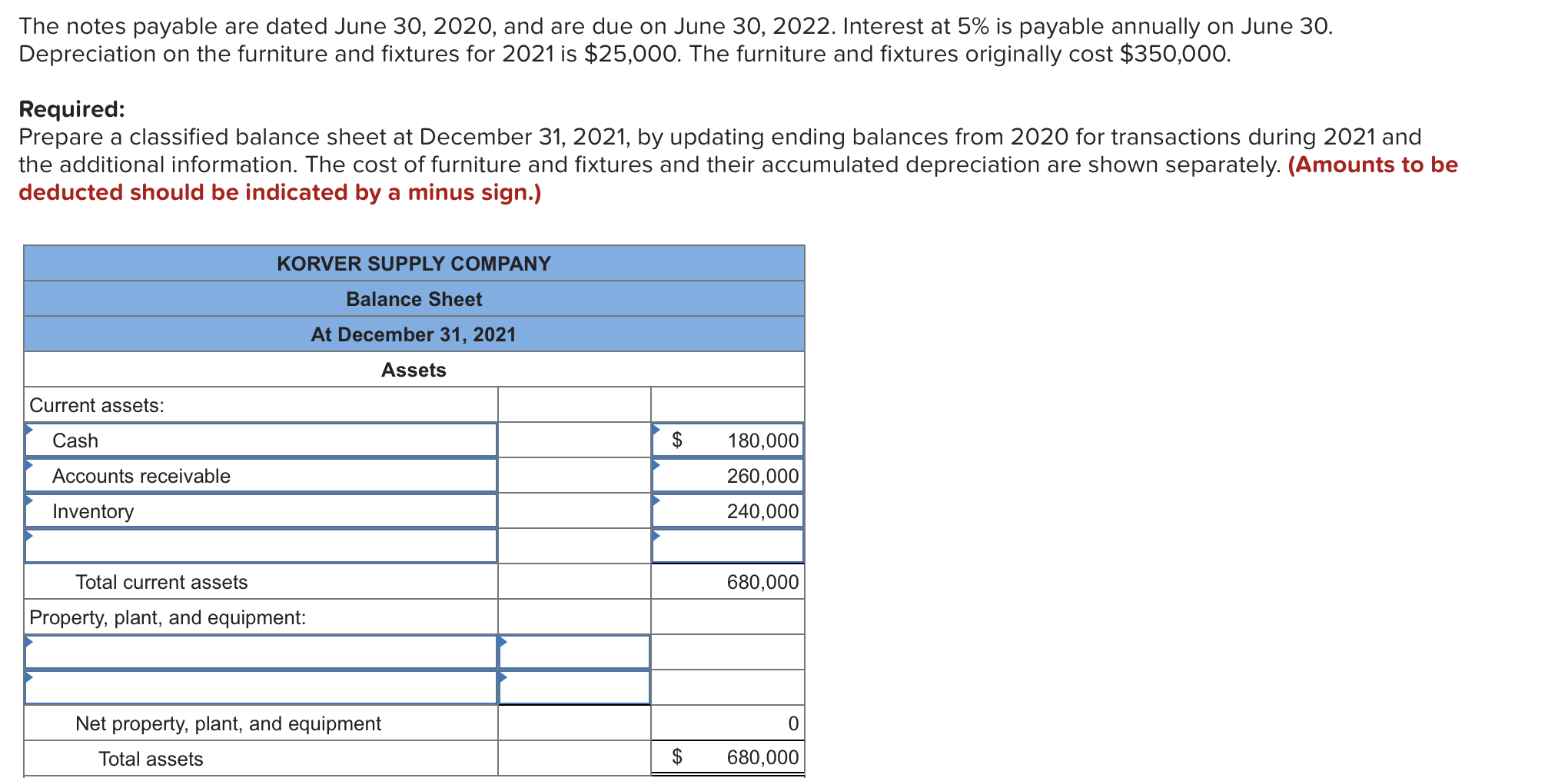

The interest compensated on a note payable is reported in the section of the cash flow statement. The statement of cash flows reports cash inflows and/or cash outflows in each of three sections: The cash amount in fact represents the present value of the notes payable and the interest included is referred to as the discount on notes payable.

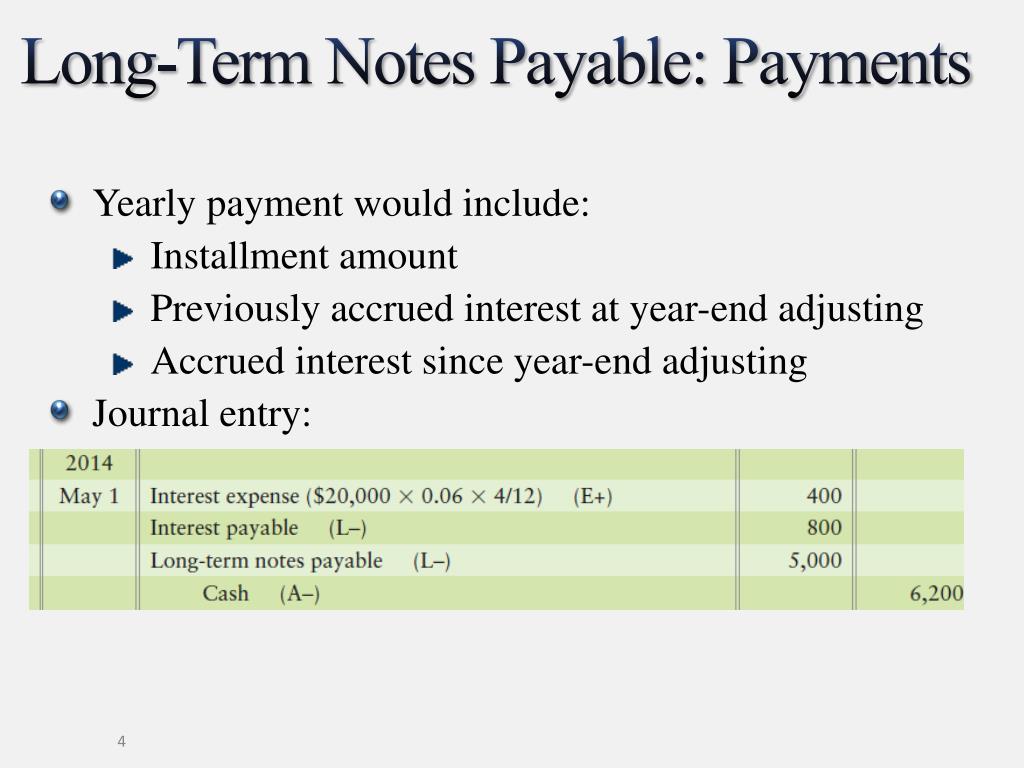

Notes payable refers to a specific type of debt that a company incurs when it borrows money from an external source. Cash payments vary and can be a single payment of principal and interest upon maturity, or payment of interest only throughout the term of the note with the principal portion. Since most corporations report the.

The interest paid on a note payable is reported in the section of the cash flow statement entitled cash flows from operating activities. Investing financing interest paid on statement of cash flow interest paid is a part of operating activities on the statement of cash flow. From the perspective of the company, the interest expense due on the notes payable is debited while the interest payable.

When a company takes out a loan, it can have a significant impact on its cash flow statement. Interest expense increases (a debit) for $4,500 (calculated as $150,000. Cash payments vary and can be a single payment of principal and interest upon maturity, or payment of interest only throughout the term of the note with the.

These notes are typically formalized through written. A note payable is a loan contract that specifies the principal (amount of the loan), the interest rate stated as an annual percentage, and the terms stated in number. Notes payable is a debt to a lender with specific repayment terms, which can include principal and interest.

This is because the amount owed needs to be paid back over time, with. Reconciliation process explained under the. The debtor can promise to pay the full principal.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)