Formidable Info About Wages Payable Income Statement Types Of Financial Analysis Pdf

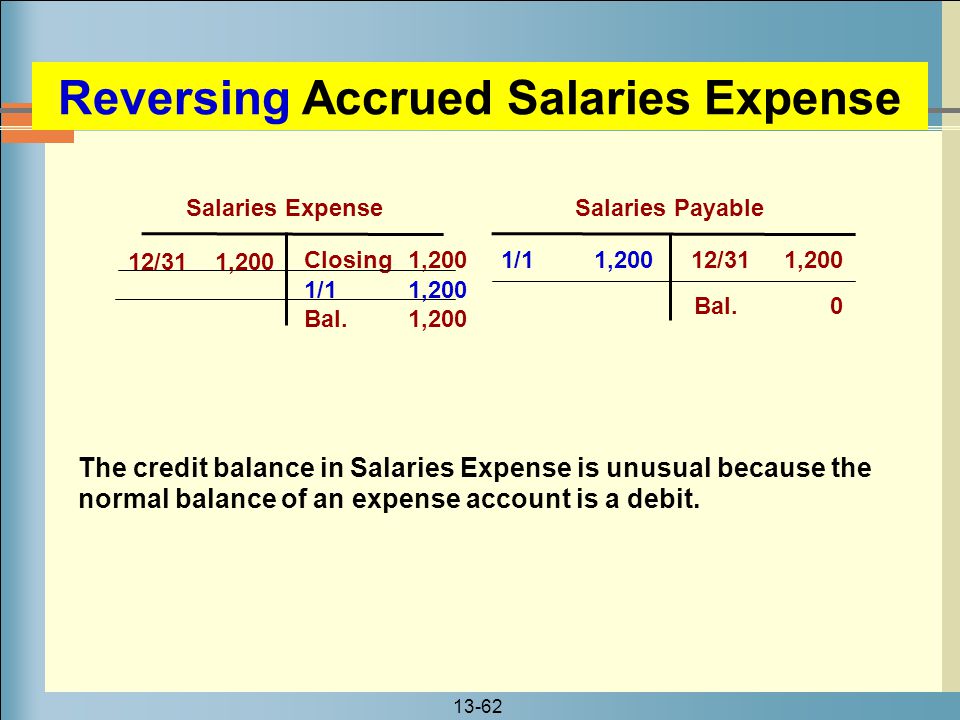

A new wages payable liability is created later in the following period, if there is a gap between the date when employees are paid and the end of the period.

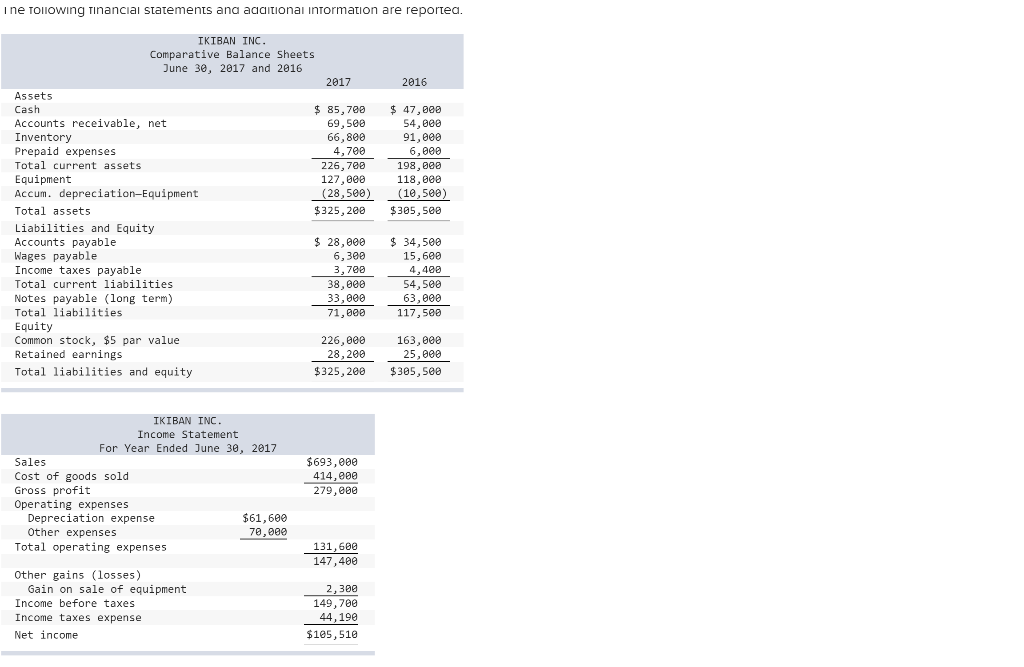

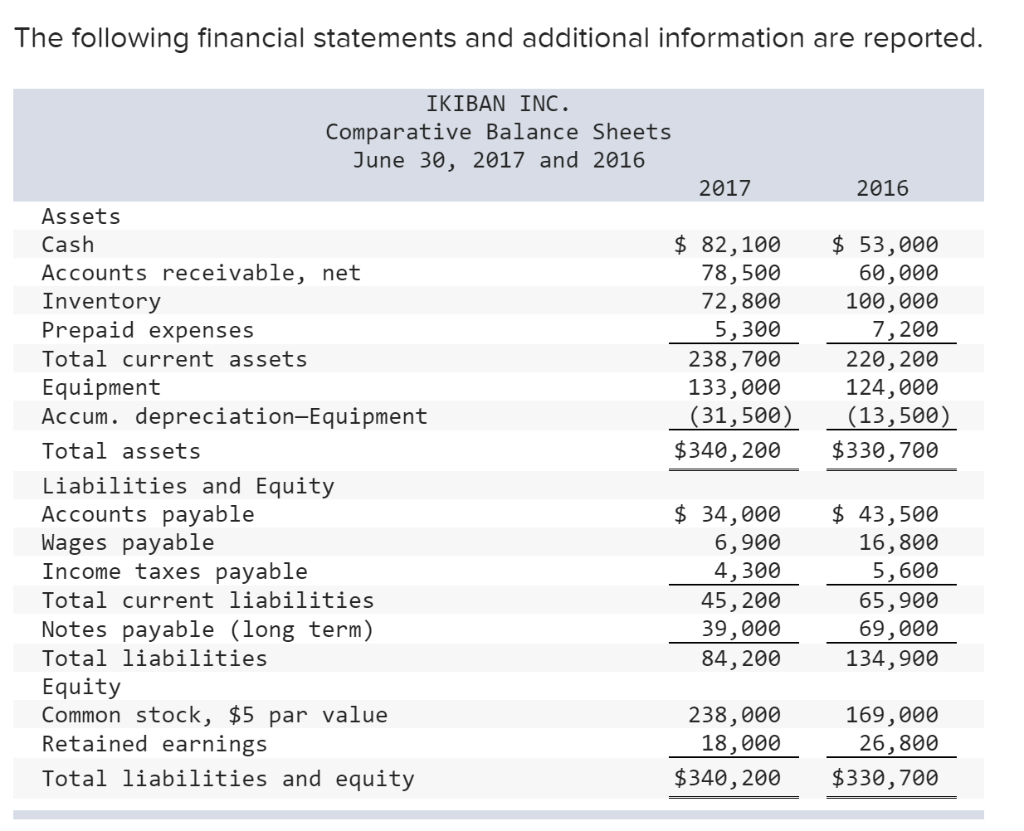

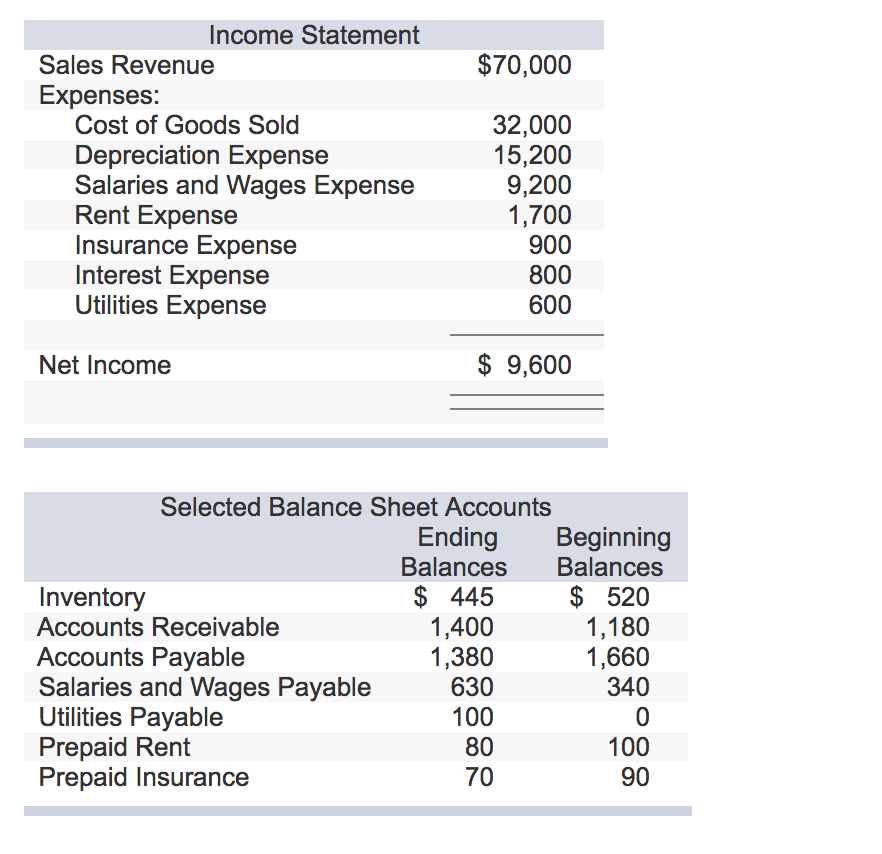

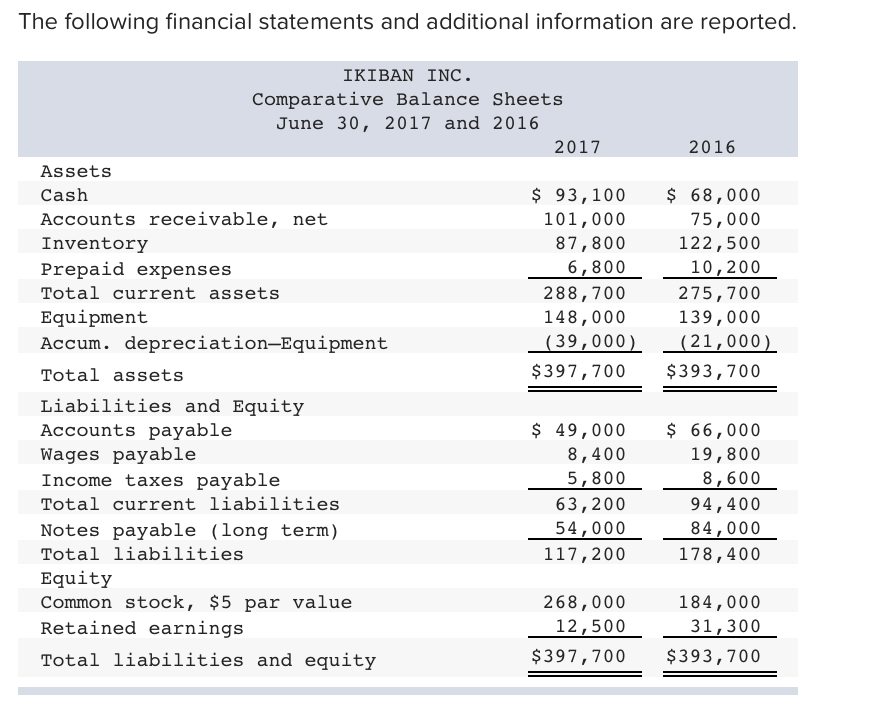

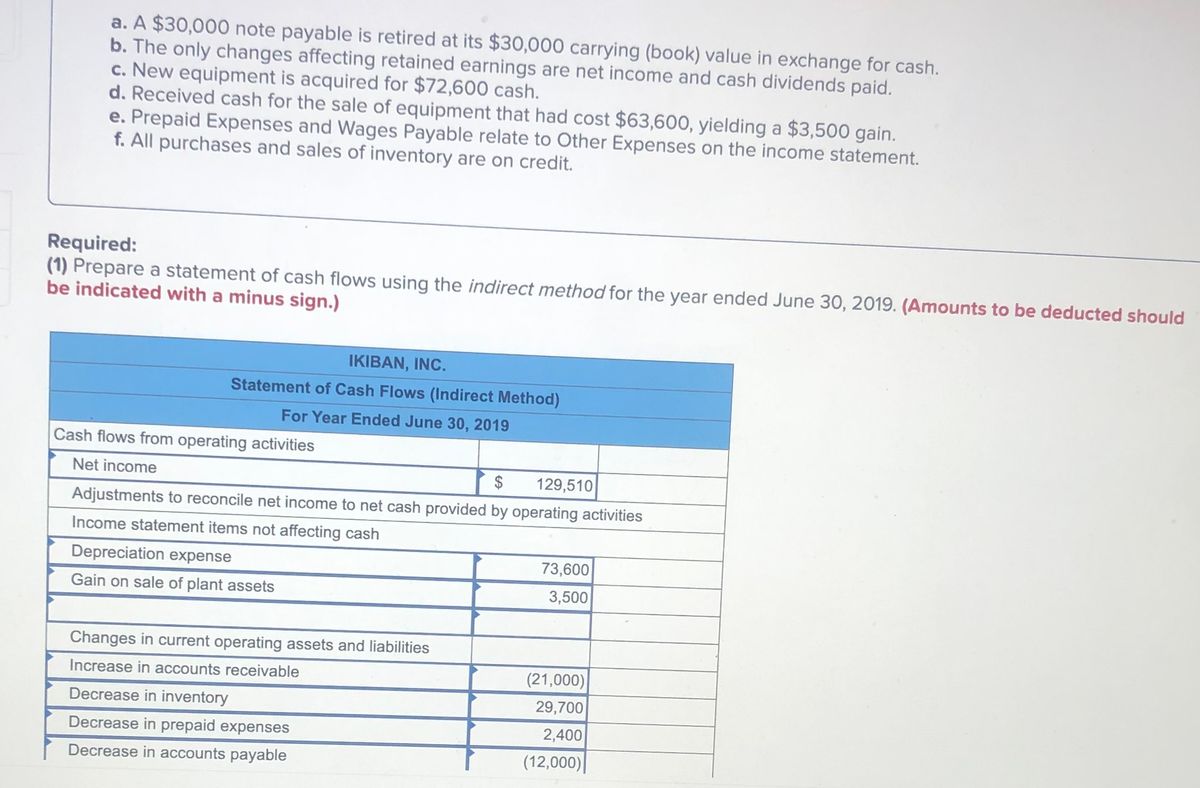

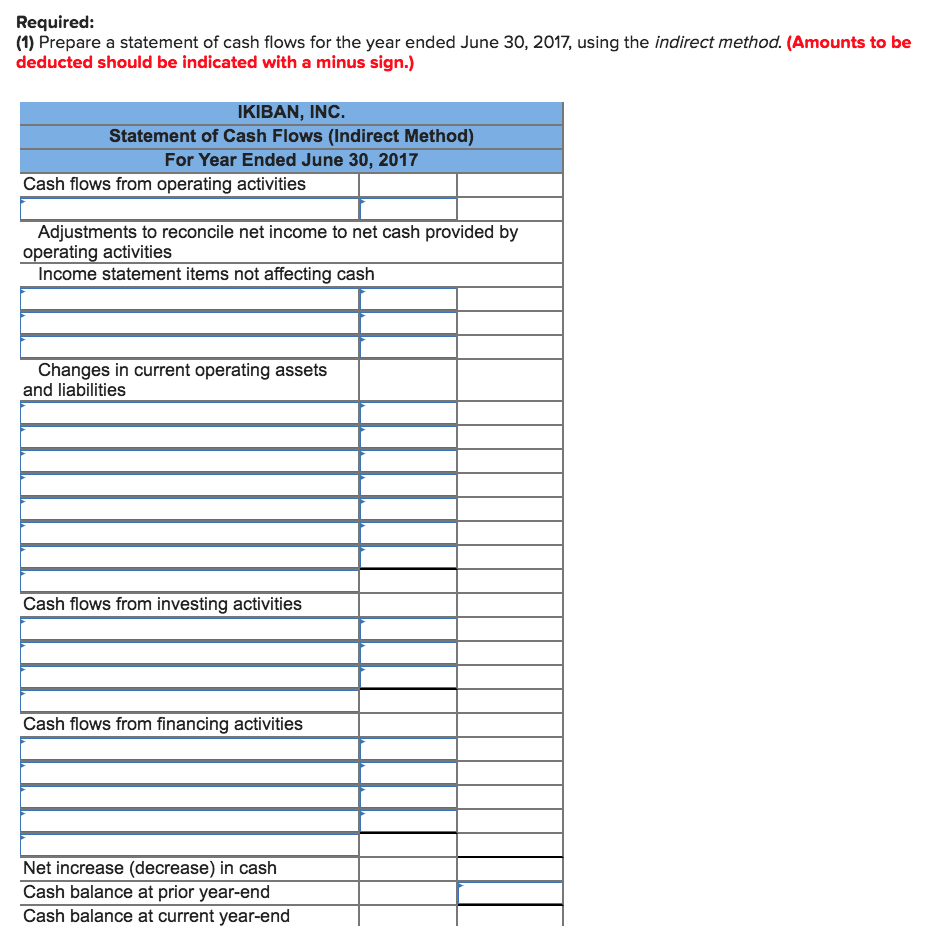

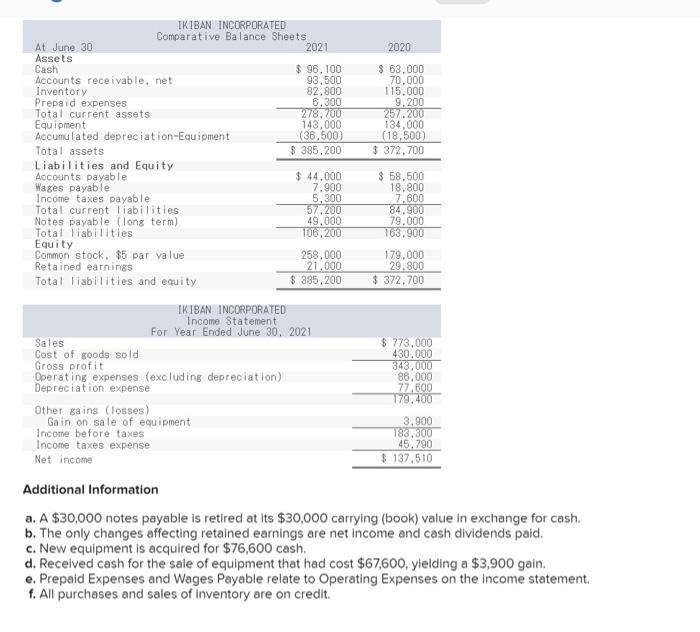

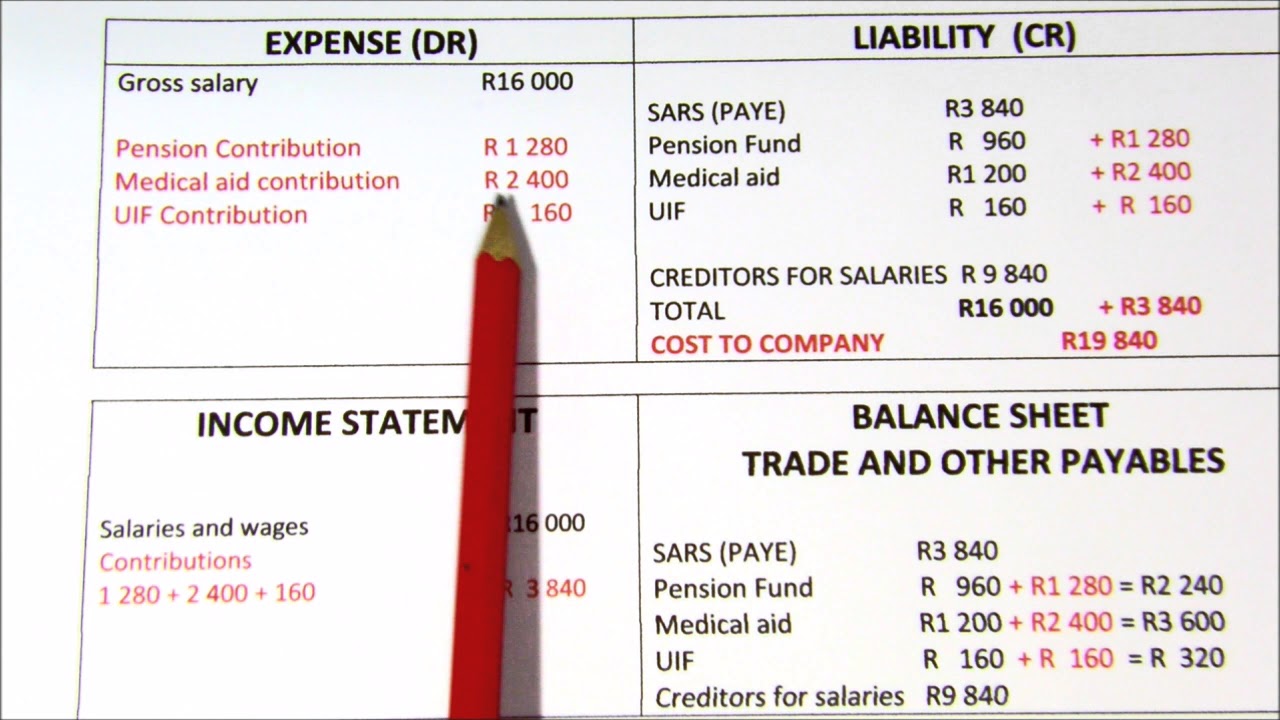

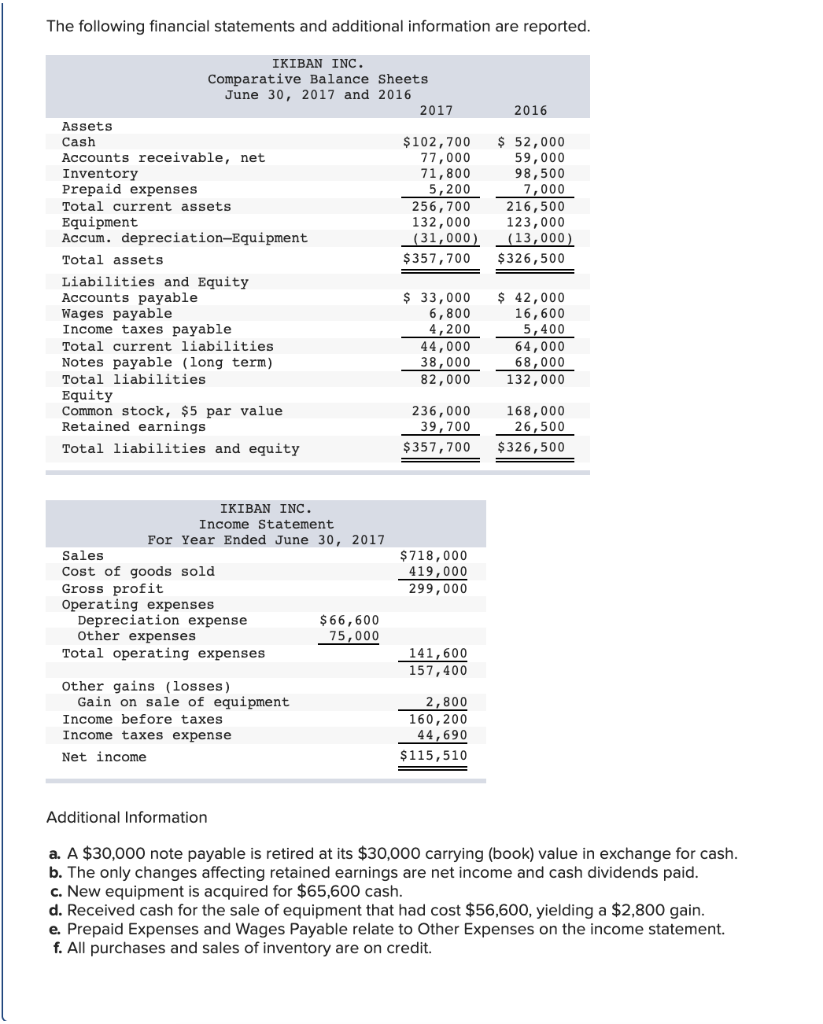

Wages payable income statement. Salary payable is a current liability account containing all the balance or unpaid wages at the end of the accounting period. Most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Accrued wages are owed but not paid at the.

However, labor expenses appear on the balance sheet as well, and in three. If it's cash accounting, they will be recorded when wages are paid. If it's accrual accounting, they will be recorded when incurred by a firm regardless of whether.

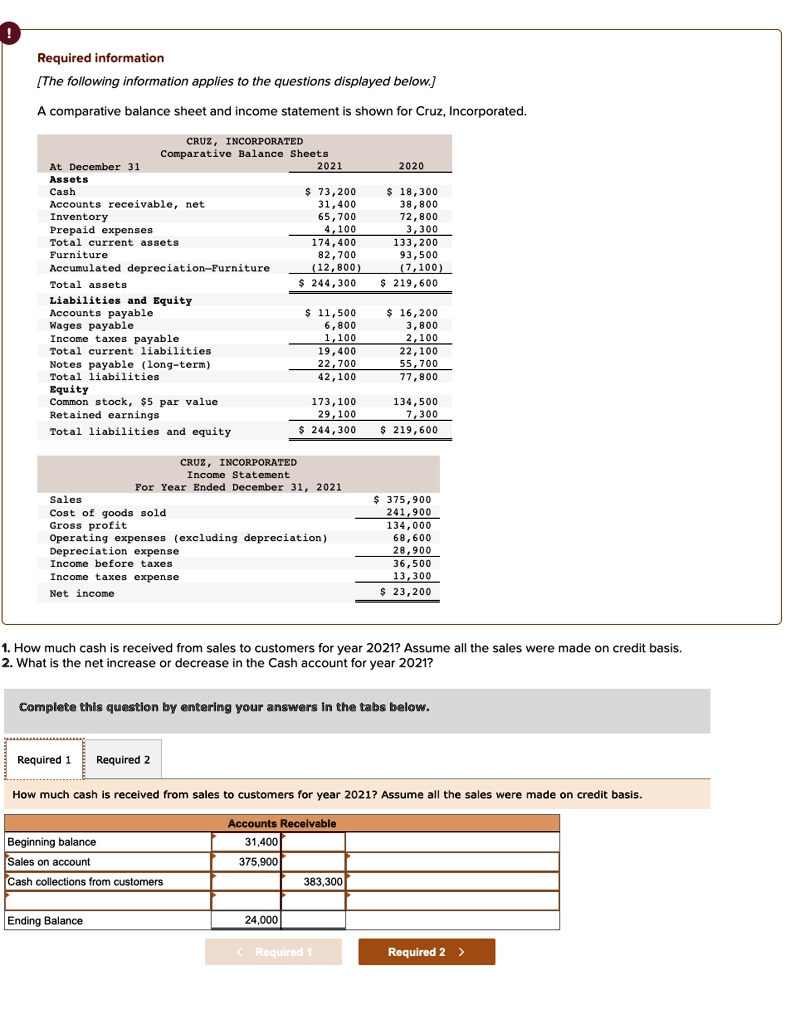

Employees 3, 4, and 5 are paid $15 per hour. In this video, learn how to compute cash paid to employees by using the wage expense amount reported in the income statement and the change in wages payable reported in. Employees 1 and 2 are each paid $6,000 per month (salary).

The salary expense for the month of january is $12,000. Wages payable definition a current liability account that reports the amounts owed to employees for hours worked but not yet paid as of the date of the balance sheet. Definition of wages and salaries expense.

On the december income statement the company must report one month of interest expense of $25. The wages payable balance increased because a larger accrual was made to represent wages owed at the end of 20x1 than 20x0. While salaries payable changes based on.

The wages expense amount on the income statement would have been too low ($4,000 instead of $4,400). Accounting wages payable guide to understanding wages payable last updated october 24, 2022 learn online now what are wages payable? 2.net income on the income statement would have been.

Salaries and wages as expenses on income statement. The account wages and salaries expense (or separate accounts such as wages expense or salaries expense) are used to record the. Wages paid is calculated by adjusting total wages from the income statement for movements in wages payable (wp) from the balance sheet.

What are accrued wages? Under the accrual method of accounting, this amount is likely recorded. Wages payable refers to the wages that a company's employees have earned, but have not yet been paid.

Accrued wages represent the unmet employee compensation remaining at the end of a reporting period, i.e. On the december 31 balance sheet the company must report that it. The income statement reports how the business performed financially.

The amount of salary payable is reported in the.

![[Solved] statement and balance sheet excerp SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1543/4/8/9/0145bffc5f6069c91543471535041.jpg)