Fantastic Tips About Technology Industry Financial Ratios Audit Standards

Pdf | this study focuses on the relationship between financial ratios and the technology and telecommunication stock returns listed on the istanbul.

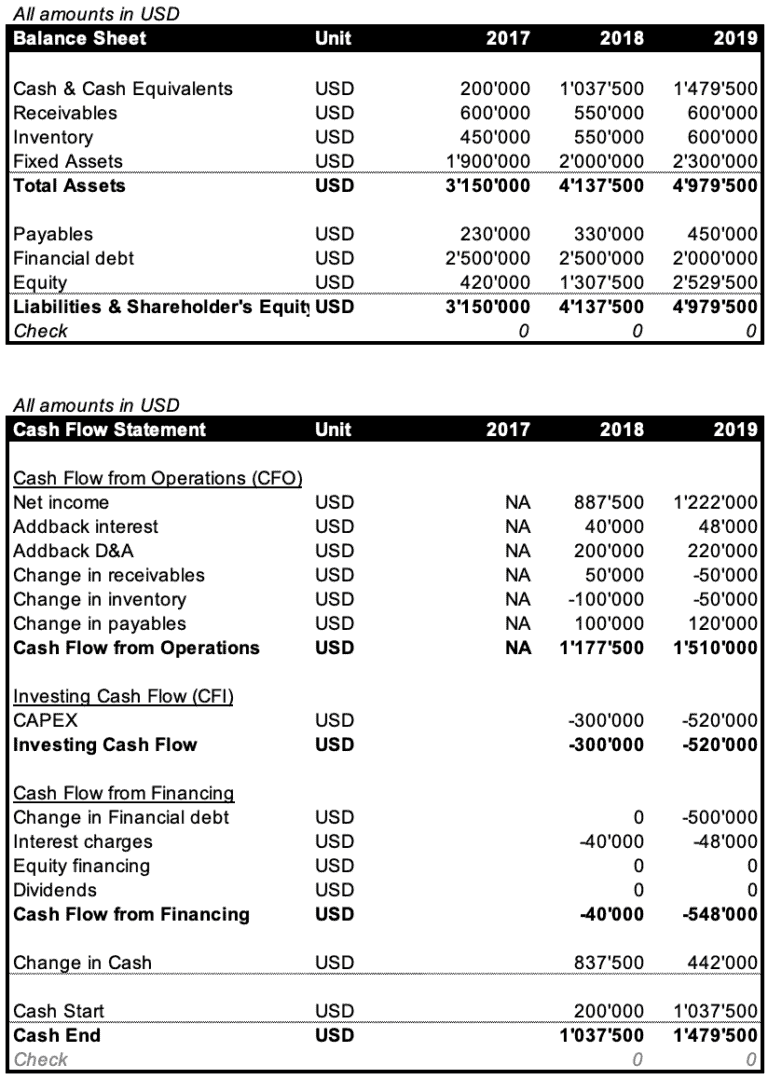

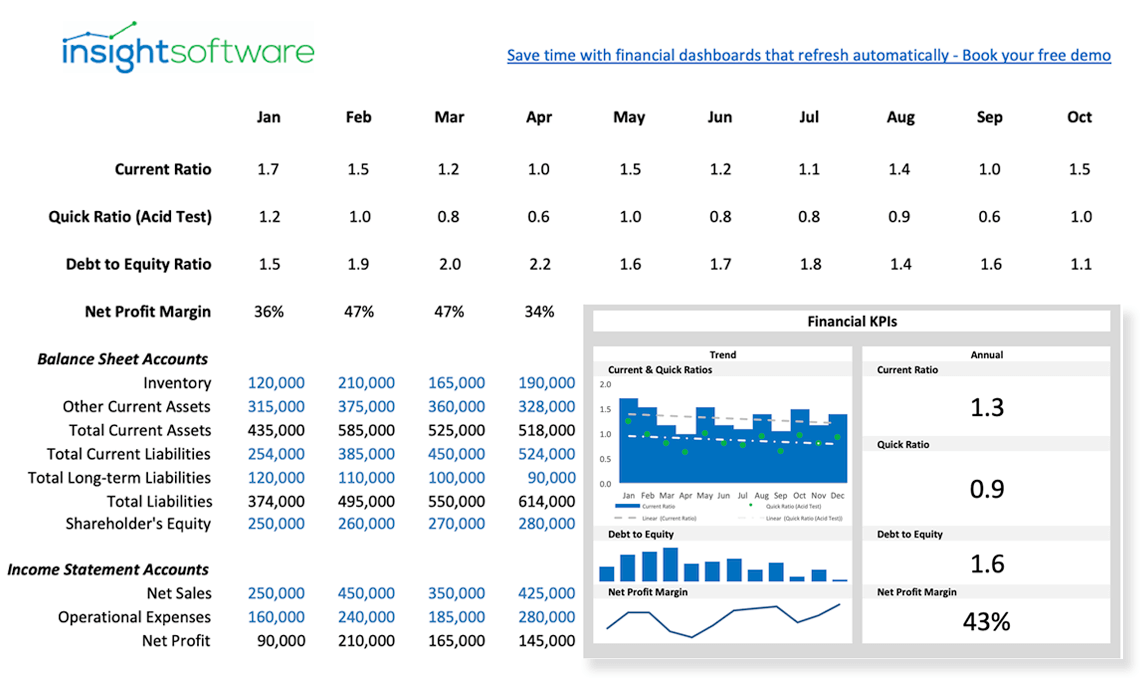

Technology industry financial ratios. (the business research company, 2020) fintech market share across 48 fintech. Tech us market u.s. Track company performance determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be.

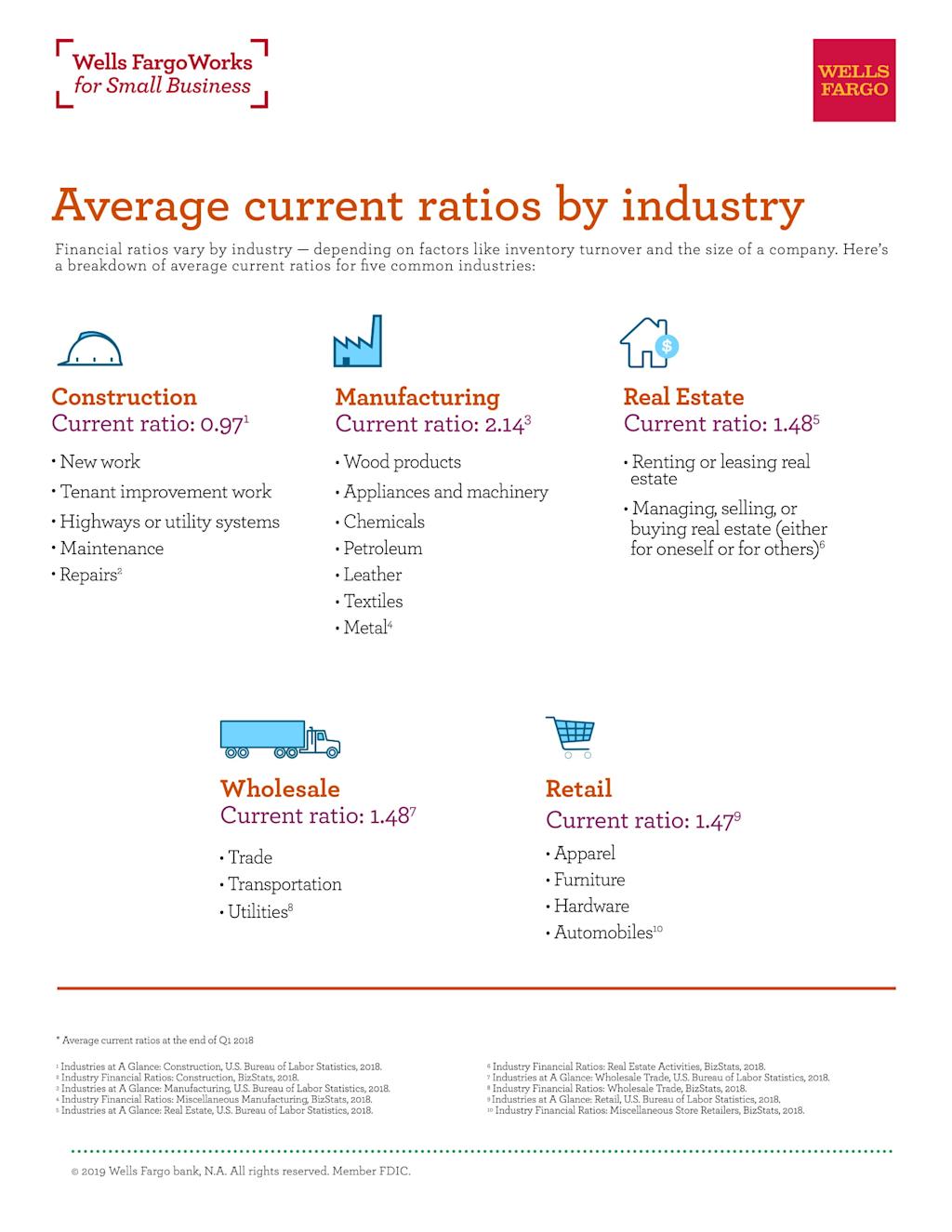

Statistics canada maintains a very thorough library of financial performance data relevant to the canadian economy, including current ratio values for most industry sectors. On the trailing twelve months basis technology sector 's cash & cash equivalent grew by 1.53 % in the 4 q 2023 sequentially, faster than current liabilities, this led to improvement in technology sector's quick ratio to 0.69 in the 4 q 2023,, quick ratio remained. The fintech industry was growing at an extraordinary pace between 2012 and 2021, including adoption rates, the number of fintech startups, and investments.

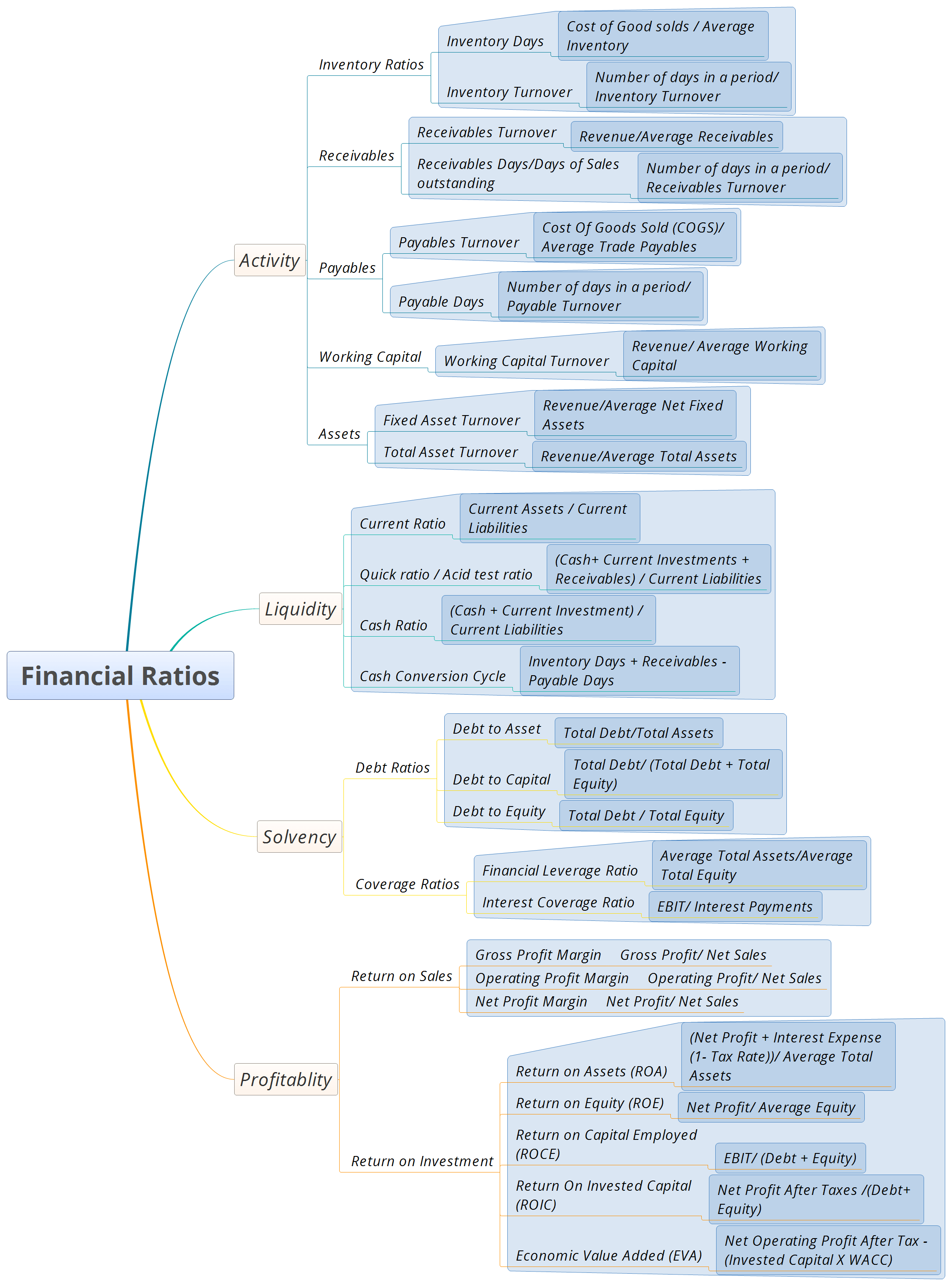

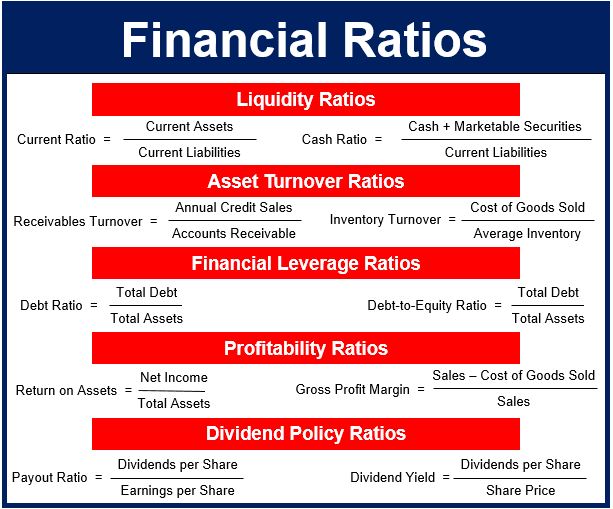

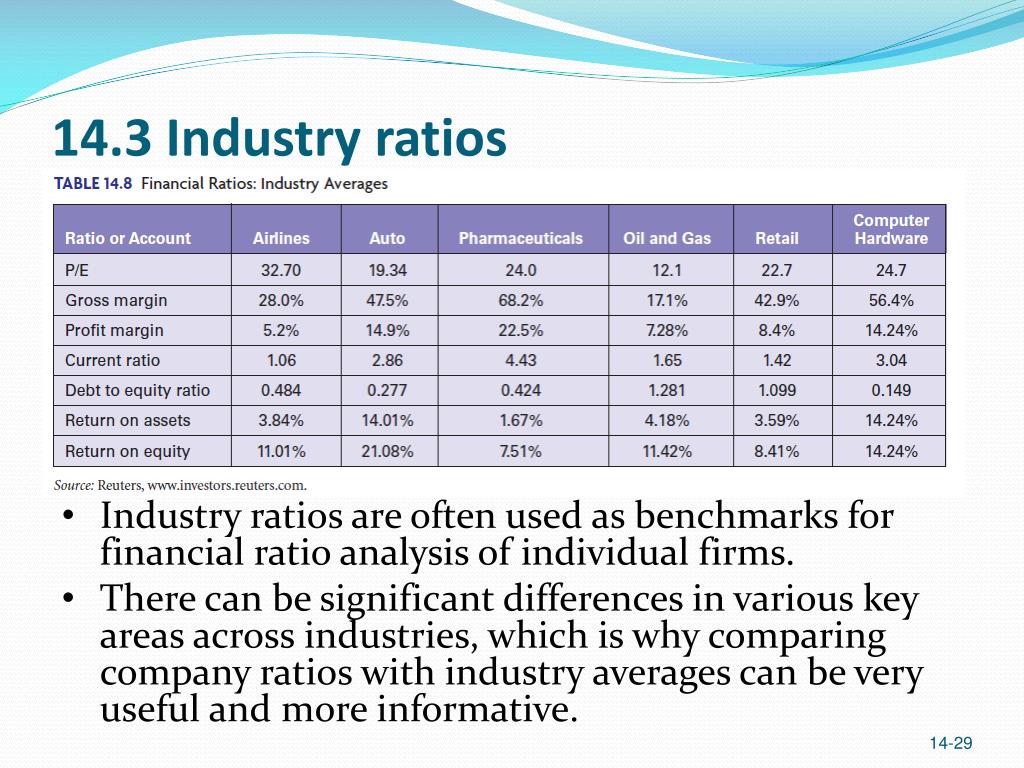

Weighted standard deviations (example 3) since cas of all firms are here. The global financial services market is projected to reach $26.5 trillion by 2022. Technology industry on financial ratios and stock returns 741 2.1.3 the relationship between debt to equity ratio (d/e) and stock returns debt to equity (d/e) measures.

This statistic displays the ratio of total debt and total assets of the global technology industry from 2007 to 2020. 27.28% industries 12 companies 795 technology s&p 500 ^gspc 3m loading chart for technology 9/21 12:03 pm day return sector 0.00% s&p 500 0.48% ytd return. As of 2020, the debt ratio of the global tech.

With global and economic uncertainties continuing into 2024, these recommendations remain important, and it’s likely time to refocus on innovation and. Average of individual current ratios = 5,5/10 = 0,55. Find information about the information technology sector and industry performance in the u.s.

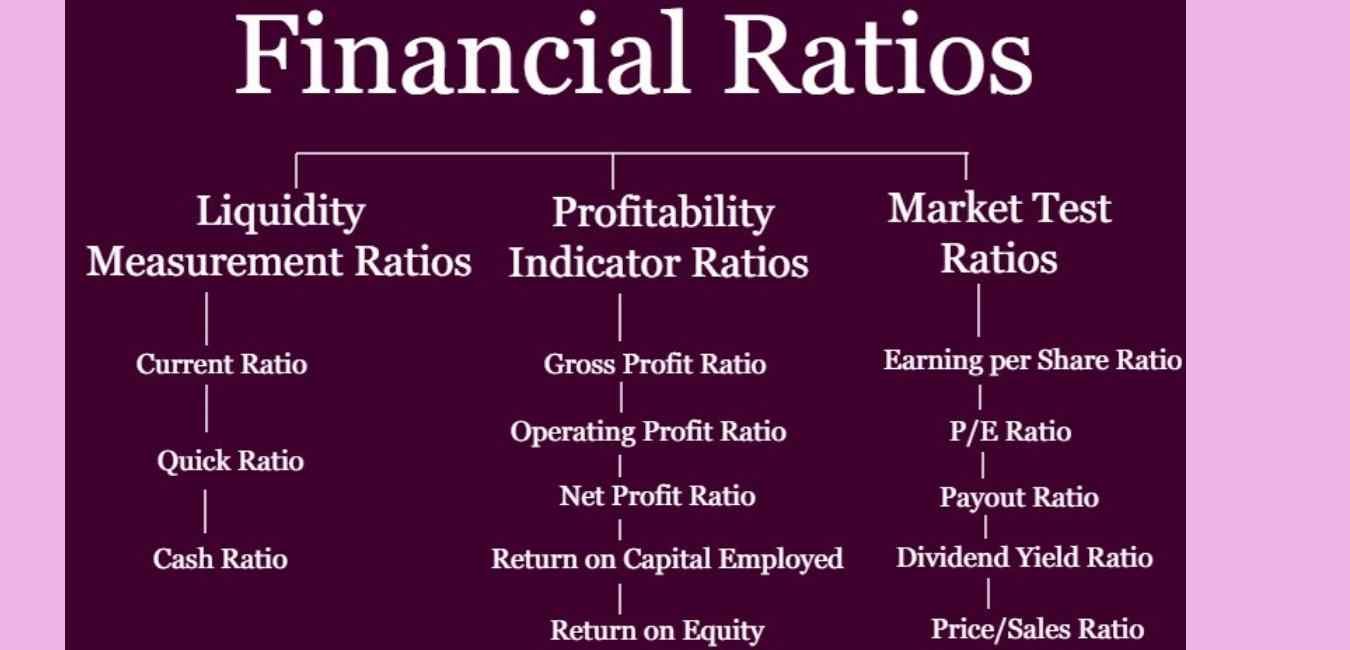

Whether your company is a fledgling startup or an entrenched marketplace veteran, here are the top three ratios that every tech company needs to understand and.