Perfect Tips About Accrual Basis Of Accounting Is Most Useful For Expenses In The Income Statement

Determining the amount of income tax an entity should pay b.

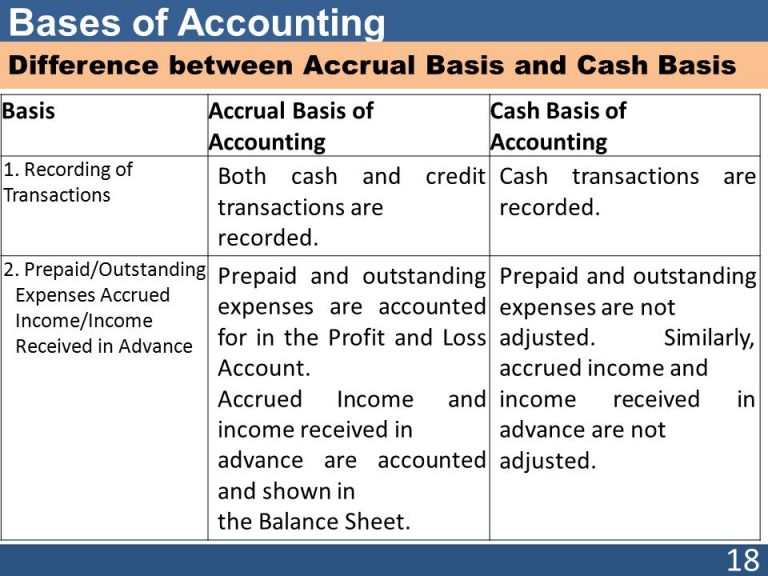

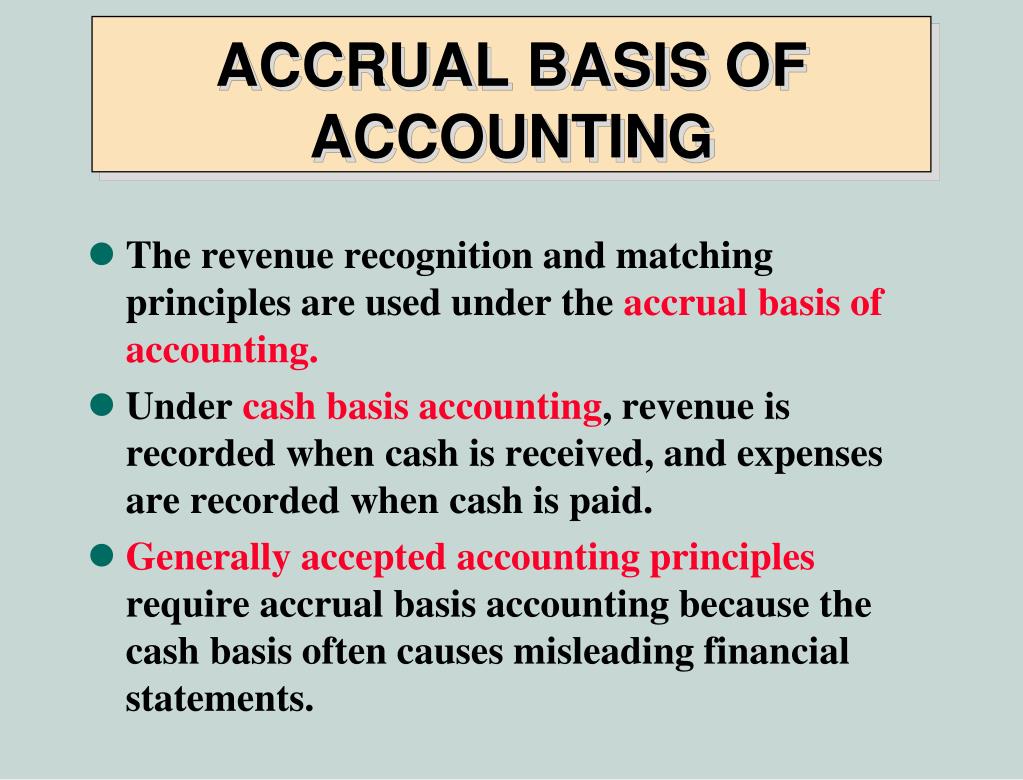

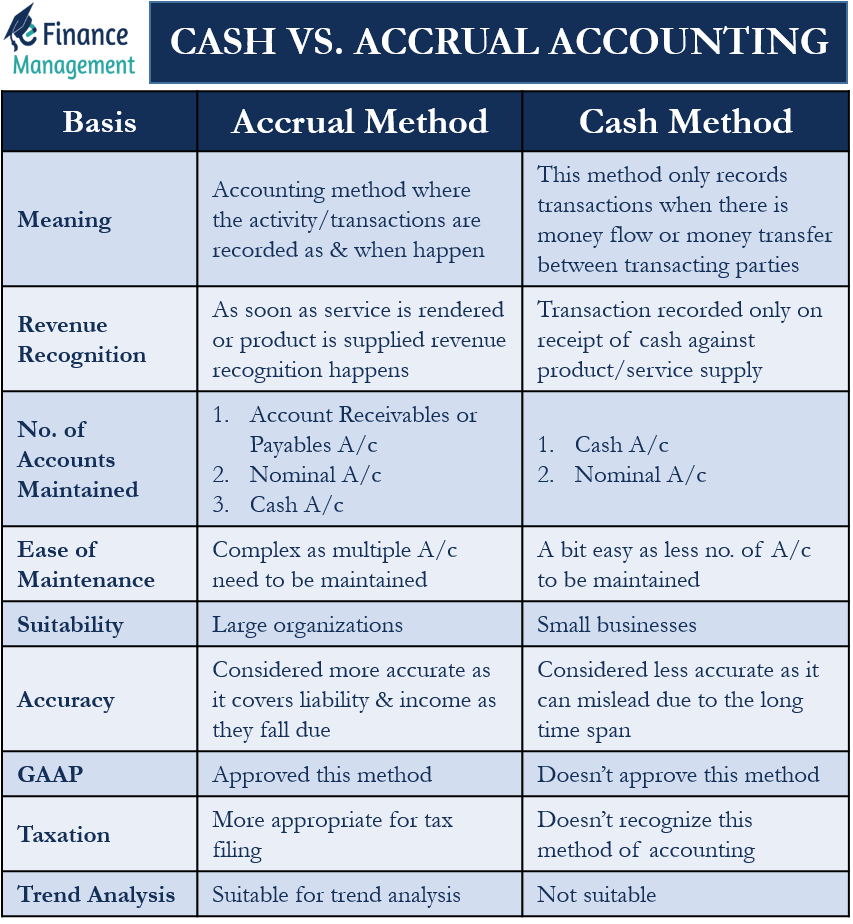

Accrual basis of accounting is most useful for. Abstract this paper reviews the field of accounting conservatism measurement and the development. The use of accrual basis for accounting is widespread in many countries, but the status is not the same as the budget. Accrual basis accounting allows for the recognition of revenues and expenses when they are earned or incurred.

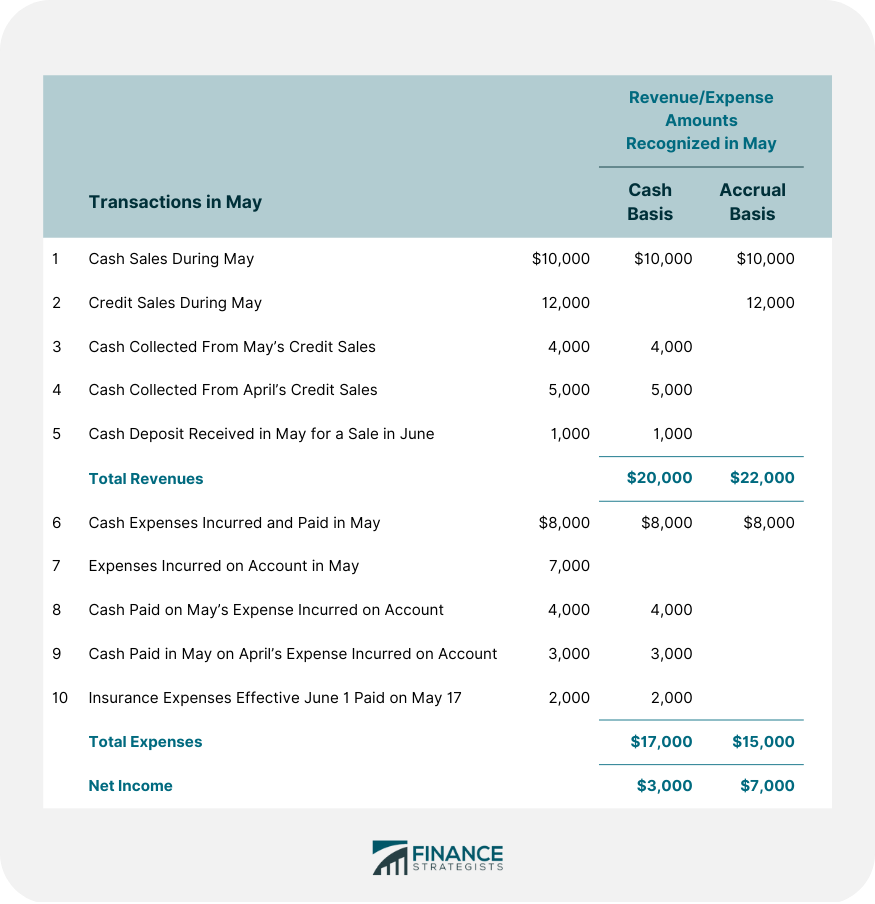

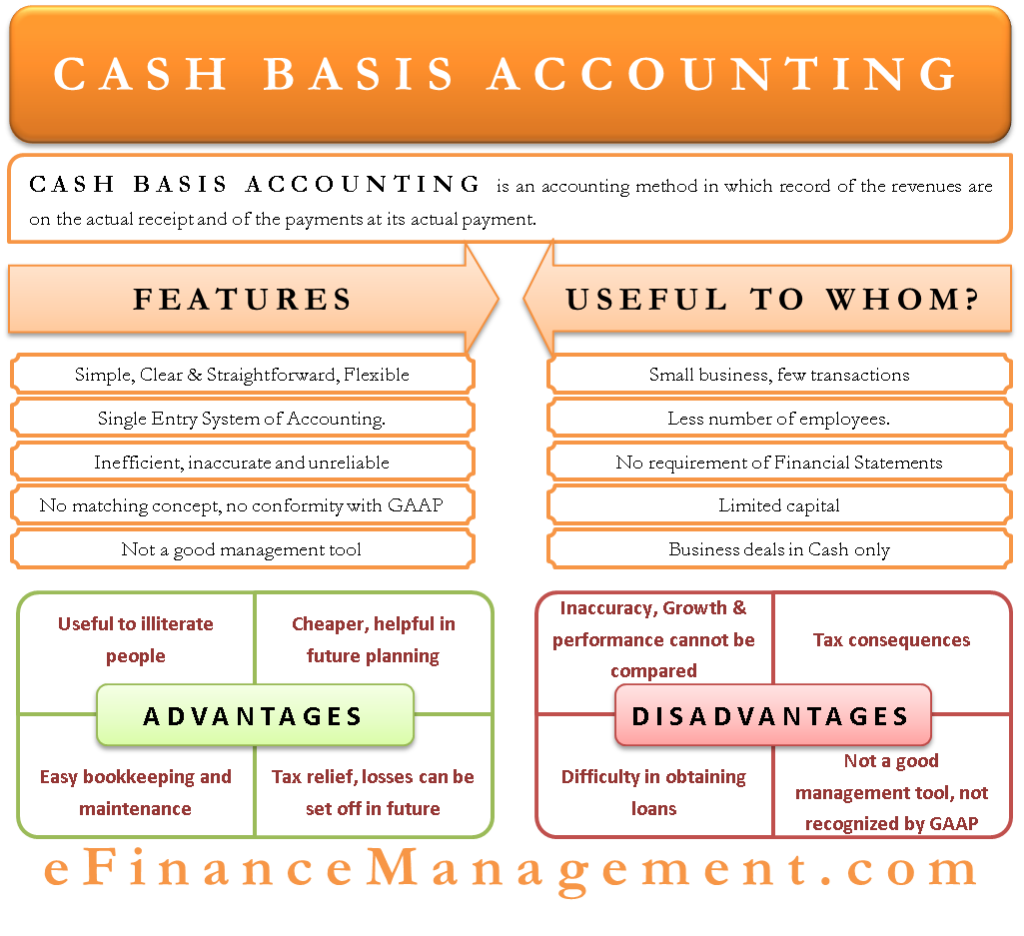

One of the biggest reasons businesses hesitate to use accrual accounting is the time and effort required to maintain the books and records. We need a more sophisticated way to track how much we owe, who owes us, and what we own. Accrual basis accounting is the method that produces the most helpful and accurate financial statements.

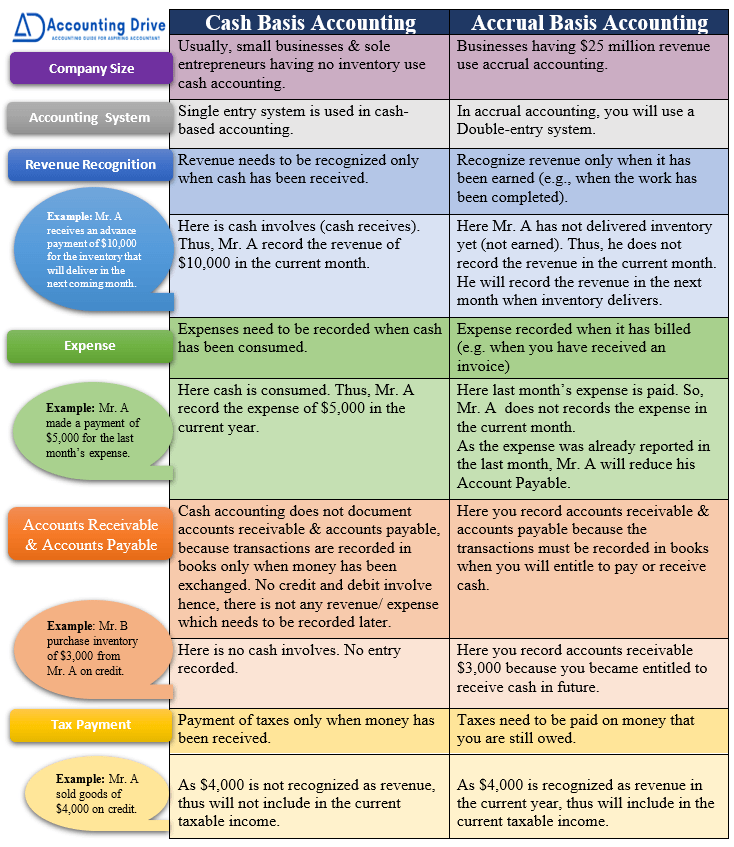

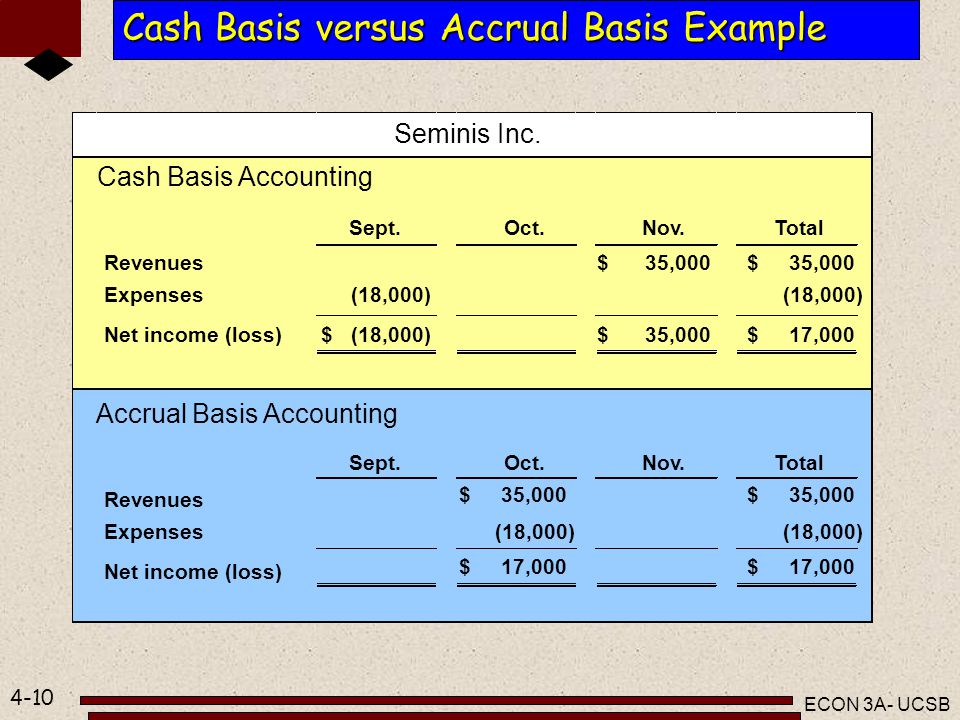

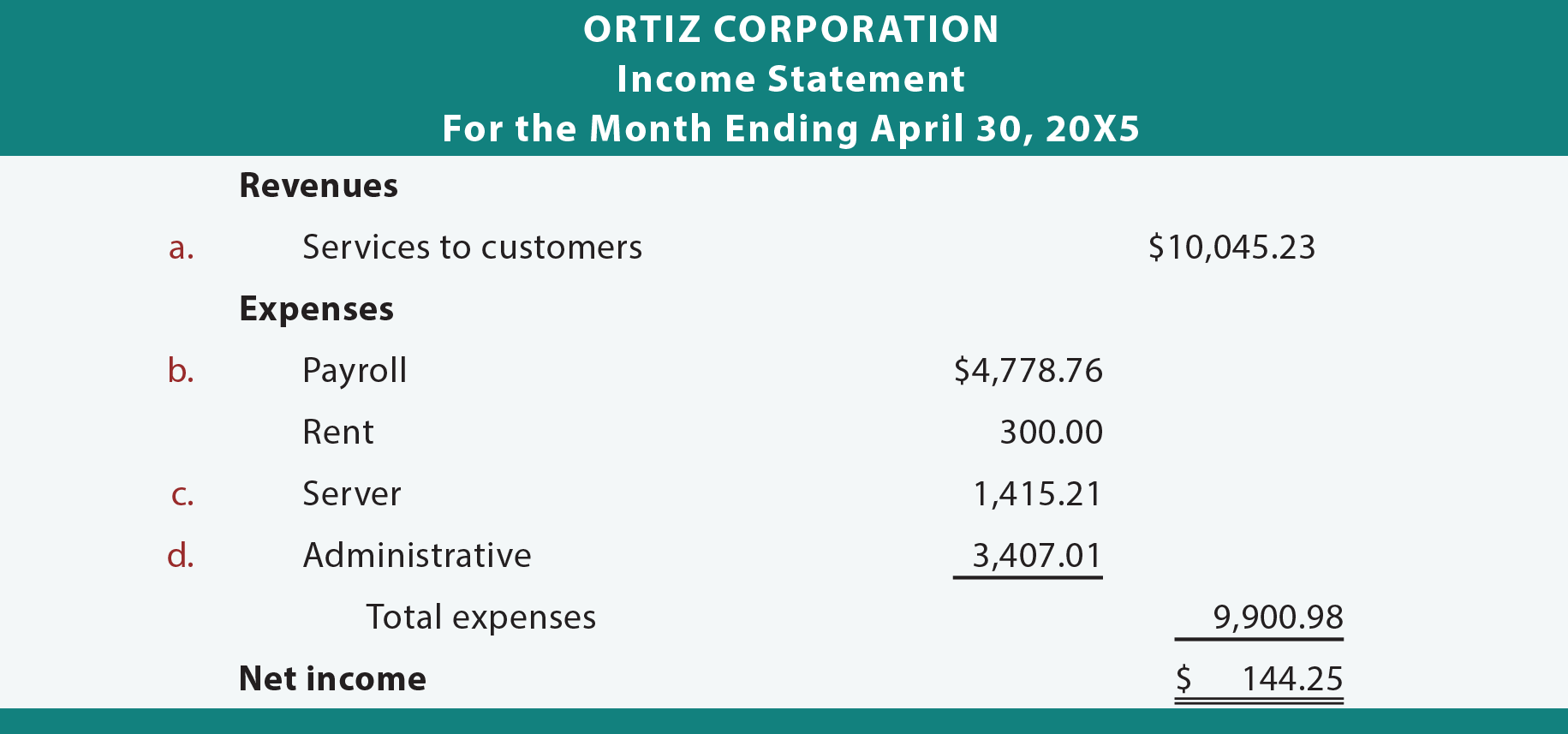

Provides a more accurate financial performance: The accrual basis of accounting recognizes revenues when earned (a product is sold or a service has been performed), regardless of when cash is received. Moreover, the revenue and expense are.

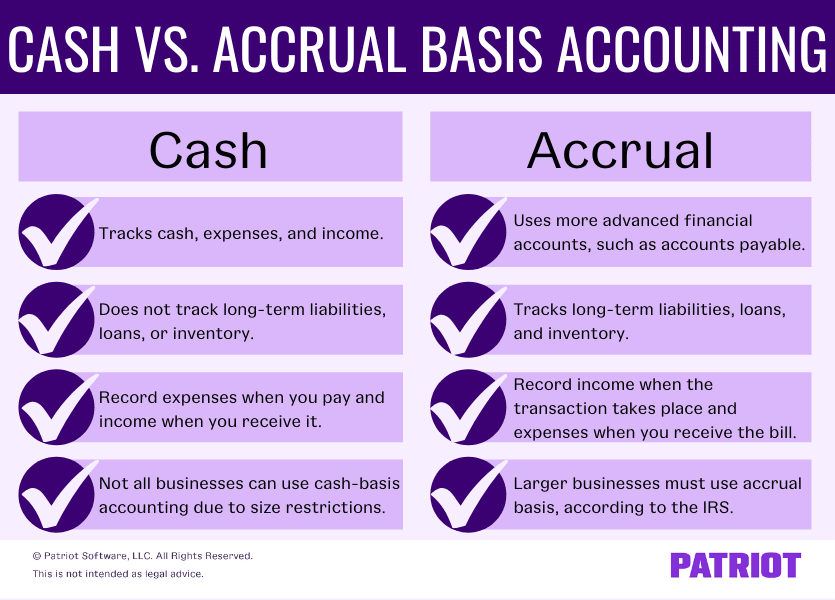

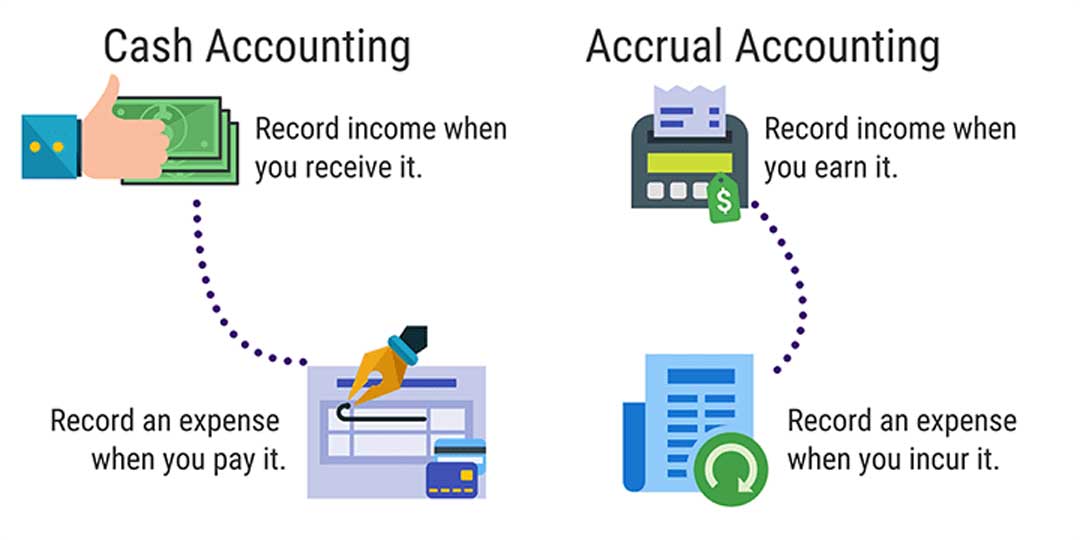

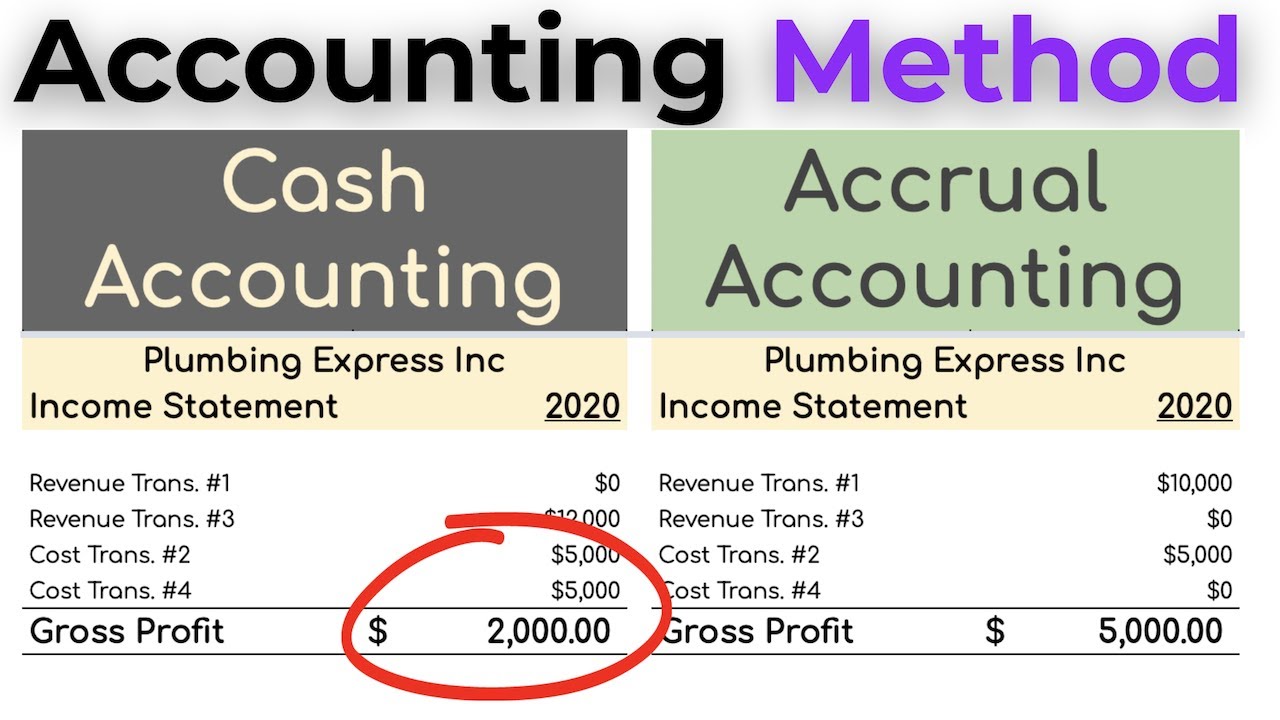

The accrual basis of accounting refers to a method of accounting that tracks financial transactions in the period in which they occur. If a business provides a. An accrual basis of accounting is one of the two accounting methods that record income and expenses when a transaction occurs.

The accrual basis of accounting is most useful for: To track this information, we use a more comprehensive system of accounting. If there is no such relationship, then charge the cost to expense at once.

Most states, even if they apply accrual basis. The accrual basis of accounting recognizes revenues when earned (a product is sold or a service has been performed),. The accrual basis of accounting tends to provide more even recognition of revenues and expenses over time, and so is considered by investors to be the most.

In this scenario, accrual basis accounting would let you track the following: The accrual method is the more. Learn about the goal of financial statements, the definition.

This is one of the most essential concepts in accrual basis accounting, since it mandates that the entire. Accrual basis accounting is one of two leading accounting methods and the preferred bookkeeping method for providing an accurate financial picture of a company’s. The accrual accounting method is more useful when a person or company is trying to understand the performance of a business over a specified time period.

It is more complex to manage accounts receivable, accounts payable and prepaid or deferred assets than to simply track cash in and cash out under the cash basis method. Accounting conservatism, measurement, accrual basis, market value basis.

:max_bytes(150000):strip_icc()/final5468-d59a89b4ff49437d99fe74b841514308.jpg)