Fine Beautiful Info About Statement Of Retained Earnings Equation Cash Flow Format Xls

The statement of retained earnings is mostly used when the retained earnings has to be shown to the outside entities such as equity holders, third party credit companies and other financial institutions.

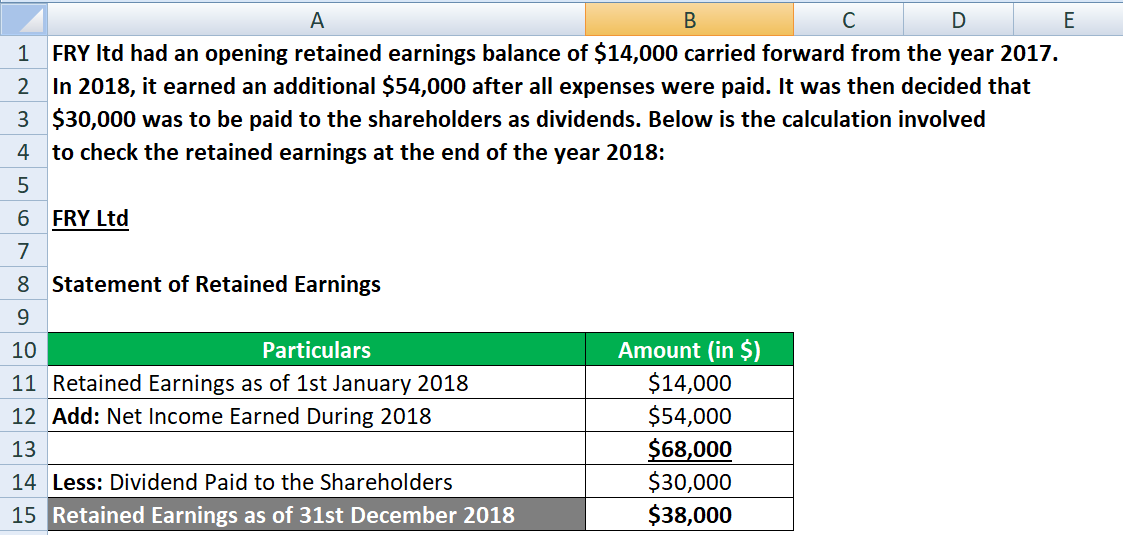

Statement of retained earnings equation. B statement of retained earnings return on assets cash balance, e time period net income / average total assets *ending cash. Essentially, you find your retained earnings by adding together your beginning holdings and your net income or loss for the accounting period, and then you subtract all dividends paid out (both cash and stock). Beginning retained earnings + net.

Accounting equation = liabilities contribute capital assets compa statement o time per equity + retained. What is the retained earnings formula? Beginning of period retained earnings

The retained earnings are calculated by adding net income to (or subtracting net losses from) the previous term’s retained earnings and then subtracting any net dividend(s) paid to the. With this formula, you can easily calculate the changes in retained. Retained earnings are calculated by adding the current year’s net profit (if it’s a net loss, then subtracting the current period net loss) to (or from) the previous year’s retained earnings (which is the current year’s retained earnings at the beginning) and then subtracting dividends paid in the current year from the same.

A statement of retained earnings details the changes in a company's retained earnings balance over a specific period, usually a year. In order to calculate the statement of retained earnings, you must first locate the retained earnings amount from the balance sheet under the shareholder’s equity section. The re formula is as follows:

The statement of retained earnings (retained earnings statement) is a financial statement that outlines the changes in retained earnings for a company over a specified period. The retained earnings formula is fairly straightforward: Retained earnings = r e + n i − d where:

The following are the main steps involved when calculating the retained earnings balance at the end of the reporting period: Then, use the following formula: Retained earnings formula and calculation.

Alternatively, a positive balance is a. Total designated retained earnings $ 252 $ 221 total retained earnings $ 12,533 $ 11,810 following the spring meetings in april 2018, a financing package was endorsed by the board of governors. The formula is as follows:

Beginning retained earnings corrected for adjustments, plus net income, minus dividends, equals ending retained earnings. It depends on how the ratio compares to other businesses in the same industry. What is the statement of retained earnings equation?

This is less any dividends that have been. The retained earnings calculation or formula is quite simple. Beginning retained earnings → the ending retained earnings balance from the prior period, which is recorded in the shareholders’ equity section of.

The beginning balance is obtained, for example, from the. Cash dividend , if paid any, can be figured out from financing activity from cash flow statements. A statement of retained earnings statement is a type of financial statement that shows the earnings the company has kept (i.e., retained) over a period of time.

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)