Ace Info About An Audit Of Historical Financial Statements Xbrl Example Balance Sheet Khc

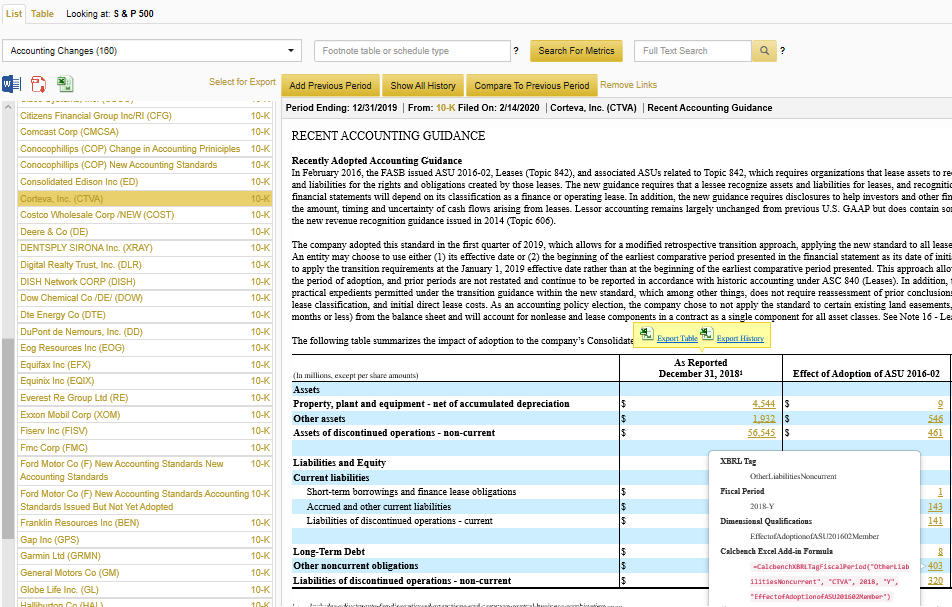

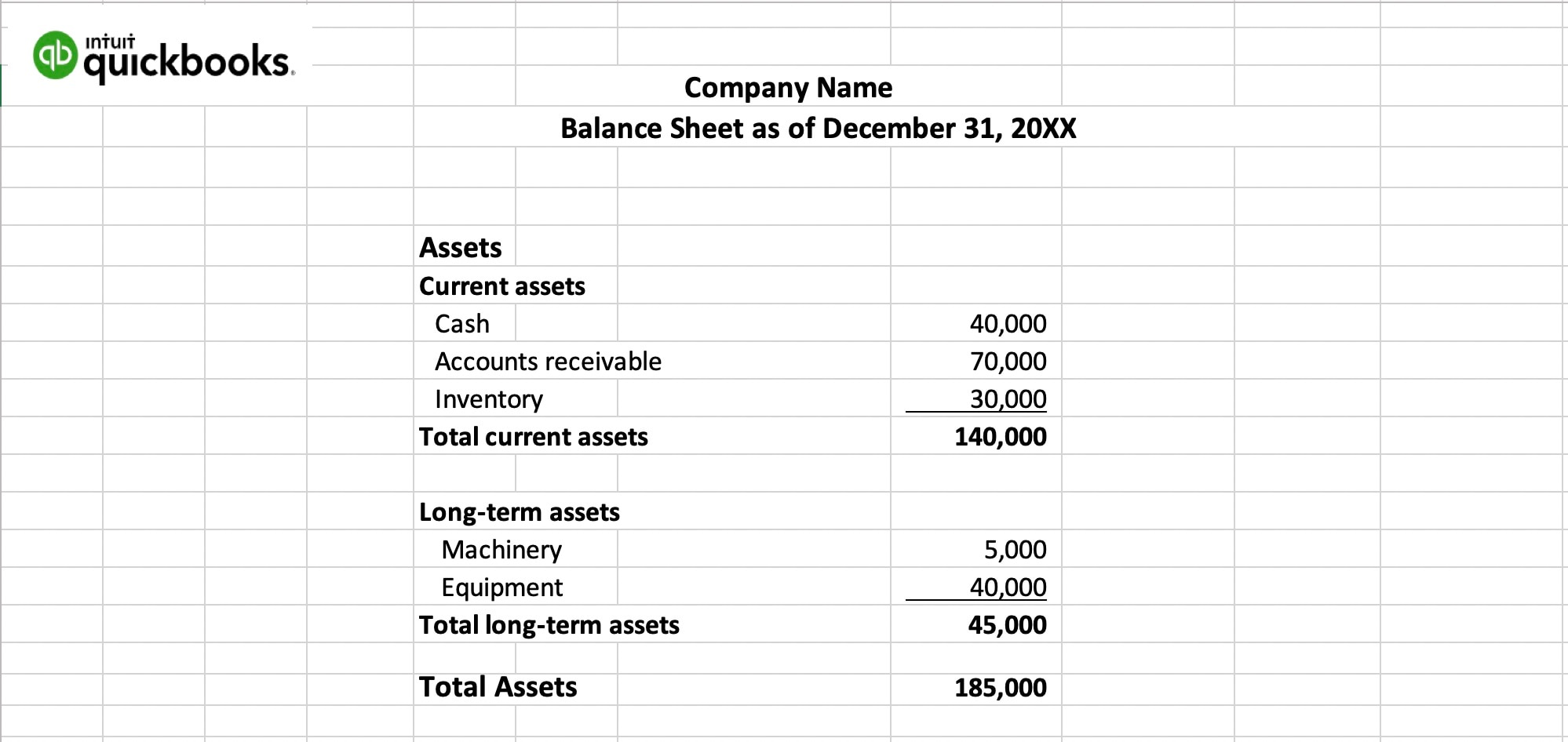

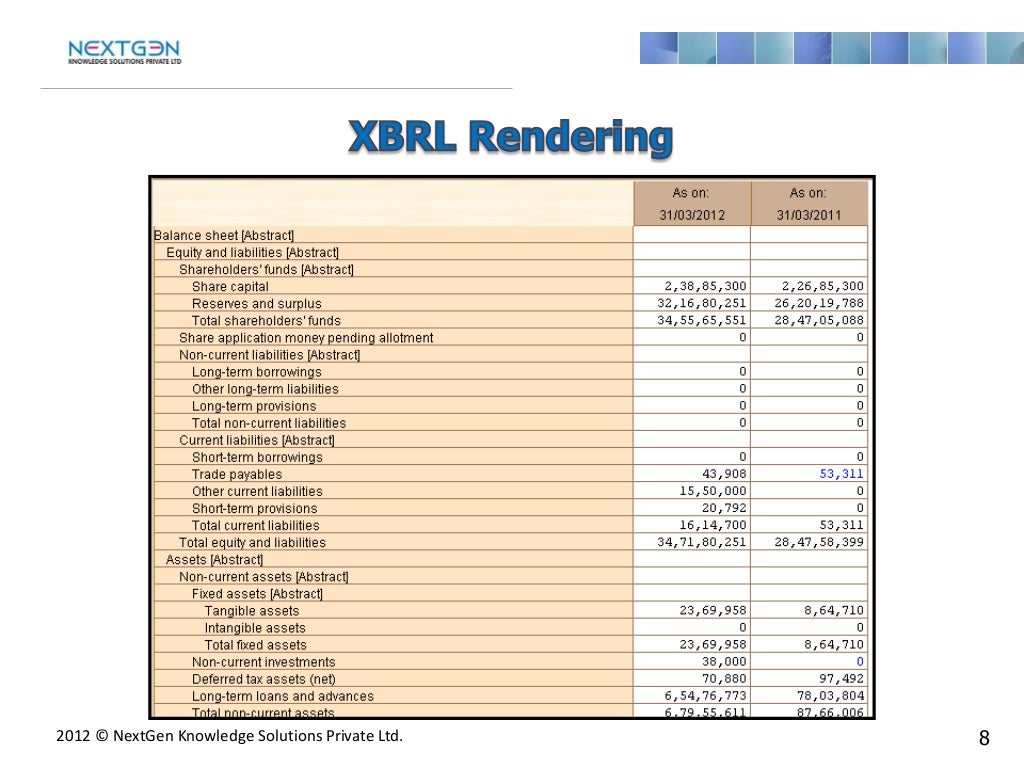

For example, if a company reports cash and cash equivalents on the face of the financial statements, the company officers will line that fact up against the equivalent element in.

An audit of historical financial statements xbrl example balance sheet. Concerns have been raised about the ability to identify the financial report type in an xbrl. Preparing your xbrl financial statements. Or rather, a template for a tree.

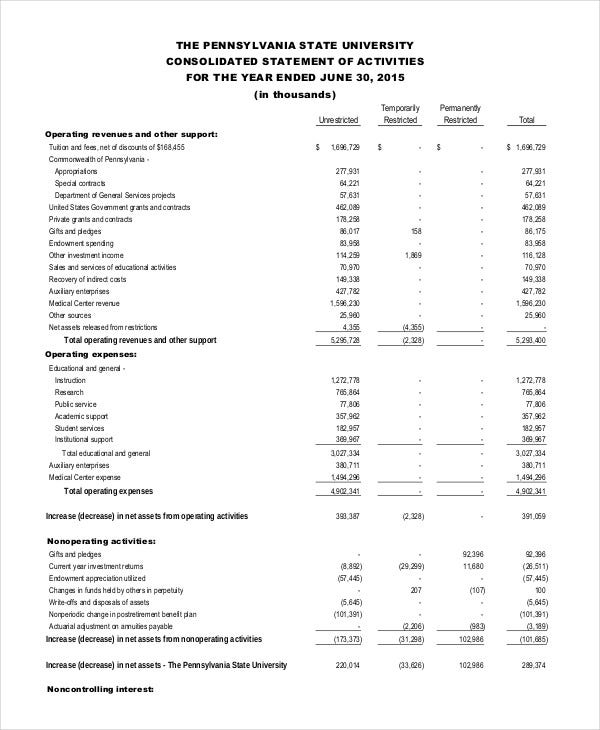

Three of the ixbrl exemption criteria (balance sheet value not exceeding €4.4m and turnover not exceeding €8.8m and average employee numbers not exceeding 50). This sample expresses a balance sheet, income statement, cash flows statement, and statement of changes in equity using xbrl. You can think of an xbrl taxonomy a bit like a tree structure.

The xbrl international annual reports can be found at the. The financial statement data sets below provide numeric information from the face financials of all financial statements. It is a representative view of the way a financial statement.

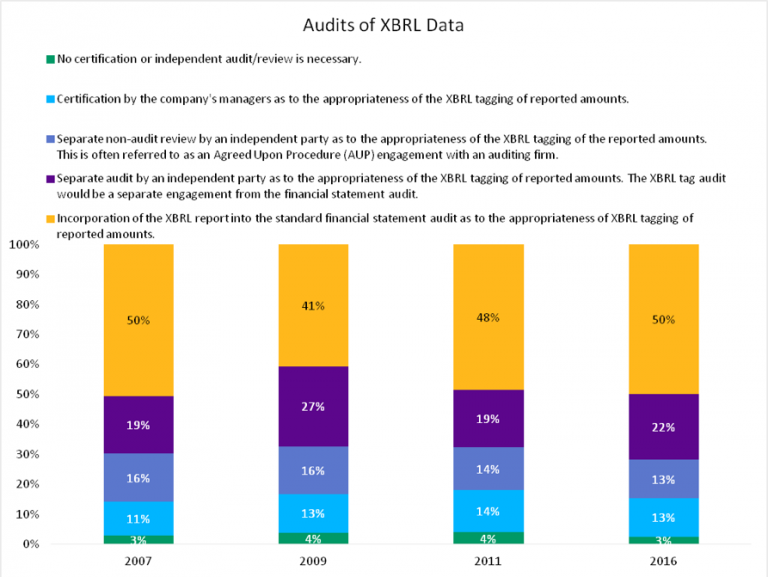

There are different types of audits that can be performed depending on the subject matter under consideration, for example: Consistent presentation of financial statements reflected the company’s activities and business environment. Example reflects full set of.

This page demonstrates an example inline xbrl (or ixbrl) report. Excel spreadsheet downloads include all the data presented in the xbrl document, with each financial statement or disclosure presented in a separate worksheet tab (see. The taxonomy is followed as.

The report must include a reconciliation of reporting within the prudential return to relevant material in financial statements, including the balance sheet and profit and loss. This section elaborates on mapping the line items in your financial statements to the relevant concepts within the acra taxonomy. This data is extracted from exhibits to.

Home > the consortium > about > annual financial statements. The format of electronic financial statements revenue has adopted the internationally recognised ixbrl standard for accepting electronic financial statements. From 1 january 2020 companies which are listed on the eu capital markets and prepare their consolidated financial statements in compliance with international financial.

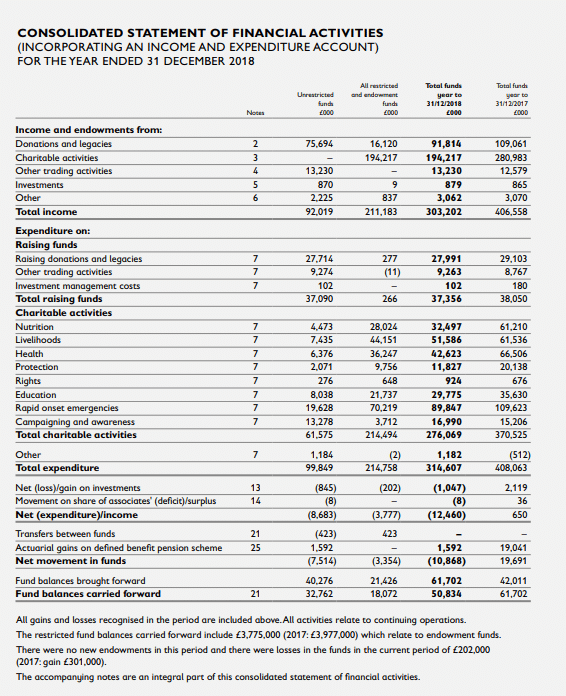

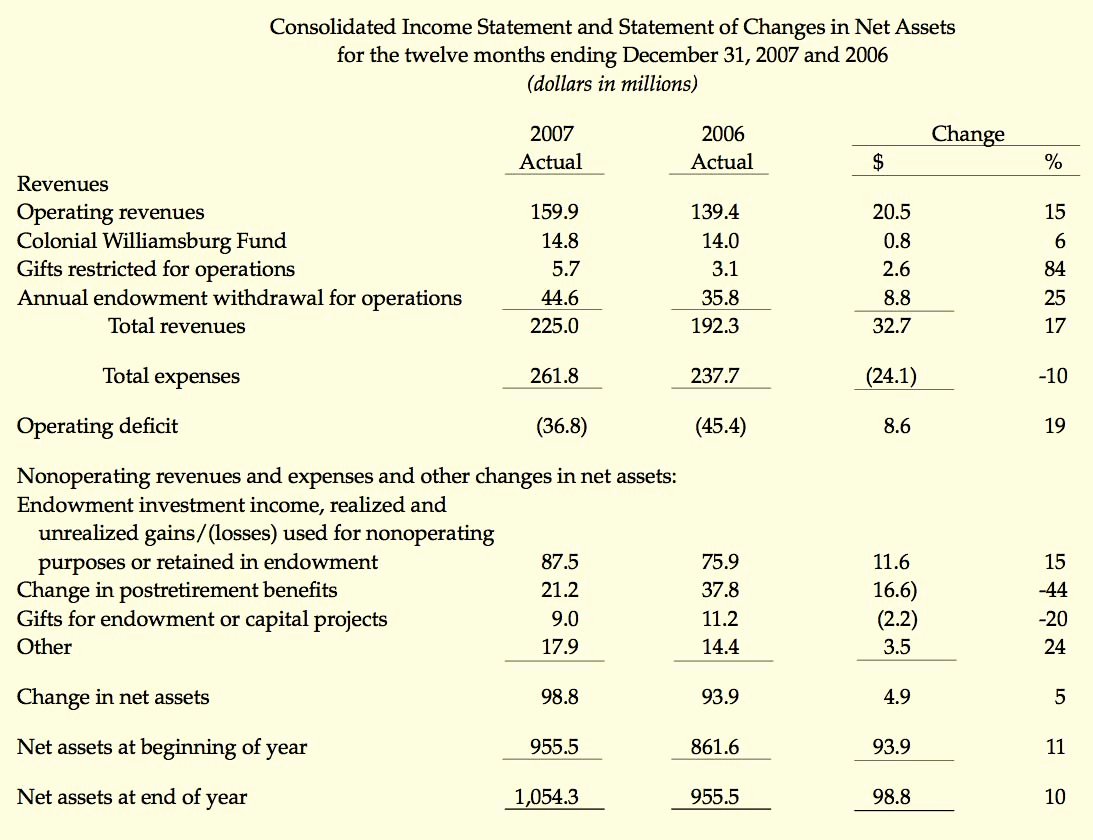

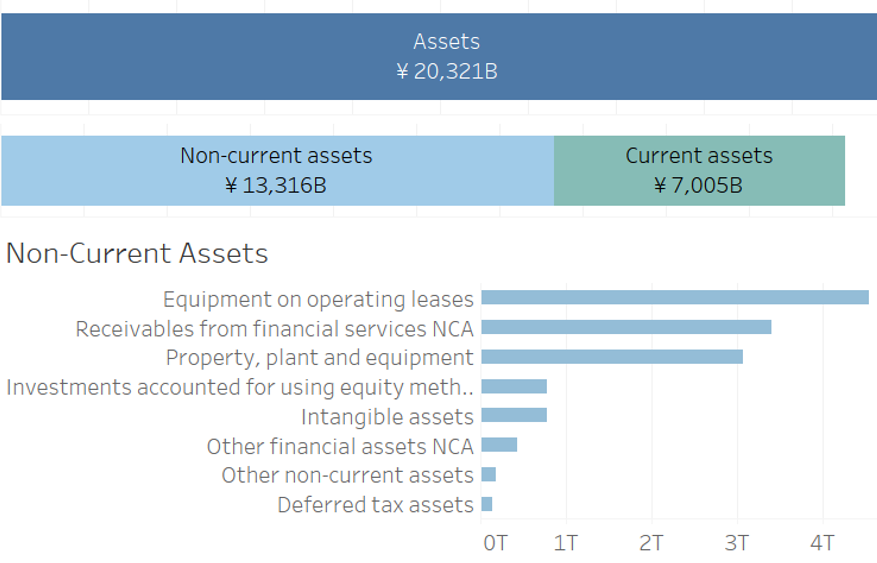

Preparing, publishing, exchanging, consuming and analysing financial statements was always a design goal and has been a key capability of xbrl for many years. Financial statement audit involves auditing the following: We focus our analyses on three main financial statements, including balance sheets, income statements, and cash flow statements.

Audit of financial statements audit of internal. We performed an extensive literature review concerning xbrl utilization in europe and in the us and identified several key areas where this technology may be. This heads up summarizes recent developments related to the use of xbrl and discusses their implications for financial reporting.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)