One Of The Best Info About Income Tax Yearly Statement How To Prepare Profit And Loss Account

What is maxis annual summary of invoices?

Income tax yearly statement. Income tax is a tax on the annual income earned by the individual or company during the fiscal year. Income tax statements are generally issued at the end of each year and include information about your salary, tax deductions, and social security contributions. You file a joint return, and you and your spouse have a.

Air canada produced very strong results for the fourth quarter and full year 2023, delivering on its key financial goals and strategic priorities. Ais is divided into two. Annual information statement (ais) is a statement that provides complete information about a taxpayer for a particular financial year.

You will need to check that income from your payment summary is in your tax return. Directorate of income tax (systems) has released handbook on annual information statement (ais). Iras annual report fy2020/21.

Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. 2023 and subsequent annual reports, quarterly reports and other filings filed with the securities and exchange commission. With a provisional income of $34,001.

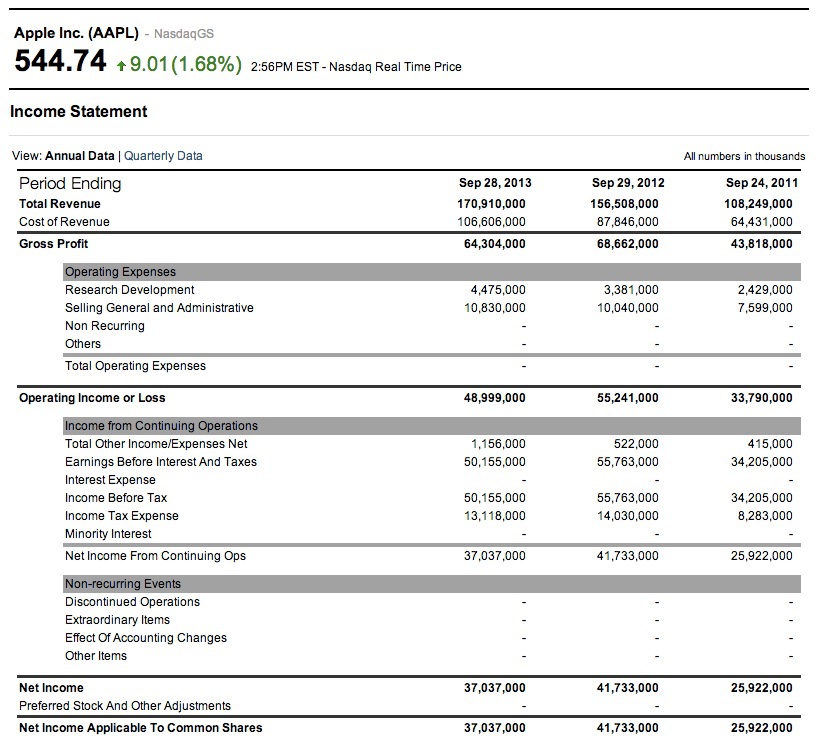

If you're submitting in the year 2022, you. View aapl financial statements in full, including balance sheets and ratios. Annual summary of invoices is the summary of your maxis invoices for previous year.

Enter your income and location to estimate your tax burden. Under ias 34.30(c), income tax expense in each interim period is based on the estimated average annual effective income tax rate applied to the pre. 'tax payable by 27 may 2023 $8,586.00' means you must pay $8,586.00 to iras by 27 may 2023, unless you are.

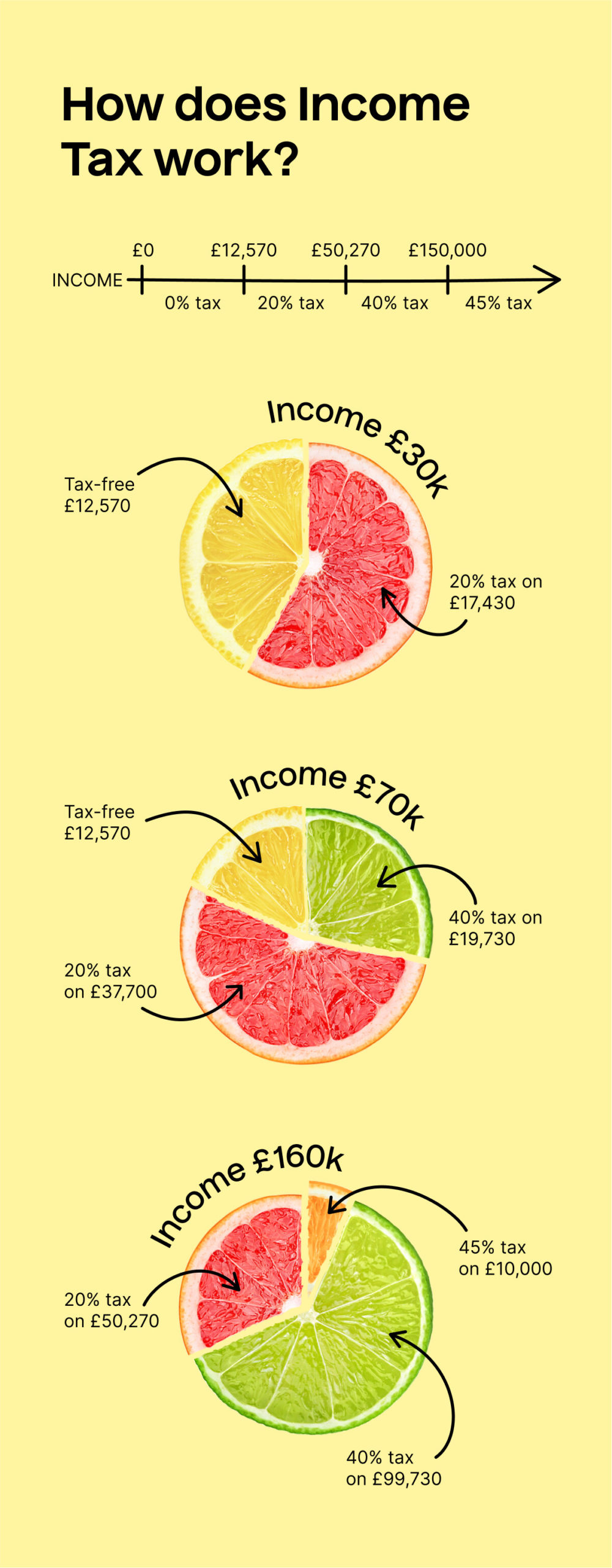

Annual information statement (ais) is comprehensive view of information for a taxpayer displayed in form 26as. What is income tax? When you earn more, you will end up paying more in taxes.

You may start filing for the year of assessment 2024 from 1 mar 2024. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. Basics of individual income tax receive tax bill, pay tax, check refunds getting my tax assessment getting my tax assessment most taxpayers should receive their tax bills.

This refers to the amount of tax that you need to pay. This will explain how the new form 26as (annual. You can view and print your statement of account (soa) online by following the steps:

The 2020/21 annual report documents iras' major initiatives and developments between 1 apr 2020 and 31 mar 2021. Log in to mytax.iras.gov.sg with your singpass.