Neat Tips About Cash Flow Exemption Prepare A Contribution Format Income Statement

Flow follows the global x u.s.

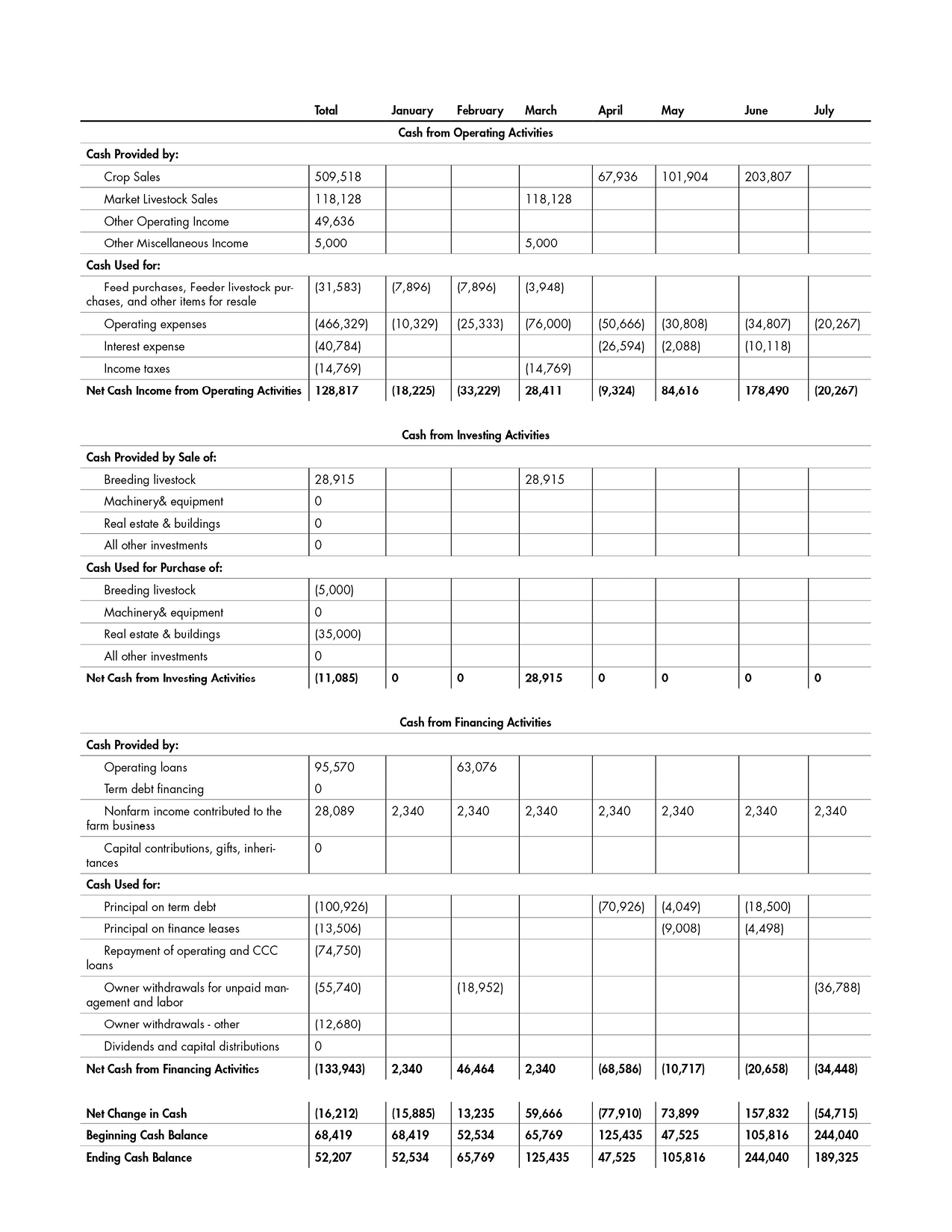

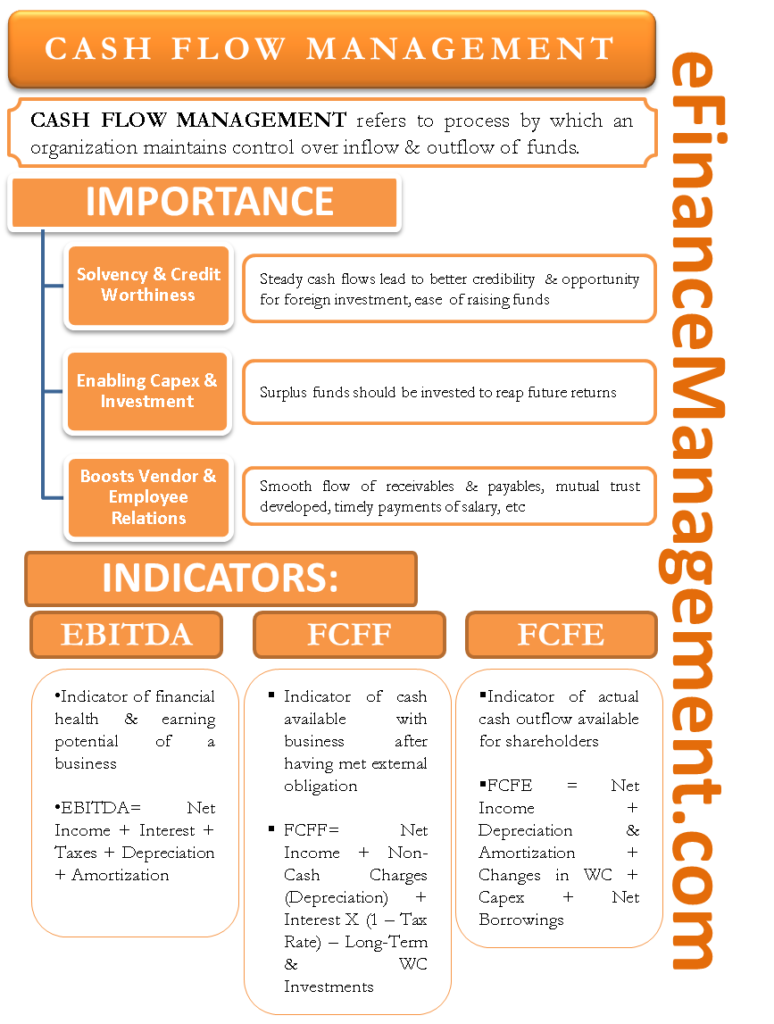

Cash flow exemption. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two. The following list contains additional. Statement of cash flows requires the provision of information about the historical changes in cash and cash equivalents during the period, classified as operating, investing and financing cash flows.

Old gaap provided an exemption either where the entity met the definition of a small entity as defined in the companies act or where the entity was a 90% or more subsidiary of a parent entity which produced publicly available consolidated. The principles of reporting cash flows are contained in asc 230, statement of cash flows; The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities.

The writer is the managing partner of daams, a social enterprise for development of smes and. Investing and financing transactions that do not require the use of cash or cash equivalents are excluded from a statement of cash flows but separately disclosed. 6.2 statement of cash flows—scope and relevant guidance.

Presentation issues 14 1 guidance overview 14 1.1 gross cash flows 14 1.2 selecting the direct or indirect methods 15 1.2.1 direct method 15. Other disclosure exemptions including capital management: Under the small entity provisions within s1a of frs 102 small companies who are not subsidiaries can claim exemption from preparing a cash flow statement.

Cash flow kings 100 etf ( flow), which debuted last july, features an approach that’s similar to what’s found with the aforementioned cowz. A recent european example of issues related to the cash flow statement, and an example of applying a prominent financial instrument exemption. Under us gaap, defined benefit pension plans that present financial information under asc 960 3 and certain investments companies in the scope of asc 946 4 may be exempt from presenting a statement of cash flows.

Considered a basic financial instrument if it gives rise to cash flows on specified dates that constitute repayment of the principal advanced, together with reasonable Present a statement of cash flows; Small entities are not required to prepare a cashflow statement.

Frc staff factsheet illustrating the format of the statement of cash flows prepared in accordance with section 7 statement of cash flows, with examples. This page provides information on the standard and recent amendments, alongside icaew factsheets. This article sets out the requirements under the new standard and the differences between frs 102 and the previous standard,

John hughes / february 4, 2014. Cash flows and exemptions. Cash flows are classified under the three standard headings of operating, investing and financing activities.

On enactment of the european directive 2013/34 by ireland, it will be possible for small irish companies to claim exemption from presenting a cash flow statement. Entities were given exemption from preparing cash flow statements but under frs 102 a complete set of financial statements must now include a cash flow statement for accounting periods commencing on or after 1st january 2015. However, asc 230 is not a comprehensive source of authoritative guidance.

It looks at exemptions from presenting a cash flow statement, reporting cash flows from operating activities, and disclosures. Exemption from the requirement of ias 1 to: Ttm = trailing 12 months.