Wonderful Tips About Purchase Of Property Plant And Equipment Cash Flow How To Draw An Income Statement

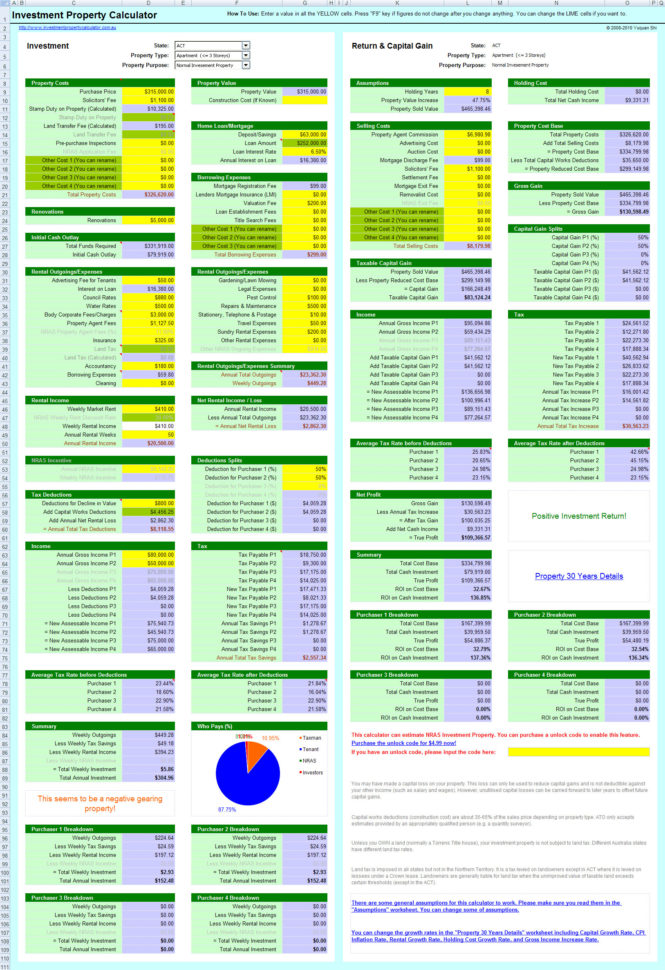

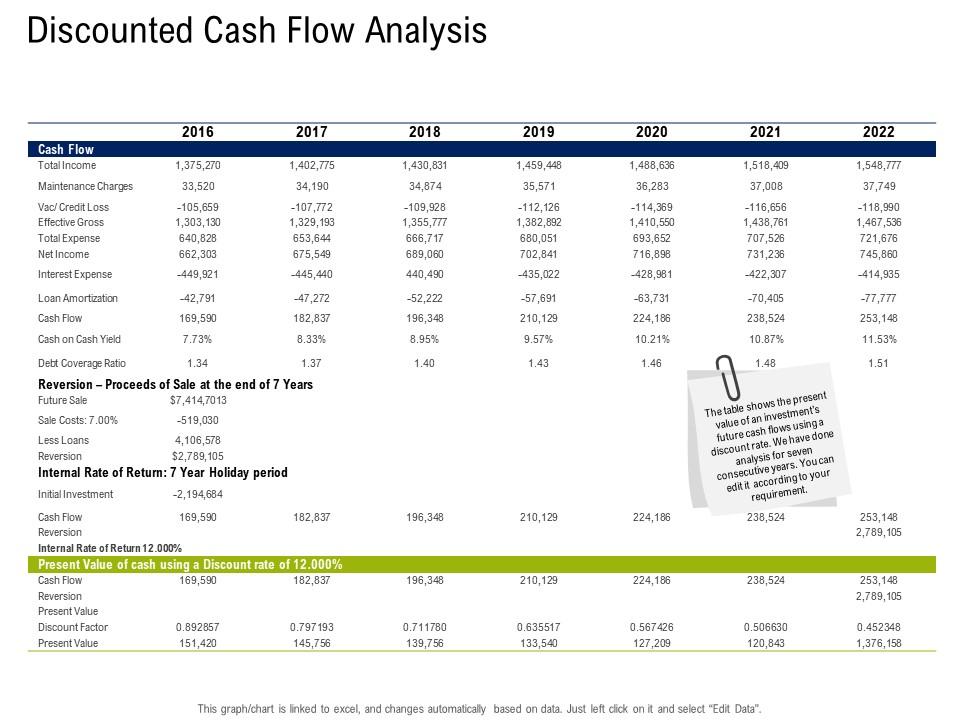

By understanding the cash flow dynamics and planning ahead, you can ensure that your business remains financially healthy while making informed decisions about property, plant, and equipment.

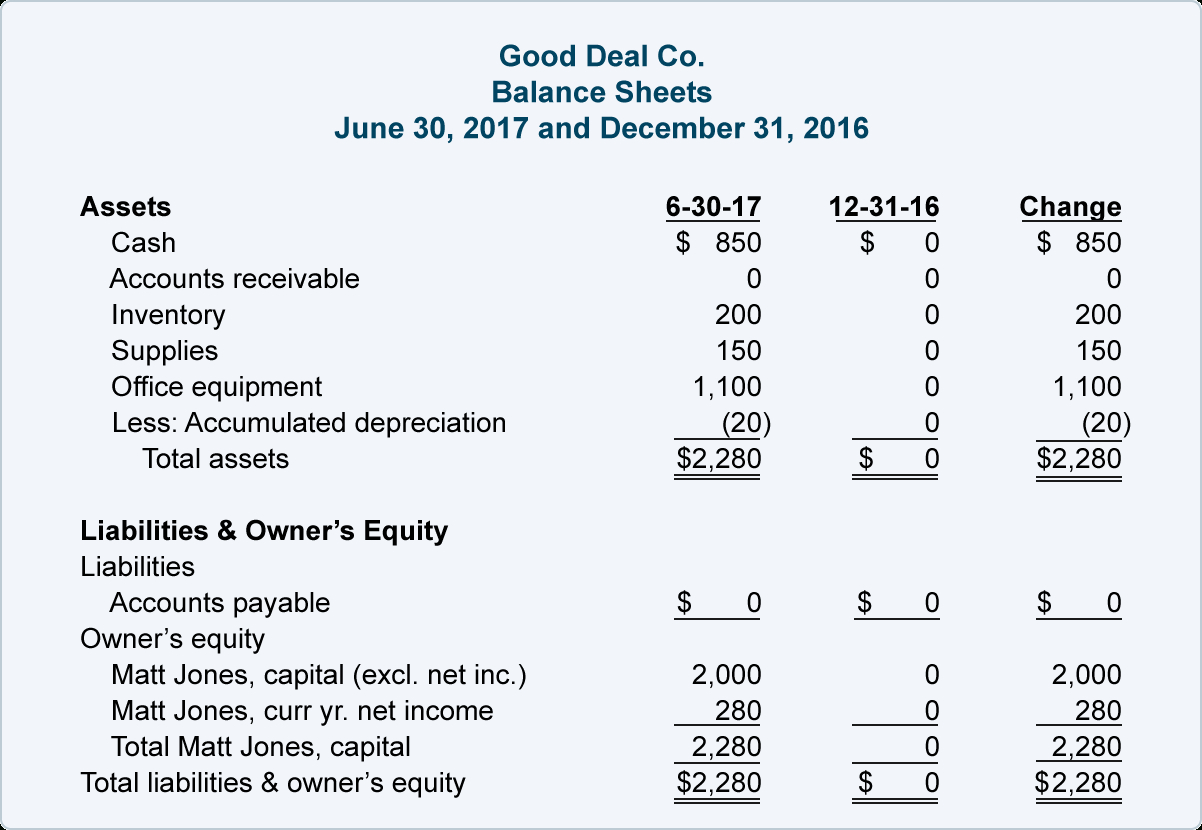

Purchase of property plant and equipment cash flow. Cash receipts and payments from forward contracts, option contracts, or other trading contracts; Therefore, from $145 million, we add the $10 million in new pp&e purchases and then subtract the $5 million in depreciation expense. Instead, record an asset purchase entry on your business balance sheet and cash flow statement.

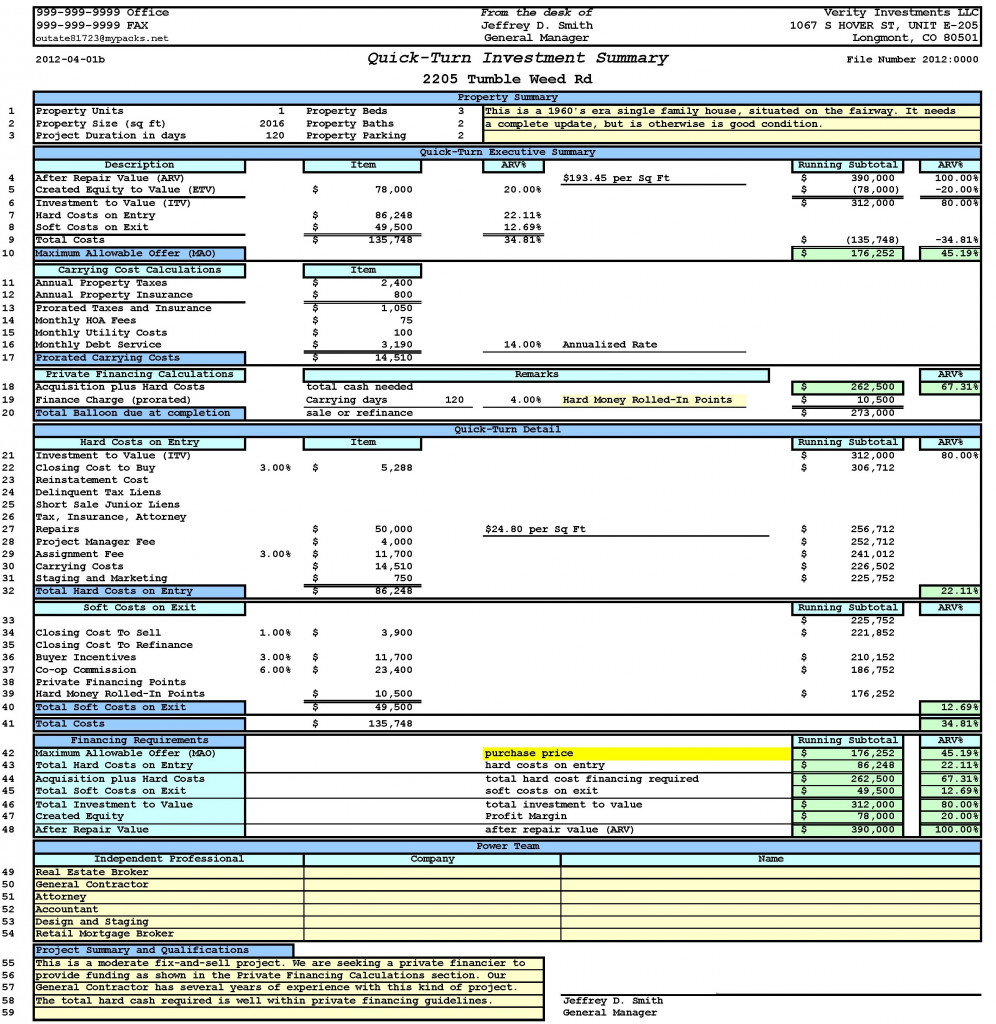

When a company acquires a plant asset, accountants record the asset at the cost of acquisition (historical cost). In may 2020, the board issued property, plant and equipment: Payments for purchase of equity instruments of other entities

The company paid a net purchase price of $150,000, brokerage fees of $5,000, legal fees of $2,000, and freight and insurance in transit of $3,000. Earlier we reported comments from the head of the un's nuclear watchdog, who said ukraine's zaporizhzhia nuclear plant has lost connection to its last external backup power line (see 17.11 post). Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life.

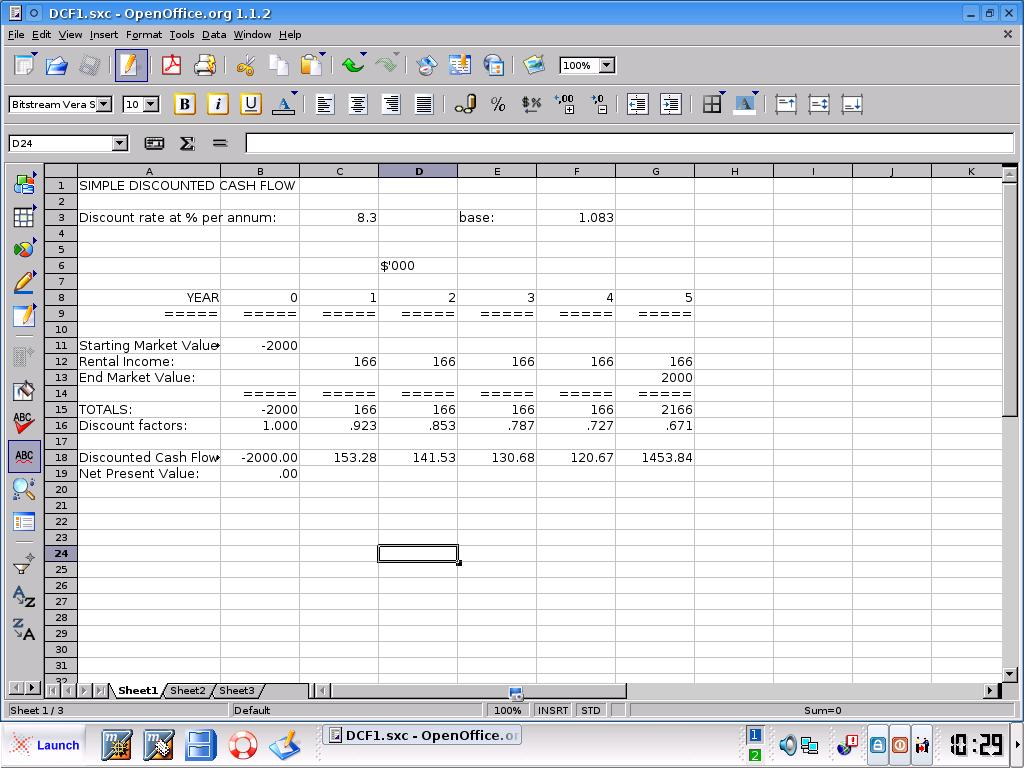

Previous chapters discussed current assets. The most common of these activities involve purchase or sale of property, plant, and equipment, but other activities, such as those involving investment assets and notes receivable, also represent cash flows from investing. The purchase or sale of a fixed asset like property, plant, or equipment would be an investing activity.

The $100 cash payment should be reported as an investing activity outflow and included with purchases of property, plant, and equipment. Proceeds from the sale of pp&e. Payments for purchase of debt instruments of other entities;

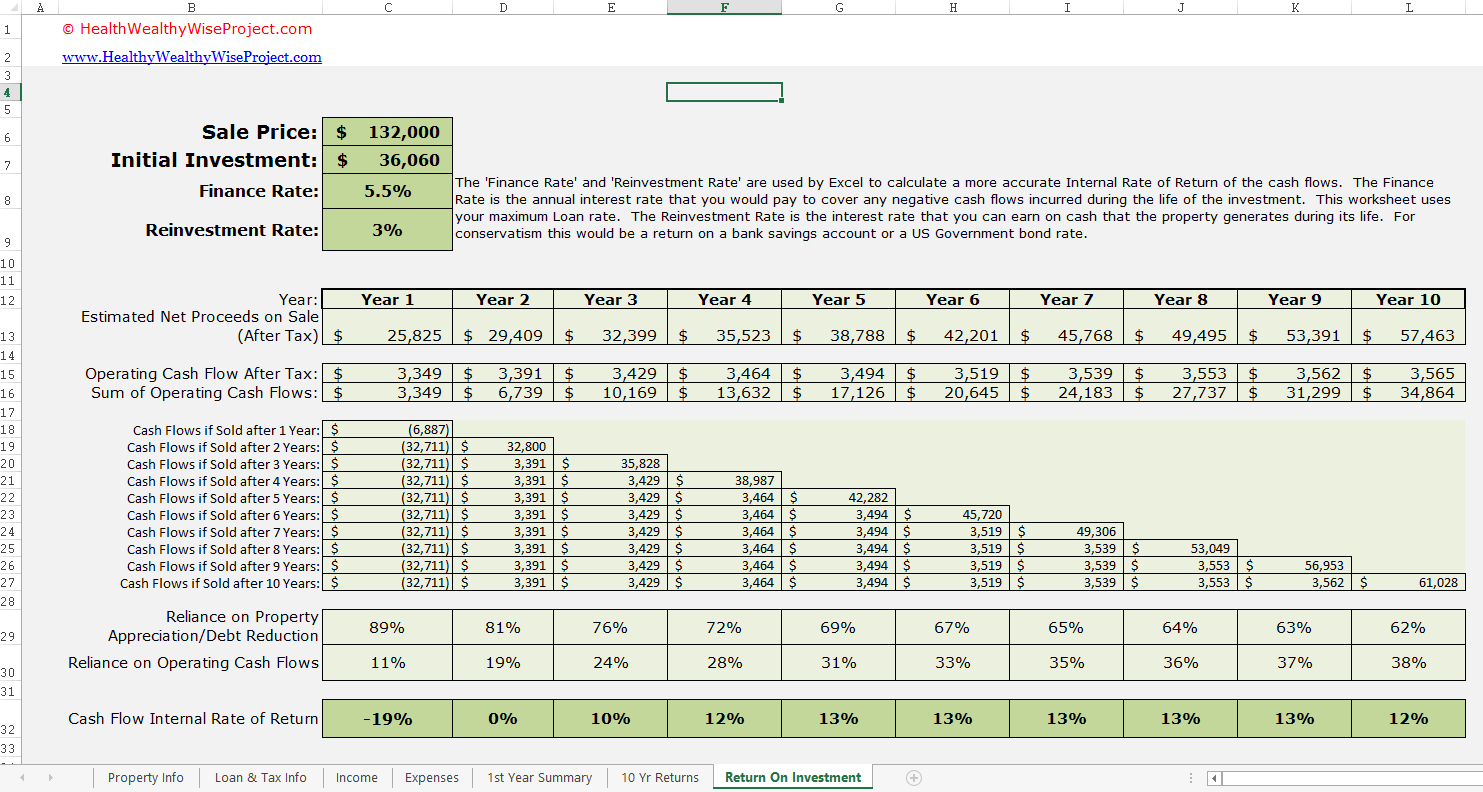

Purchase of property plant, and equipment (pp&e), also known as capital expenditures. Calculation of interest and dividends received again, the calculation should take account of both the incomereceivable shown in the income statement and any relevant receivablesbalance from the opening and closing statement of financial positions. Purchase of property, plant and equipment.

The cash paid for the purchase of equipment during the year is $27,000, and the proceeds from the sale of equipment during the year are $16,750 (= $9,500 cost + $7,250 gain). Proceeds before intended use (amendments to ias 16) which prohibit a company from deducting from the cost of property, plant and equipment amounts received from selling items produced while the company is preparing the asset for its intended use. Dividends or interest received from.

Pp&e plays a key part in the financial planning and analysis of a company’s operations and future expenditures, especially with. The objective of this standard is to prescribe the accounting treatment for property, plant and equipment so that users [refer: Cash flow from investing activities refers to cash inflow and outflow of cash from investing in assets (including intangibles), purchasing of assets like property, plant and equipment, shares, debt, and from sale proceeds of assets or disposal of shares/debt or redemption of investments like a collection from loans advanced or debt issued.

Ias 16 was reissued in december. Property, plant, and equipment are often called plant and equipment or simply plant assets. Common plant assets are buildings, machines, tools, and office equipment.

Proceeds from the sale of other businesses (divestitures) purchases of marketable securities (i.e., stocks, bonds, etc.) Investing activities can include: Asc 360, property, plant, and equipment is the authoritative us gaap for pp&e and defines property, plant, and equipment as follows:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)