Real Tips About Dividend Paid In Cash Flow Statement Notes Receivable On Balance Sheet

This video shows how to calculate the amount of dividends for the financing section of the statement of cash flows.

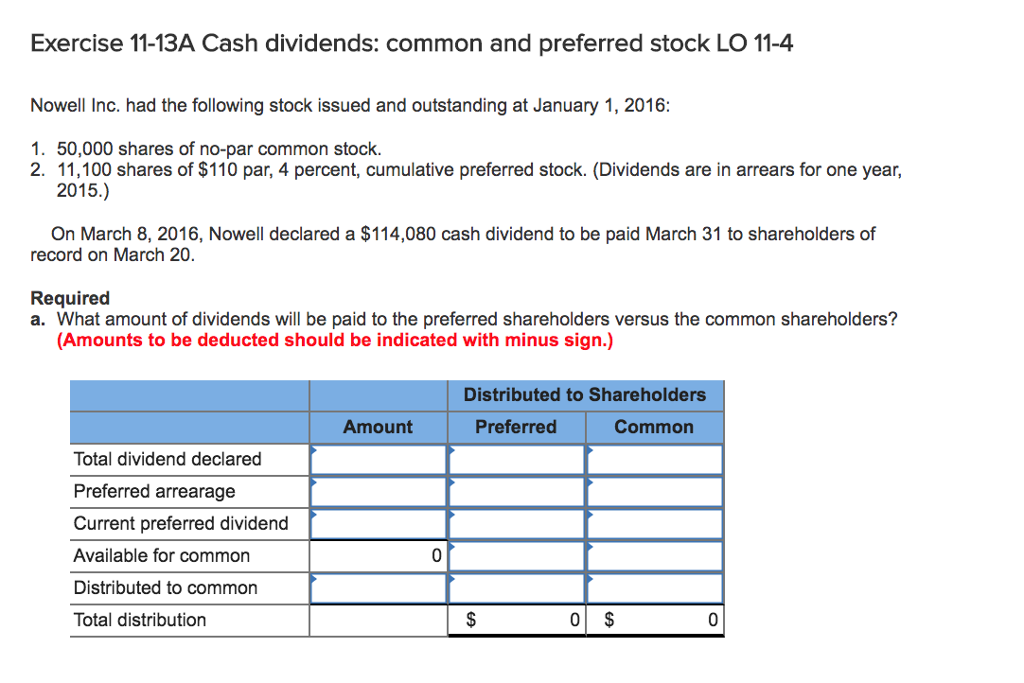

Dividend paid in cash flow statement. Here is the formula for dividends per share: Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally. Understanding the treatment of a dividend a board of directors must approve dividend.

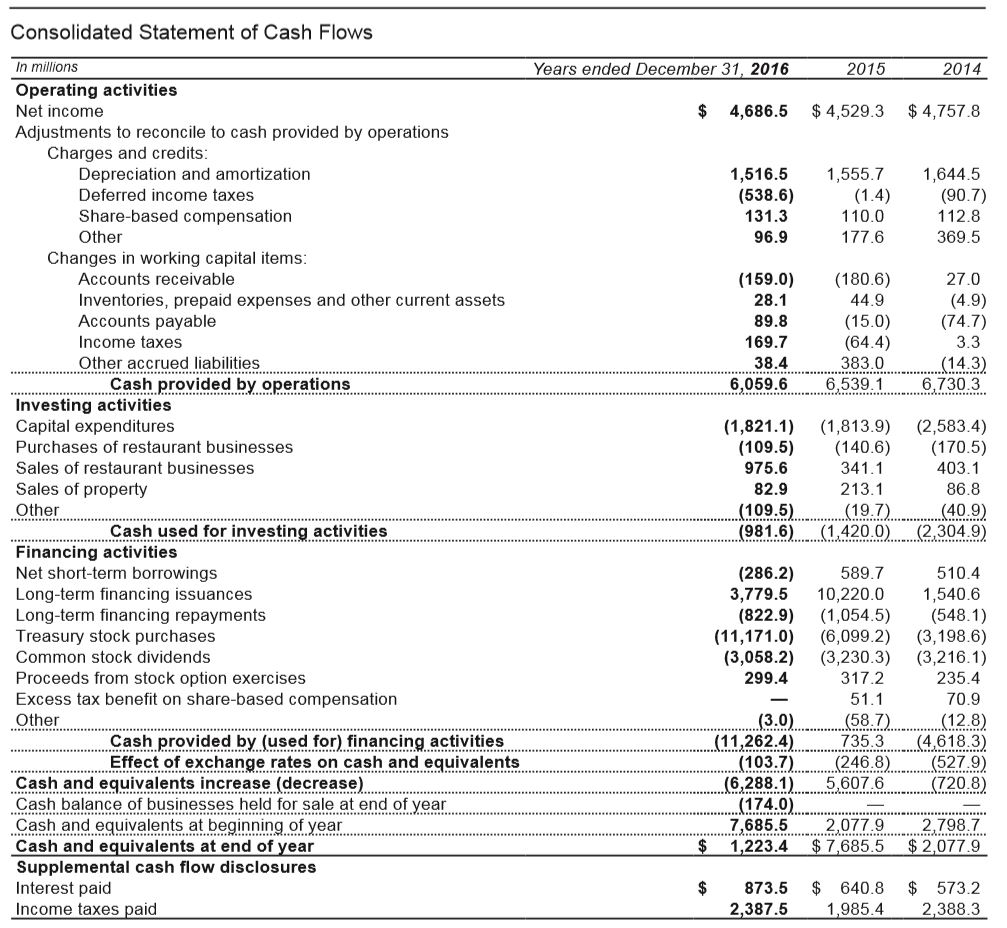

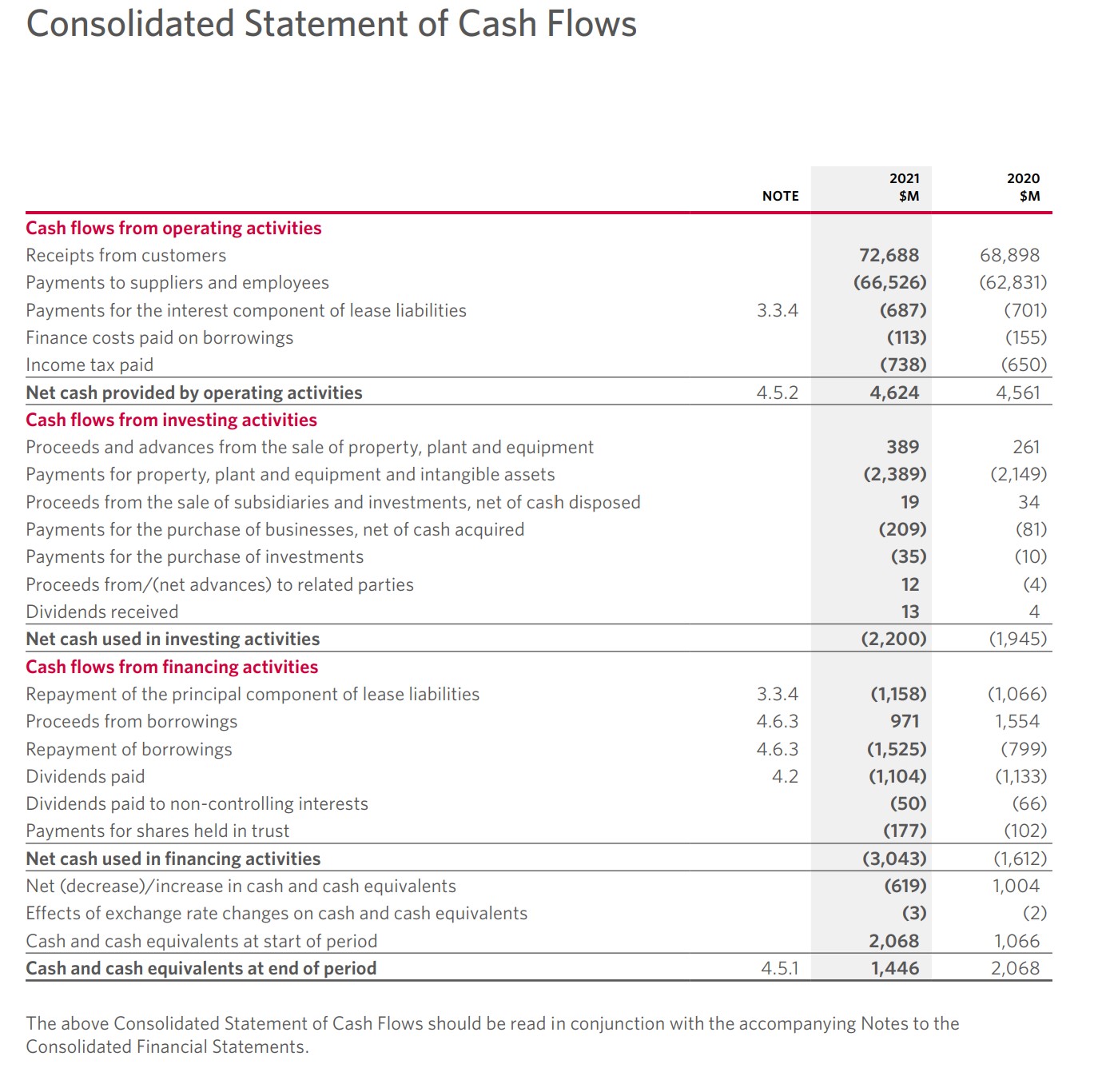

In summary, on the cash flow statement, dividends paid to shareholders are reported as cash outflows in the financing activities section. In financial modeling, it’s important to have a solid understanding of how a dividend payment impacts a company’s balance sheet, income statement, and cash flow statement. How do dividends impact cash flow?

Dividend payments are recorded on the cash flow statement in the financing section, because they involve owners and affect cash flow. This money does not arise as a result of the business interacting with its customers. And (d) dividends received should be reported as cash flows from investing

So, are dividends in the cash flow statement? Total dividends ÷ shares outstanding = dividends per share. It’s listed in the “cash flow from financing activities” section.

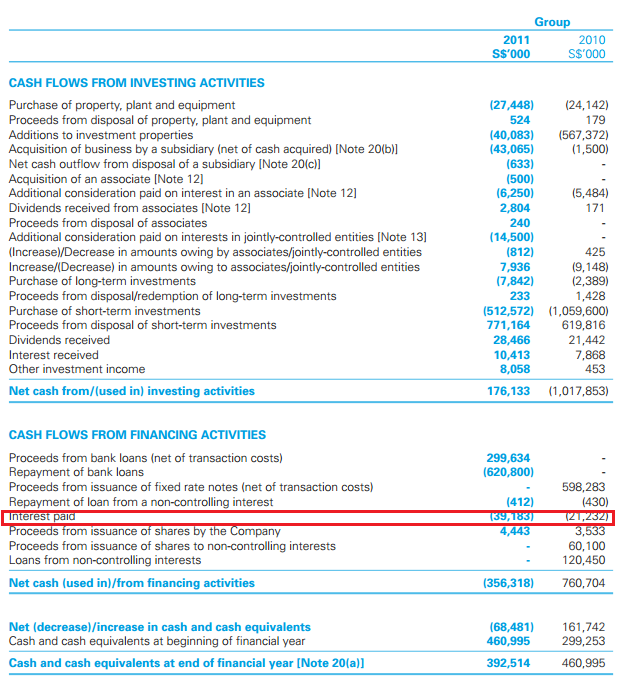

Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (ppe) which is an investing activity cash out flow and dividends paid, which is a financing activity cash out flow. August 07, 2023. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

Dividends paid out are reported on the. This is the sole impact that dividend issuance. If the company has not directly disclosed this information, it is still possible to derive the amount if the investor has access to the company's income statement and its beginning and ending balance sheets.

Dividends on the cash flow statement dividends are typically found in the financing activities section of the cash flow statement. The amount of dividends can be determined if you know the net income (or net. In cfi’s financial modeling course, you’ll learn how to link the statements together so that any dividends paid flow through all the appropriate accounts.

The cfs highlights a company's cash management, including how well it generates. Definition of cash dividends cash dividends are a distribution of a corporation's earnings to its stockholders or shareholders. Understanding the fundamentals it is important to remember that not all outbound cash flow is devoted to dividend payments.

Differences exist between the two frameworks for the presentation of the statement of cash flows that could result in differences in the actual amount shown as cash and cash equivalents in the statement of cash flows (including the presentation of restricted cash) as well as changes to each of the operating, investing, and financing activity sec. They are presented separately from other cash flow activities to provide transparency and highlight the impact of dividend distributions on a company’s cash flow position. And (b) results in a classification in the statement of cash flows that is generally consistent with the classification of the related income or expense in the

The board of directors proposes to the annual general meeting to be held on 13 march 2024 that for the financial year ended 31 december 2023 a total dividend of eur 1.47 per share be paid in two instalments. We explain the treatment of dividends and interest paid, and dividends and interest received in the cash flow statement. The statement of cash flows will report the amount of the cash dividends as a use of cash in the financing activities section.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)