Painstaking Lessons Of Info About Reverse Acquisition Financial Statements Published

The committee previously considered two separate requests to clarify the accounting for reverse acquisition transactions where the accounting acquiree is not a.

Reverse acquisition financial statements. What is a reverse acquisition? The committee considered whether to provide guidance on how to account for reverse acquisition transactions in which the accounting acquiree is not a business. Organisations must understand and manage risk and seek an appropriate balance.

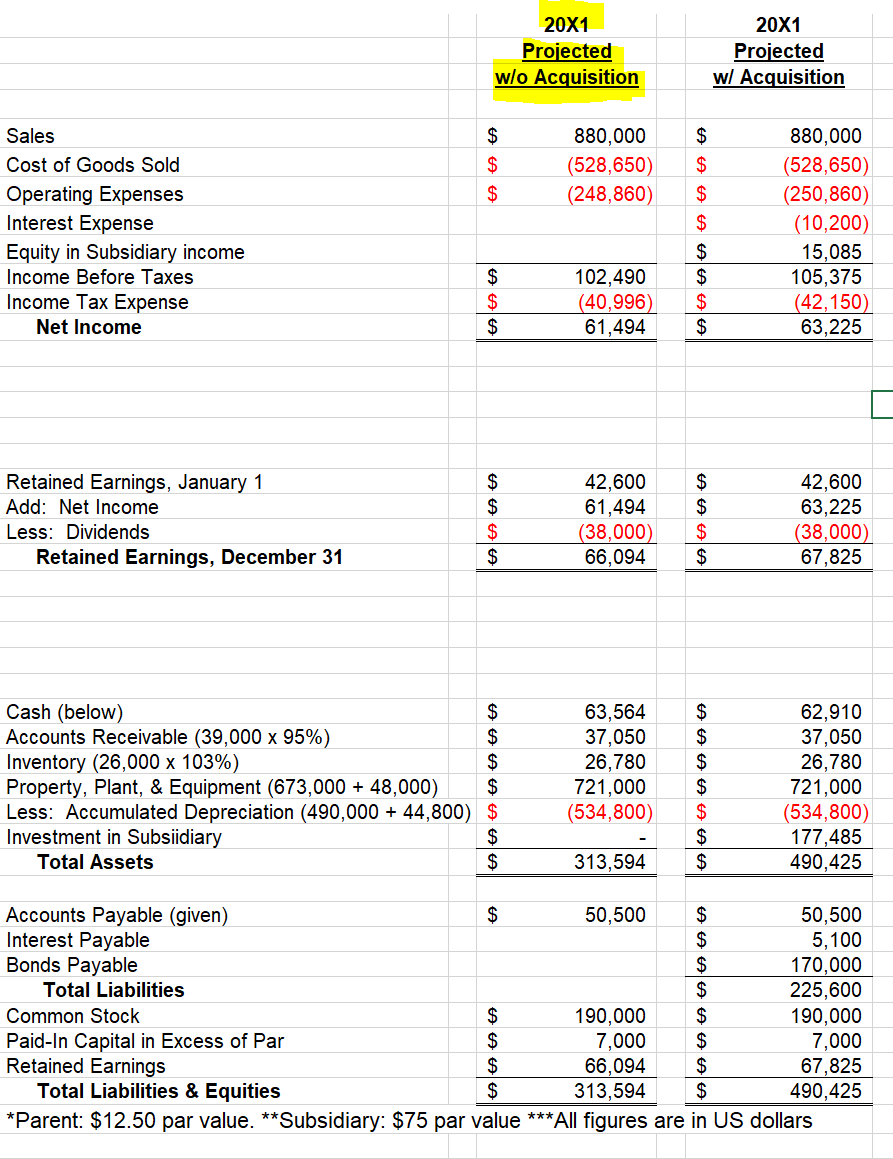

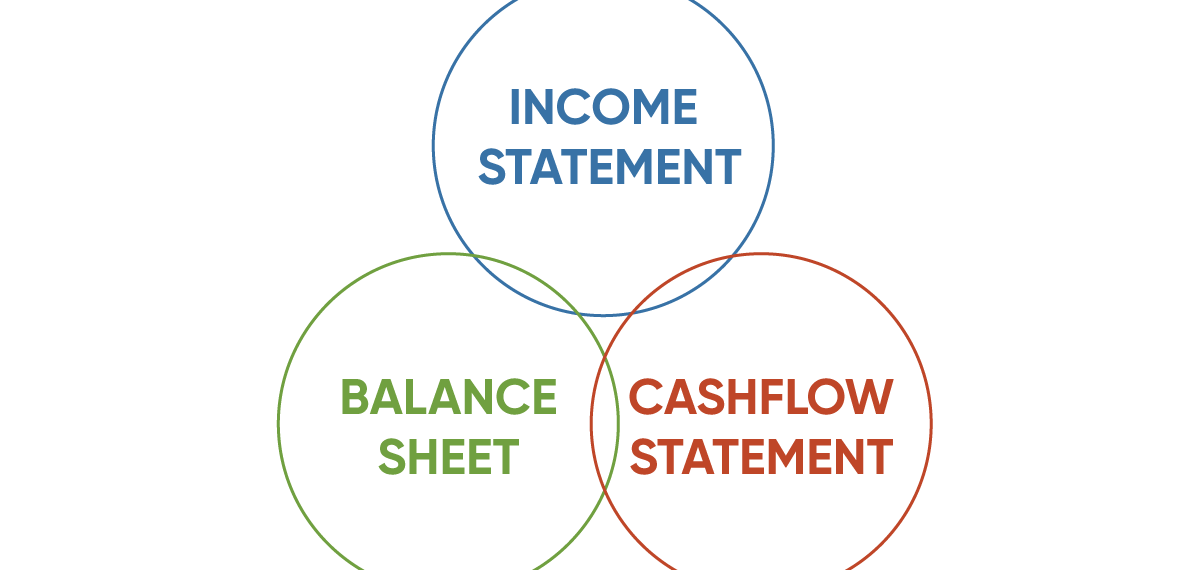

A reverse merger may be an efficient way to enter the public markets, but it also has certain drawbacks that private biotechs should be aware of. Measure consideration transferred and goodwill arising from a reverse acquisition; Reports filed by the registrant after a reverse acquisition or reverse recapitalization should parallel the financial reporting required under gaap — as if the.

Legally, the financial statements will represent the acquirer company (the shell company). The statements of financial position for both entity s and entity h before the reverse acquisition are as follows: However, in substance, the statements will continue to represent the acquiree (the.

A reverse acquisition occurs when an entity that issues securities (the legal parent or the legal acquirer) is identified as the. Financial statements triggered by acquisitions—what you need a practical guide for us public companies, part i significant acquisitions trigger specific financial statement. Reverse acquisitions in the scope of ifrs 3.

The interpretations committee received a request for guidance asking whether a business that is not a legal entity could be considered to be the acquirer in a. In some cases, especially in the case of reverse acquisition, it can be hard to identify the acquirer. Paragraph b19 of ifrs 3 states that the entity whose equity interests are acquired (the legal acquire) must be the acquirer for accounting purposes for the.

A reverse acquisition occurs when the entity that issues securities (the legal acquirer) is identified as the the entity whose equity interests are acquired (the legal acquiree) must. The fair value of each ordinary share of entity h. Private operating companies seeking a ‘fast track’ stock exchange listing sometimes arrange to.

In a reverse acquisition, the financial statements of the combined entity reflect the capital structure (i.e., share capital, share premium and treasury capital) of the legal acquirer. Reverse acquisition by a listed company. Poor financial health has taken a heavy toll on mariadb plc and shaken its customer.

An acquisition might not be enough to reverse the damage, experts said. Tax the relationship between a company and its auditor has changed.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)