Best Info About Stockholders Equity On Balance Sheet Frito Lay Financial Statements

![[Solved] Hi! Can someone help me with this Financial Accounting](https://media.cheggcdn.com/media/4c4/4c4bbe11-fc6f-4eb1-bfd8-2e0d2cff8414/phpIbQZHT.png)

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

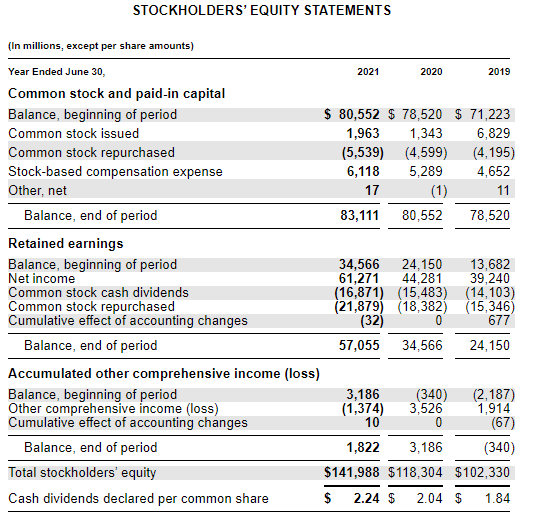

Stockholders equity on balance sheet. In this article, you will get to understand the components of stockholder’s equity in the balance sheet, its calculation, and how. These are assets that can be converted to cash. Stockholders’ equity section of the balance sheet

Shareholders' equity is the amount of money that a company could return to shareholders if all its assets were converted to cash and all its debts were paid off. The company stockholders’ equity also known as shareholders’ equity is an account contained in the balance sheet. Soros fund management is positioned to become the biggest shareholder of audacy inc.

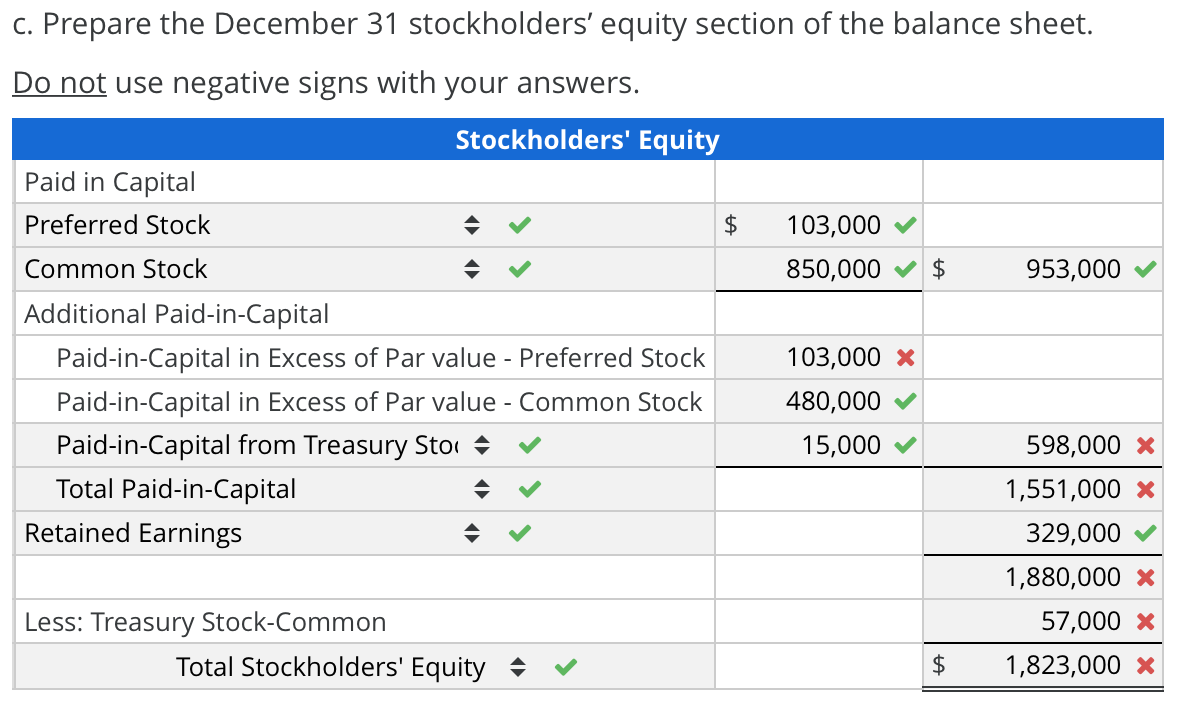

In our modeling exercise, we’ll forecast the shareholders’ equity balance of a hypothetical company for fiscal years 2021 and 2022. It also represents the residual value of assets minus liabilities. Stockholders' equity is a line item that can be found on a company's balance sheet, and the trend in stockholders' equity can be assessed by looking at past balance sheet reports.

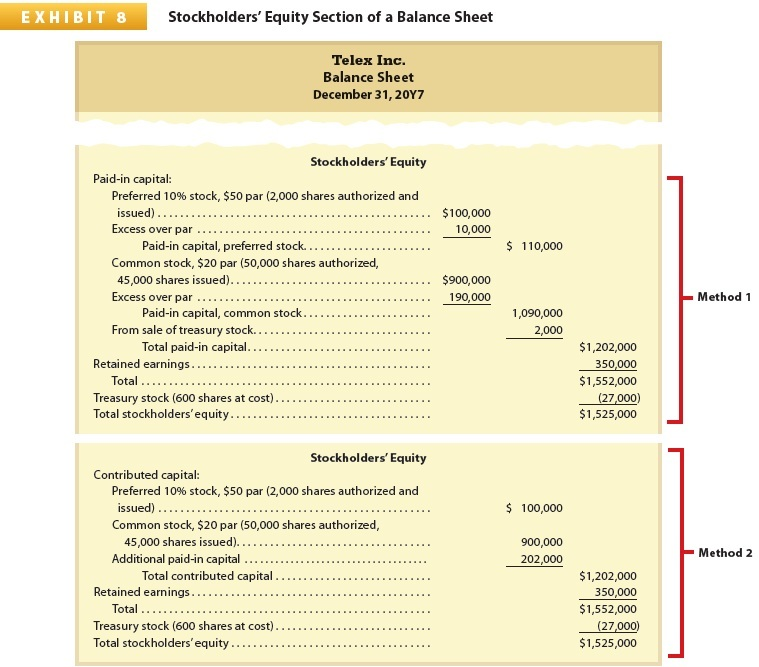

On the balance sheet, what gets listed as stockholders' equity typically falls into two categories. This amount appears in the firm's balance sheet as well as the statement of stockholders' equity. Includes common stock, preferred stock, and any paid in capital accounts including paid in capital for treasury stock.

Stockholders equity in more detail 6.8: In short, the equity portion of the. All the information needed to compute a company's shareholder equity is available on its balance sheet.

Summary shareholders’ equity is the shareholders’ claim on assets after all debts owed are paid up. Comes from the statement of retained earnings financial statement. Three major factors influence stockholder equity:

When the radio and podcast company emerges from bankruptcy. $125,000 + $170,000 = $295,000. All the information required to compute shareholders' equity is available on a company's balance sheet, including total assets:

Stockholders equity (also known as shareholders equity) is an account on a company’s balance sheet that consists of share capital plus retained earnings. Four components that are included. Stockholders' equity is to a corporation what owner's equity is to a sole proprietorship.

As you can see, stockholders' equity is one of the three main components of a corporation's balance sheet. If you rearrange the equation, you will see that stockholders' equity is the difference between the asset amounts and the liability amounts: The video explains we have 3 sections in stockholder’s equity:

The shareholders’ equity is the value of the assets of a company, which remain after the debt is subtracted from it. Stockholders' equity preferred stock, common stock, additional paid‐in‐capital, retained earnings, and treasury stock are all reported on the balance sheet in the stockholders' equity section. 185 share 44k views 5 years ago shareholders' equity (also known as stockholders equity) is an account on a company’s balance sheet that consists of share capital plus retained earnings.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)