Outrageous Tips About Trial And Balance Accounting How To Read Understand Financial Statements

This is done in order to aggregate accounting information for inclusion in the financial statements.

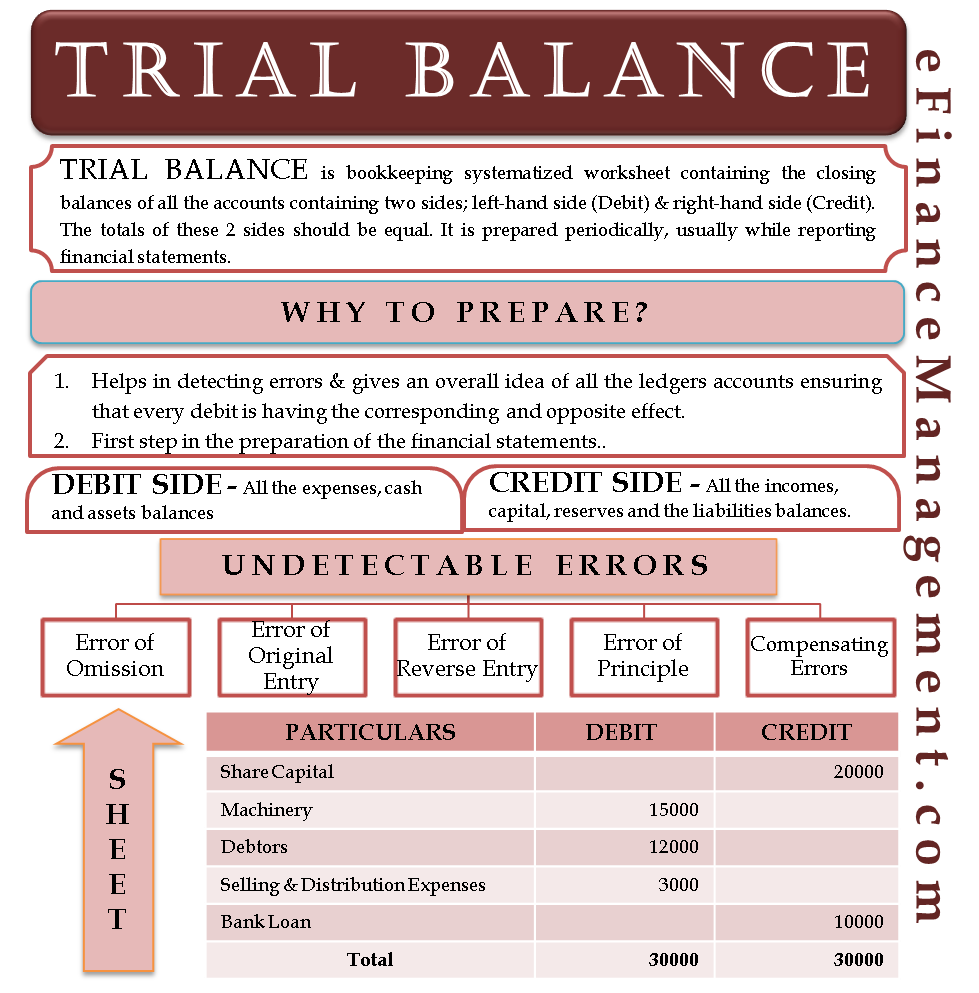

Trial and balance accounting. It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct. It is a working paper that accountants. A trial balance is a financial accounting document that lists the balances of all the general ledger accounts of a company at a specific point in time.

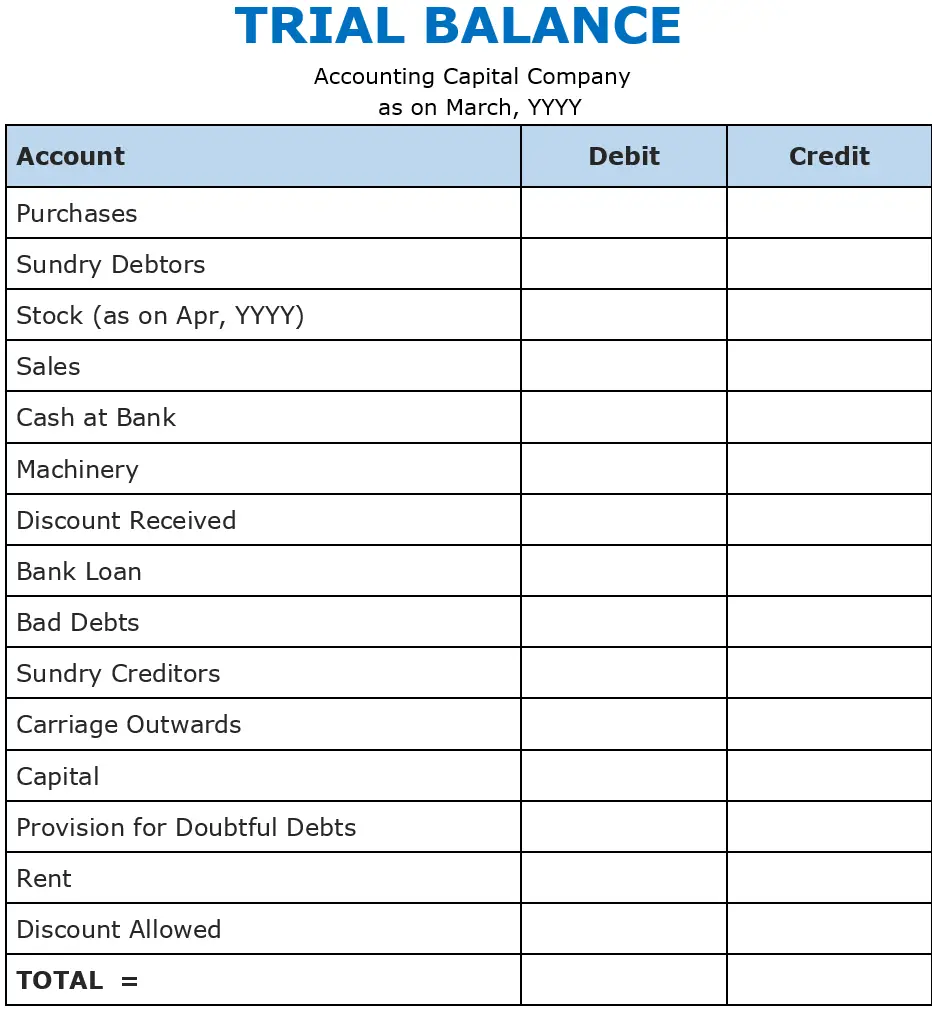

This article is a guide to the format of trial balance. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

It is the first step in the end of the accounting period process. Steps for preparing a trial balance list every open ledger account on your chart of accounts by account number. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

What is a trial balance? Use of a trial balance. Trial balance definition.

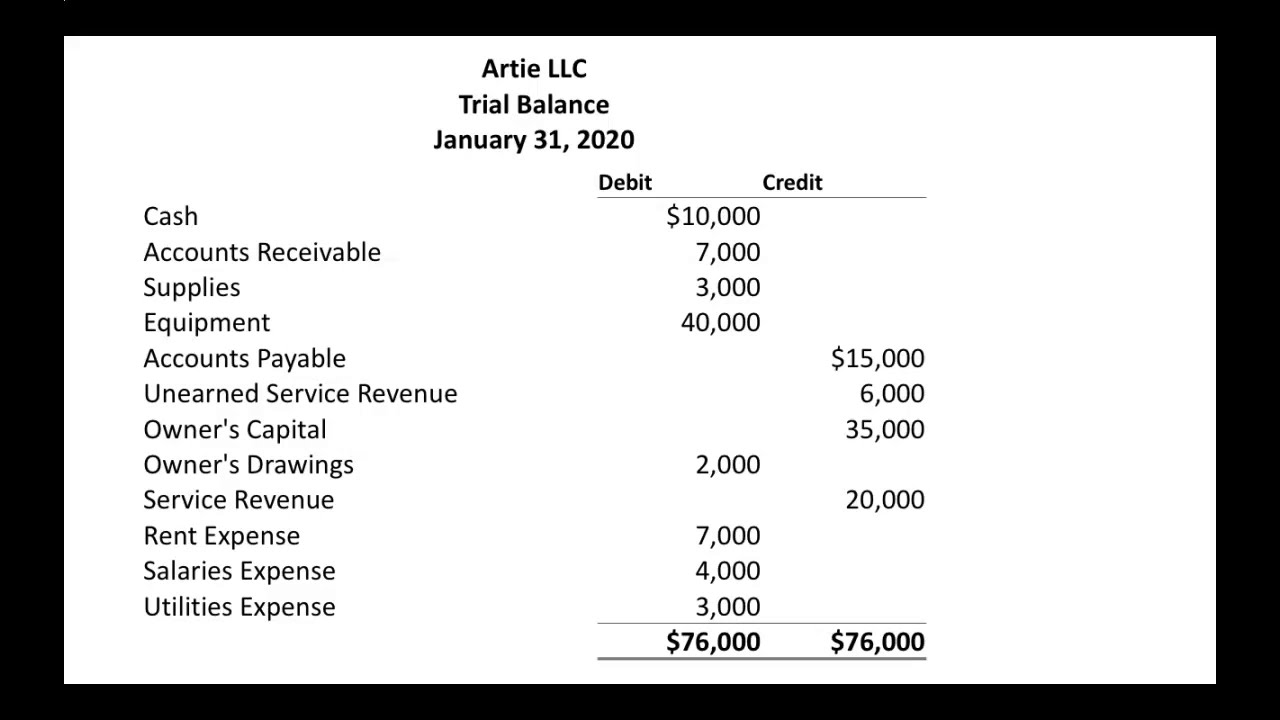

Next, verify the balances of each account listed in the trial balance. The accounting equation is balanced, as shown on the balance sheet, because total assets equal $29,965 as do the total liabilities and stockholders’ equity. He said a substantial portion of that 60%.

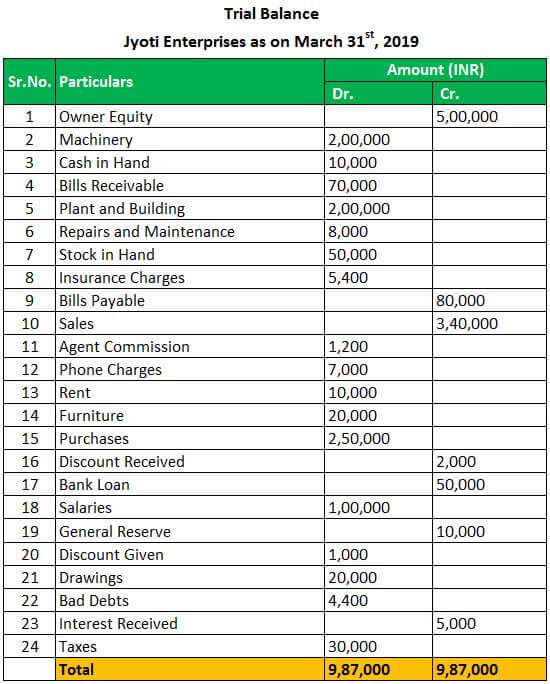

For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown. This means that it states the total for each asset, liability, equity, revenue, expense, gain, and loss account. A company prepares a trial balance.

Purpose of a trial balance trial balance acts as the first step in the preparation of financial statements. What is a trial balance? When a new york judge delivers a final ruling in donald j.

Moreover, pay attention to account names and codes to ensure consistency. What’s the role of a trial balance in accounting? It is typically prepared at the end of an accounting period, such as a month or a year, to ensure that the total debit balances equal the total credit balances in the company’s ledger.

Notice that the debit and credit columns both equal $34,000. What is adjusted trial balance? The tb does not form part of double entry.

Ms james argued he had exaggerated his wealth by as. If we go back and look at the trial balance for. Forty witnesses appeared over 44 days in court.