Outstanding Info About Nonprofit Financial Statements Example Oci Income Statement

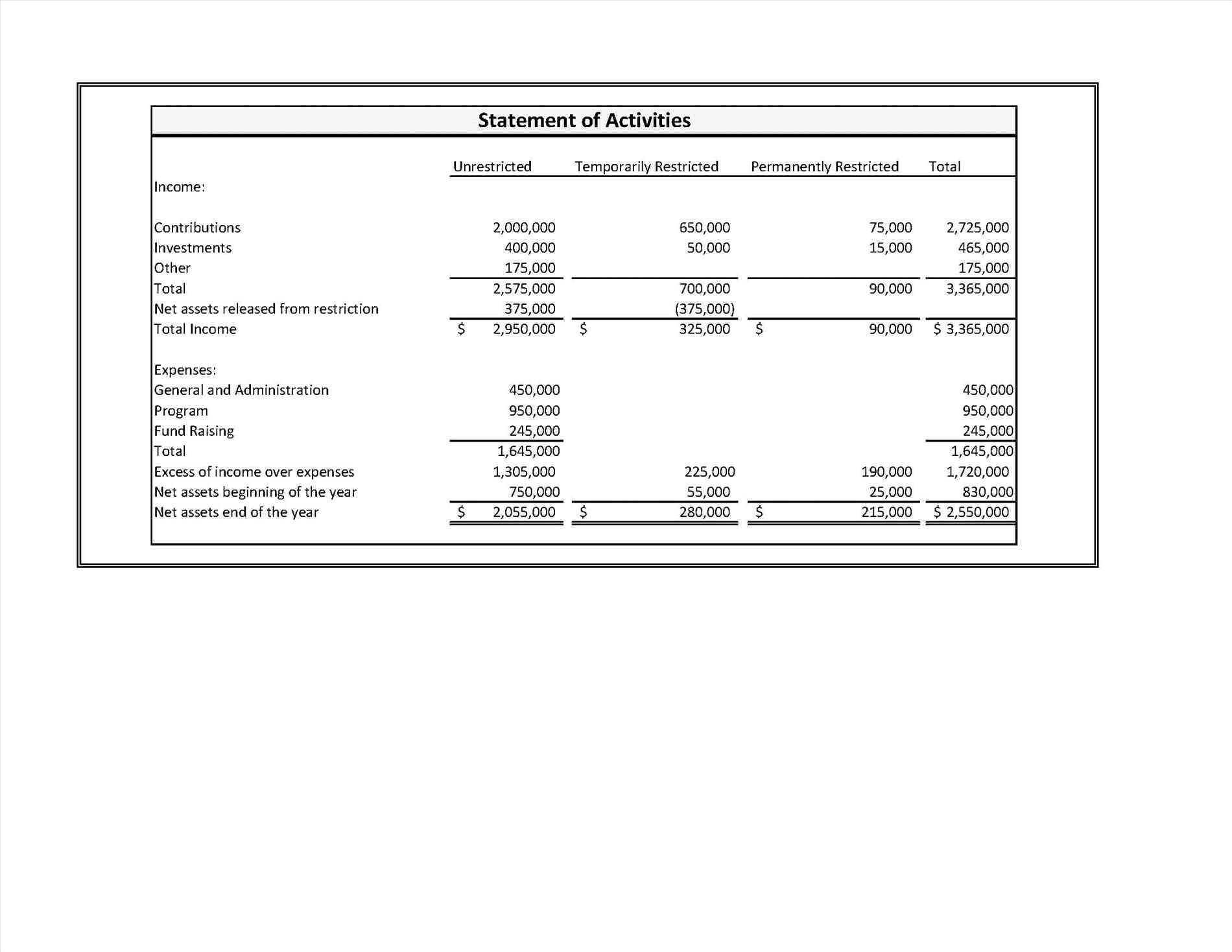

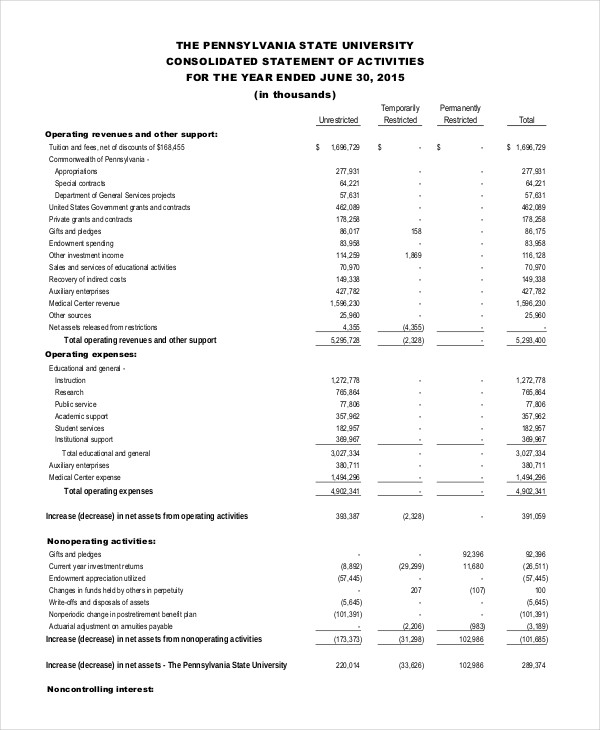

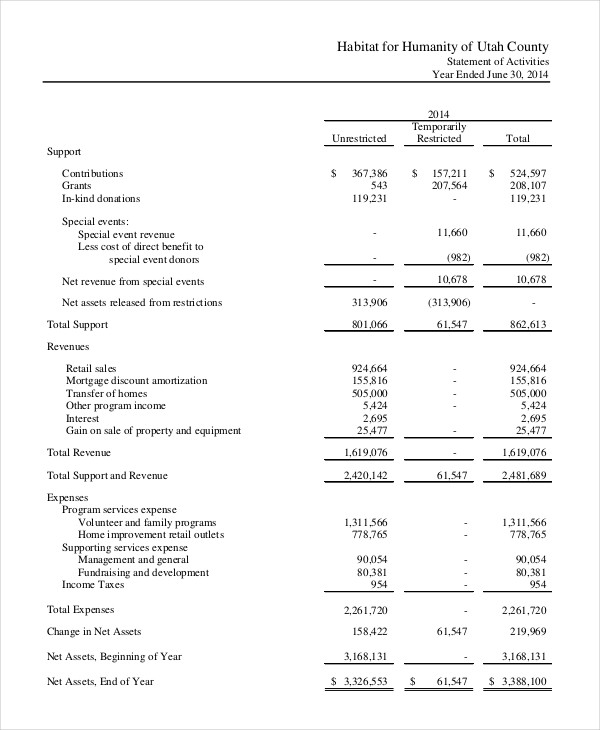

The following 3 nonprofits have included corporate statements with different ways.

Nonprofit financial statements example. Download these linked documents in excel and word to understand how the elements. As we mentioned former, many nonprofits use these treasury statement in their annual reporting to show transparency press build trust stylish their organization. We have reviewed the accompanying statements of financial position of habitat house, inc.

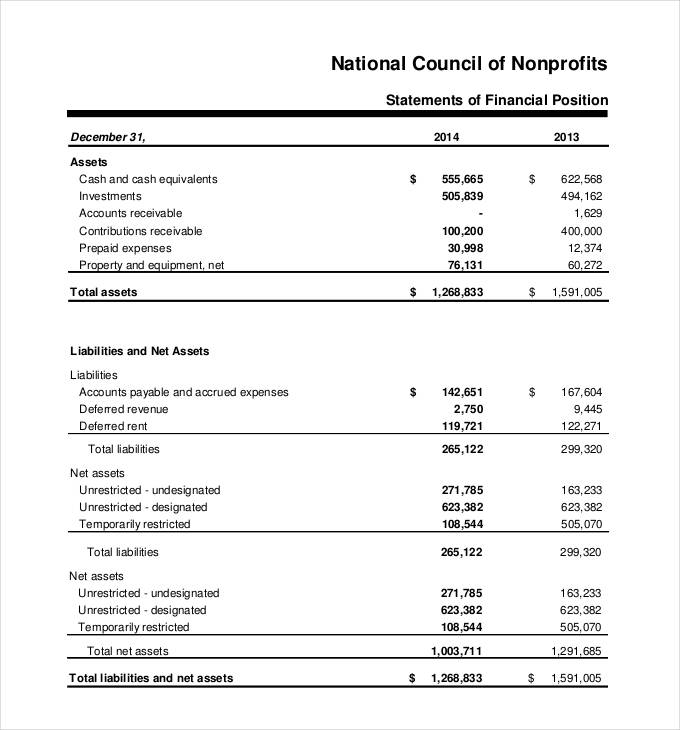

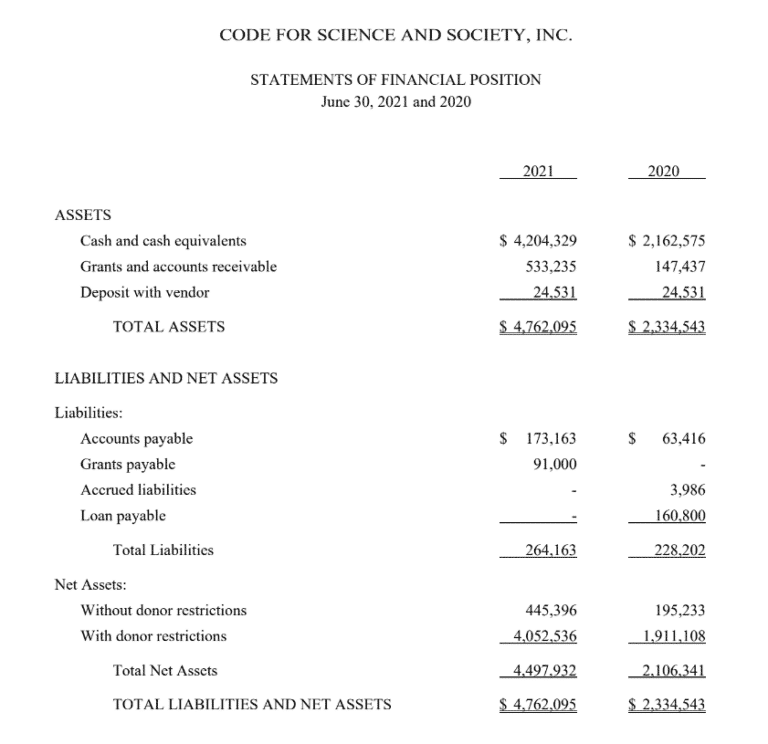

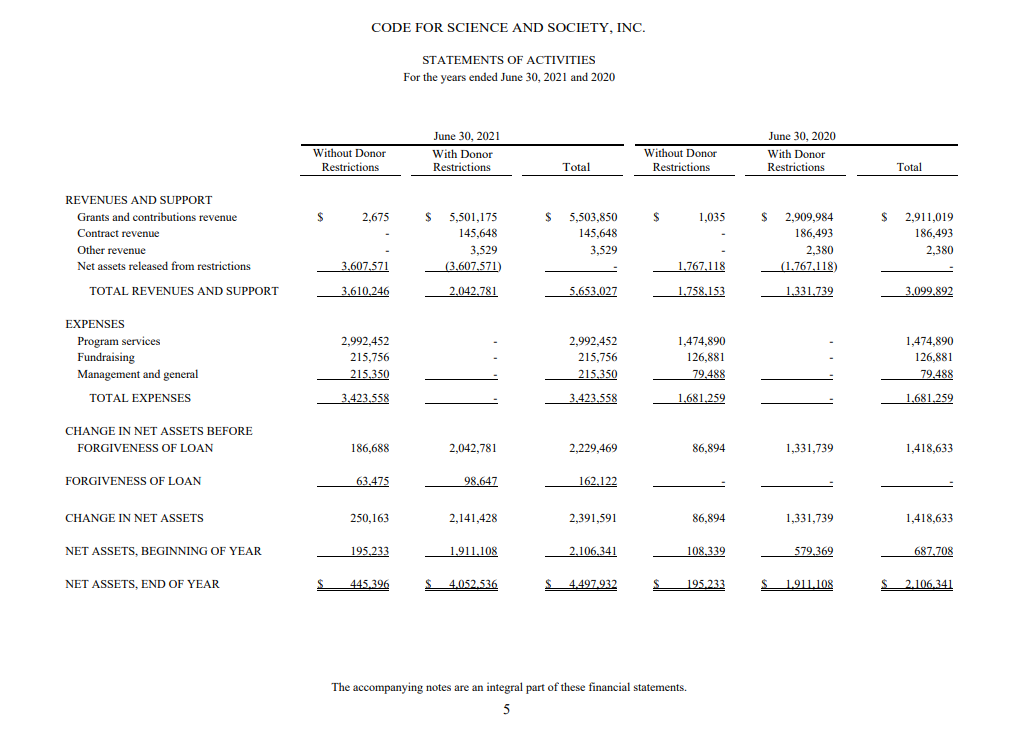

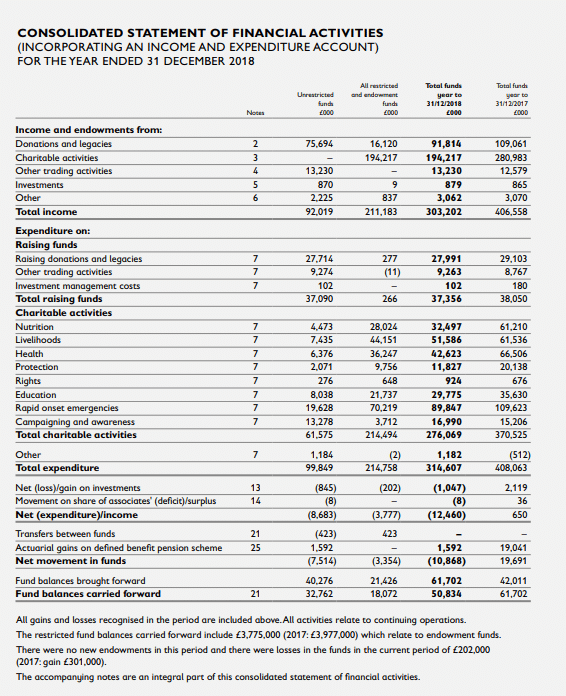

The statement of financial position provides a snapshot of an organization’s assets, liabilities, and net assets. Nonprofit financial statements: 3 great examples of nonprofit financial statements.

Download anafp's guide to understanding nonprofit financial statements to learn more. Report of independent auditors and financial statements for big national charity, inc. Here are four financial statements nonprofits must file every year to remain in compliance with the irs.

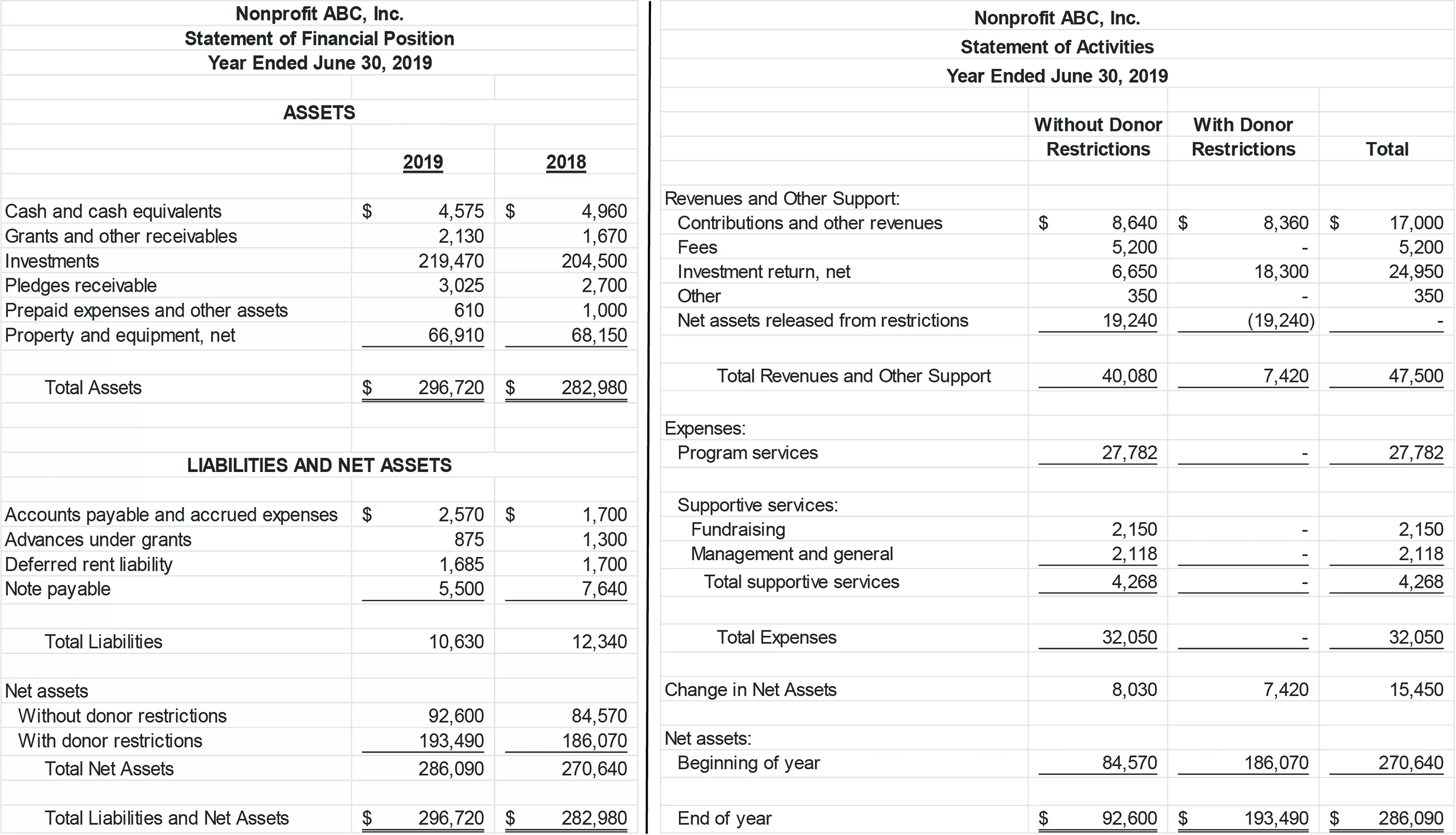

For we mentioned earlier, many nonprofits use save pecuniary statements in your annual reports to how transparency and build trust in their organization. In get article, we’ll discuss more concerning. (a nonprofit corporation) as of june 30, 20x7 and 20x6, and the related statements of activities, functional expenses, and cash flows for the years

Sharing financial statements with donors remains one of the most ways to provide distinctness and build trust. Within this object, we’ll explain more about each financial statement, why and when nonprofits need financial statements and share examples of how organizations have used you in their annual reports. Your financial statement also demonstrates that your nonprofit has spent income from donors, grantors, and other sources as promised and in ways that align with your mission.

Key takeaways nonprofit financial statements are important tools for assessing the financial health and accountability of nonprofit organizations. The 4 major nonprofit financial statements; Why are financial statements important for nonprofits?

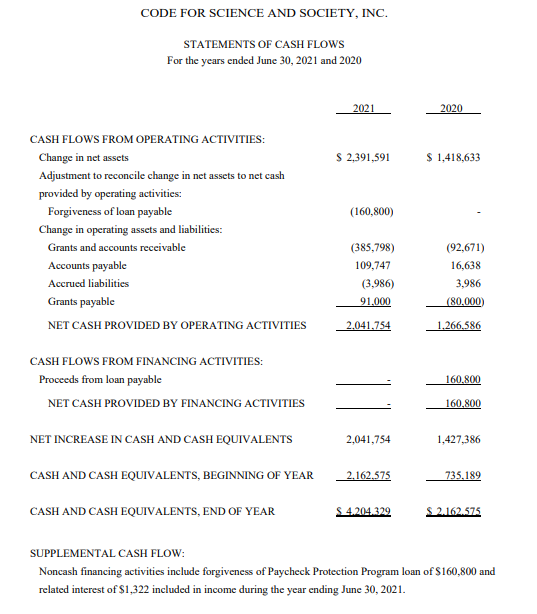

In this article, we’ll walk you through the five nonprofit financial statements that you’ll need regardless of your size or mission. There are four financial statements nonprofits must file every year to remain in compliance include the irs. To help simplify financial reporting, genest tarnow offers the following top three financial reporting items that nonprofits should review each month.

The financial statements issued by a nonprofit are noted below. These examples demonstrate some of the diversity of current practice. We have audited the accompanying financial statements of [entity name], hud project no.

3 great examples of nonprofit financial statements. In this guide, we’ll walk through the basics of the nonprofit financial statements, including: The following 3 nonprofits have included financial statements in different ways.

Irs form 990 * *note: The following 3 nonprofits have include financial statements in different ways. It is a record of your nonprofit’s income and expenses.