Divine Info About Financial Reporting Fraud What Is Balance Sheet In Hindi

Consumers reported losing more money to investment scams—more than $4.6.

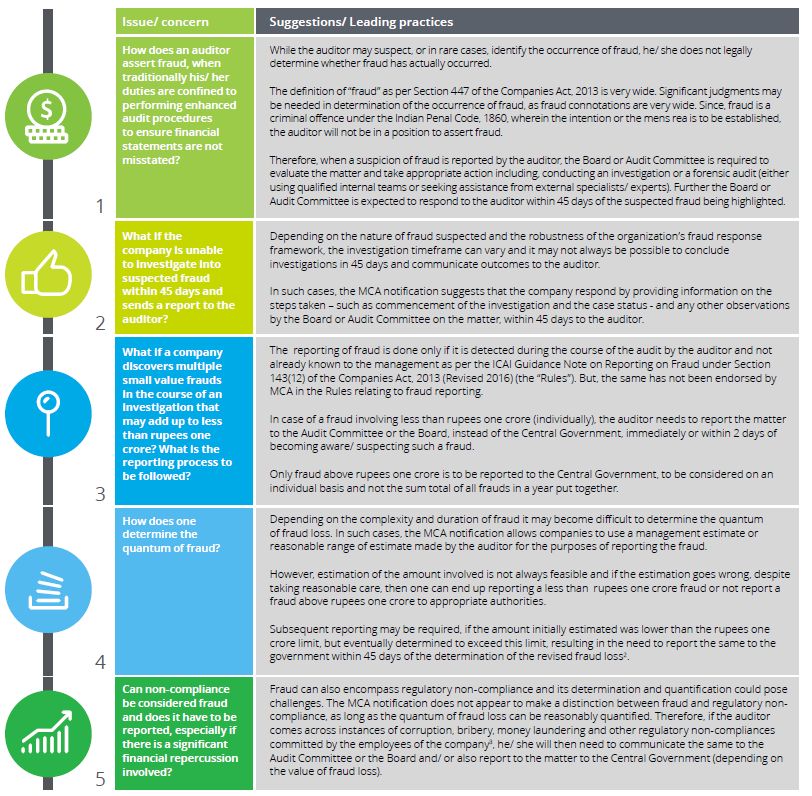

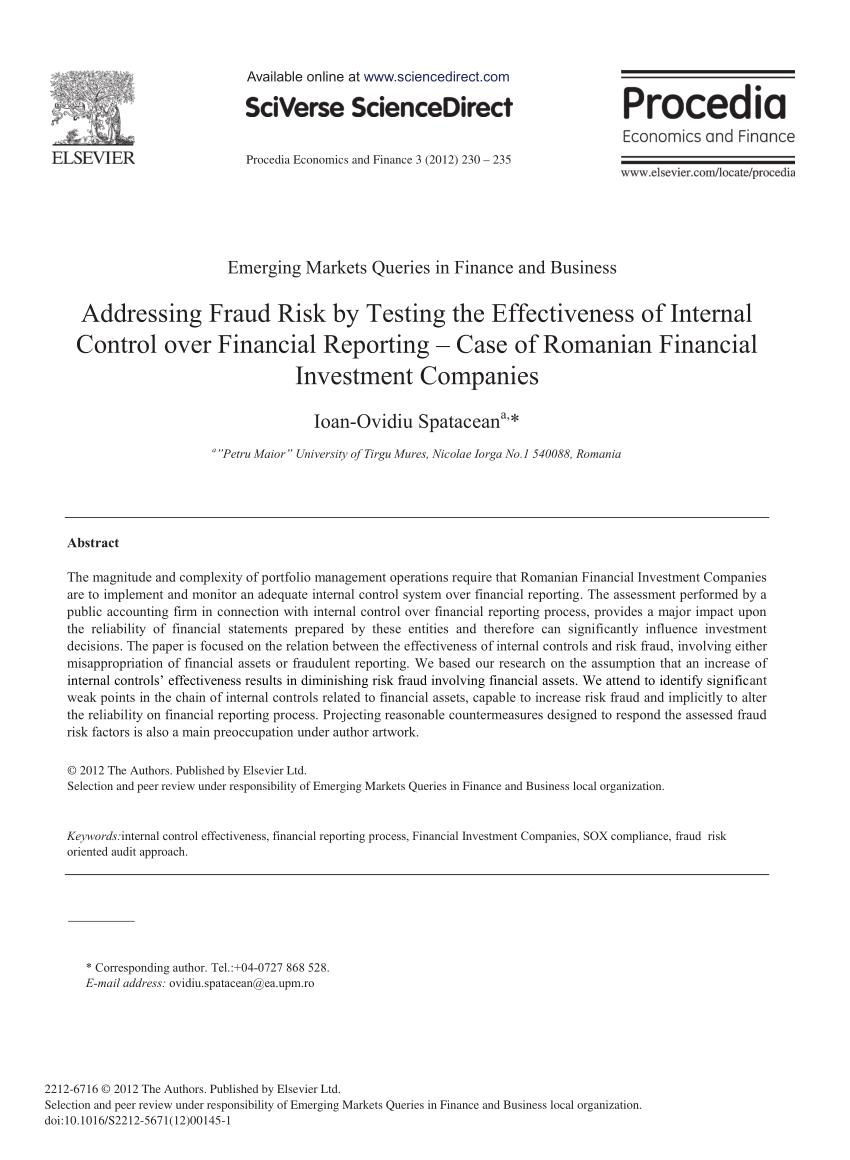

Financial reporting fraud. In particular, it explores (1) how common financial reporting fraud is in egypt, (2) the perpetrators and victims of financial reporting fraud in egypt and (3) how financial reporting fraud is committed and concealed in egypt. This study reviews the literature on. The role of the auditor profession in this issue is very important for early detection and prevention of the possibility of fraudulent financial.

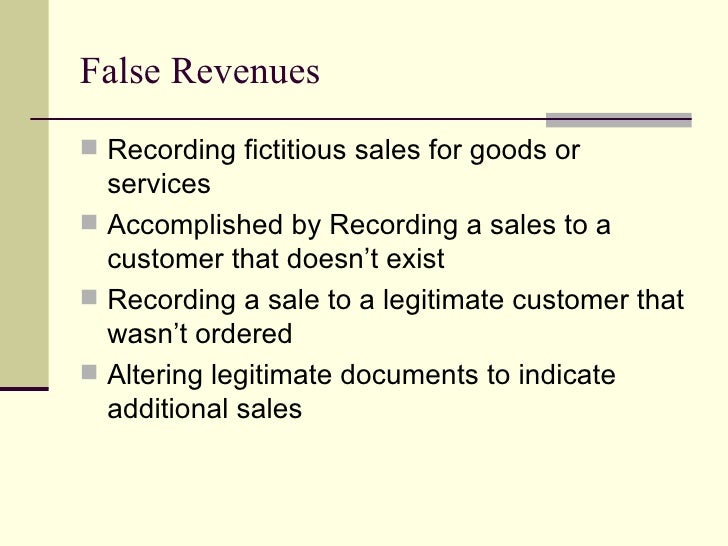

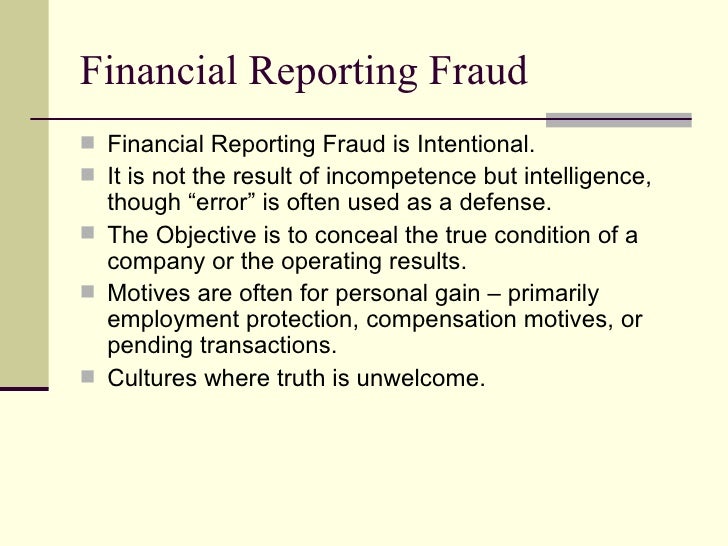

The management changes the accounting policies, or the way estimates are calculated with the intention to improve the firm’s results. Or to simply buy time. Financial statement fraud, corruption, and asset misappropriation — part 1 and part 2.

One driver may be the state of the economy in the united states today. The firm's latest fraudtrack analysis shows that the total reported value of fraud in the uk reached a whopping £2.3 billion (€2.69 billion) last year. Fraudulent financial reporting not only causes the declining in the ethical value of the accounting profession, but also causes financial losses with a sizable amount (antawira et al., 2019).

Fraud reporting entails the systematic collection and distribution of critical information about fraudulent activities and incidents. Newly released federal trade commission data show that consumers reported losing more than $10 billion to fraud in 2023, marking the first time that fraud losses have reached that benchmark. In addition to exploring fraudulent financial reporting directly, others (beasley, 1996;

(2018) conclude that these results indicate that reputational capital plays a primary role in encouraging truthful financial reporting and discouraging financial misconduct. Imposter scams remained the top fraud category, with reported losses of $2.7 billion. Bourke, 2006) have examined the effect of a number of

The study sheds light on generic issues that could have implications for auditors and audit regulators. A new icaew report argues that auditors play a significant role in detecting and preventing fraud and sets out recommendations for how to do this. According to the acfe, financial statement fraud is the least common type.

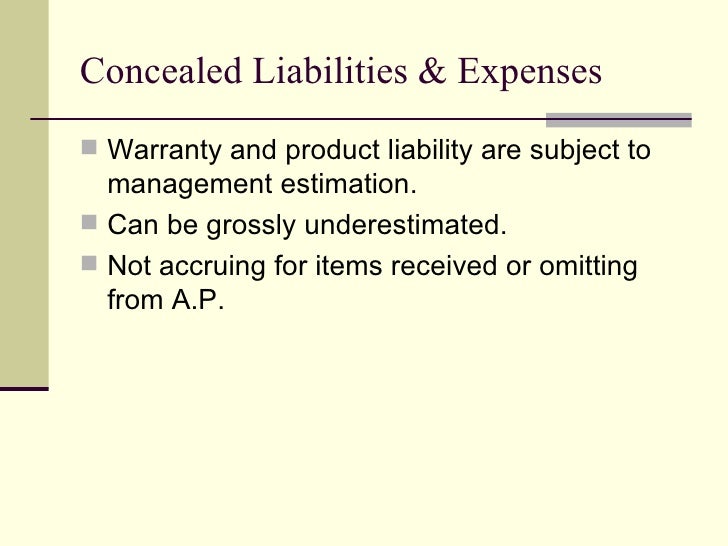

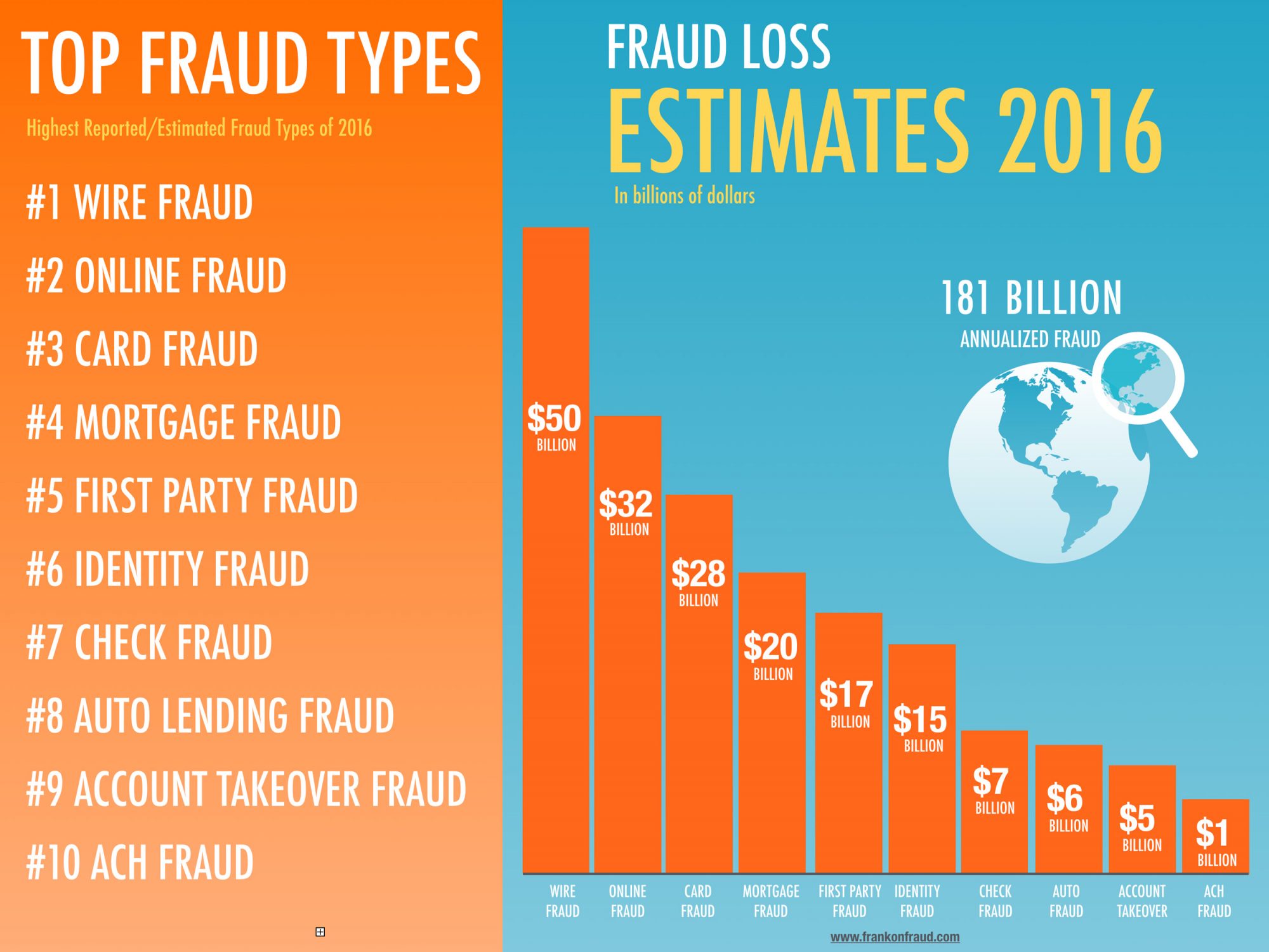

Identifying this type of fraud can be difficult as accounting treatments are often judgmental, resulting in a fine line between optimistic, but acceptable financial reporting, and fraud. The association of certified fraud examiners (“acfe”) estimates that organizations lose 5% of revenue to fraud each year, an estimated loss of $4.7 trillion on a global scale. Virtual currency investment scams (more commonly

Financial reporting misconduct, especially fraud, lies at the far right of a spectrum of discretionary accounting choices, with “earnings management” to convey private information that complies with the provisions of gaap on the far left. To enhance the company’s reputation by misleading potential investors; Accounting fraud is the illegal alteration of a company's financial statements to manipulate a company's apparent health or to hide profits or losses.

In the complex web of financial operations, it serves as. A conceptual framework for the historical study of fraud and scandals. In finding that the defendants were able to purchase the old post office in washington, d.c., through their use of the fraudulent financial statements, justice engoron rules that the.

Fraud, by its very nature, is deliberately hidden, and is therefore harder for financial experts to spot than other irregularities or honest errors. Trump lost his civil fraud trial on friday, as a judge found him liable for violating state laws and penalized him nearly $355 million plus interest. The accounting improprieties resulted in kraft reporting inflated adjusted ebitda, a key earnings performance metric for investors.