Amazing Info About Expenses And Revenue On Balance Sheet Pwc Us Gaap Illustrative Financial Statements

The impact of expenses on the balance sheet.

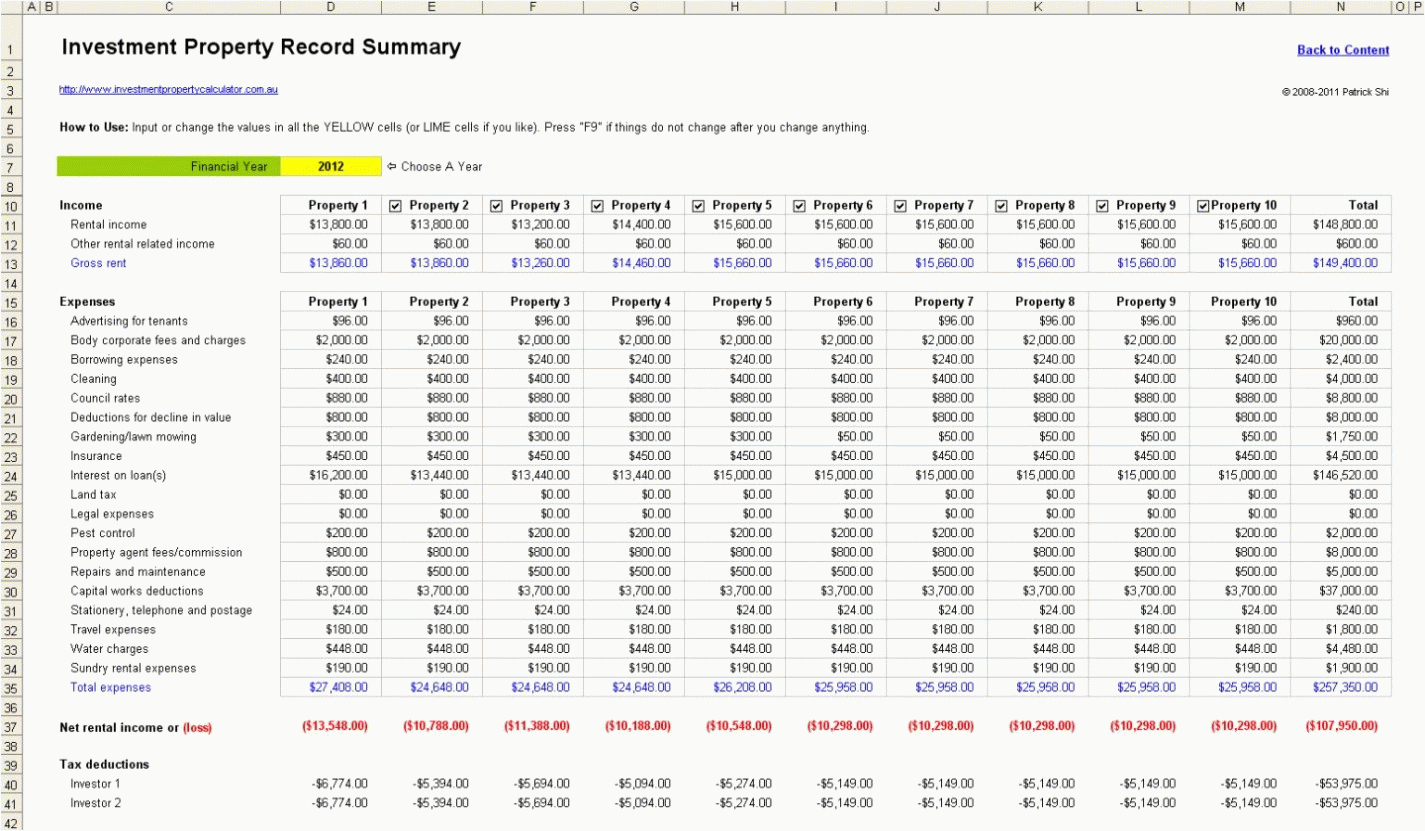

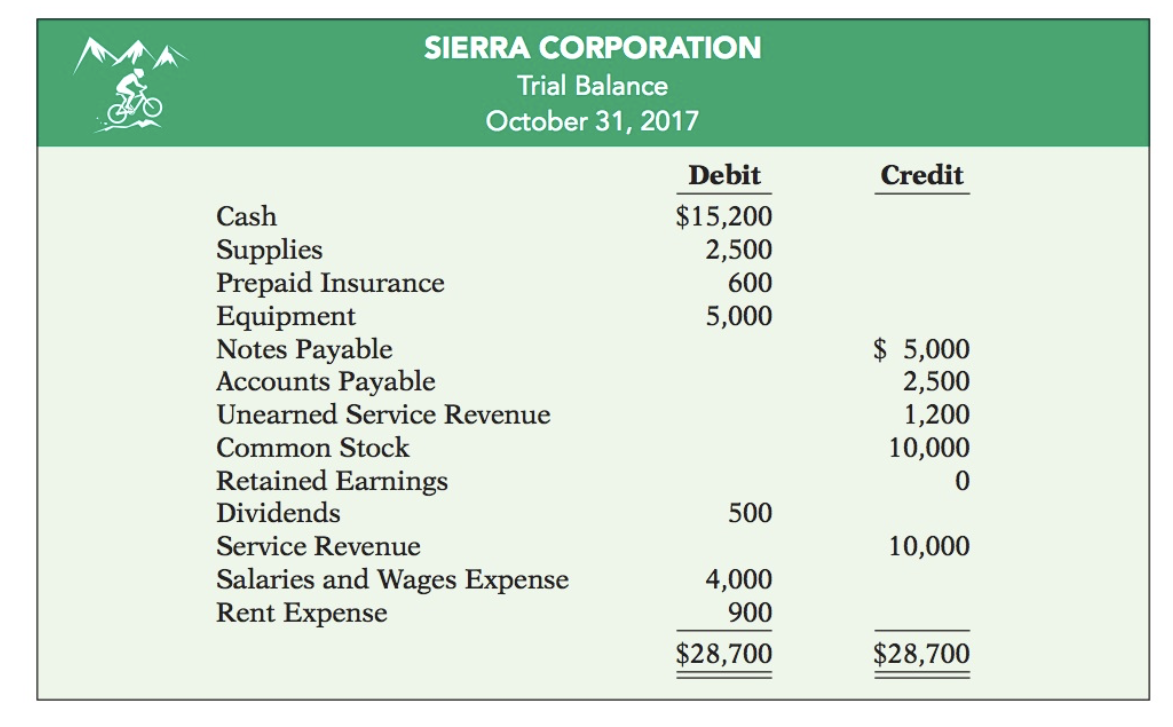

Expenses and revenue on balance sheet. An expense is a cost that has been used up, expired, or is directly related to the earning of revenues. Most of a company's expenses fall into the following categories: After the entries through december 3 have been recorded, the balance sheet will look like this:

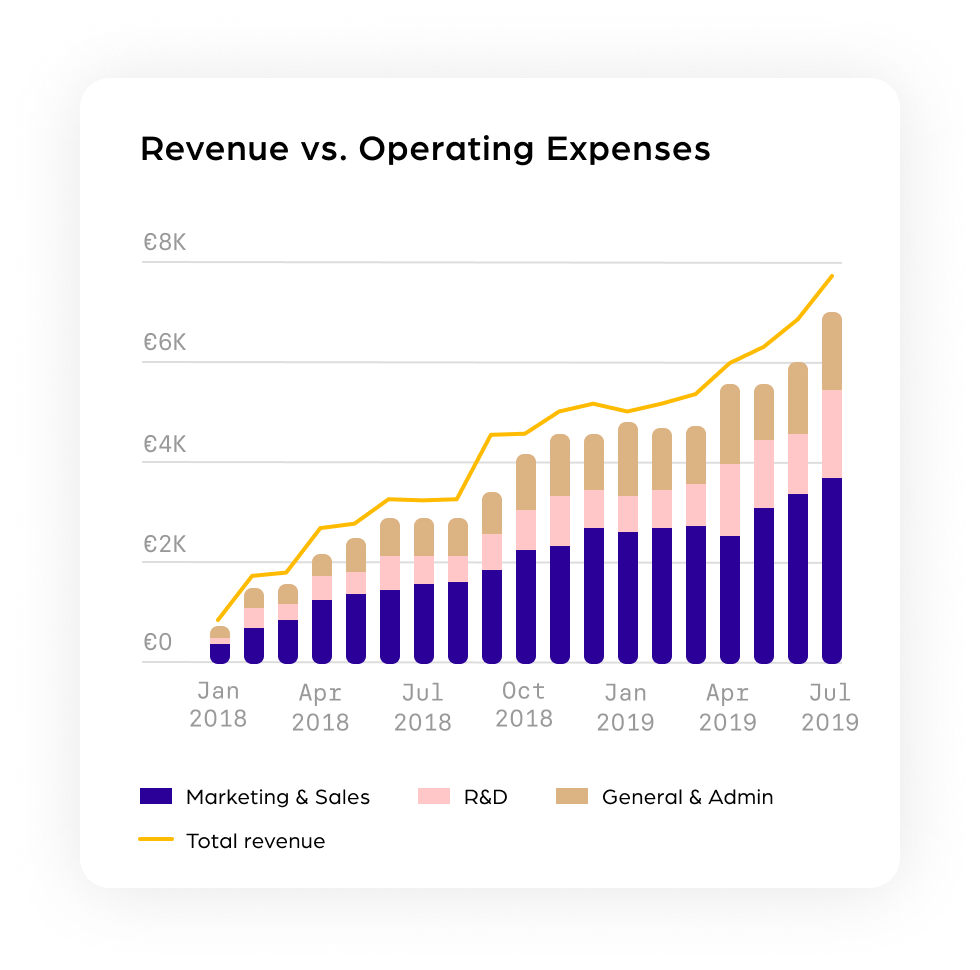

Revenue, expenses, gains, and losses. Revenue is a measure showing demand for a company’s offerings and is calculated as the sum of all sales for a given period. 2023 — these faqs update question 9 to provide that a united states military service member who is a wrongfully incarcerated individual and who receives back pay following the reversal of a court martial conviction may not exclude the payments under section 139f if the.

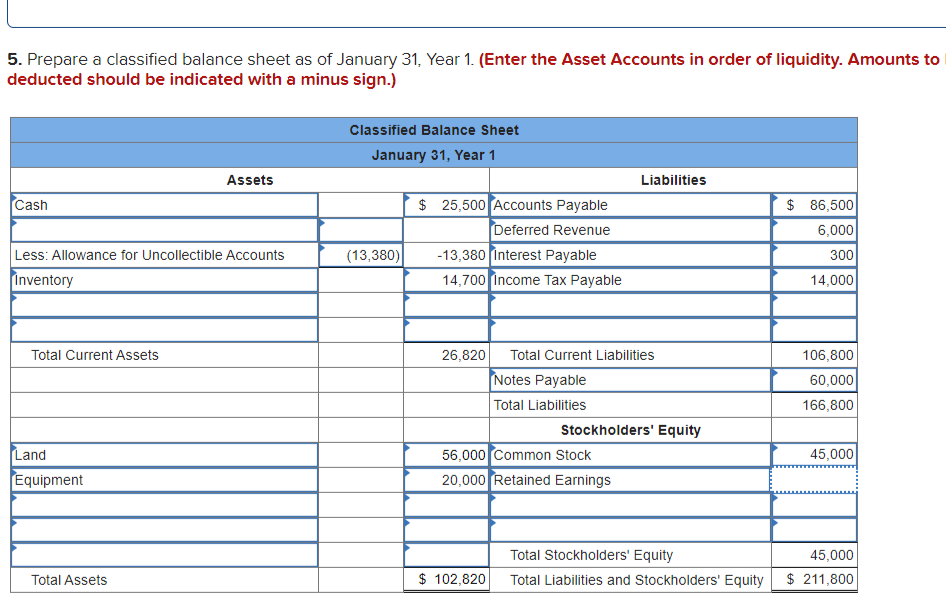

For a more accurate figure, locate any deductions mentioned on the income statement. In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax returns to reduce related wage or salary expenses the employer could otherwise deduct on its federal income tax return for the applicable tax year. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

Effect of revenue on the balance sheet generally, when a corporation earns revenue there is an increase in current assets (cash or accounts receivable) and an increase in the retained earnings component of stockholders' equity. However, it also has an impact on the balance sheet. An expense is a cost incurred in the process of producing or offering a primary business operation.

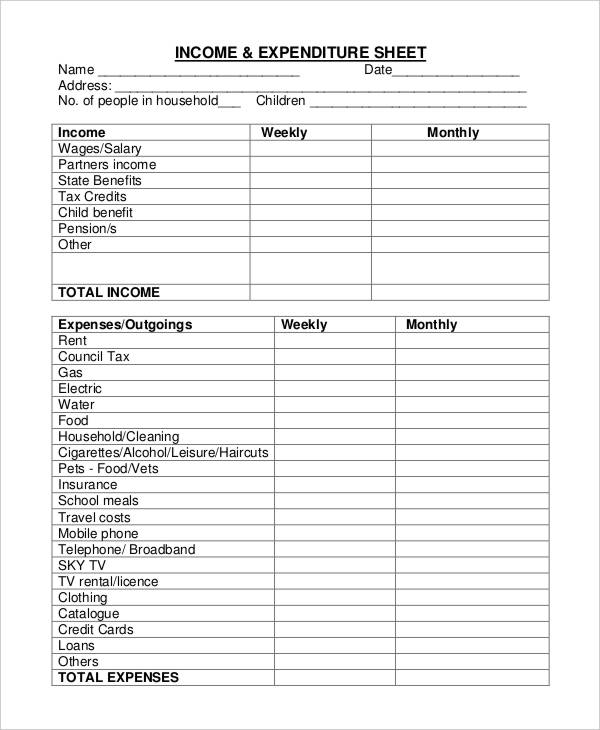

Revenues and expenses appear on the income statement as shown below: Sales, general and administrative expenses; It can also be referred to as a statement of net worth or a statement of financial position.

The balance sheet follows a basic accounting equation: Operating income was $116 million after subtracting total expenses from total revenue. All revenues the company generates in excess of its expenses will go into the shareholder equity account.

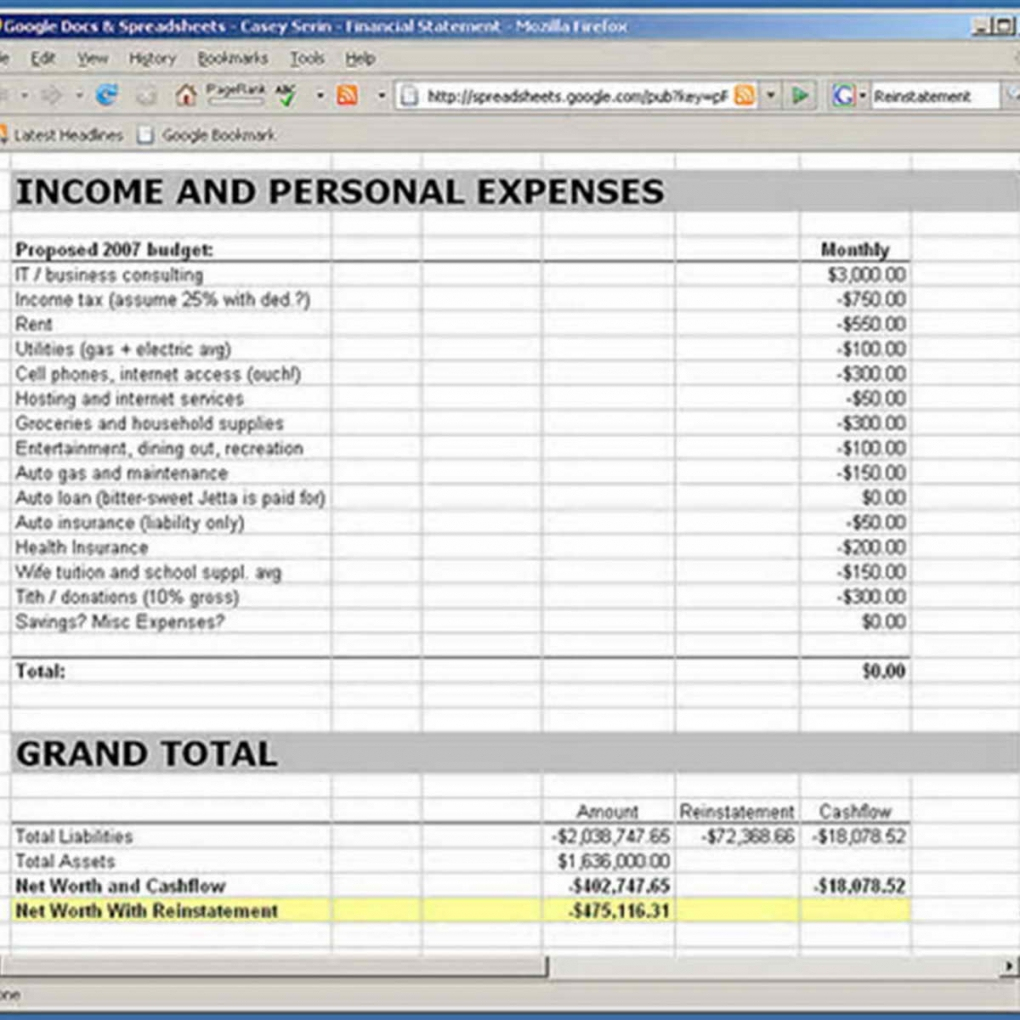

Locating total revenue on the balance sheet requires a careful analysis of the financial statements. It is useful to always read both the income statement and the balance sheet of a company, so that the full effect of an expense can be seen. Because the income statement resets each year, all revenue and.

During the period close process, all temporary accounts are closed to the income summary account, which is then closed to retained earnings. **the income statement (which reports the company's revenues, expenses, gains, and losses during a specified time interval) is a link between balance sheets. Sales on credit) or cash.

When a business incurs an expense, this reduces the amount of profit reported on the income statement. If a company's payment terms are cash only, then revenue also creates a corresponding amount of cash on the balance sheet. Gains and losses gains and losses are the opposing financial results that will be produced.

Retained earnings is also an element of the statement of stockholders’ equity, which we will cover later in this chapter. The income statement focuses on four key items: An income statement, or profit and loss statement, shows how your revenue compares to your expenses during a given period such as a month or a year.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-03-05at10.15.17AM-b1c05918ed68413fbbaa818d057eda34.png)