Cool Tips About Depreciation In Cash Flow Statement For Construction Project Excel

Because depreciation is in essence.

Depreciation in cash flow statement. Assuming a 30% tax rate, net income would decline by. It represents an accounting entry that doesn’t involve actual cash outflow but. In your video, you subtract the depreciation on the cash flow statement;

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a. Due to this depreciation does not. Income statement → if depreciation increases by $10, operating income (ebit) would decrease by $10.

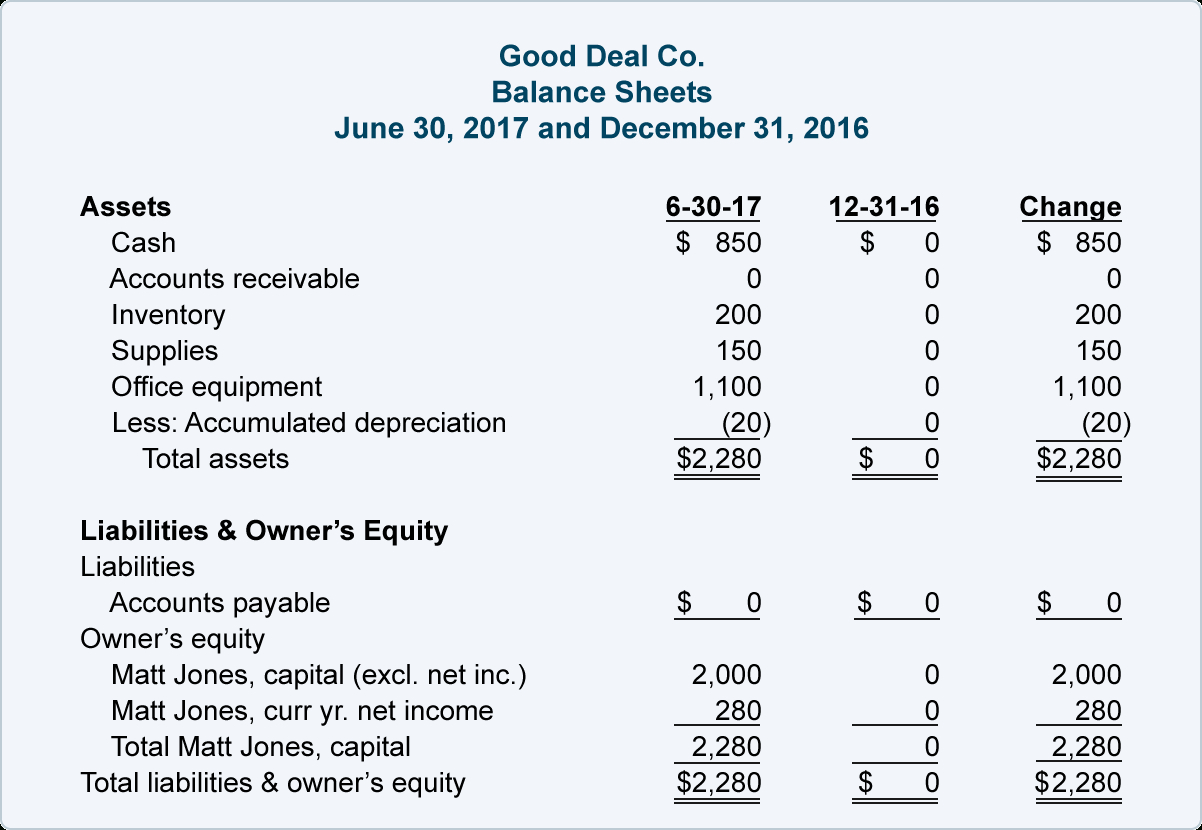

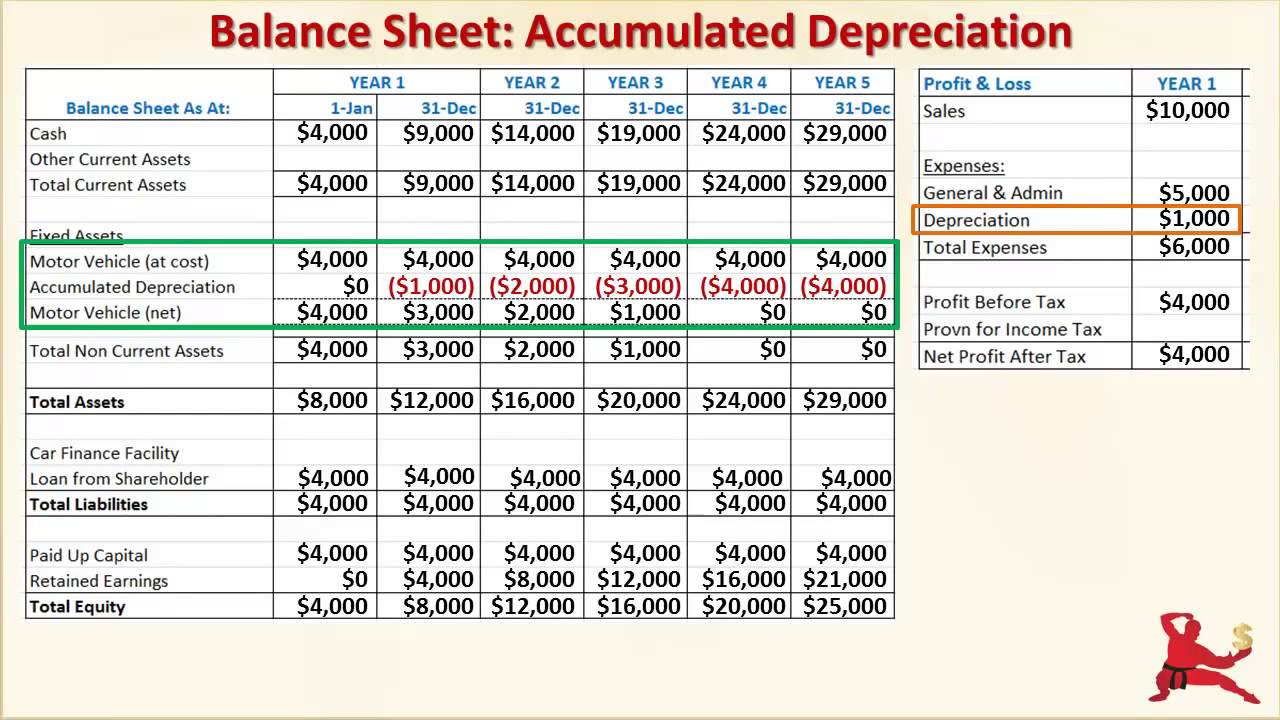

Once it depreciates to a certain point, the asset’s value will become. Depreciation moves the cost of an asset from the balance sheet to depreciation expense on the income statement in a systematic manner during an asset's useful life. Combining the $20,000 and the $18,000 results in a book value (or carrying value) of $2,000.

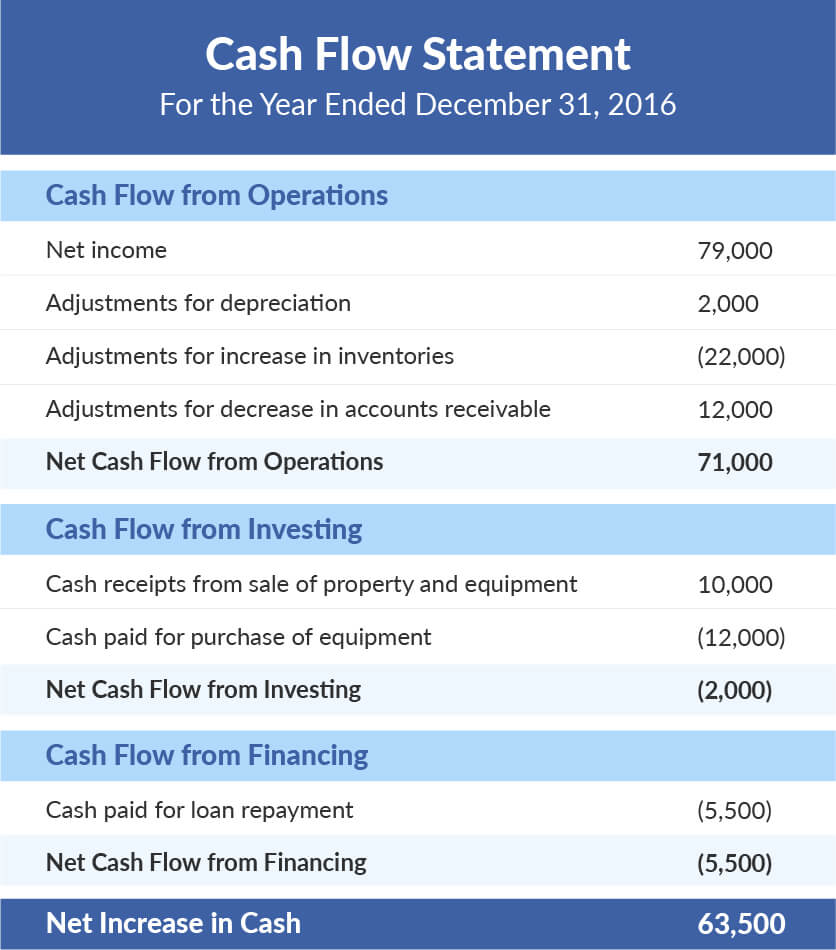

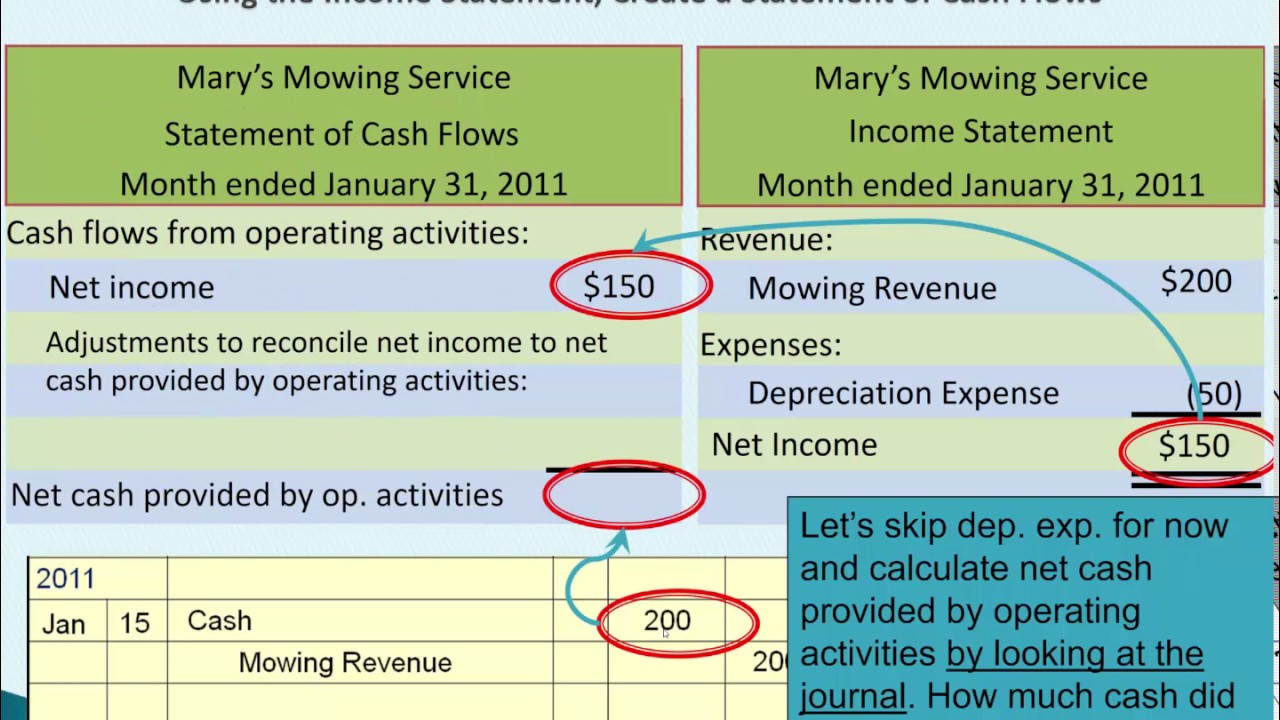

Add back noncash expenses, such as depreciation, amortization, and depletion. Remove the effect of gains and/or losses. The amount of this reduction is recognized as an expense each year.

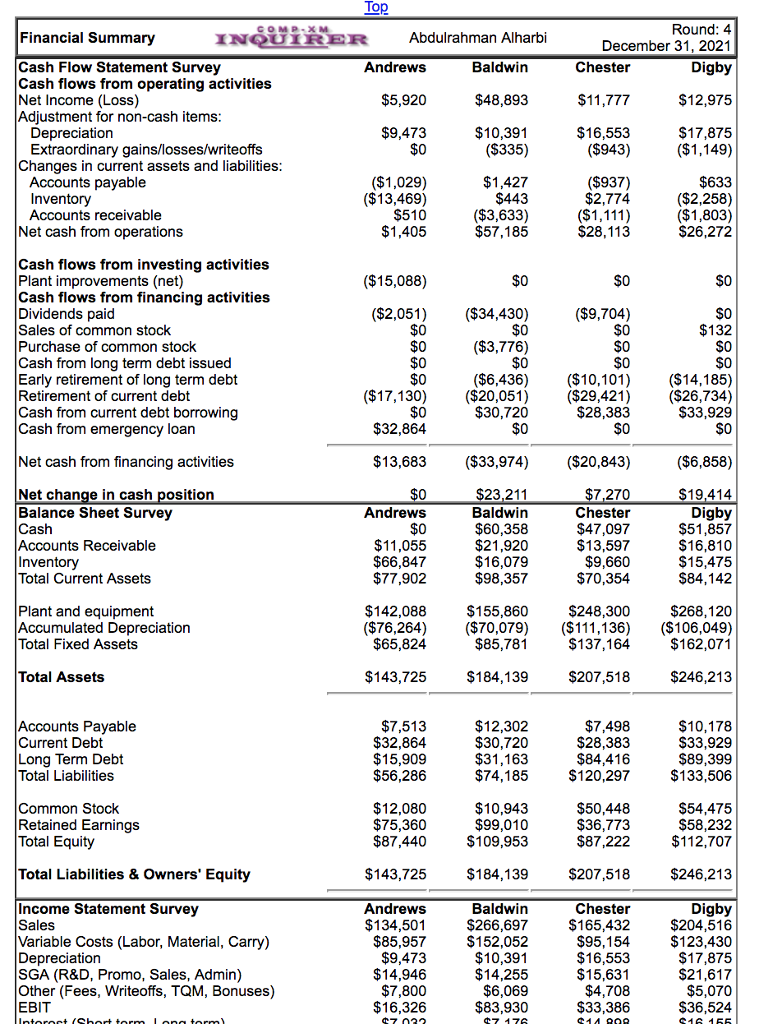

Depreciation expense is a noncash expense that we charge to the income statement and add back to the net income to arrive at the net cash flow from operating activities. Let's review the cash flow statement for. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of.

The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the. It is an accounting measure. Depreciation is a concept in accounting where assets lose value over time — they depreciate.

However, right now, i am looking at a 2017 cash flow statement from walmart , but. Learn how to prepare the cash flow statement with depreciation expense, its impact on the cash. Depreciation in cash flow statements is calculated by adding the depreciated amount to the net income after taxes.

While depreciation does not directly impact cash flow, it indirectly affects cash flow from operations. Depreciation in cash flow statement. You can find depreciation on your cash flow statement, income statement, and balance sheet.

When creating a budget for cash flows, depreciation is typically listed as a reduction from expenses, thereby implying that it has no impact on cash flows. Begin with net income from the income statement. Cash flow statement.

In a nutshell, depreciation is an accounting measure and added back to revenue or net sales while calculating the company’s cash flow. Did you get it ⬇️樂 question:

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)