Nice Tips About Prepaid Expenses Shown In Balance Sheet Journal Entry For Profit Distribution

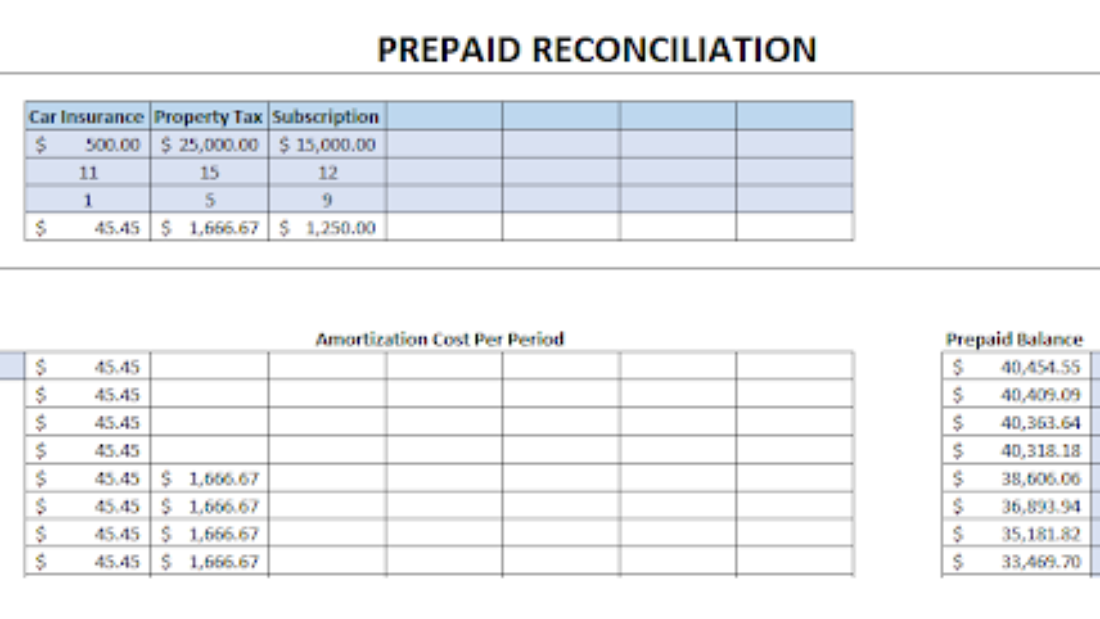

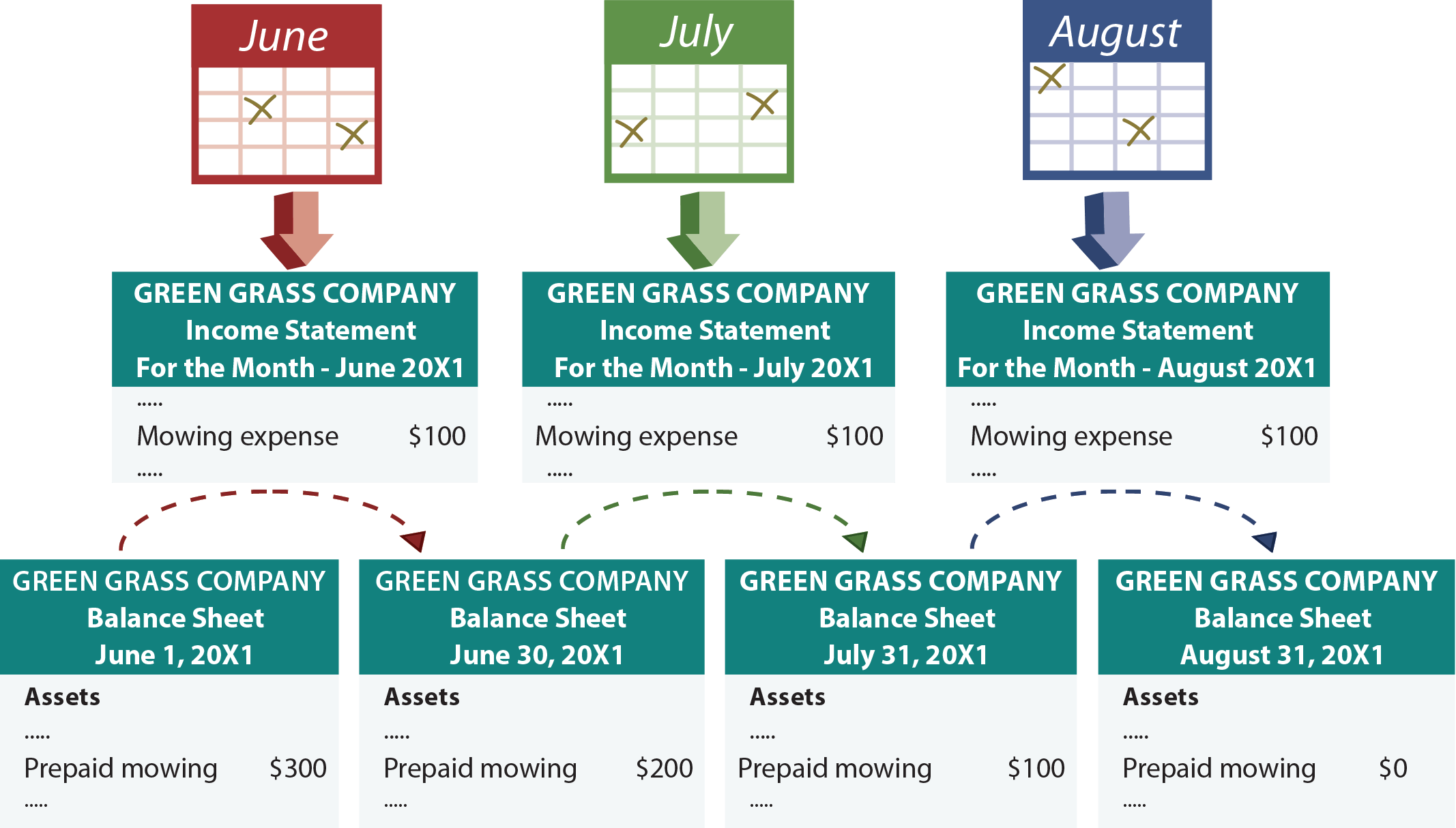

Prepaid expenses refer to payments made in advance for goods or services that a company will receive or use in the future.

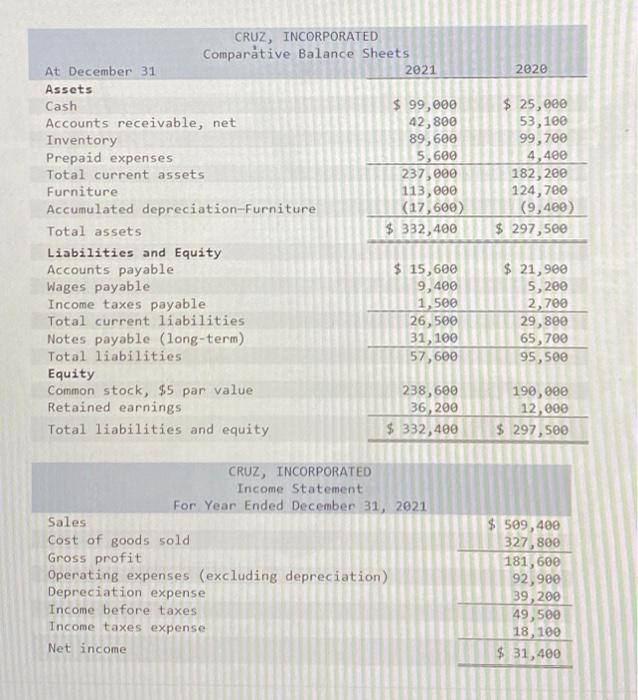

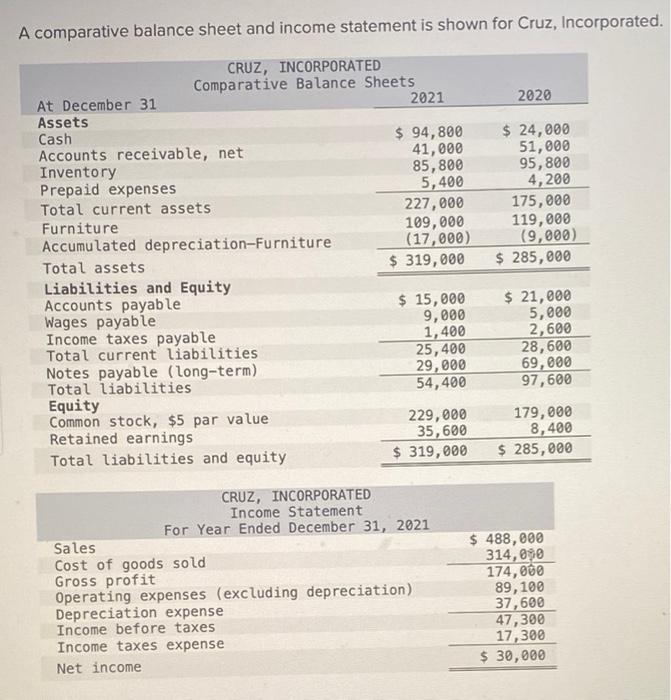

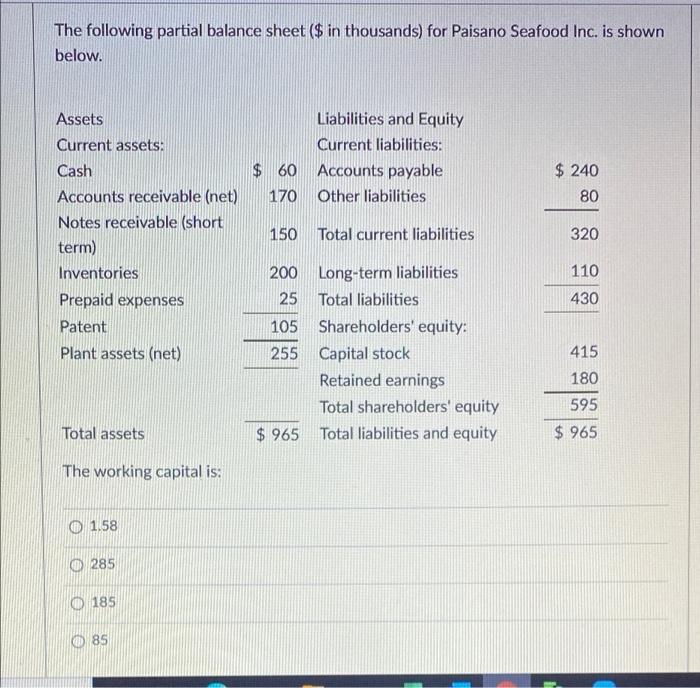

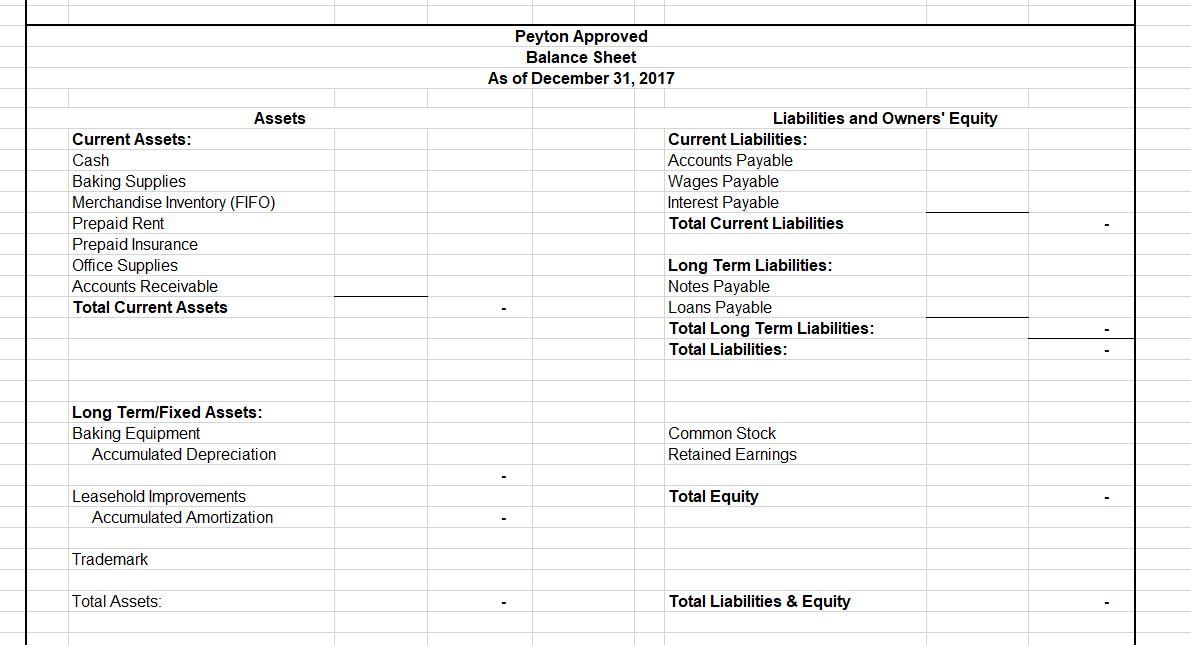

Prepaid expenses shown in balance sheet. Their primary purpose is to allocate. This means it will appear as one of your company's assets and increase its total. Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset.

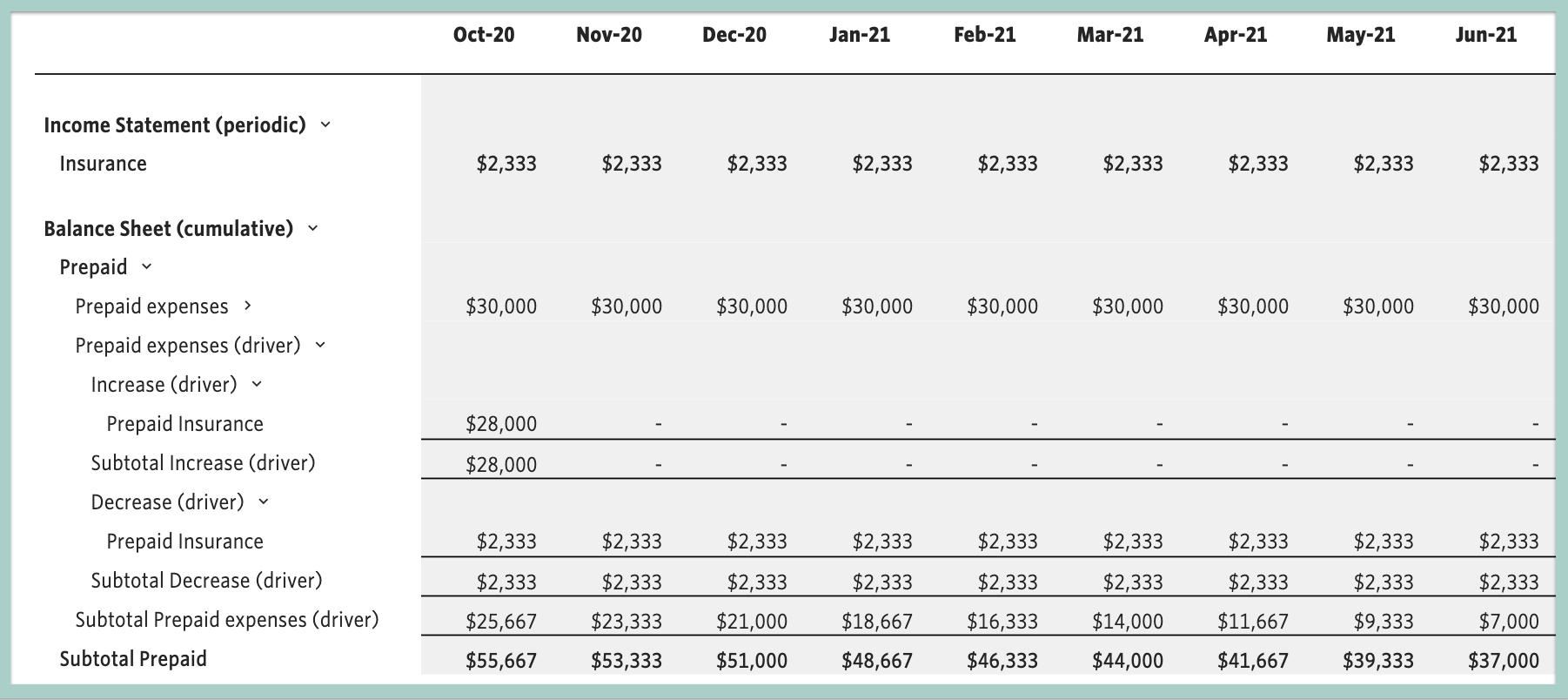

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. How to find prepaid expenses on the balance sheet? As mentioned above, prepaid expenses are shown on the balance sheet as current assets.

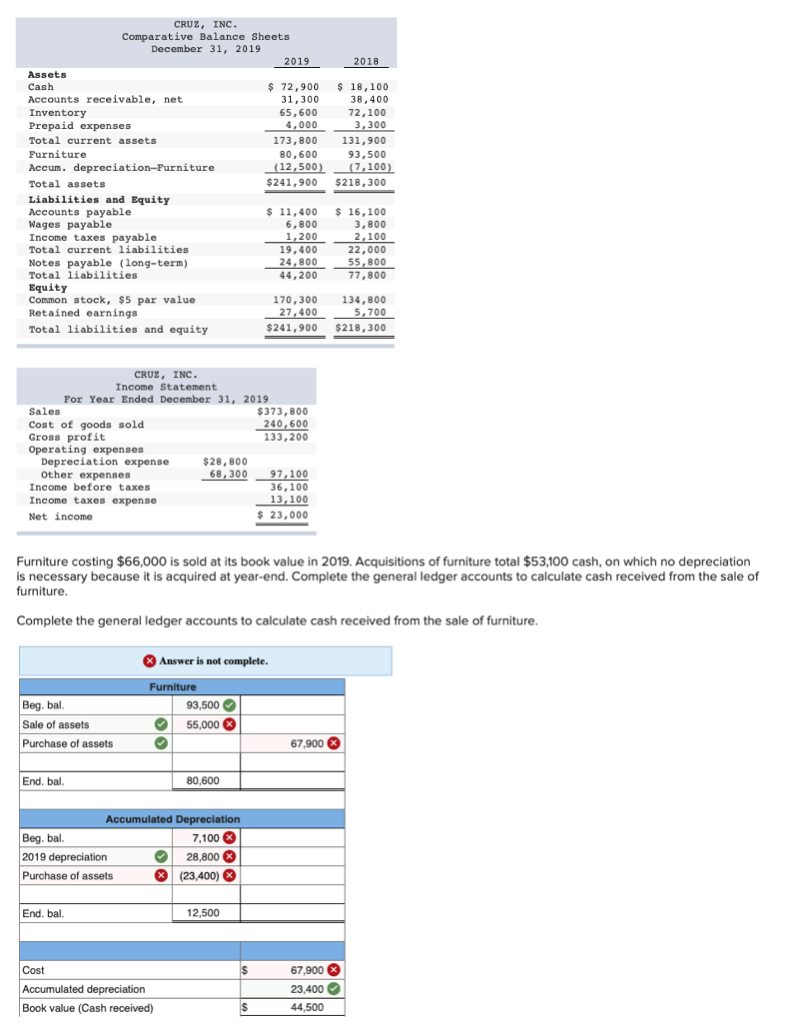

The initial journal entry for a prepaid expense does not affect a company’s financial statements. In the company’s balance sheet, the prepaid expenses are recorded as a current asset account. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that was due for the particular year.

Prepaid expenses are shown on the asset side of the balance sheet outstanding expenses are shown on the liability side of the balance sheet. Other types of current assets include inventories, accounts receivable, cash and. The gaap matching principle prevents expenses from being recorded.

Before answering the question “where do prepaid expenses appear on balance sheets?”, you first need to understand what is meant by a prepaid expense. These are both asset accounts and do not increase or decrease a company’s. Circumstances change such that it is no longer probable.

Prepaid expenses are the money set aside for goods or services before you receive delivery. For example, refer to the first example of prepaid rent. This is because it represents a future economic benefit to the company.

Other current assets are cash and equivalents, accounts receivable,. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet. They are considered assets because the firm has paid for a future benefit in.

The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Yes, prepaid expense is a line item recorded as an asset on the balance sheet. When you pay for a prepaid expense, the cost is recorded as an asset on your balance sheet.

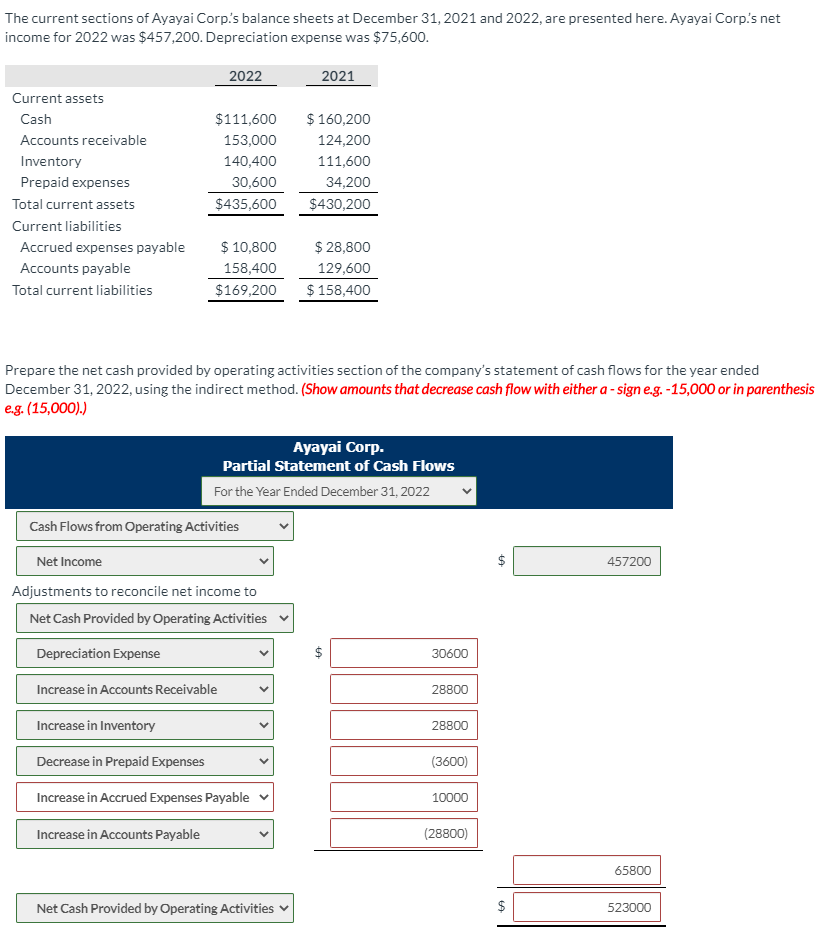

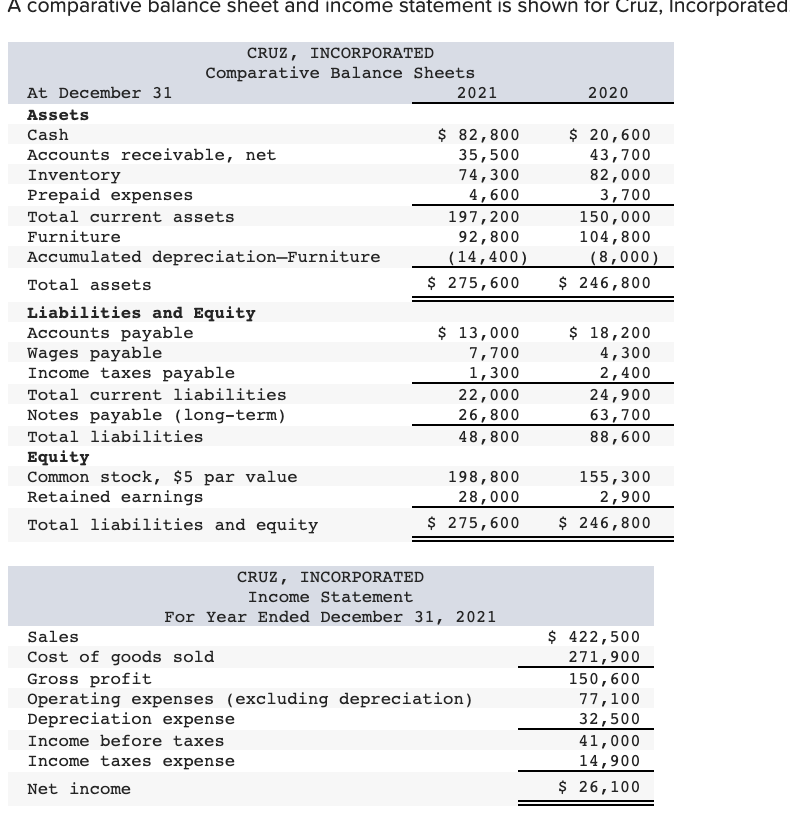

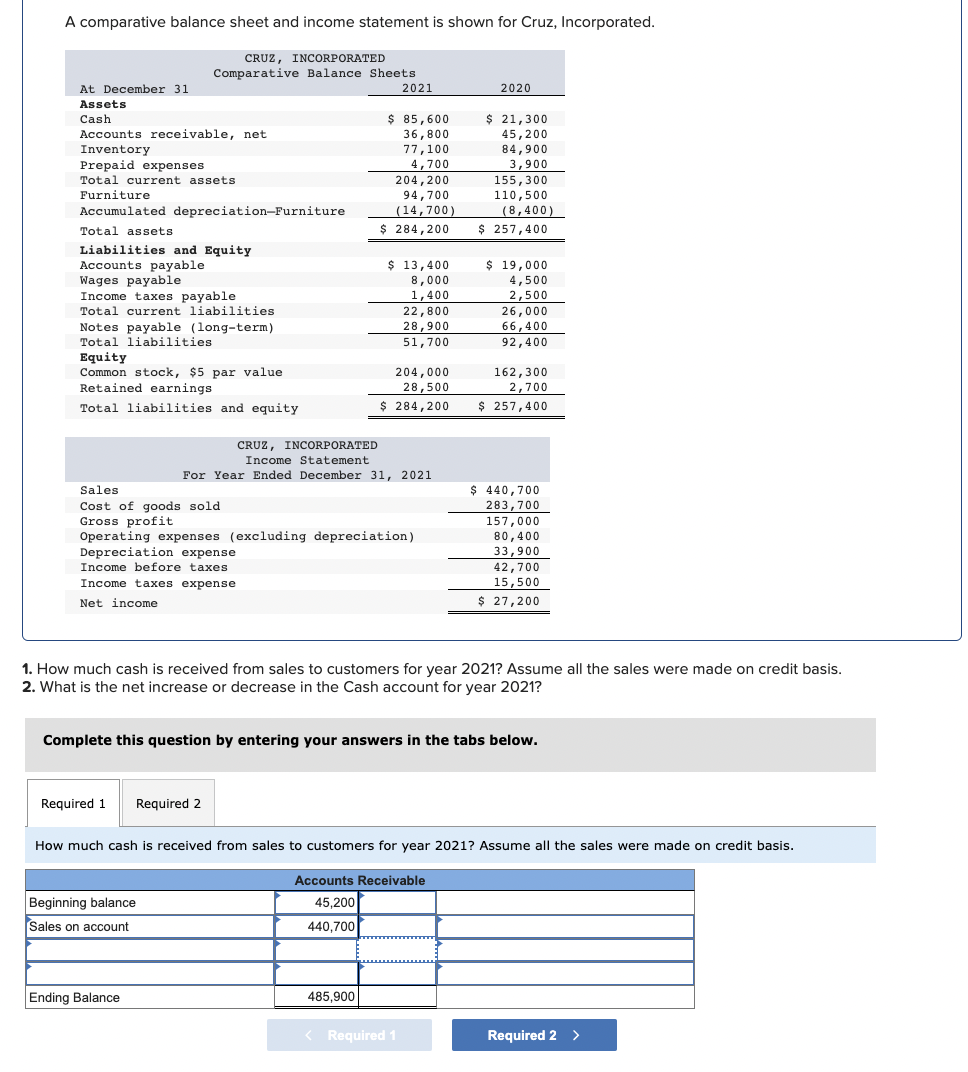

Prepaid expenses on the balance sheet the balance sheet is an equal sign with company assets on one side, liabilities plus owners' equity on the other. With the $5,300 increase in prepaid expenses and other information in the example, we can prepare a schedule of cash flows from operating activities under the. Prepaid expenses refer to expenses that a company pays in advance for goods or services that it will receive in the future.