Marvelous Info About Dividend Payable On Balance Sheet Income And Expense Statement For Child Support

After the dividends are paid, the dividend payable is reversed and is no longer present on the liability side of the balance sheet.

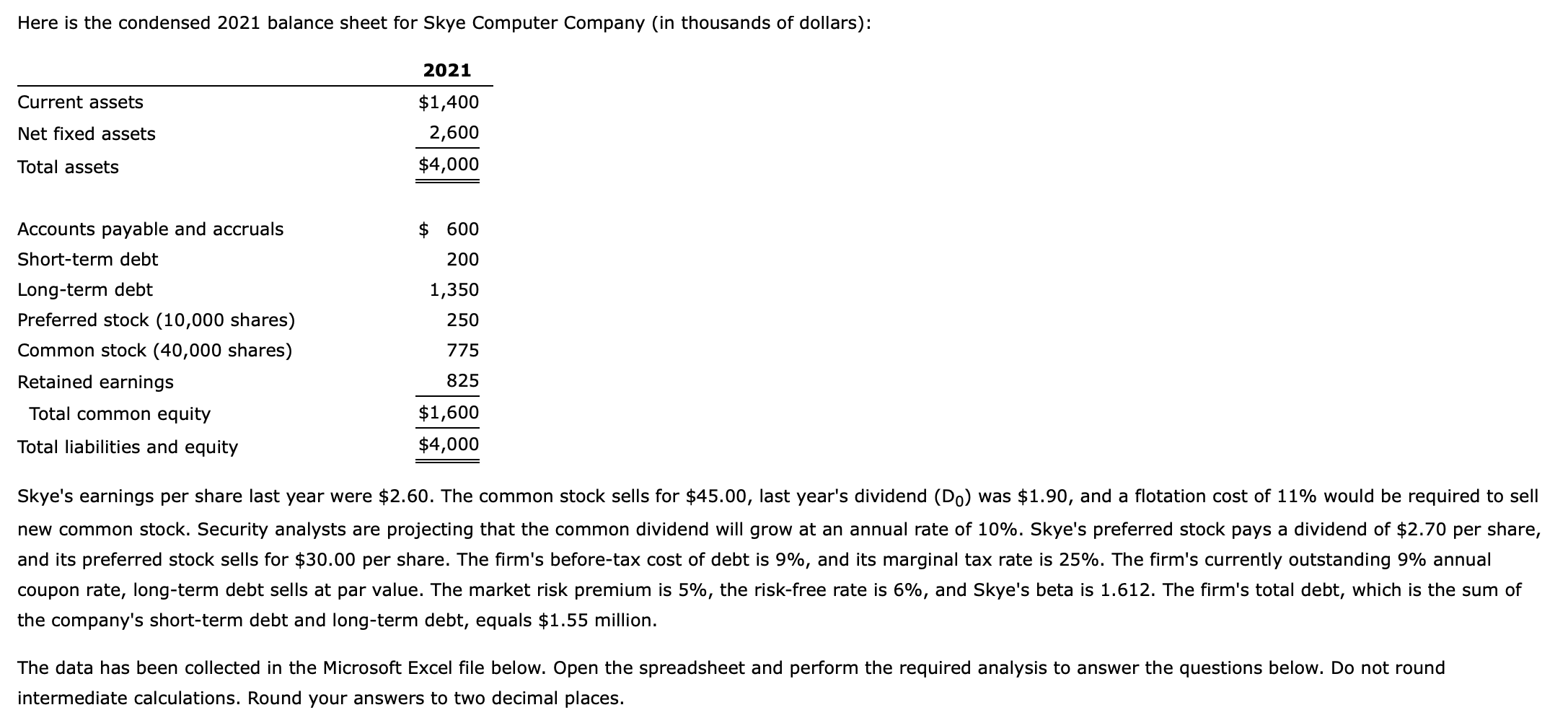

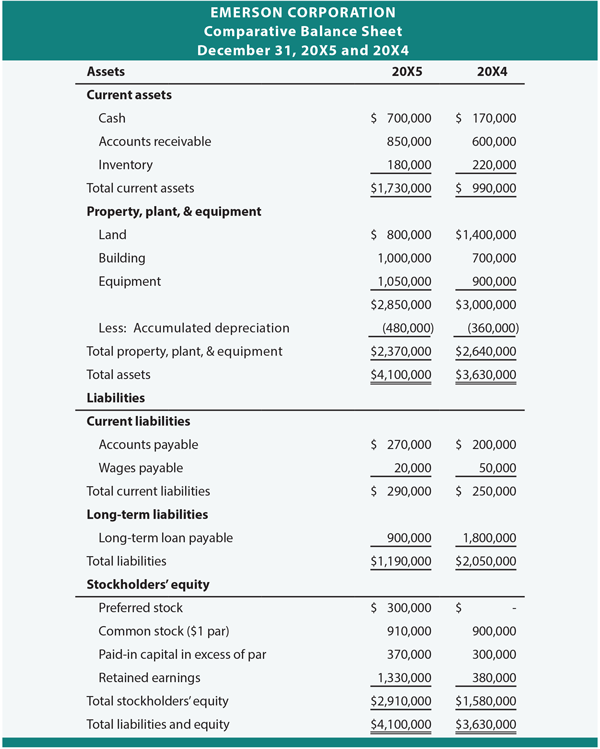

Dividend payable on balance sheet. Cash dividends on the balance sheet cash dividends affect two areas on the balance sheet: Definition of dividends cash dividends are a distribution of a company's profits. Accounts payable is a liability since it is money owed to creditors and is listed under current liabilities on the balance sheet.

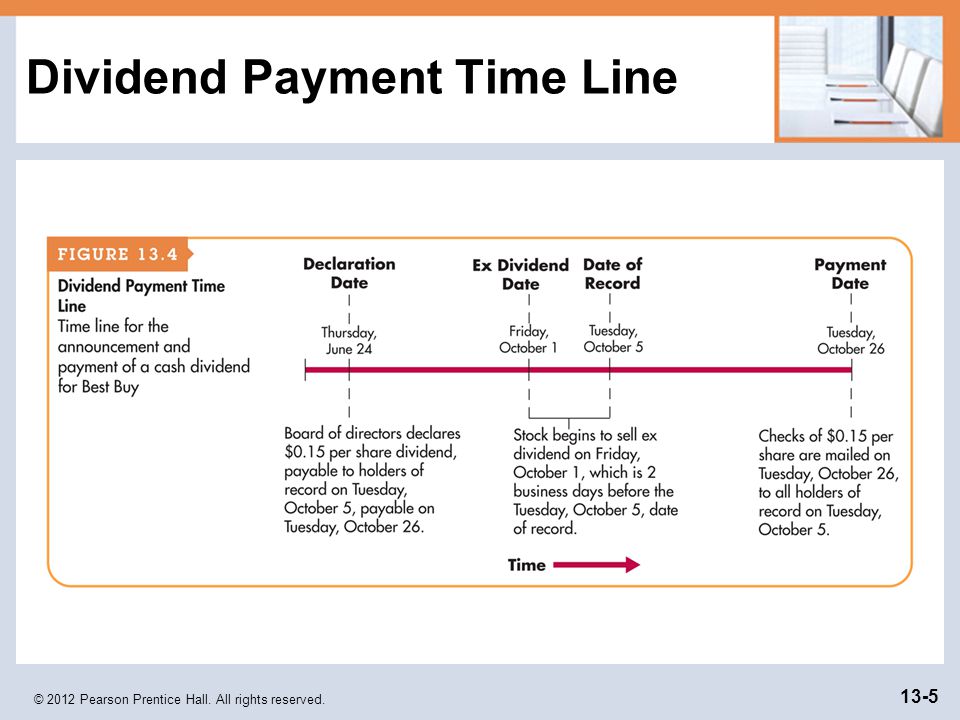

The board of directors will propose the payment of a 2023 dividend of € 1.80 per share (2022: When dividends are paid, the impact on the balance sheet is a decrease in the company's dividends payable and cash balance. The income statement is not affected by the declaration and payment of cash dividends on common stock.

In both cases, the amount paid out is in proportion to the number of shares already held by shareholders. Paying the dividends reduces the amount of retained earnings stated in the balance sheet. October 01, 2023 what are dividends?

Learn about the dividends payable with the definition and formula explained in detail. A corporation may issue dividends to its shareholders, which represent a distribution of its retained earnings to them. The cash and shareholders' equity accounts.

It is displayed as declared payments to shareholders that have been announced by the board of directors but are yet to be distributed to. Our dividend proposals are a reflection of the strong 2023 financials, our growth prospects in 2024 and balance sheet strength.”. As a result, the balance sheet size is reduced.

The debit to the dividends account is not an expense, it is not included in the income statement, and does not affect the net income of the business. The cash dividend affects the cash and shareholders' equity accounts primarily. For shareholders of record mar.

Accounts payable is listed on a company's balance sheet. In terms of classification, dividends declared but not yet paid are reported as a current liability in the liabilities section of the balance sheet under “dividends payable.” once the dividends are paid to the shareholders, the liability is reduced, reflecting the distribution of dividends. What account is dividend payable?

Current liabilities (such as dividends payable) will increase. Dividend payable is a current liability account on the balance sheet. Adr is payable april 3;

Before dividends are paid, there is no impact on the balance sheet. These three balance sheet segments. The dividends account is a temporary equity account in the balance sheet.

The common practice concerning the dividends payable account treats it as a current liability if the amount is to be paid within 12 months. When the cash dividend is paid, the following will occur: There is no separate balance sheet account for dividends after they are paid on the declared payable date.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)