Brilliant Tips About Financial Ratios For Investors Korean Air Statement

Capital one is a level iii bank, which means that it is subject to annual supervisory capital stress tests.

Financial ratios for investors. Discover’s tier i risk based capital (13.2%) and. The three most important financial statements are the income statement, balance sheet and cash flow statement. Financial ratios every investor should know 10 mins 24 nov 2022 0 comment 9 likes share introduction stock selection is a difficult process.

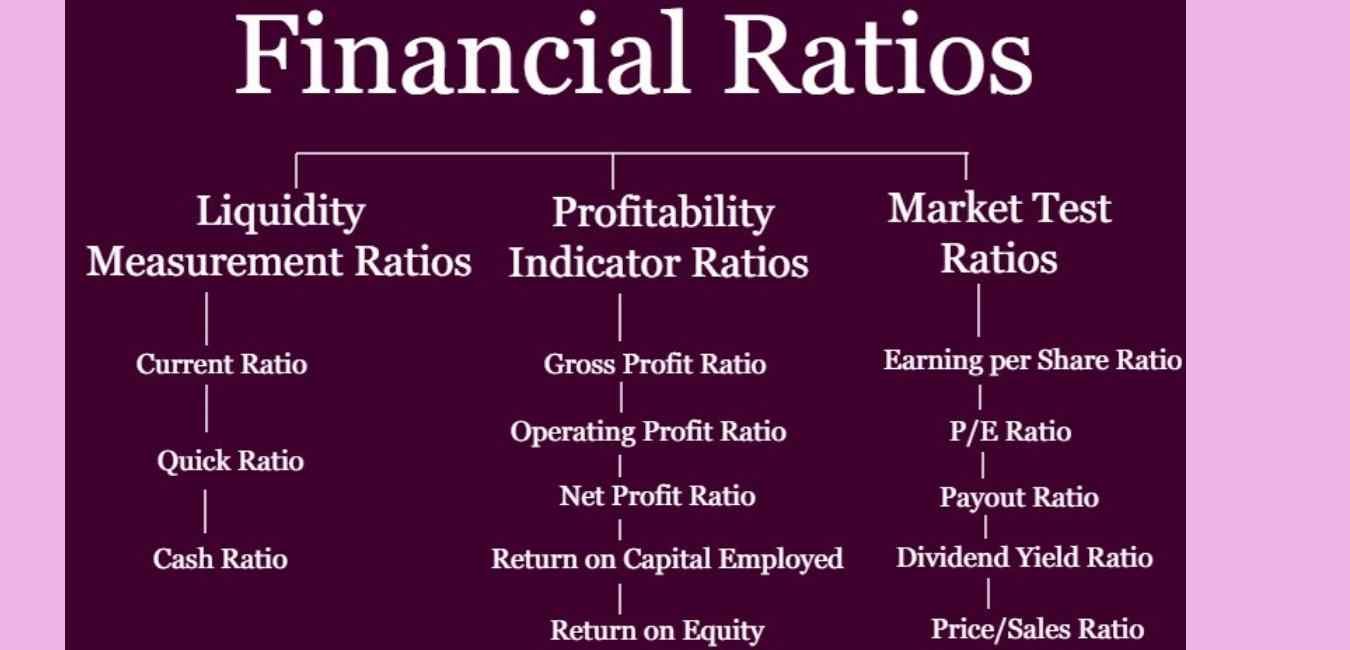

Financial ratios provide investors with essential information about a company’s financial position, profitability, liquidity, and this complete guide will delve. Financial ratios are the indicators of the financial performance of companies. Eps = net profit / number of common shares to find net profit, you’d subtract total expenses from total revenue.

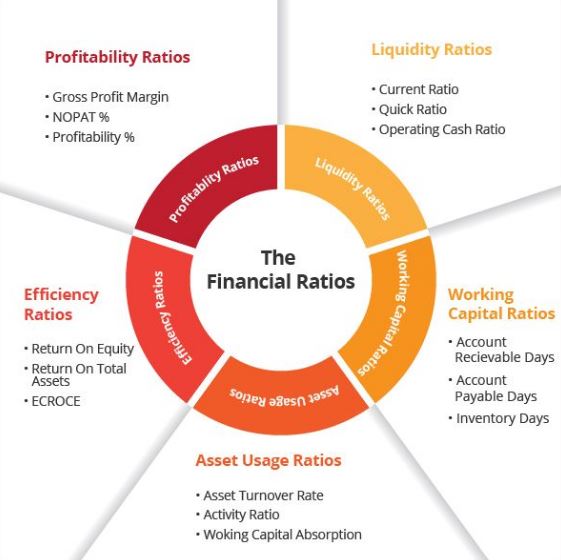

Different financial ratios indicate the company’s results, financial risks, and working efficiency,. Ratio analysis helps investors screen for potential stock investments. A reconciliation from apms “underlying earnings” and “combined ratio” to the most directly related line item, subtotal, or total in the financial statements of the.

Track these down before proceeding further. Investor ratios are defined as financial ratios that investors use to gauge the company’s ability to generate a positive and profitable return for the investors. Types of ratio analysis the various.

One of the uses of ratio analysis is to compare a company’s financial performance to similar firms in the industry to understand the company’s position in the. Basically, the ratios let investors know. Ratios—one variable divided by another—are financial analysis tools that show how companies are performing in their own right and relative to one another.

What are financial ratios? Called p/efor short, this ratio is used by investors to determine a stock's potential for growth. But investors may be dissuaded from investing in the healthcare company for the dividend as pfizer reported diluted earnings per share (eps) totaling just $0.37 in.

Investor ratios are the ratios that investors use to evaluate the potential of a company to generate a return on investment. Corporate finance ratios are quantitative measures that are used to assess businesses. It's often used to compare the potential value of a selection of stocks.

(investors might also refer to net. Financial ratios are made with the utilization of mathematical qualities taken from budget reports to acquire significant data about an. It reflects how much they would pay to receive $1 of earnings.

These ratios are used by financial analysts, equity research analysts, investors, and. Financial ratios help investors determine if a stock is undervalued or overvalued.