Stunning Info About Corporation Tax Balance Sheet The Sterling Tire Companys Income Statement

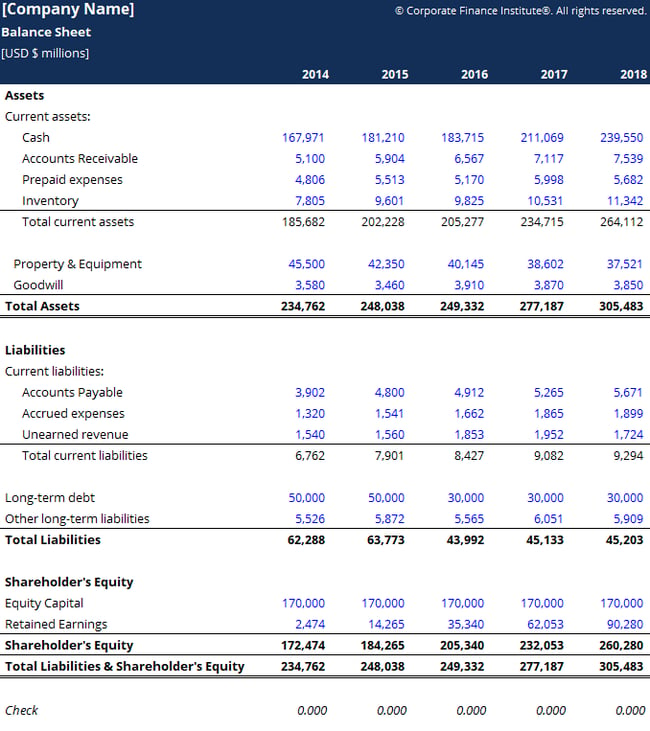

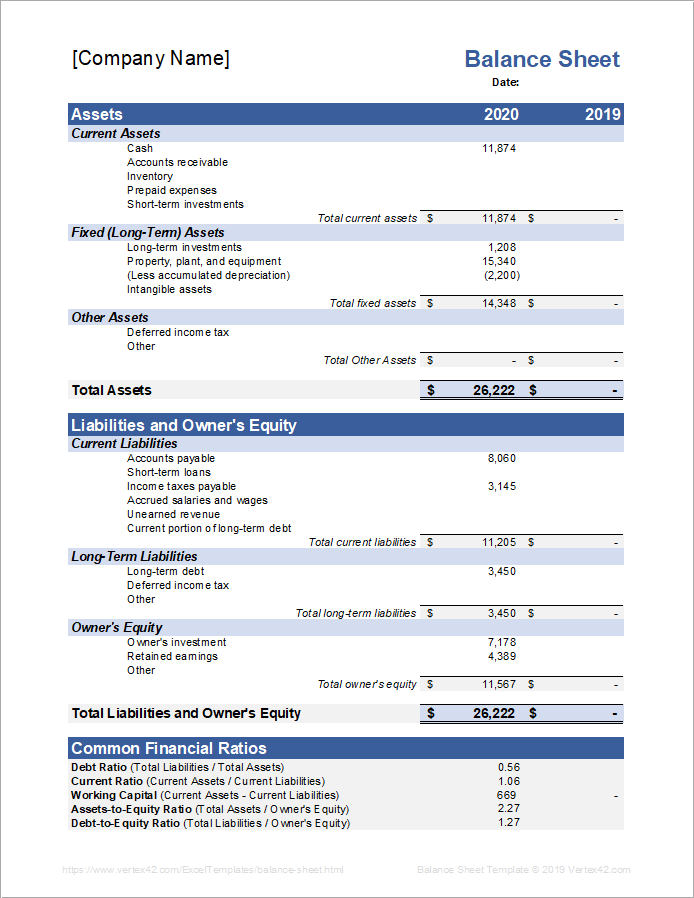

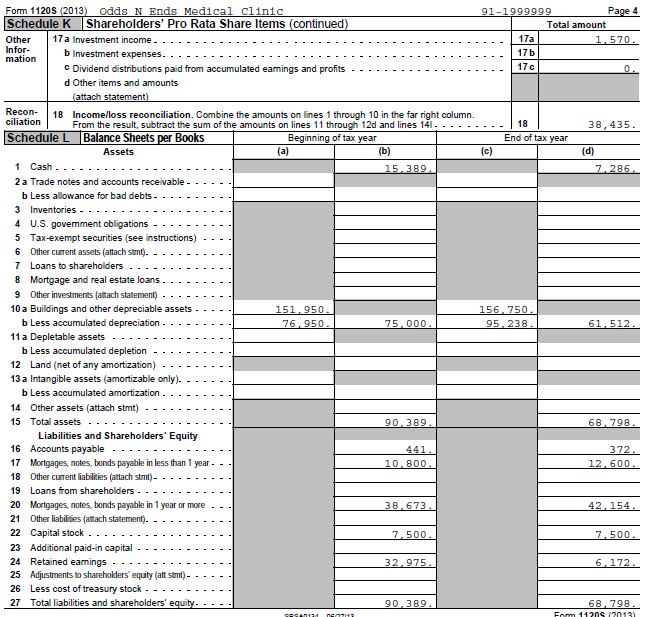

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

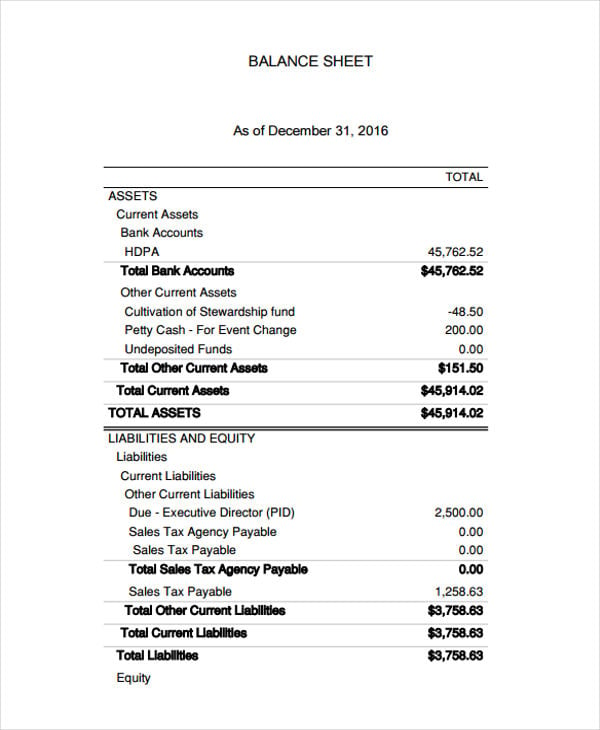

Corporation tax balance sheet. There should be a credit balance arising from last year's accounts in the balance sheet (perhaps called 'corporation tax liability'). I have just submitted the company accounts and. As fixed assets age, they begin to lose their value.

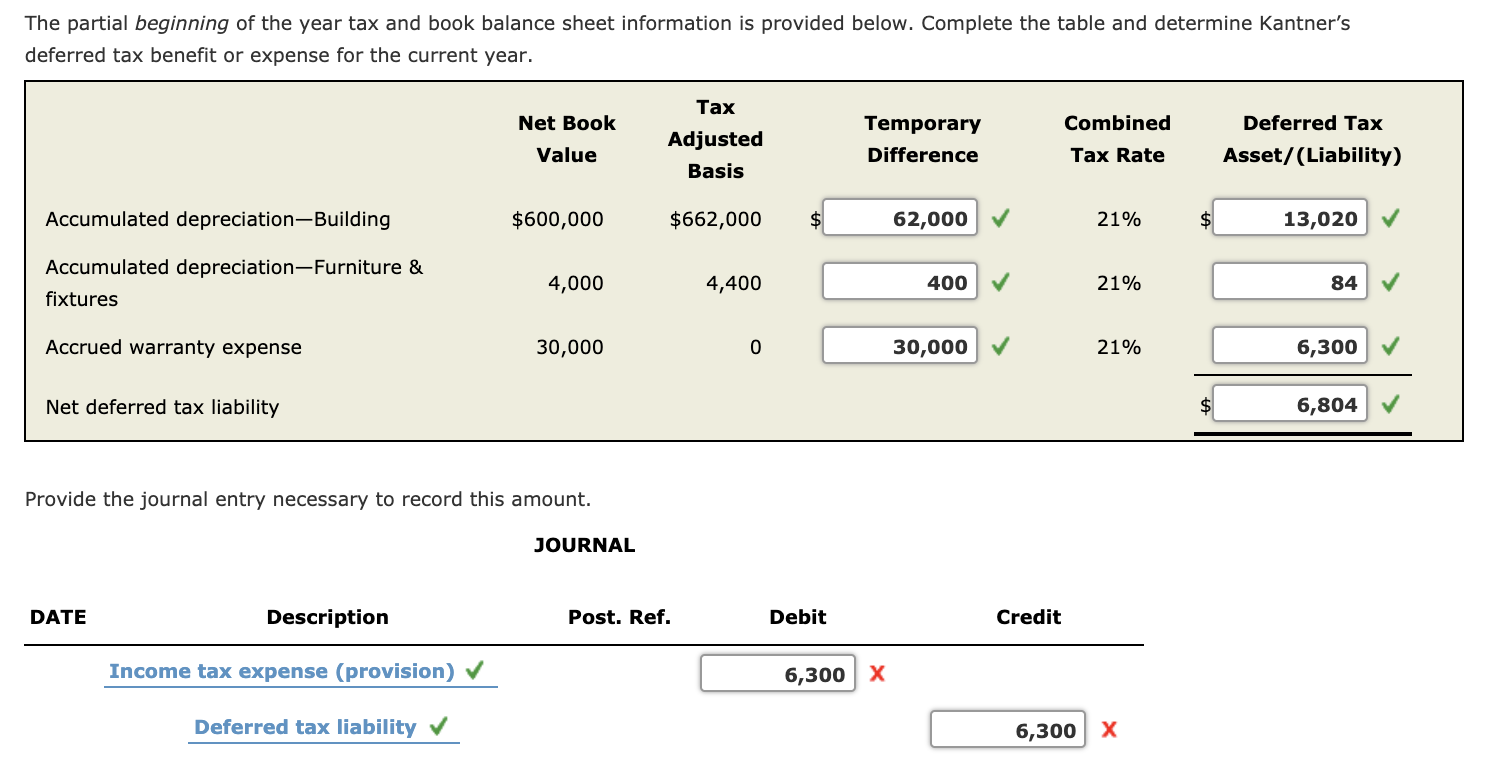

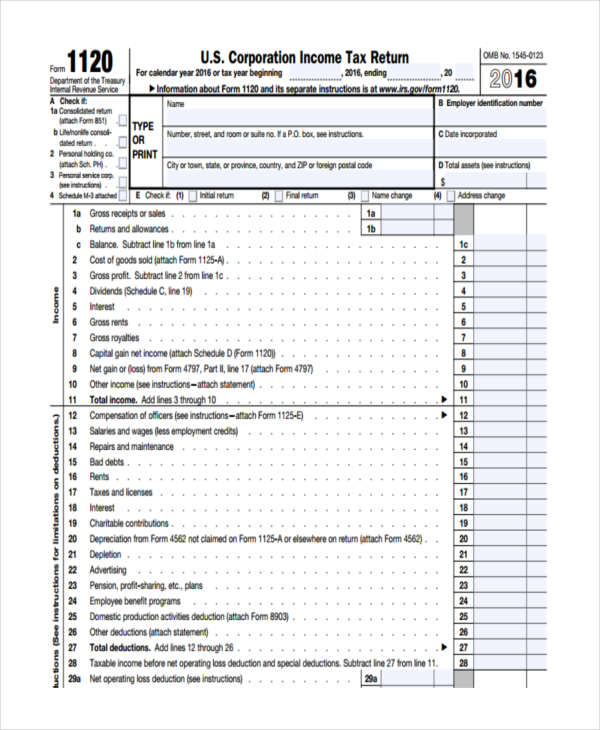

1 0 jul 8, 2016 #1 hi, i am the director of a uk limited company (england and wales) and i am filing the company tax return. Complete the boxes debiting the corporation tax account (in the tax expense group of the profit & loss account) and crediting the corporation tax account (in the current liabilities.

Dr corporation tax (profit and loss) with the calculated tax. In reality, the company is likely assessed the flat 21% flat corporate tax rate. 30th sep 2007 14:16.

Ifrs example consolidated financial statements 1. Definition of income tax in the accounting for a regular u.s. Corporate taxes adjustment by:

Get advice on how this critical element affects business decisions and. Cr corporation tax (balance sheet) with the same amount. A ‘balance sheet’, which shows the value of everything the company owns, owes and is owed on the last day of the financial year a ‘profit and loss account’, which shows the.

Is income tax an expense or liability? We’re a network of independent assurance, tax and advisory firms, made up of 56,000+. 21, 2024 — using inflation reduction act funding and as part of ongoing efforts to improve tax compliance in.

It is available to companies with fewer than 500. The audits will be focused on aircraft. Sharon, calgary my client's books opening balance in a corp.

To accrue for the annual corporation. Corporation, income tax usually refers to the federal, state, local, and. Small businesses with profits of less than £50,000 will retain the lower 19% rate.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)