Neat Tips About Net Loss Shown In Balance Sheet Financial Ratios Cfi

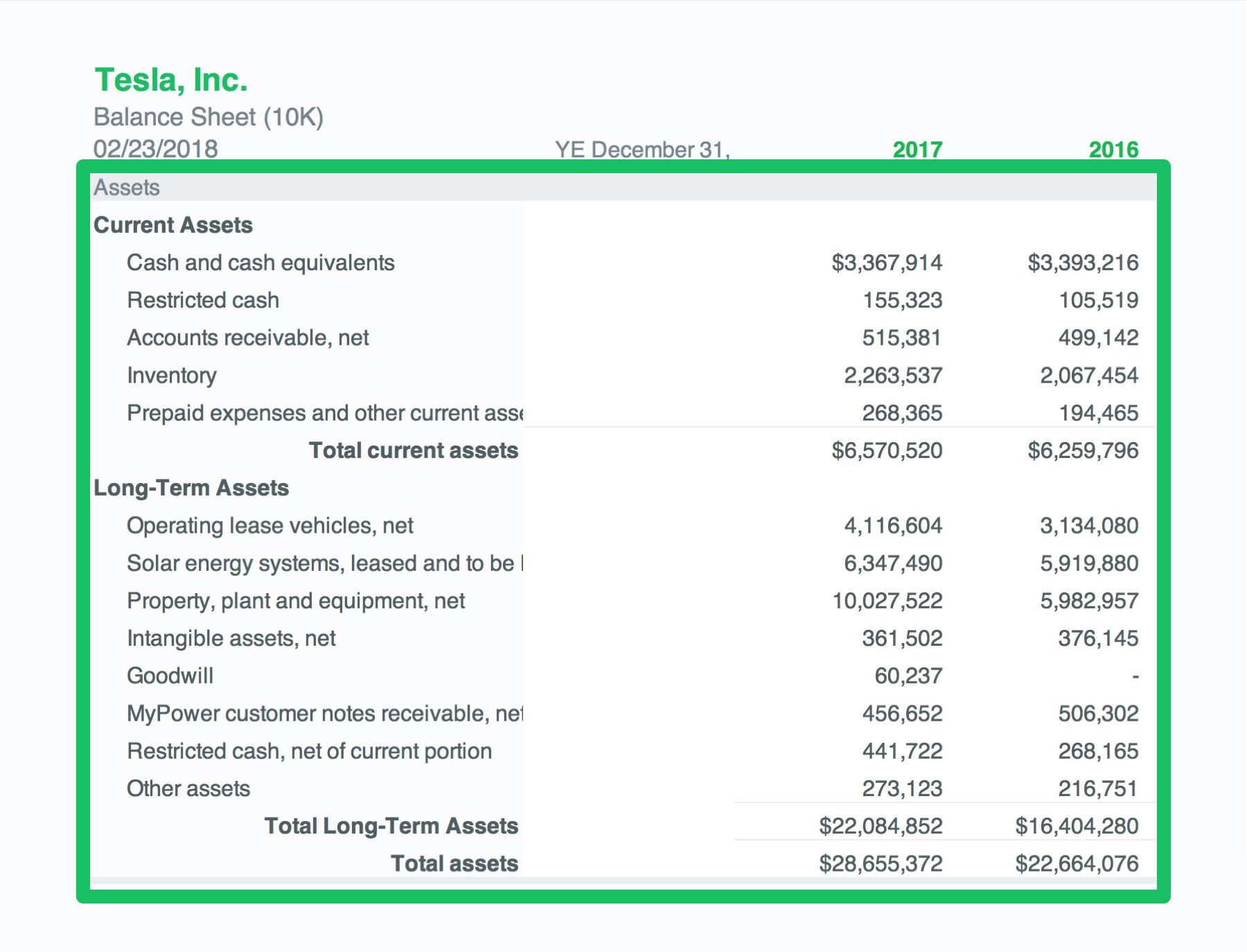

The balance sheet, the profit and loss (p&l) statement, and the cash flow statement.

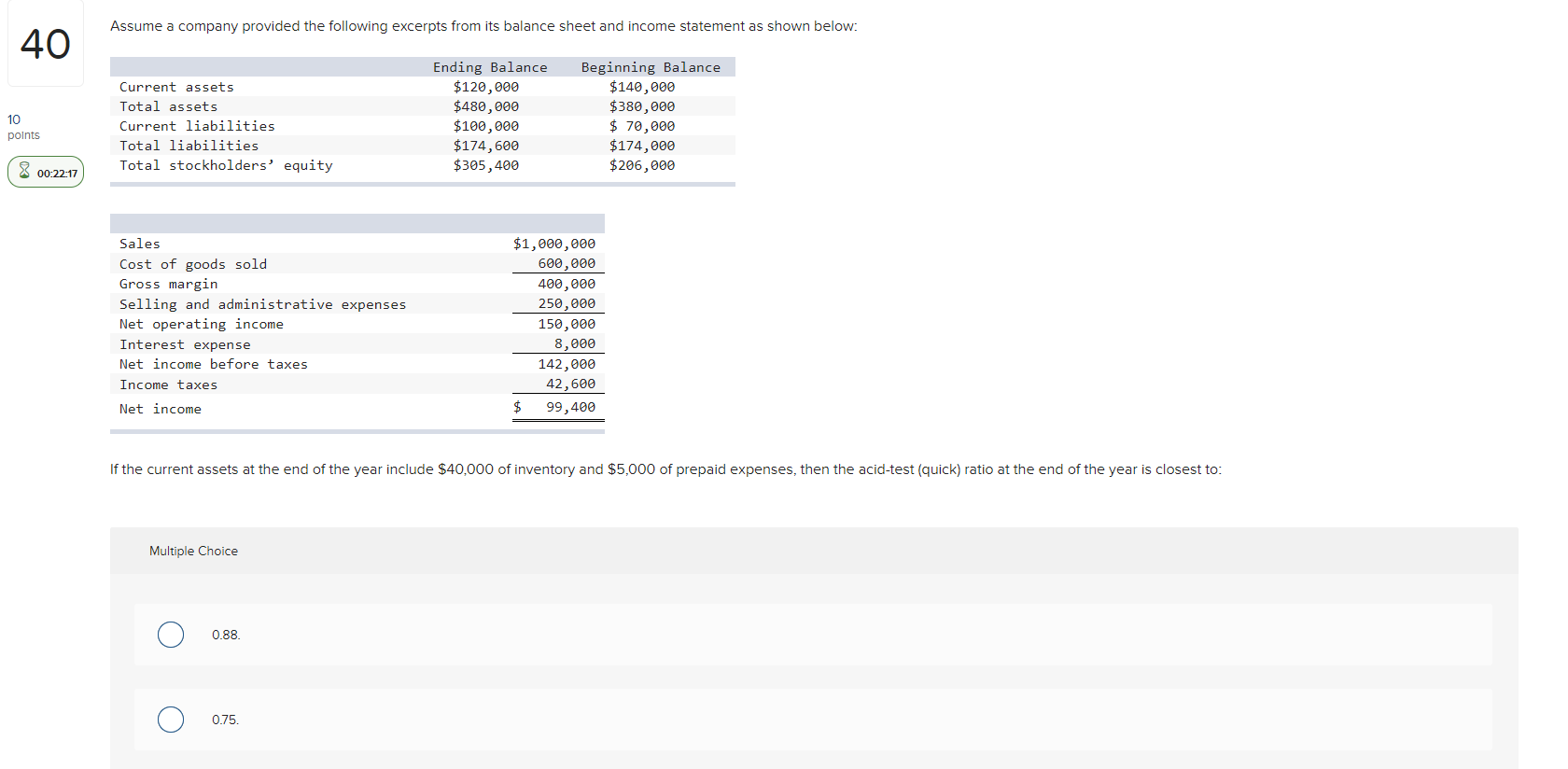

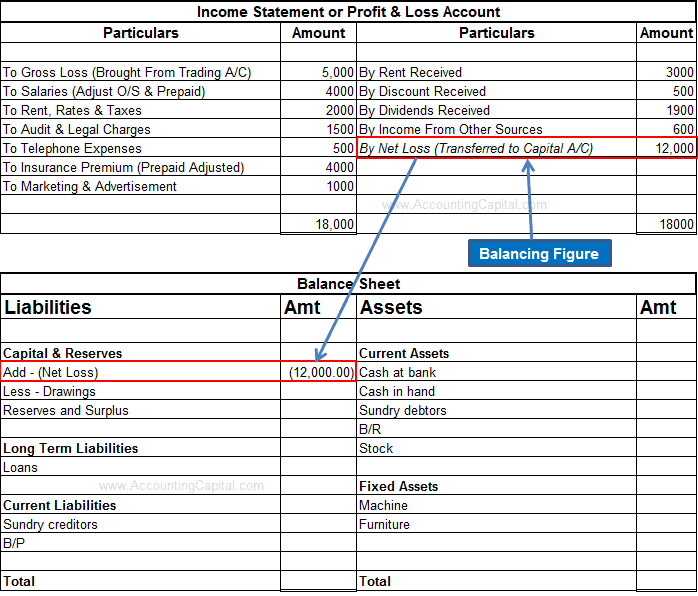

Net loss shown in balance sheet. An amount of net profit is added to the capital. Matching principle and accrual accounting 28 january 2015 is the 'net loss' from the p&l account transferred to 'miscellaneous expenditure' in assets side or only accumulated losses are transferred there?

Dividend of € 1.80 per share; This snapshot of the company’s financial position is important for. A balance sheet depicts the financial position of the company at any given point in time.

At the end of a financial year, the net loss is transferred to the balance sheet and shown as a deduction from capital. Net loss also differs from gross loss, which is the negative amount left after subtracting the cost of goods sold from total revenues. Profit loss account is prepared to find out gross profit or gross loss.

Special dividend of € 1.00 per share. The net profit belongs to the ownership of the business which is represented by the capital account. It is also called the ‘shareholders equity’ or the ‘net worth’.

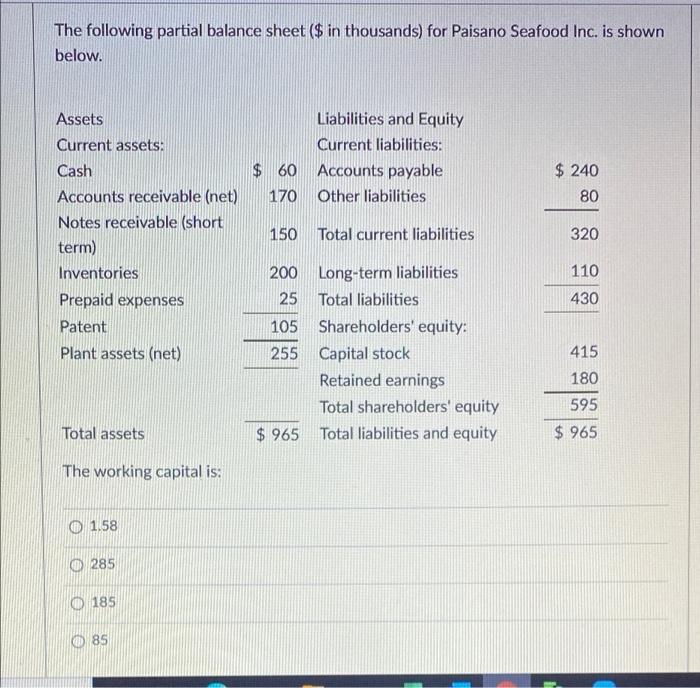

Read about the liability side of a balance sheet in this chapter. The balance sheet is based on the fundamental equation: Net loss or net income is a key indicator used to evaluate the company operating results in a specific period.

Free cash flow before m&a and customer financing € 4.4 billion; What is the logic behind doing this? The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

Trading account is a part of profit & loss account. Calculating net income and operating net income is easy if you have good bookkeeping. Importance of net income/net loss.

It is reflected as a negative amount, indicating the. If you have retained earnings, you enter them in the “owners’ equity” section of the balance sheet. Representing this in the form of an equation :

The income statement lists all your revenues and expenses over a given period of time, usually per quarter or per year. December 04, 2023 what is net loss? Hence this is shown on the liabilities side of the balance sheet.

A p&l statement provides information about whether a company can generate. All expenses are included in this calculation, including the effects of income taxes. Net cash € 10.7 billion.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)