Cool Info About Operating Expenses In Financial Statement Current Ratio Calculation Formula

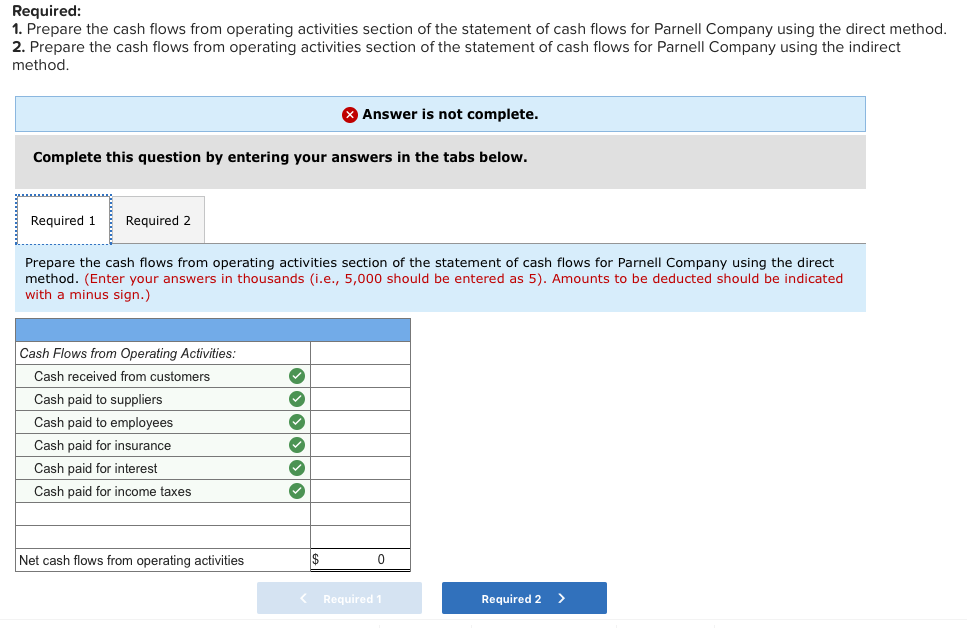

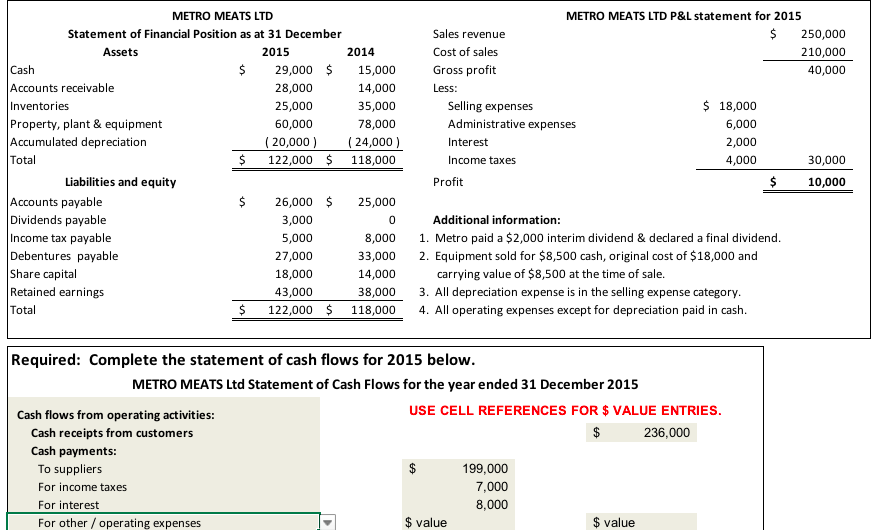

An operating statement is a financial report that provides a detailed breakdown of a company's revenues and expenses, allowing business owners to analyze their performance and make informed decisions.

Operating expenses in financial statement. Operating expense is defined as the expense incurred by a business for its normal operational activities. Operating expenses are those expenses incurred during regular business operations. Also referred to as opex, these costs are attributed to the various operational activities of a business.

The annual financial statements of the ecb are prepared in accordance with decision (eu) 2016/2247 of the ecb of 3 november 2016 on the annual accounts of the ecb (recast) (ecb/2016/35) (oj l 347, 20.12.2016, p. Operating expenses are generally defined when identifying and assessing the theentity’ss operating profits. For most businesses, these costs should be between 60% and 80% of gross.

Operating expenses refer to all costs payable during normal business operations. Other costs excluded from the operating cost include auditor fees, debt. Operating expenses, operating expenditures, or “opex,” refers to the costs incurred by a business for its operational activities.

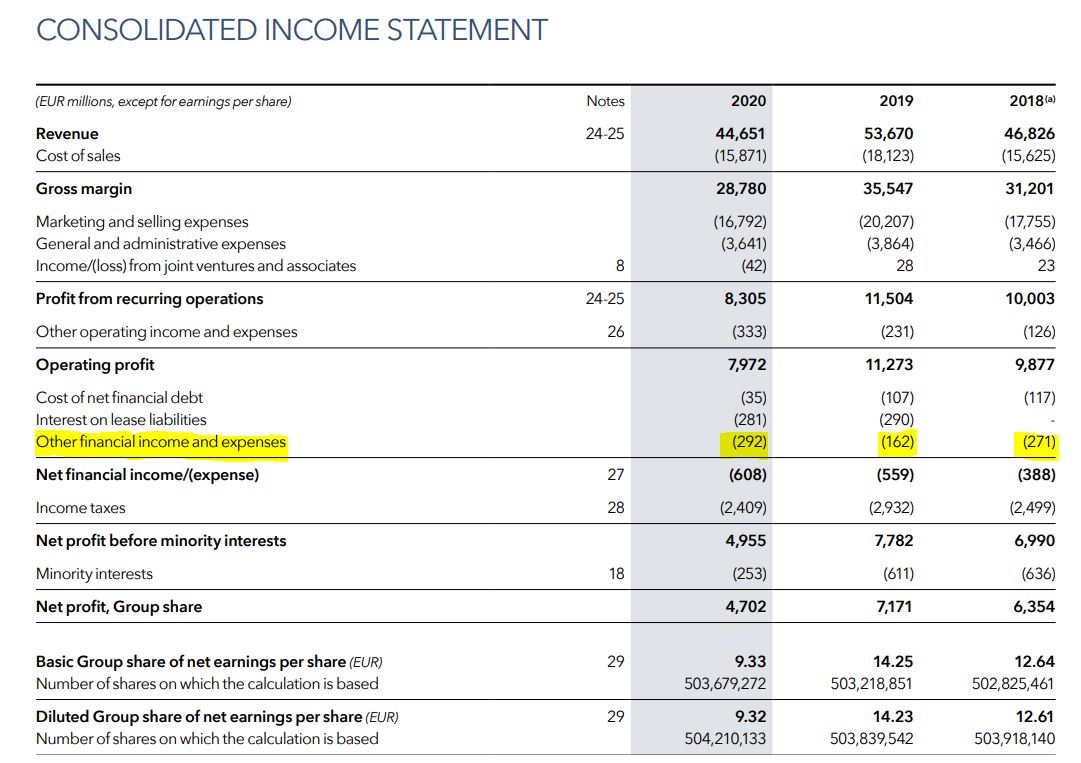

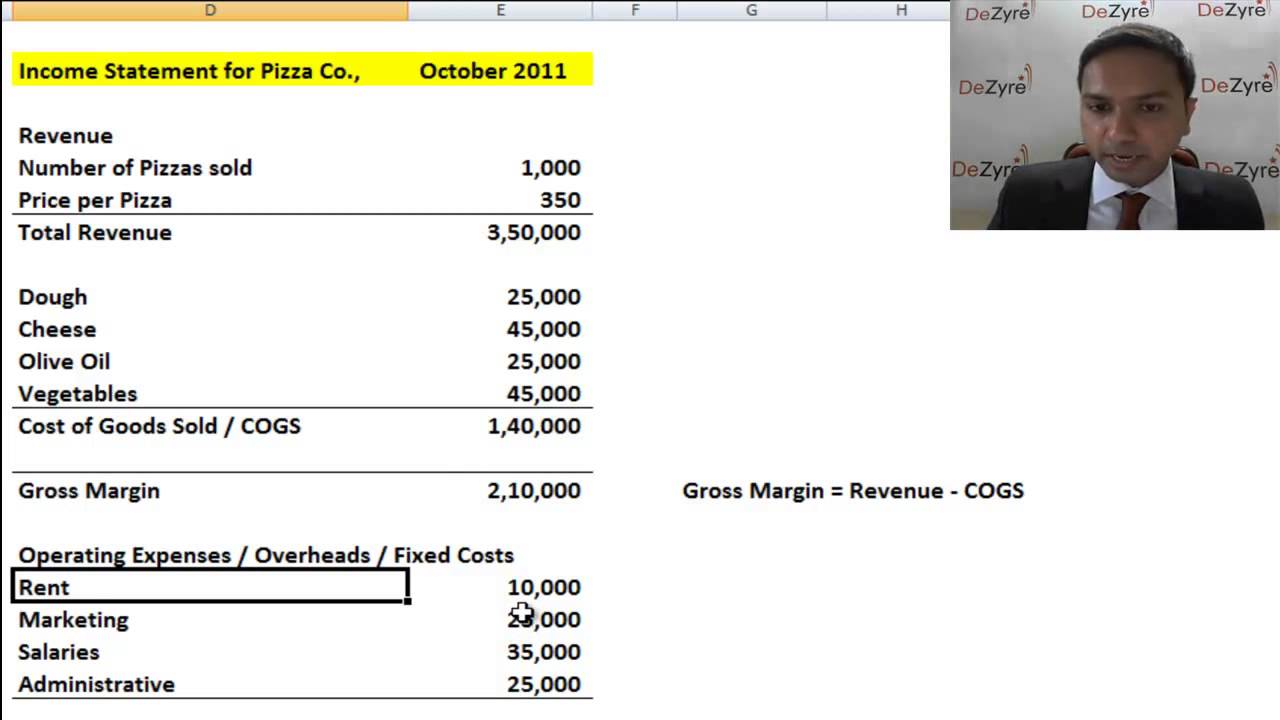

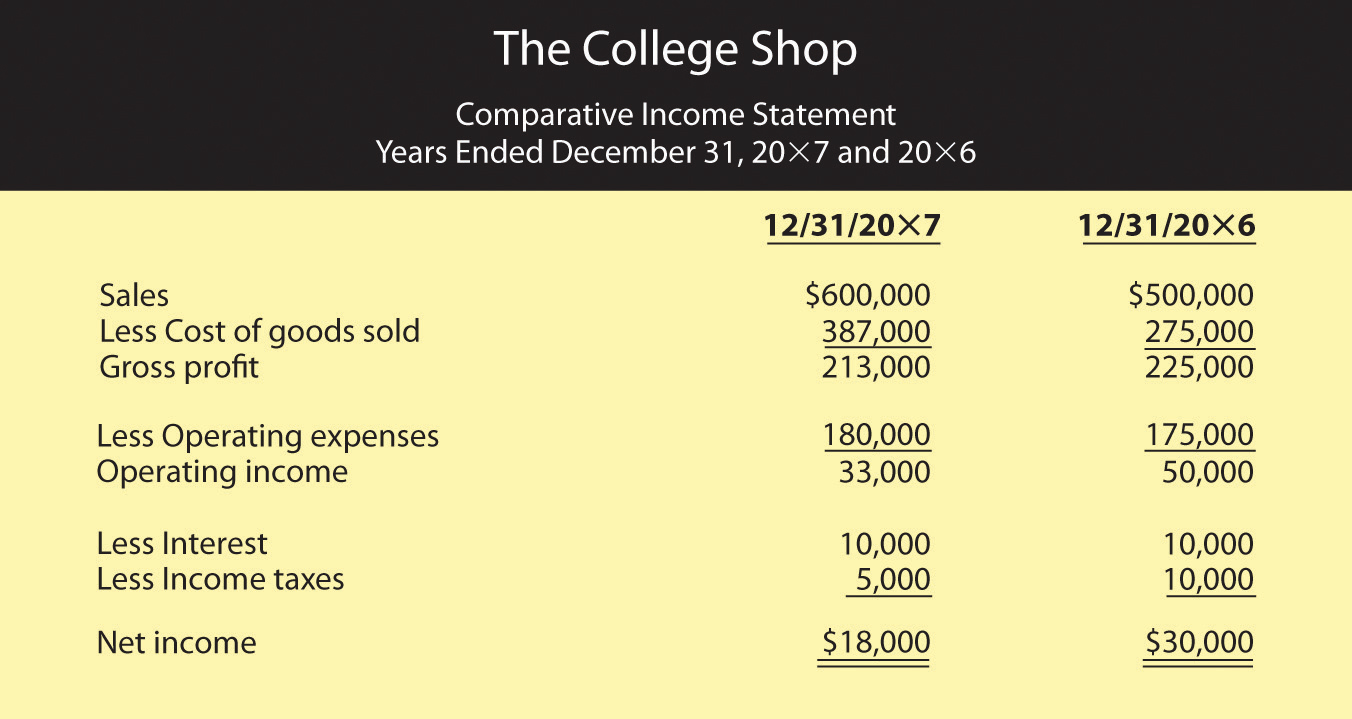

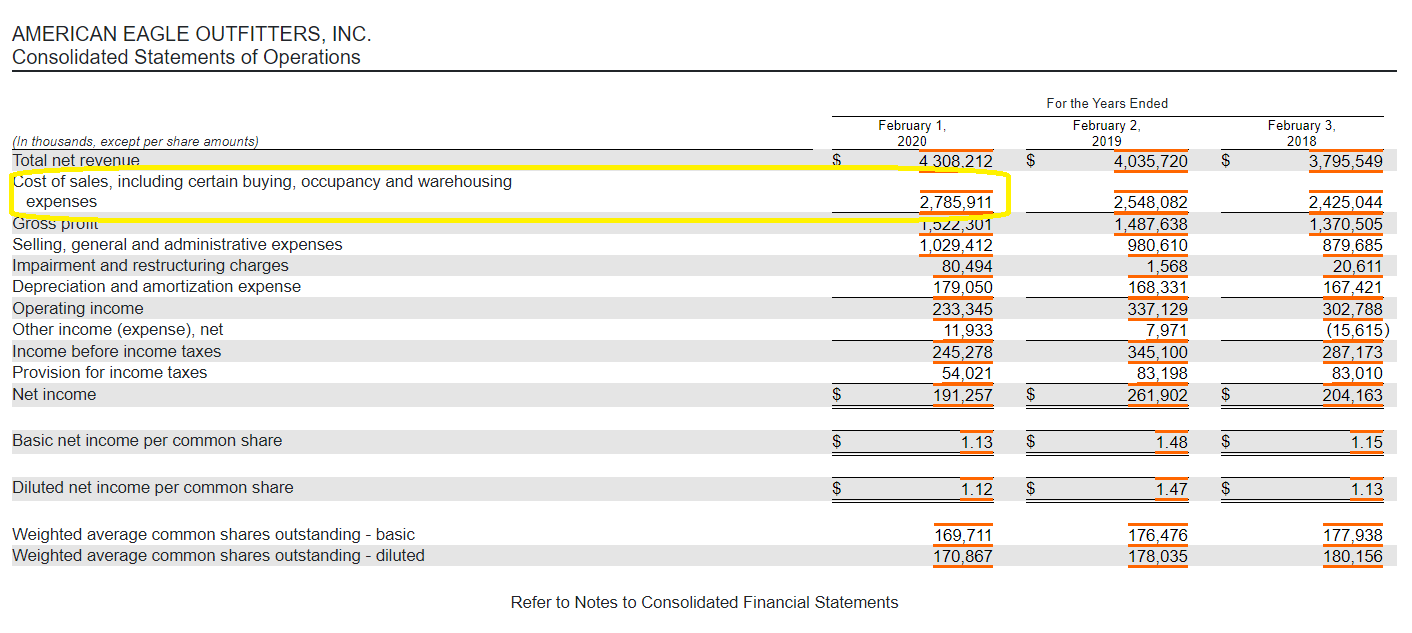

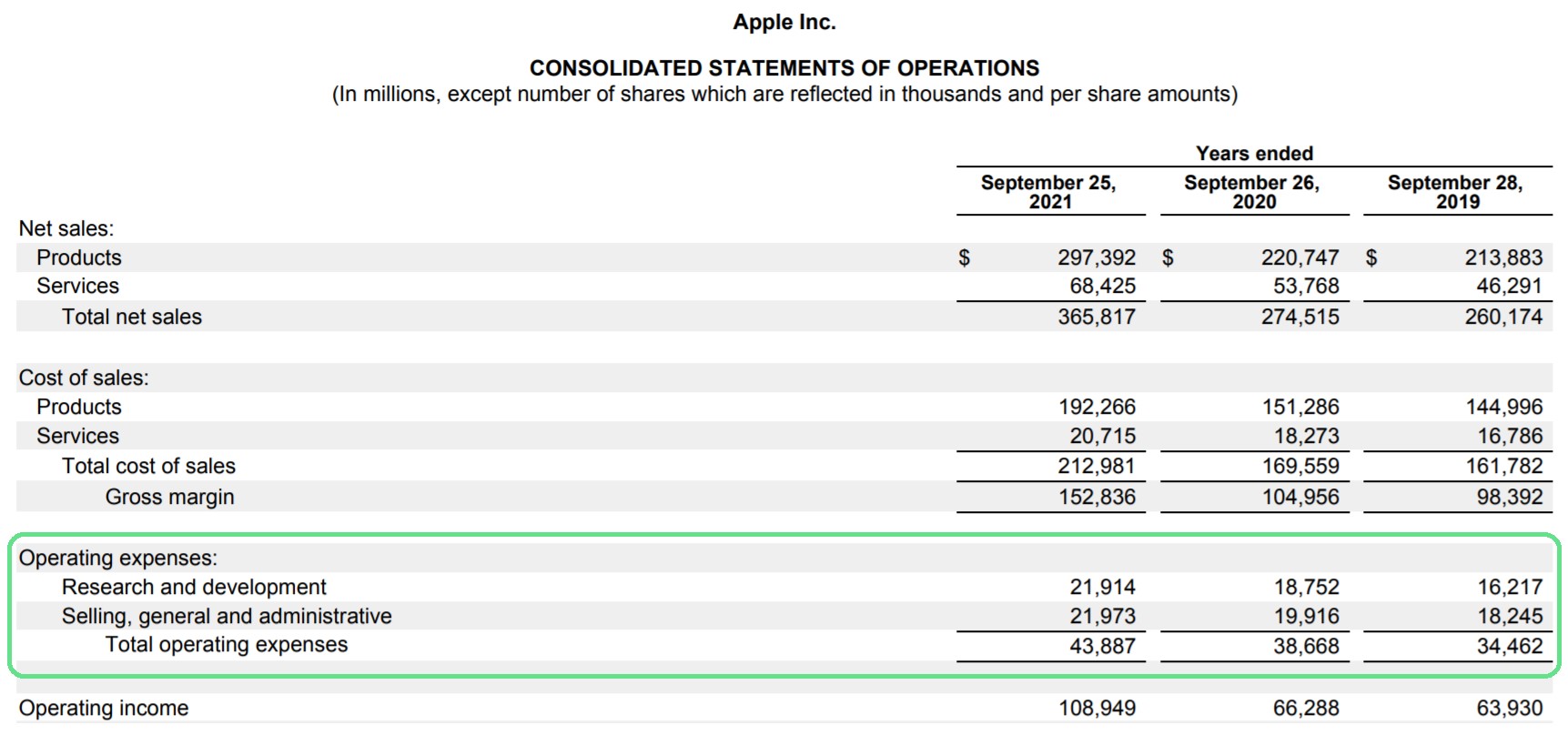

Operating costs include both costs of goods sold (cogs) and other operating. Operating income is an accounting figure that measures the amount of profit realized from a business's operations, after deducting operating expenses such as cost of goods sold (cogs) , wages and. The income statement of a company always recognizes the operating expenses as the business expenses that occurred in a.

This section discusses many of the common operating expenses that reporting entities may separately identify in the income statement. Cost of goods sold (cogs) and operating expenses (opex) are two essential components of your financial statement. The statement typically includes information on revenue, cost.

Unique to operating expenses, most costs classified as opex are fixed costs, which means they are not directly linked to revenue. The list of such costs includes production expenses like direct material and labor costs, rent expenses, salary and wages paid to administrative staff, depreciation expenses, telephone expenses, traveling expenses, sales promotion expenses, and other routine expenses. Both cogs and opex play a crucial role in.

Operating expense (opex) is the cost incurred in the normal course of business. Cogs refers to the direct costs of producing the goods and services sold by a company. It does not include expenses such as the cost of goods sold directly related to product manufacturing or service delivery.

They are easily available in the income statement and other costs subtracted from the operating income to. A company’s operating expenses, sometimes called opex, are reflected in its income statement. Sbsw) will release its full operating and financial results for the six months and year ended 31 december 2023 on.

The statement of operations is also known as an income. Operating expenses are essential for analyzing a company’s operational performance. Understanding the concept of operating expenses is very simple because this example lies in our daily life business operations.

They are a fundamental component of a company’s income statement, also known as the statement of operations or profit and loss statement. It is also known as an income statement or profit and loss statement. Operating expenses are the expenses incurred in the entity for its normal operational purposes and activities that generally include both the cost of products or services and sales & administrative expenses.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/Apple10K2021-f845adaeca254e728a75fa5af5c7eff1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)