Here’s A Quick Way To Solve A Tips About Financial Ratios Important To Investors Uses Of Cash Budget

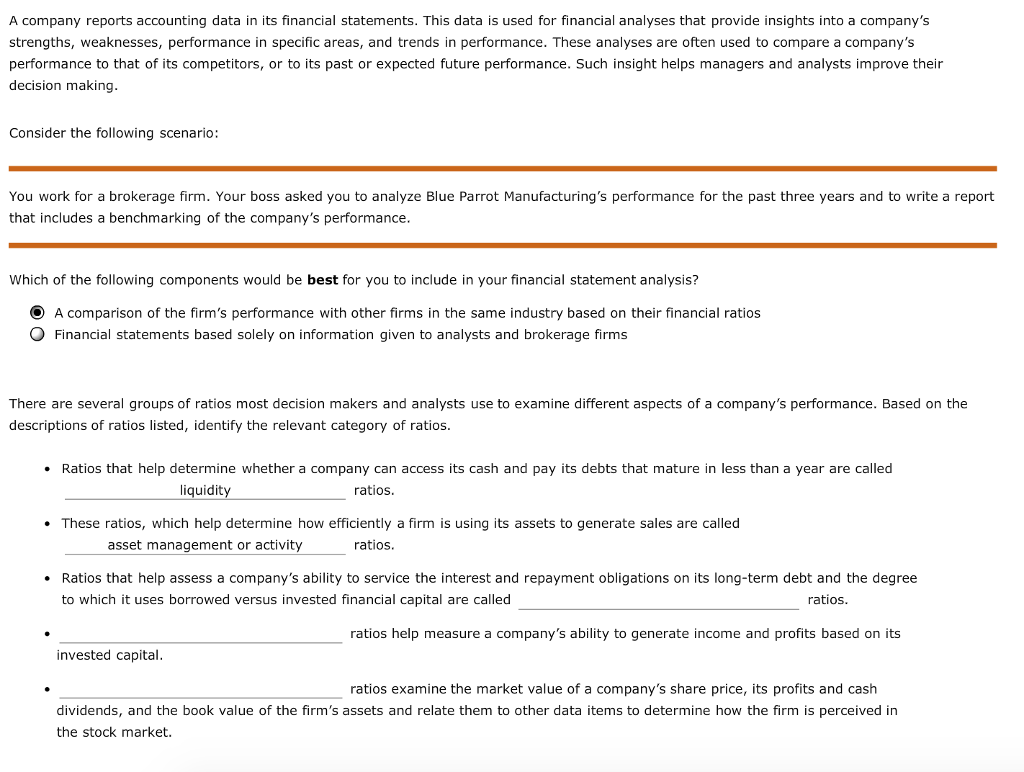

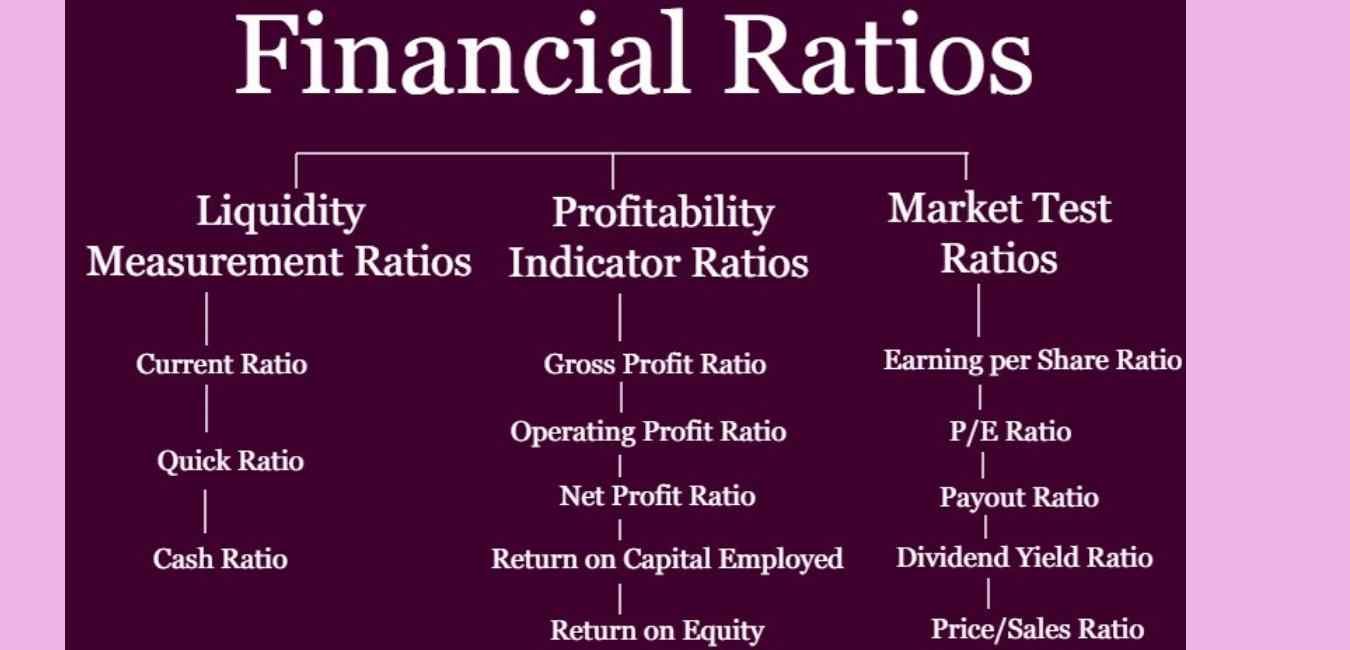

Financial ratios are grouped into the following categories:

Financial ratios important to investors. They're important, because they allow for more accurate comparisons between companies. It depends on how much depth of perspective you need. Price, profitability, liquidity, debt, and efficiency.

By using ratios, they can better understand a company’s financial health and performance and make decisions based on objective and structured information. Financial ratios are powerful tools to help summarize financial statements and the health of a company or enterprise. It is calculated by dividing the company’s net profit by the total number of outstanding shares.

Earnings per share (eps) eps represents the earnings on every unit of stock you own. From profitability to liquidity, leverage, market, and activity, these are the 20 most important ratios for financial analysis. Investors compare the performance of the company against its competitors and industry as a whole.

Financial ratios are significant because they allow investors, creditors, analysts and other stakeholders to compare and evaluate a company’s financial performance. How does it help: Read more financial ratios are numerical calculations that illustrate the relationship between one piece or group of data and another.

Considering factors like fund manager's track record and ratios—such as churn and sharpe—can prevent costly mistakes for retail investors, according to aditya shah, founder of. Eps is calculated on a quarterly and annual basis, and preferential shares are not taken into account. 22 feb 2024, 11:08 am ist.

Investors in deciding whether to invest in a company or not. For example, suppose a company has a revenue of $500,000 and a cost of goods sold of $300,000. Investors and analysts employ ratio analysis to evaluate the financial health of companies by scrutinizing past and current financial statements.

In this article you will learn. Financial ratios are numerical expressions that indicate the relationship between various financial statement items, such as assets, liabilities, revenues, and expenses. This number tells you how much a company earns in profit for each.

Comparative data can demonstrate how a. Return on assets (roa) 9. Financial ratios help:

Figuring out a stock's value can be as simple or complex as you make it. Return on equity (roe) 11. Conduct fundamental analysis.

A variety of ratios is used by individual investors, institutional. Earnings per share (eps) 10. Price to book value (p/bv) ratio 3.