Glory Tips About Comparative Statement Example Kpmg Illustrative Financial Statements 2020

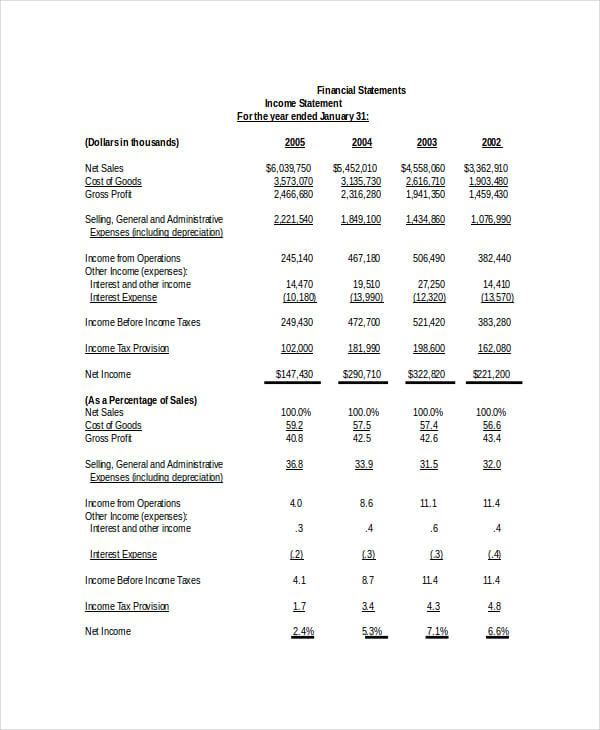

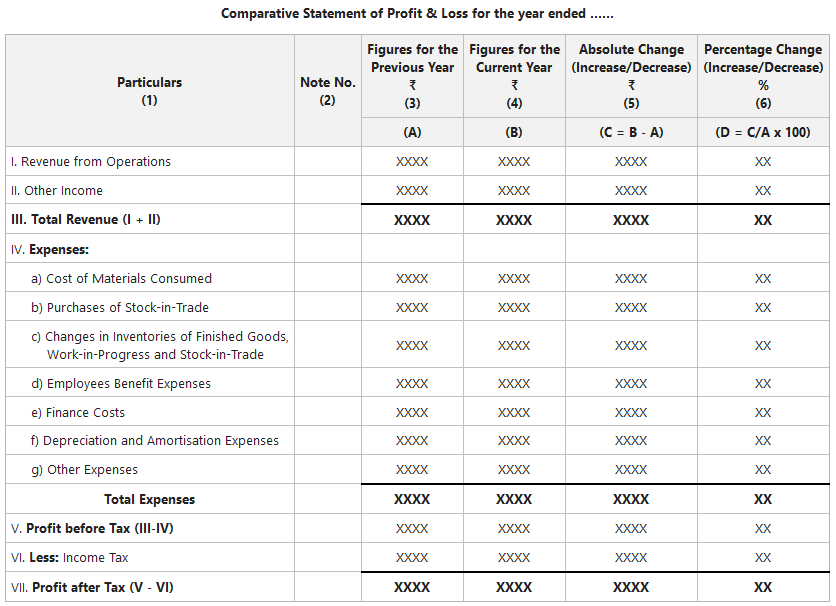

Different kinds of comparative income statement analysis 1.

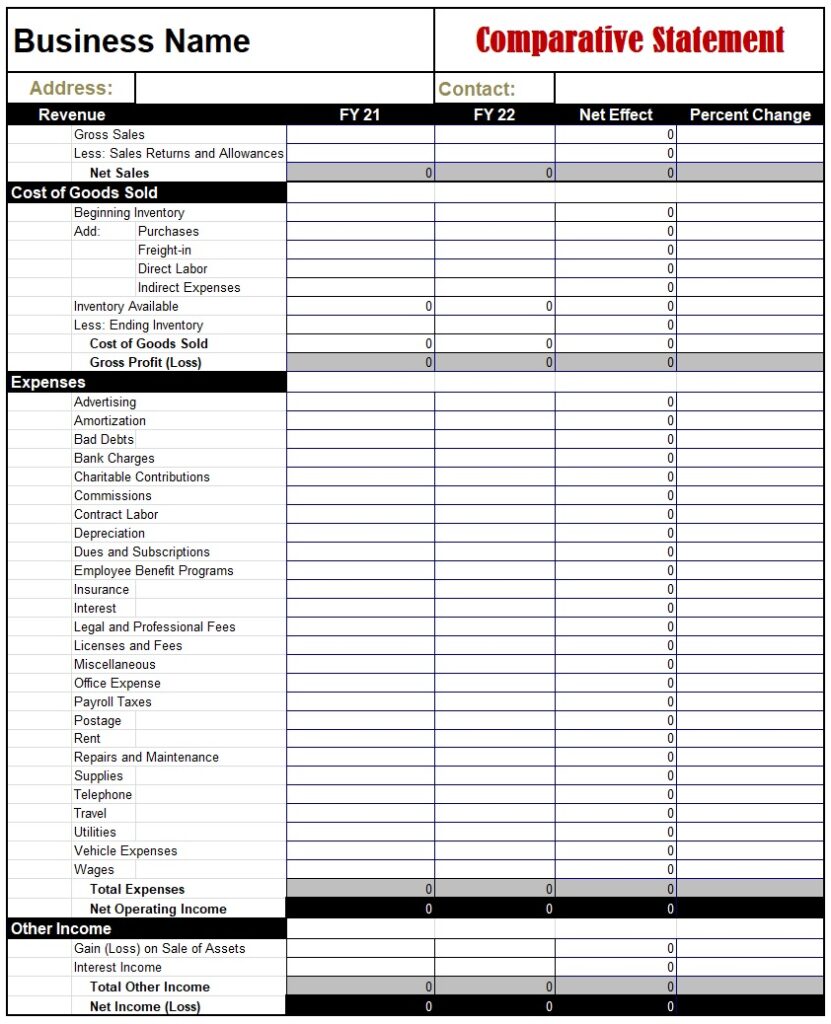

Comparative statement example. To find the percentage change, first calculate the dollar change between each period. Percentage change = (absolute increase or decrease)/absolute figure of the previous year’s item) * 100. Male mice who were fed a diet heavy in fructose/glucose, produced 25% fewer offspring than male mice not fed the diet.

Then, divide the dollar change by the base year profit. (ii) changes in absolute figures i.e., increase or decrease in absolute figures. This information is the business intelligence decision makers use for determining future business decisions.

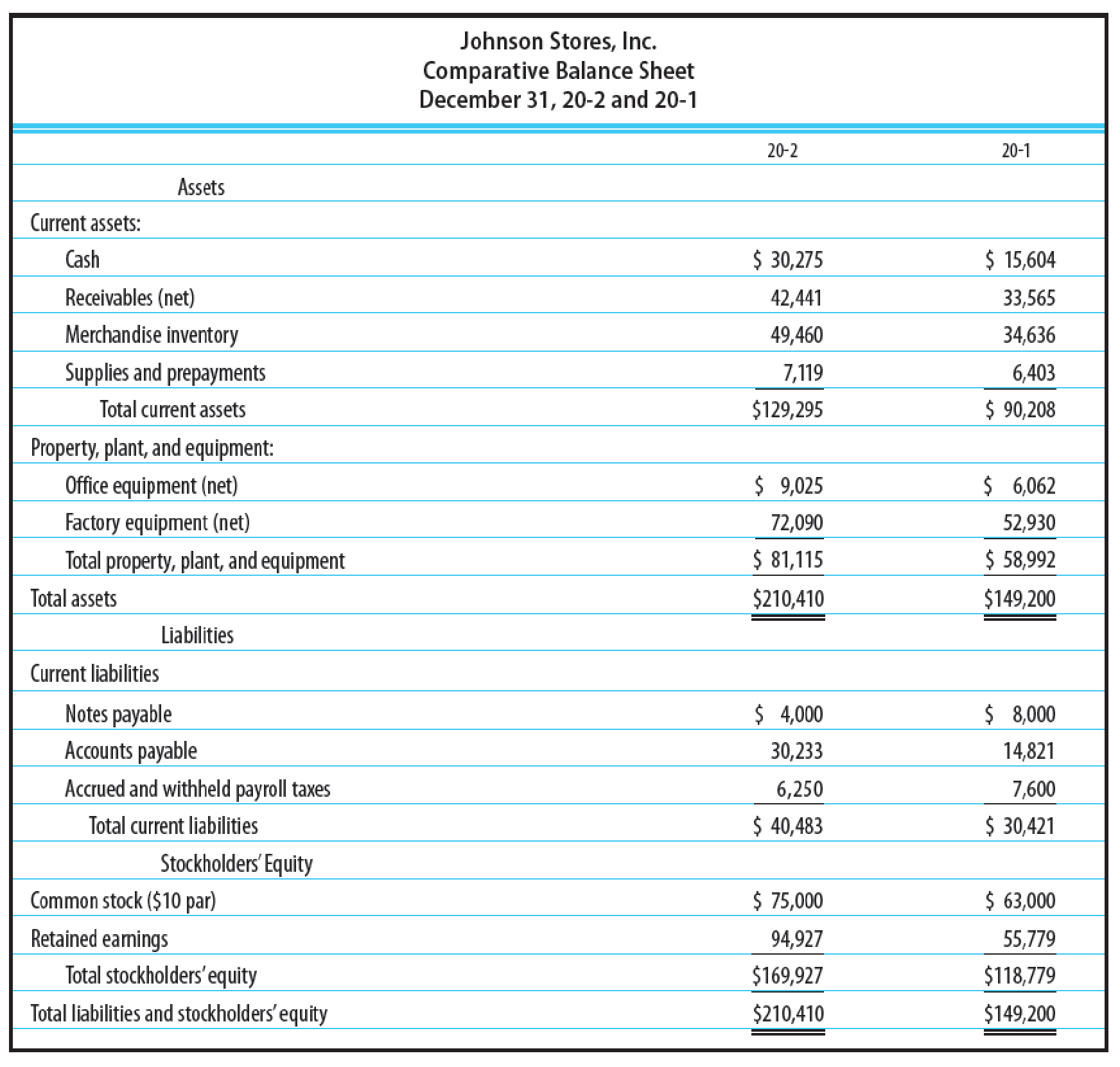

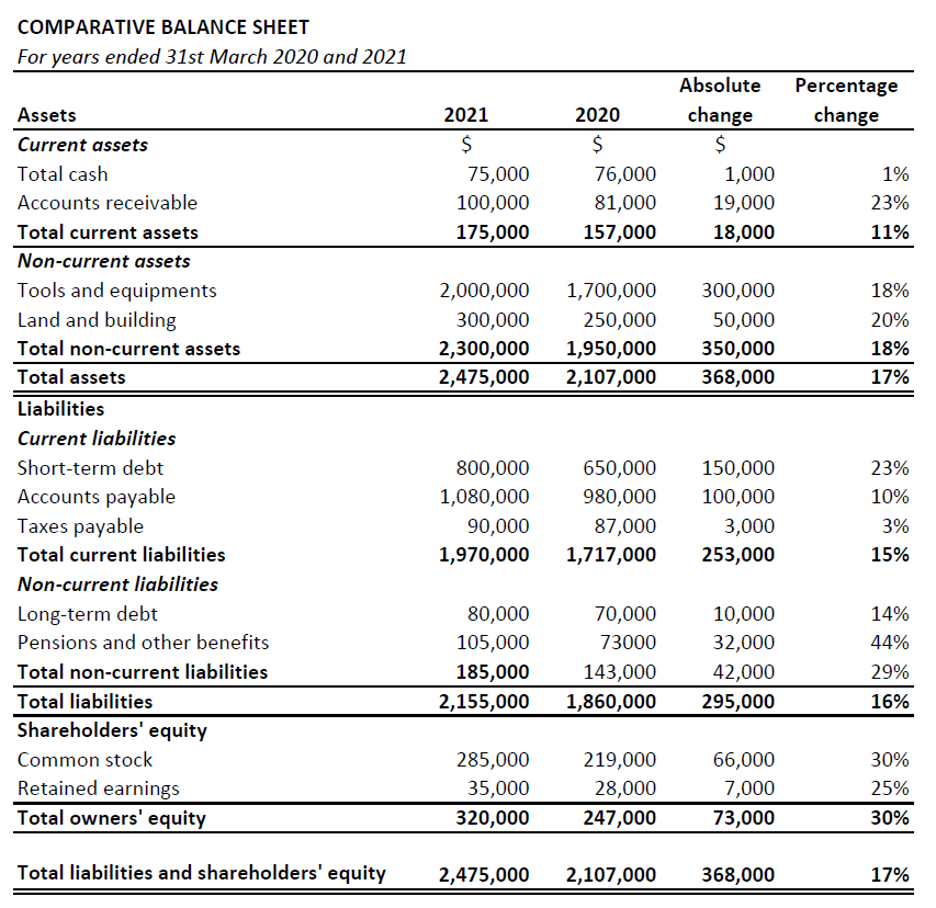

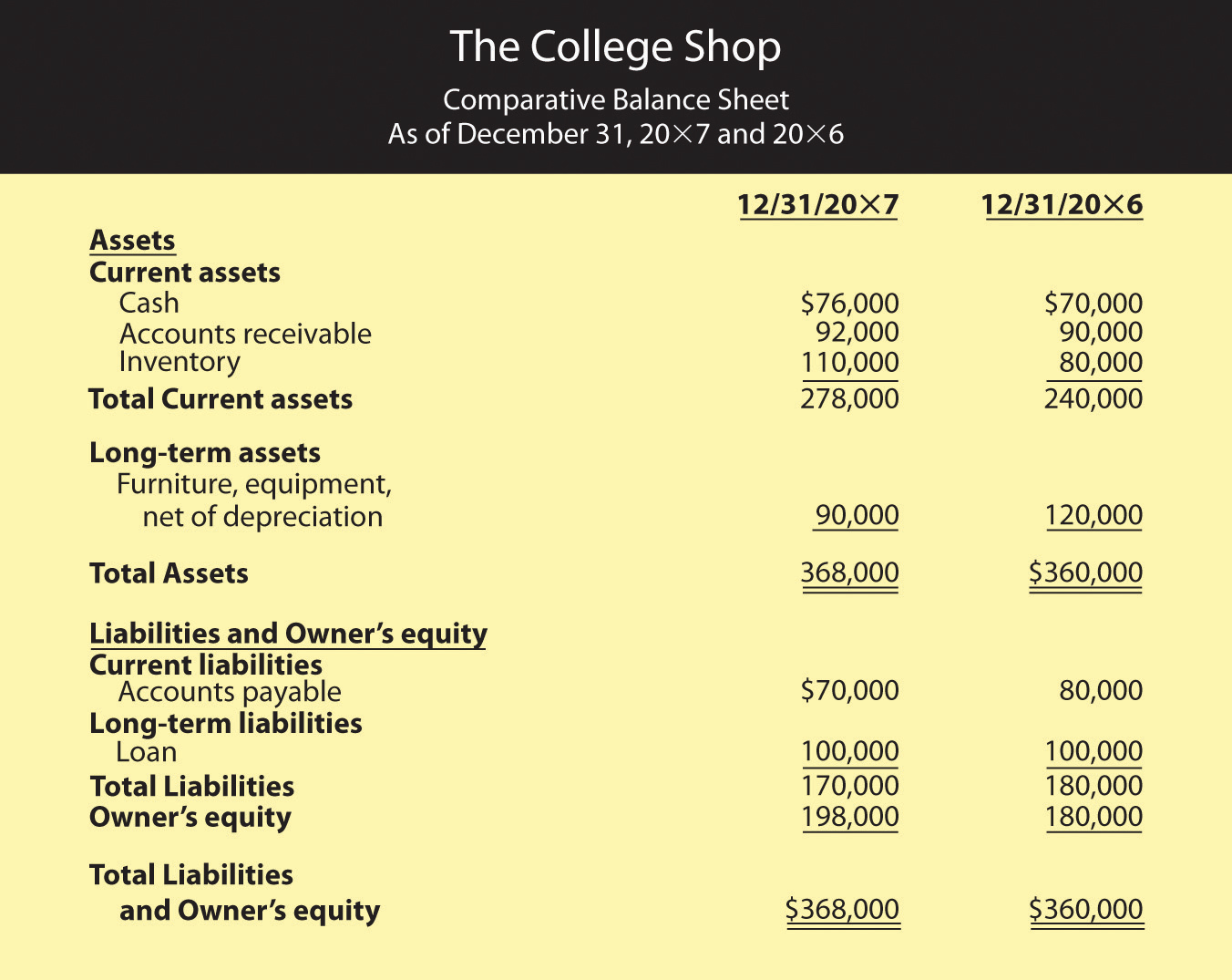

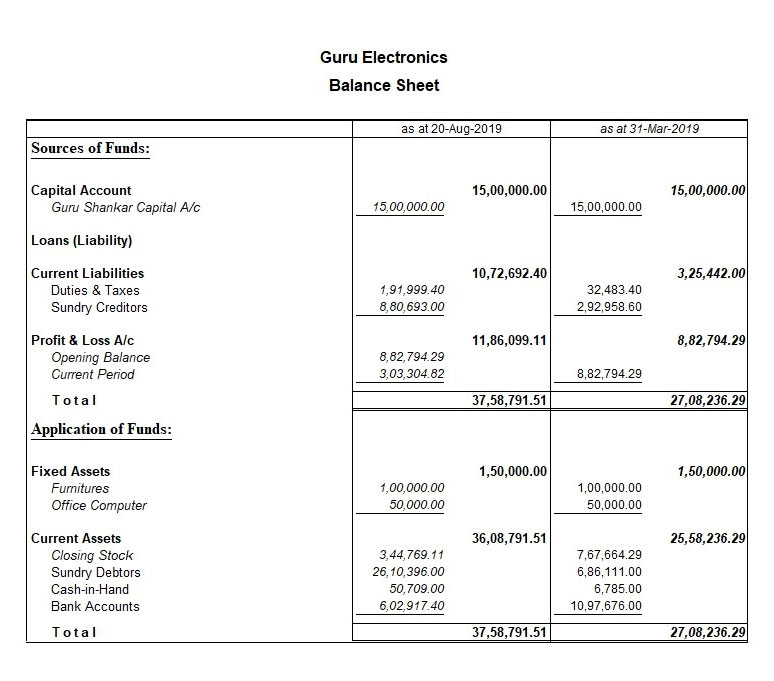

Individuals such as investors, analysts and business managers use a company’s income statement for comparative purposes. A comparative balance sheet is a type of comparative statement used by business owners, investors, and analysts to evaluate a company’s performance over time. (iv) increase or decrease in terms of percentages.

Comparative statement example. Comparative statements example. Comparative financial statements, as the word suggests, are the statements that show the financial numbers of more than one year (consecutive periods) of an entity.

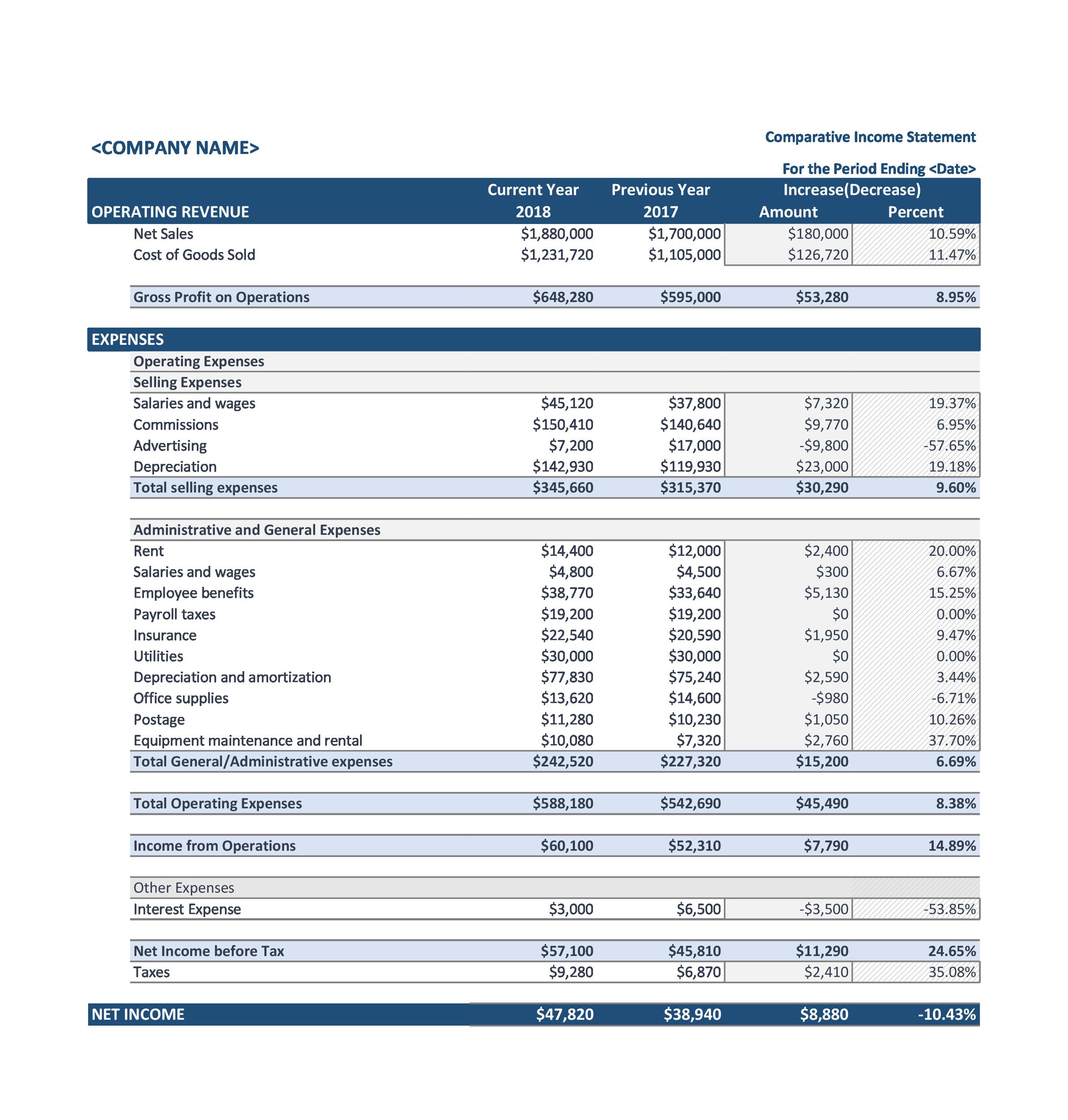

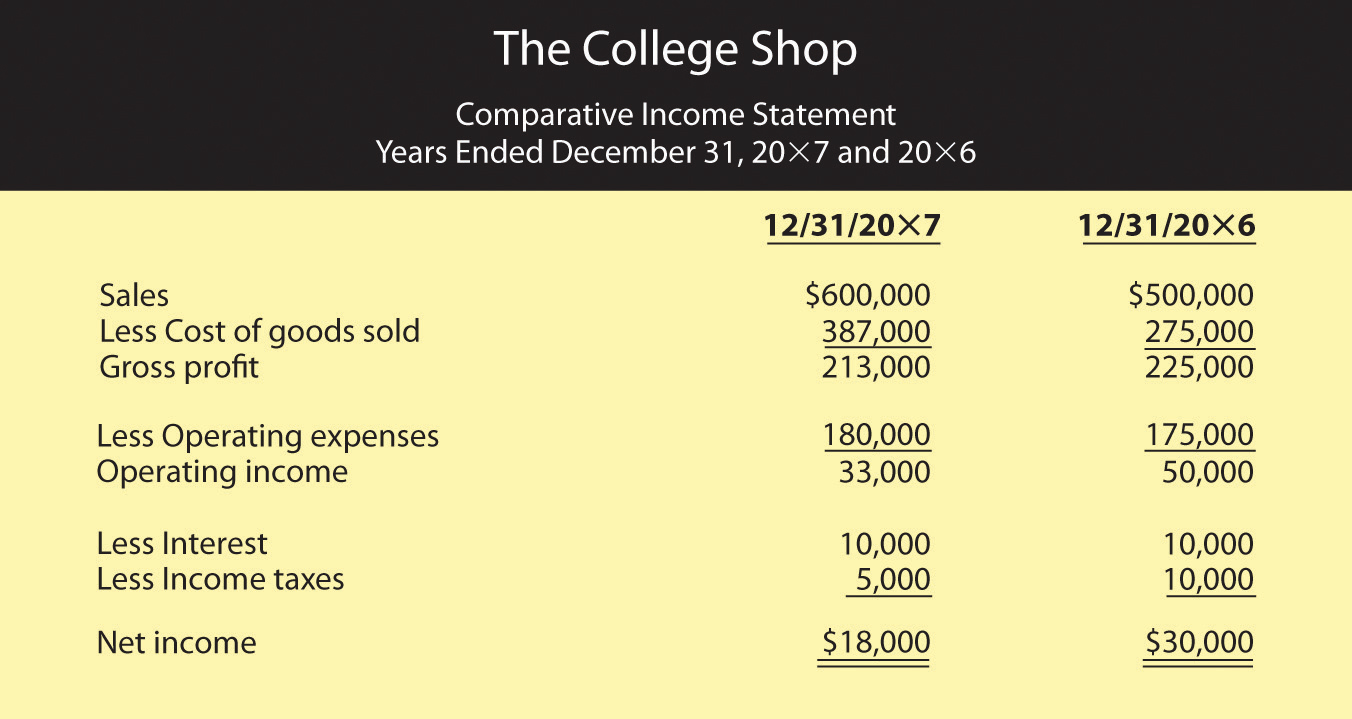

These reports show the activity for both years. Vertical analysis advantages and disadvantages of comparative income statement advantages disadvantages why should we use comparative income statements? Vertical analysis comparative income statement example

The internal market and environment committees adopted on wednesday their position on the rules on how firms can validate their environmental marketing claims. For example, if a company consistently demonstrates revenue growth and profitability over several years, it may be an attractive investment opportunity. Some additional examples of effective quantitative comparison statements:

It can also be used to compare two different companies’ operating metrics. The analyst is able to draw useful conclusions when figures are given in a comparative position. A comparative income statement is an income statement in which different periods of the income statement are dealt with and compared side by side to allow the reader to compare prior year’s incomes and determine whether or not to invest in the firm.

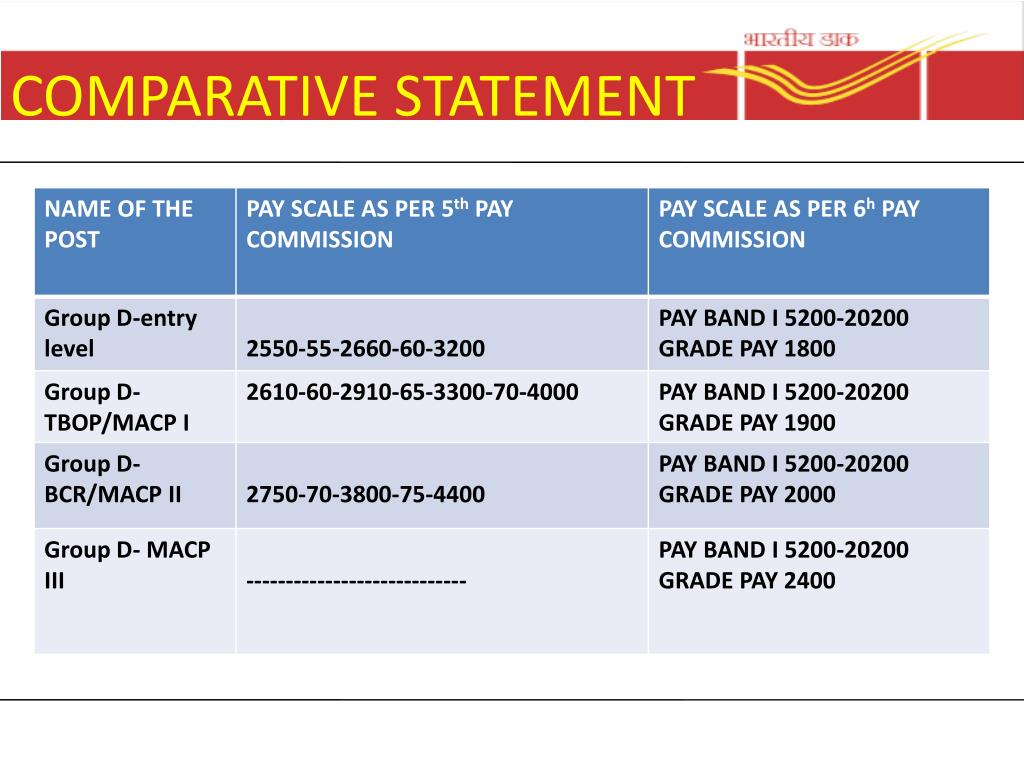

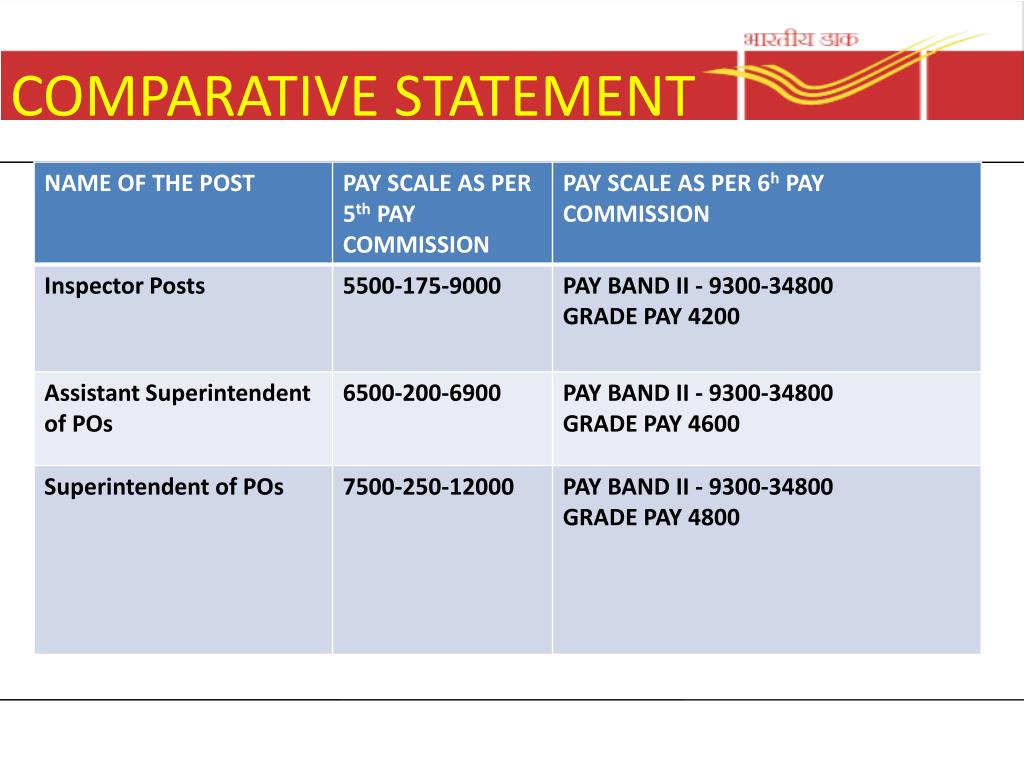

Abc international balance sheet comparative financial statements are the complete set of financial statements that an entity issues, revealing information for more than one reporting period. Comparative statement example. The comparative statement may show:

Assume, for example, that a manufacturer's cost of goods sold (cogs) increases from 30% of sales to 45% of sales over three years. Example of a comparative income statement? Examples of comparative statements let’s take a look at two simple examples to illustrate how comparative statements are used:

If you made $45,000 in 2021 and $50,000 in 2022, the dollar change is $5,000. Moreover, such a type of presentation allows the reader to compare the financial performance of the company with previous years. Compare the increase or decrease in sales with a relative increase in the cost of goods sold 2.

:max_bytes(150000):strip_icc()/comparative-statement_final-638912a8e4d7465aacd99e115d561f8f.png)