Divine Info About Equity And Liabilities In Accounting Method Balance Sheet

#1 book value of equity.

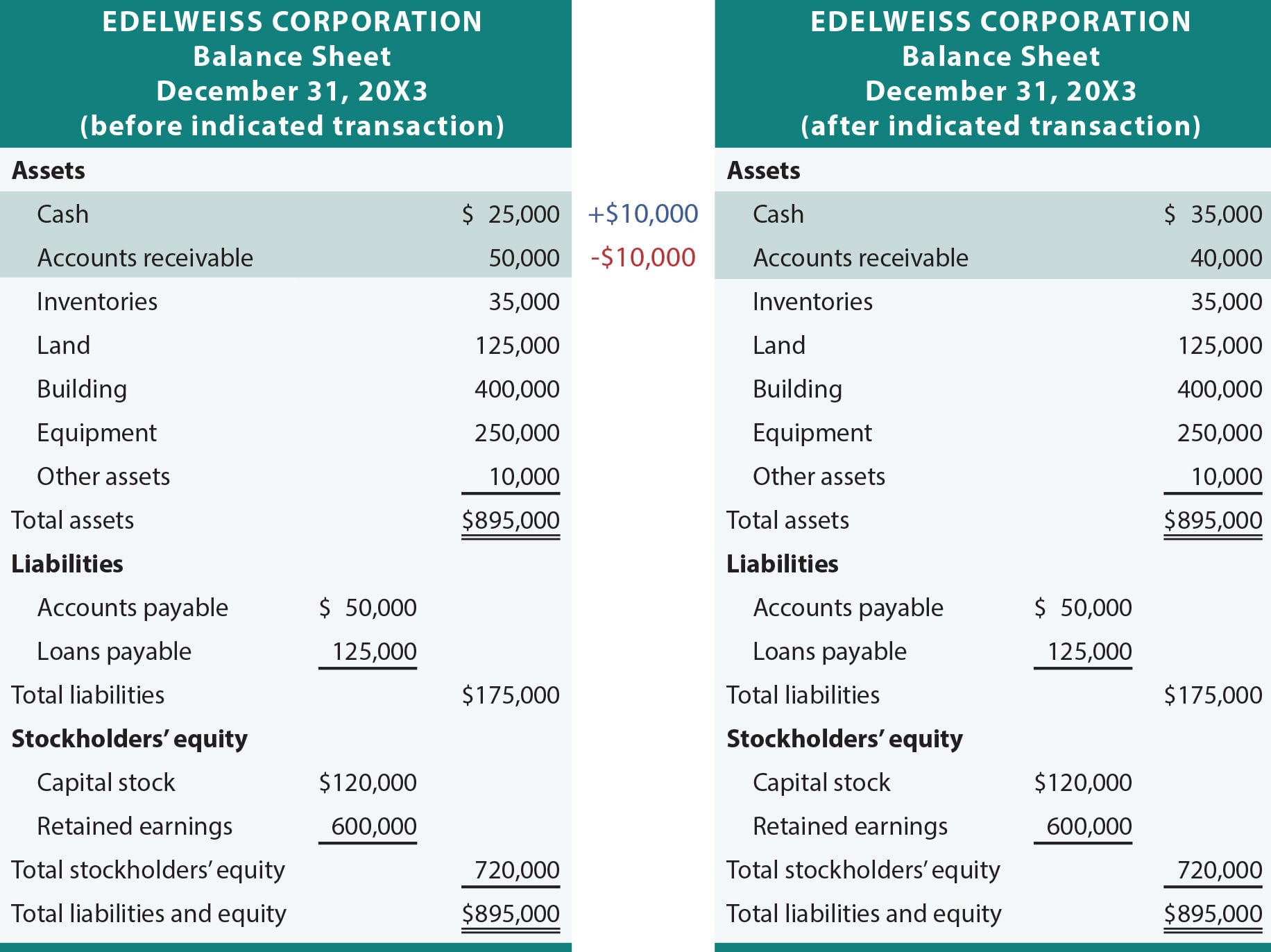

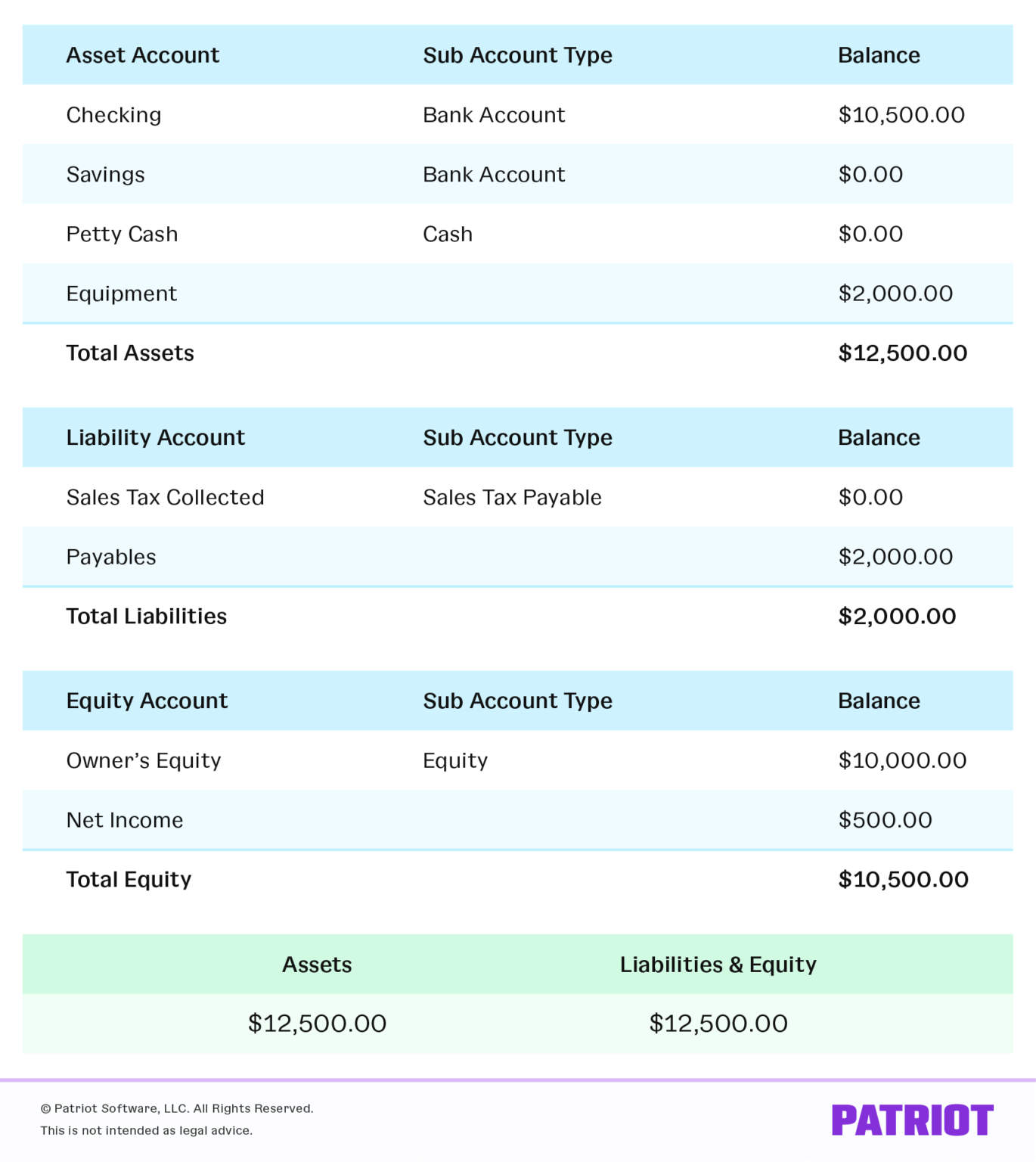

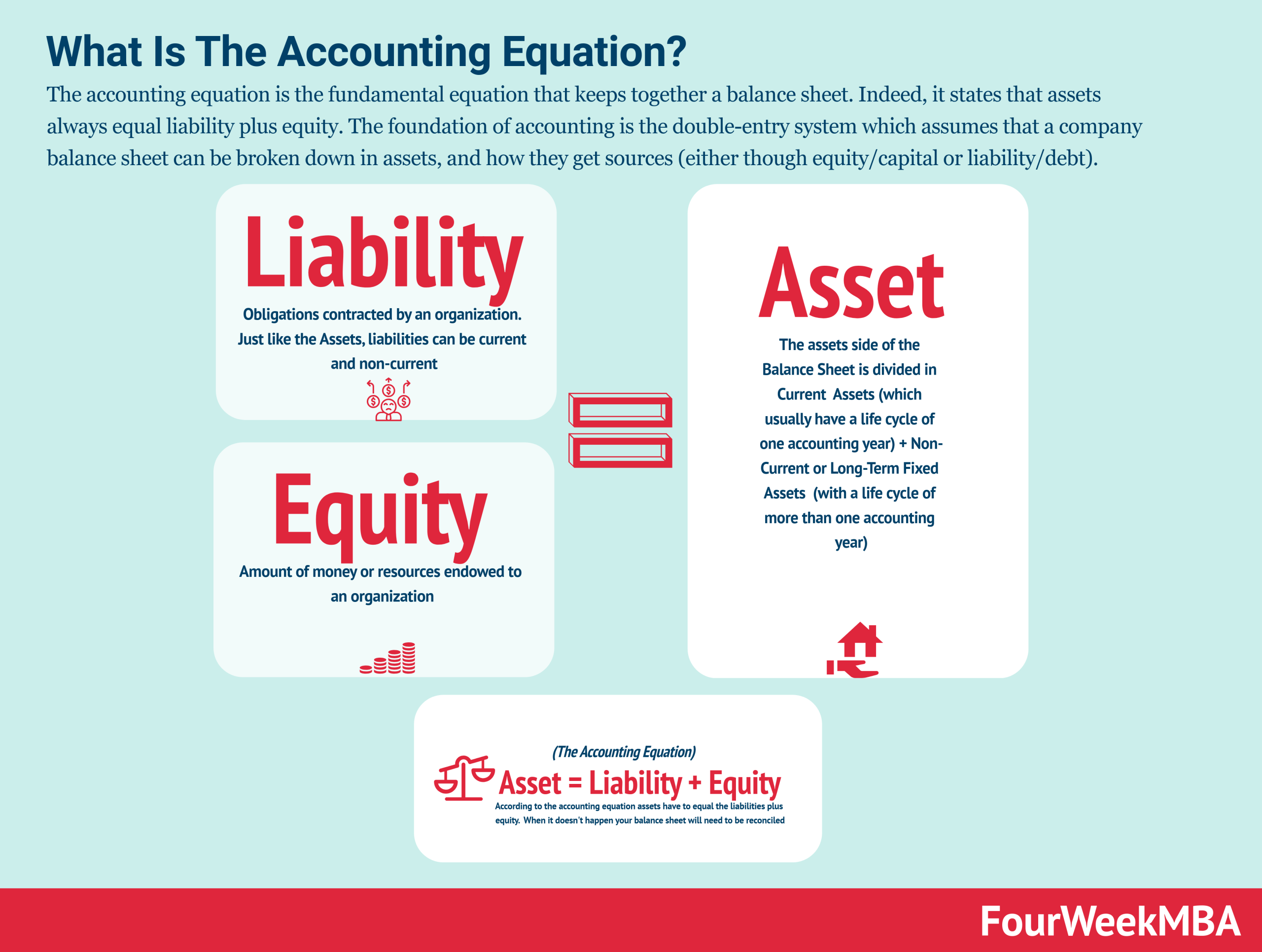

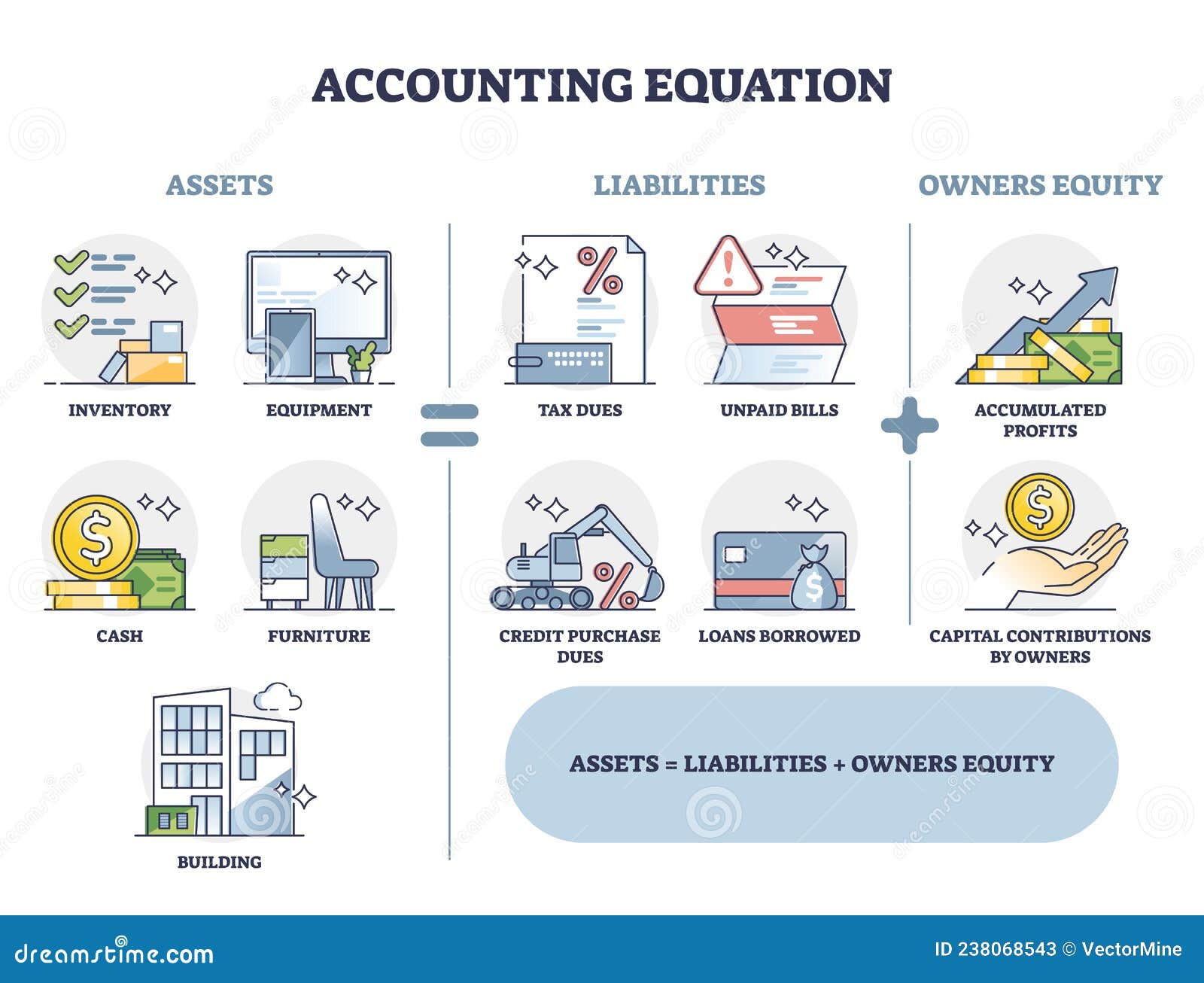

Equity and liabilities in accounting. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. But what do they actually mean and include? The accounting equation is:

The nfl’s succession problem: Kansas city chiefs owner clark hunt celebrates after the afc. Owner’s equity (or shareholders’ equity, for a corporation) is the difference between the value of a company’s assets and its liabilities.

Below, we’ll explore what exactly goes on a balance. Equity is a company's net worth or the value of its assets minus its liabilities. Liabilities refer to things that you owe or have borrowed;

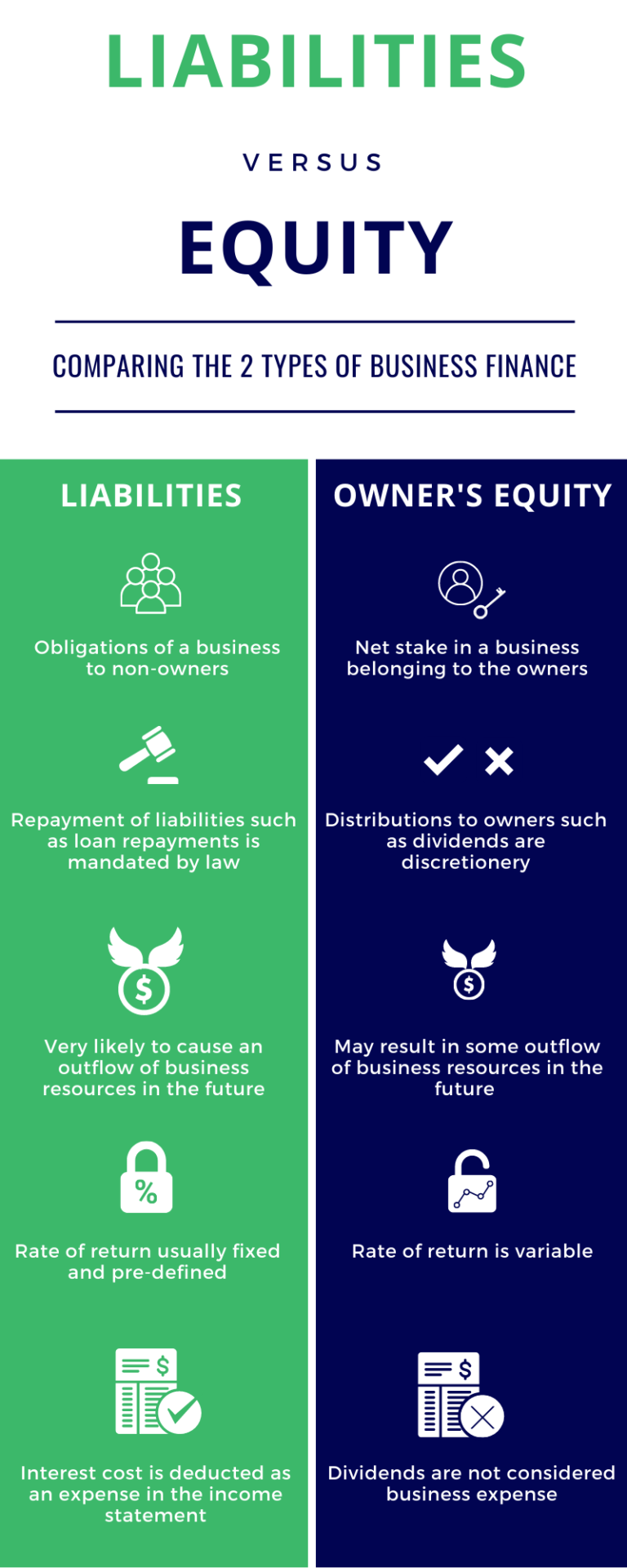

The equity method is an accounting technique used by firms to assess the profits earned by their investments in other companies. Compare and contrast the different types of equity. Current liabilities are debts that are paid in 12 months or less, and consist mainly of monthly operating debts.

You will explore the various types of liability, including: The firm reports the income earned on the investment. In contrast, an item like accounts receivable is directly employed in the business.

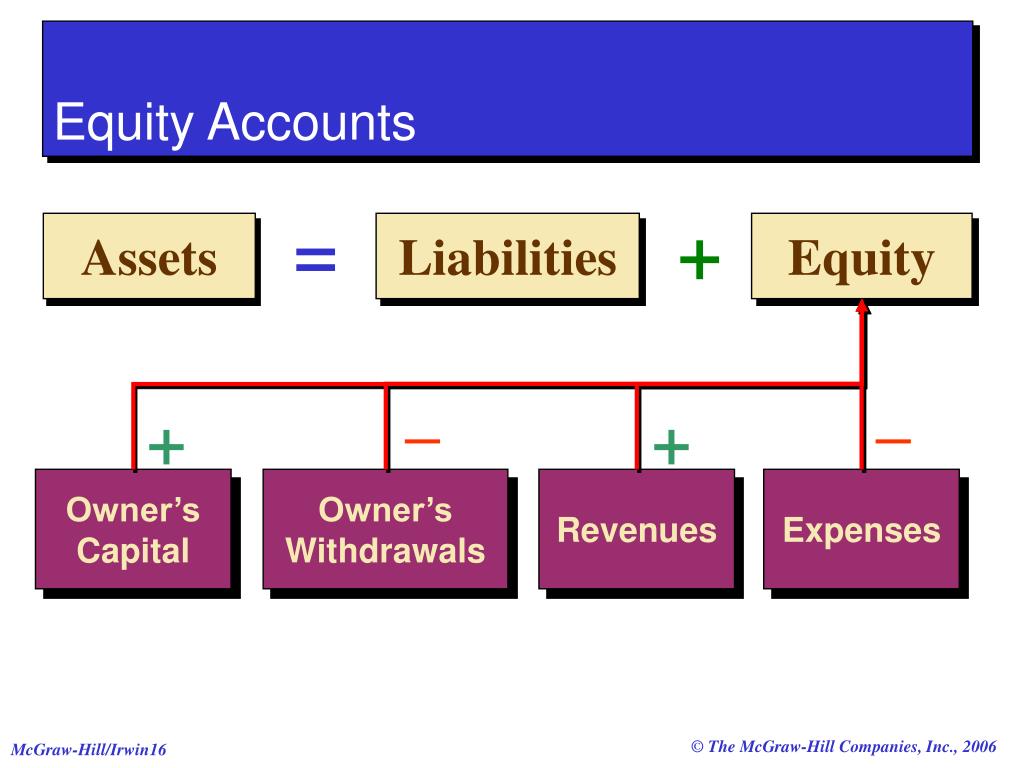

Equity, typically referred to as shareholders' equity (or owners' equity for privately held companies), represents the amount of money that would be returned to a company's shareholders if. You’ve probably heard at least some of these terms before. Assets = liabilities + equity.

The most important equation in all of accounting. Assets = liabilities + equity. If you have mastered bookkeeping basics and understand accounting assets, you are ready to jump into liabilities and equity in accounting.

Balance sheets provide the basis for. The accounting equation states that a company's total assets are equal to the sum of its liabilities and its shareholders' equity. Difference between liabilities and equity liabilities are the financial obligations (debt) that a business owes to anyone besides the owners, such as suppliers, lenders, and tax authorities.

What does the equity section of a balance sheet entail? Tax liabilities are so bad for billionaire families they’re considering a private equity hail mary. In comparison, equity is what’s left in a business for its owners after subtracting all external liabilities from the total assets.

This relationship is expressed in the accounting equation: Assets = liabilities + equity. Assets = liabilities + equity.