Ideal Tips About Dividend Received In Cash Flow Statement Review Of Historical Financial Statements

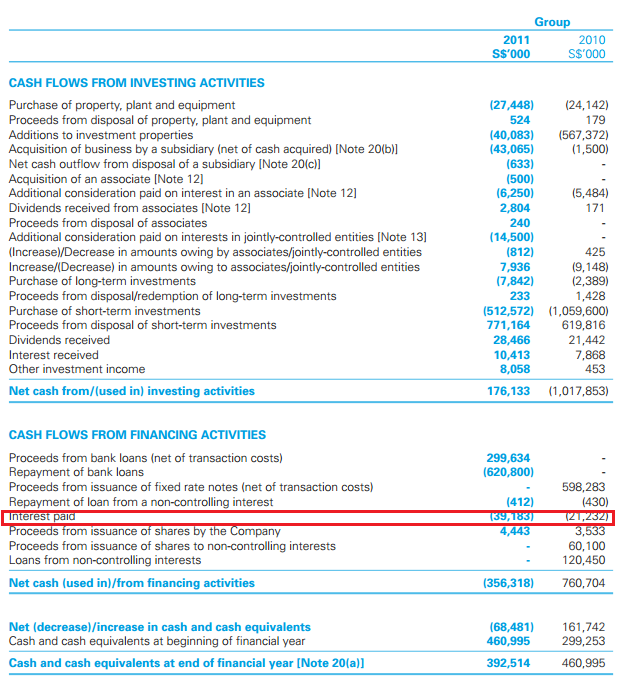

In addition, investing cash flows from/to integral associates and joint ventures would

Dividend received in cash flow statement. Paying cash dividends to shareholders proceeds received from employees exercising stock options receiving cash from issuing hybrid securities, such as convertible debt negative overall. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. Dividends paid are required to be classified in the financing section of the cash flow statement and interest paid (and expensed), interest received, and dividends received from investments are required to be classified as cash flows from operations.

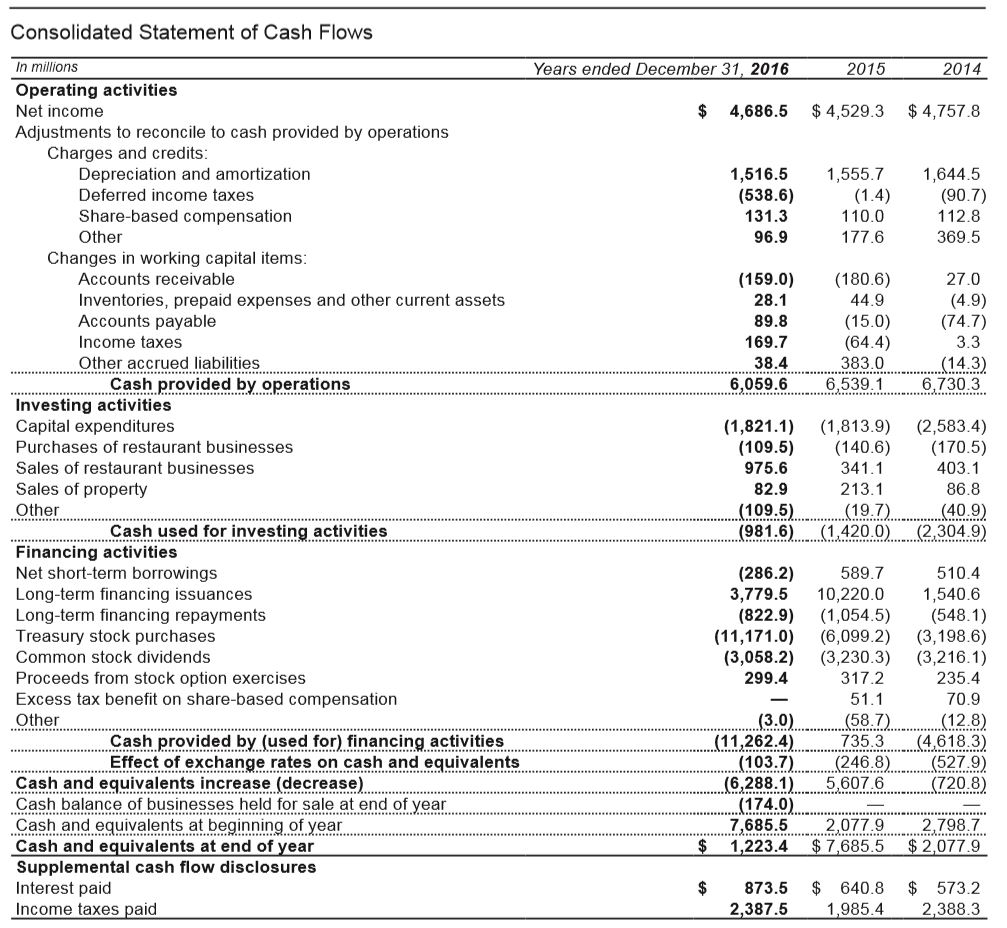

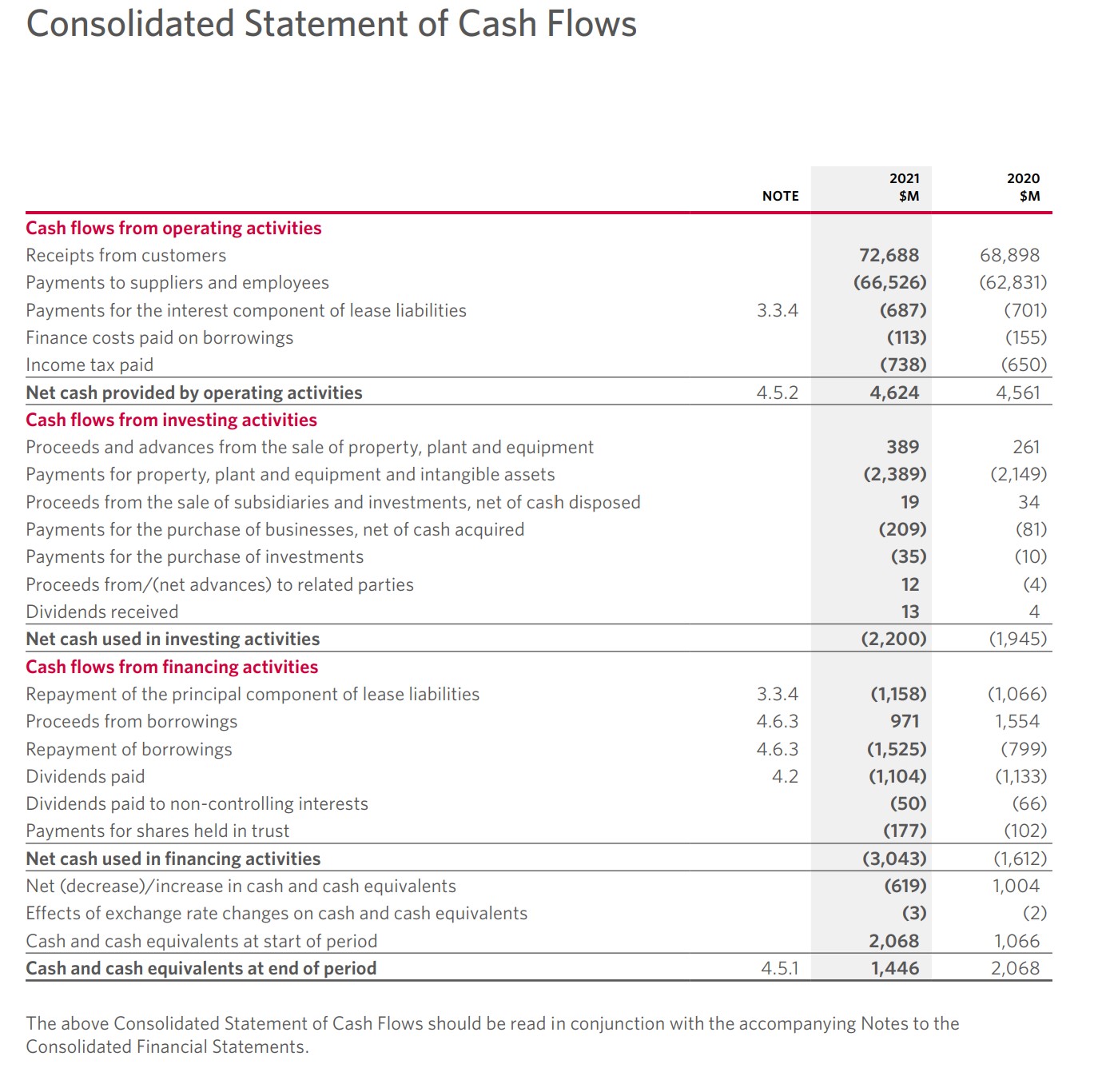

This paper explores the removal of options for the classification of interest/dividends paid and interest/dividends received in the statement of cash flows by prescribing a single classification for each of these items. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Cash flows from investing activities. The drug manufacturer paid a final dividend totaling to. Examples of financing cash flows include the cash received from new borrowings or the cash repayment of debt as well as the cash flows with shareholders in the form of cash receipts following a new share issue or the cash paid to them in the form of dividends.

This video shows how to calculate the amount of dividends for the financing section of the statement of cash flows. Any dividend income should be recorded in the operation section as a cash inflow. We explain the treatment of dividends and interest paid, and dividends and interest received in the cash flow statement.

So, are dividends in the cash flow statement? If it is $8,000 in the income statement, adjustments add $2,000, and your operating cash flow is $10,000. In summary, on the cash flow statement, dividends paid to shareholders are reported as cash outflows in the financing activities section.

Alternatively, dividends paid may be classified as a component of cash flows from operating activities in order to assist users to determine the ability of an entity to pay dividends out of operating cash flows. Cash flows from interest and dividends received and paid shall each be disclosed separately. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

Dividends paid may be classified as a financing cash flow because they are a cost of obtaining financial resources. How do dividends impact cash flow? Where is dividend income recorded in the cash flow statement?

Acquisition of subsidiary x net of cash acquired ( 550) purchase of property, plant and equipment ( 350) proceeds from sale of equipment. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities. Figuring the formula for dividends and cash flow.

Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in. Each shall be classified in a consistent manner from period to period as either operating, investing or financing activities. The statement of cash flows acts as a bridge between the income statement and balance sheet by.

Net cash used in investing activities ( 480) cash flows from financing activities. They are presented separately from other cash flow activities to provide transparency and highlight the impact of dividend distributions on a company’s cash flow position. Cash payments of 350 were made to purchase property, plant and equipment.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)