Best Tips About Liabilities Have Which Balance Income Tax Payable In Cash Flow Statement

Recall that credit means right side.

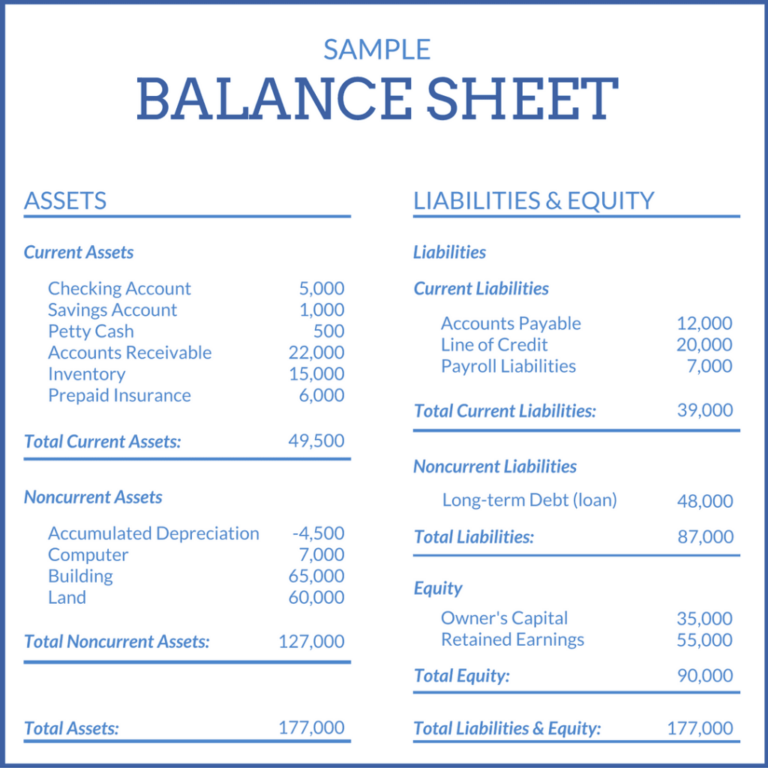

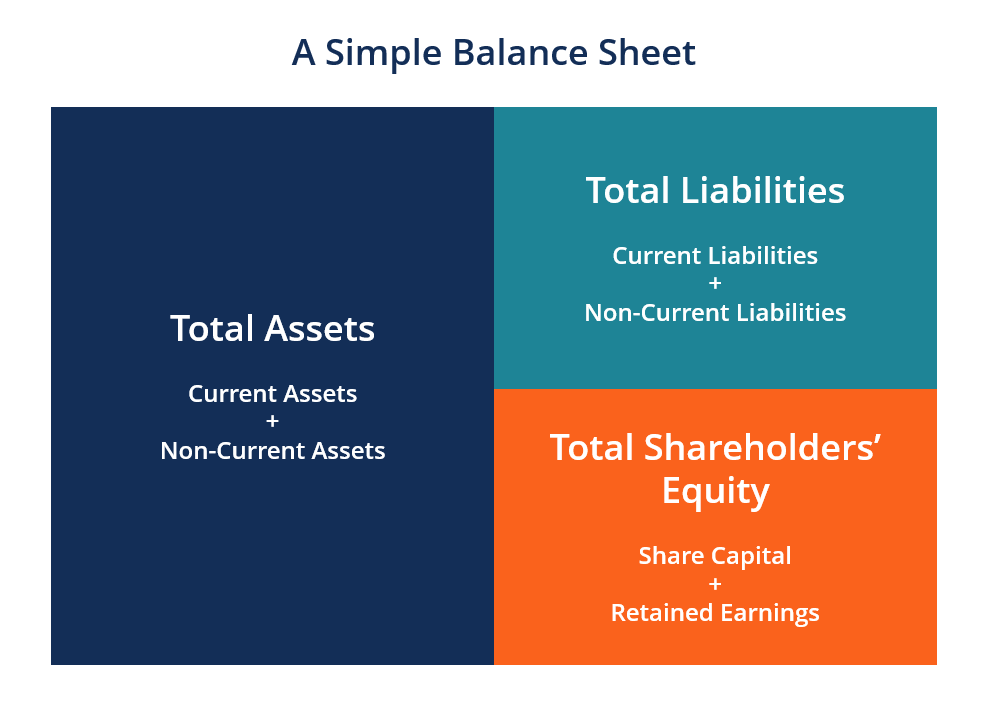

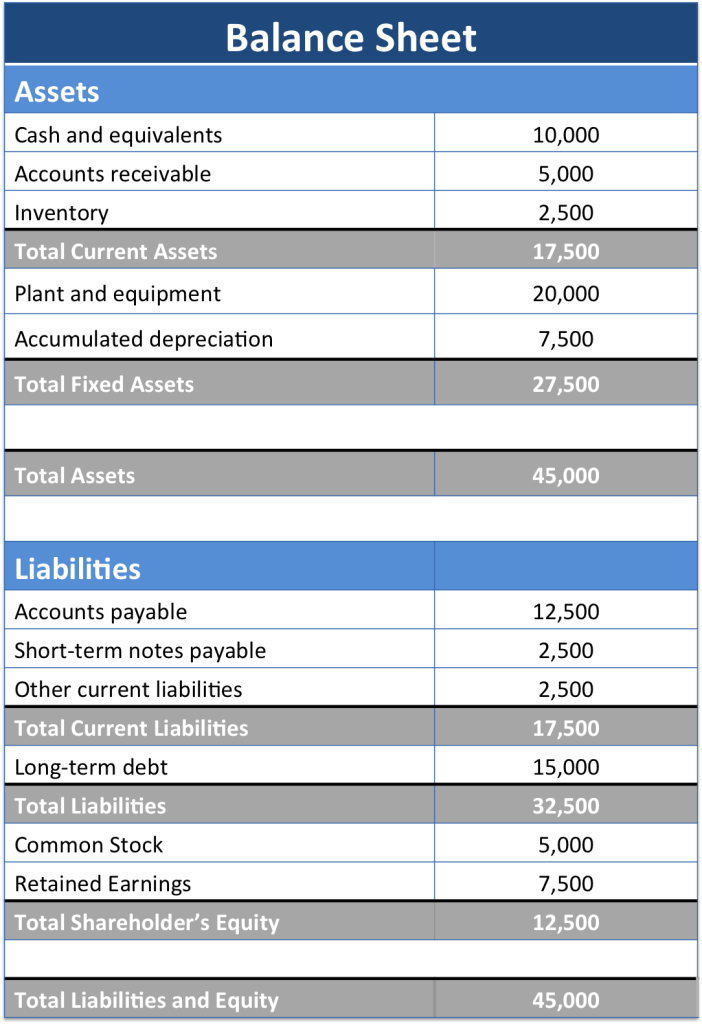

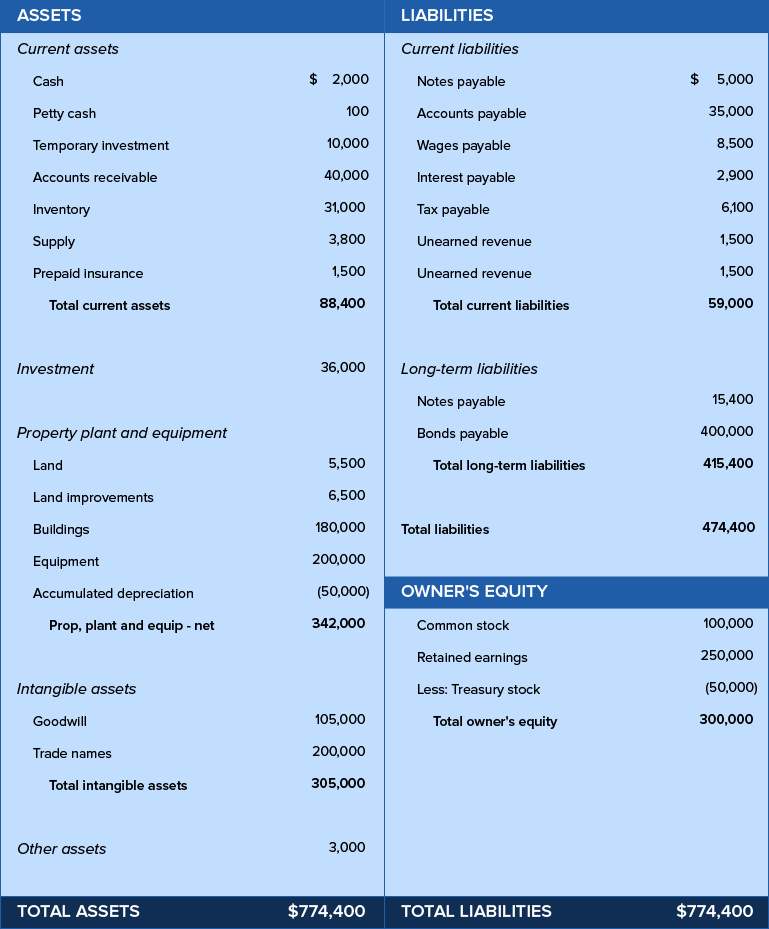

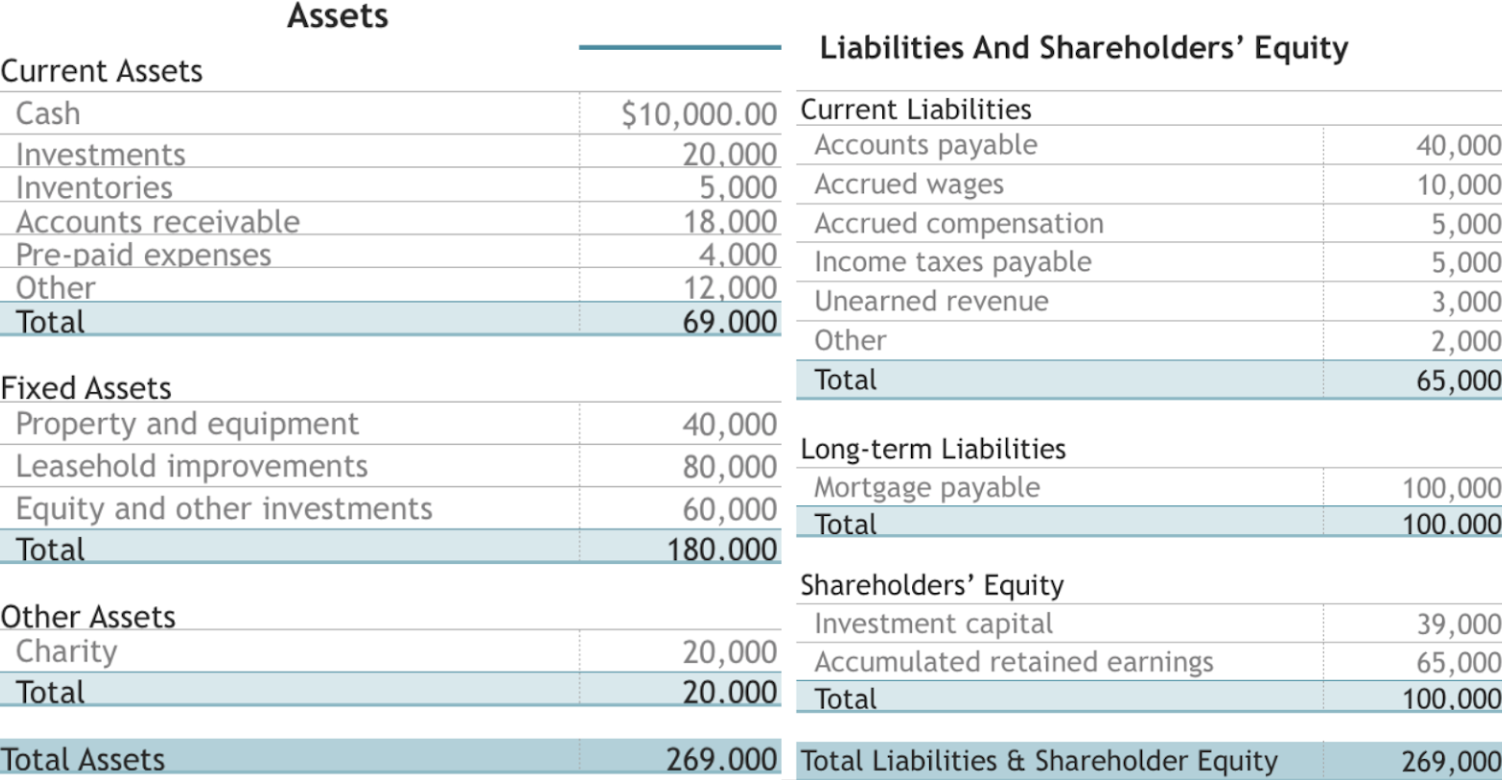

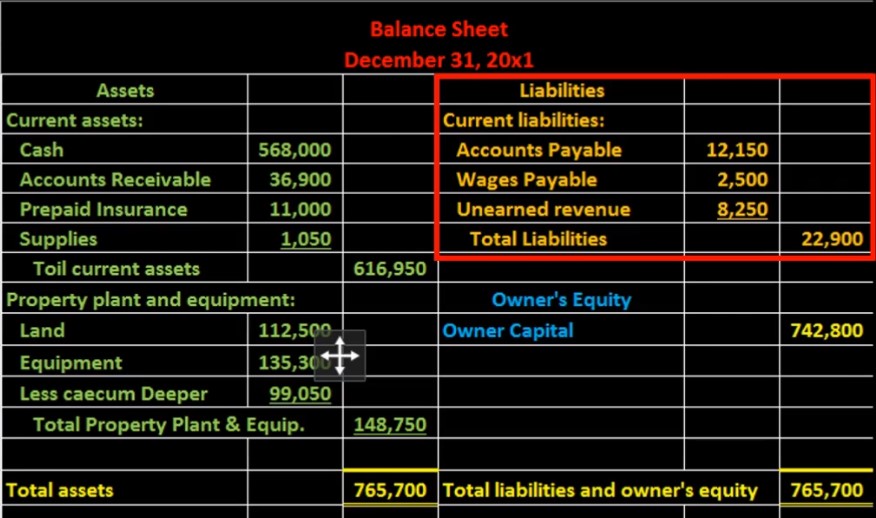

Liabilities have which balance. The shareholders' equity section displays the company's retained earnings and the capital that has been. In the below example, the assets equal $18,724.26. In the accounting equation, liabilities appear on the right side of the equal sign.

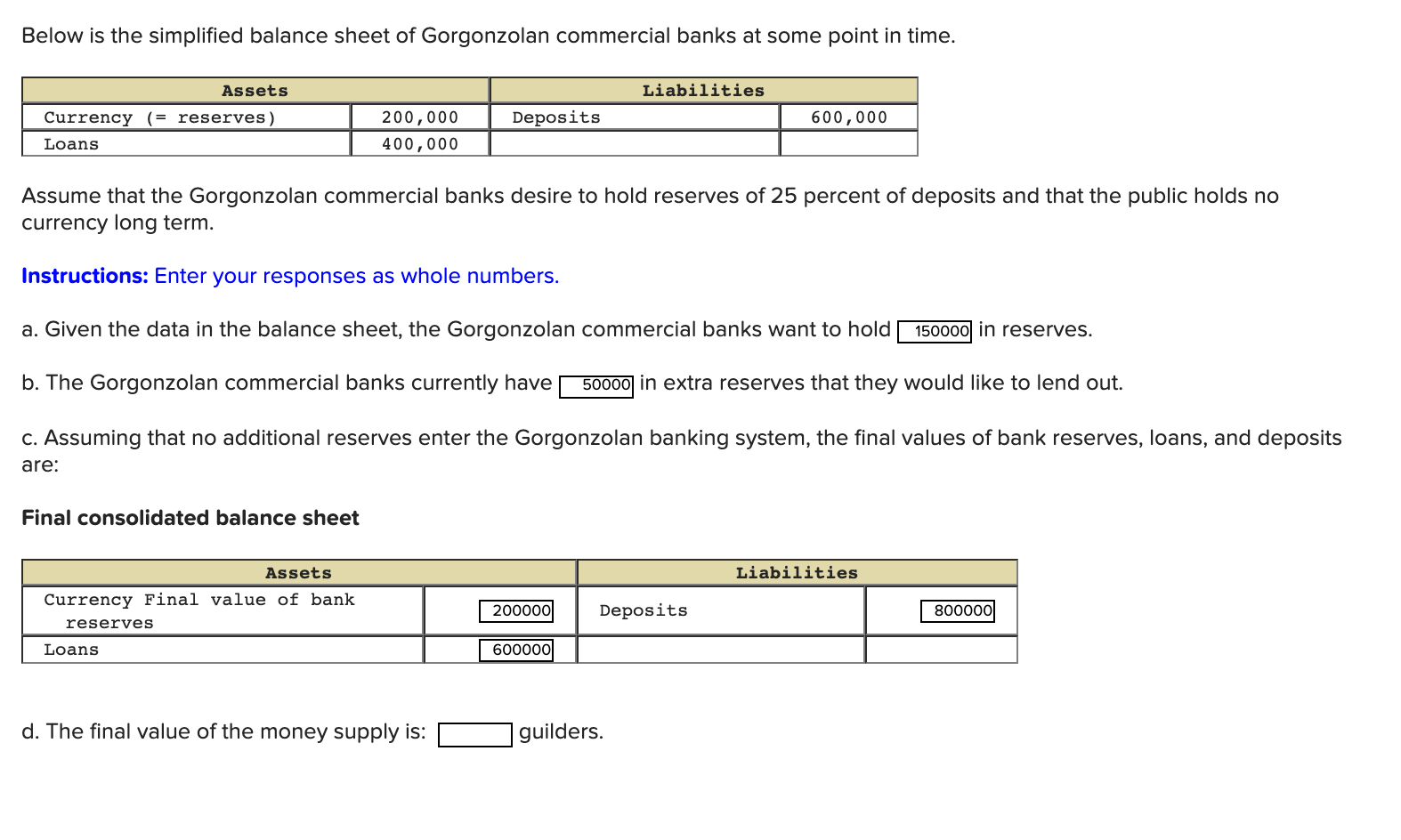

On a balance sheet, liabilities are listed according to the time when the obligation is due. This chapter looks at a government's balance sheet, showing the various types of assets and liabilities it contains. We’re also going to provide a list of liabilities to give you a better idea of what they are.

It defines net worth as the difference between total assets and total liabilities and explains why net worth is a better, more comprehensive, measure of fiscal position than the more common measure, debt. This is a list of what the company owes. Entities keep making profits and incurring losses year to year.

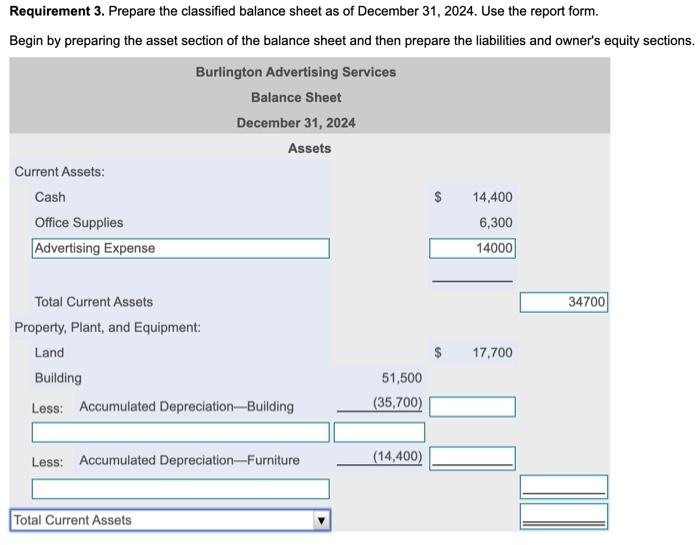

(the other two being the income statement and the cash flow statement.) all balance sheets are divided into three sections: Below is a list of the most common current liabilities that are found on the balance sheet: If you already know your total equity and assets, you can also use this information to calculate liabilities:

They include loans, bonds, accounts payable, and other contractual obligations that result in. Having a good grasp of liabilities is essential. The new york attorney general's office estimated his annual net worth at $2bn in 2021.

This is a list of what the company owes. Liability accounts will normally have credit balances and the credit balances are increased with a credit entry. Assets are listed by their liquidity or.

1 of the calendar year). You can learn about the health of a business by looking at its balance sheet. On the balance sheet, the liabilities section can be split into two components:

What are some examples of assets? See the balance sheet example below: Assets minus liabilities equals owners’ equity.

With liabilities, this is obvious—you owe loans to a bank, or repayment of bonds to holders of debt. Current liabilities — coming due within one year (e.g. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

Liabilities in a balance sheet are the commitments of the company to external parties. It is a snapshot of the company's financial situation at the date of the statement. Financial liabilities are obligations or debts owed by an entity to external parties, often involving the repayment of funds or providing goods or services in the future.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)