Supreme Tips About Salaries Payable On Income Statement How Do You Get Retained Earnings A Balance Sheet

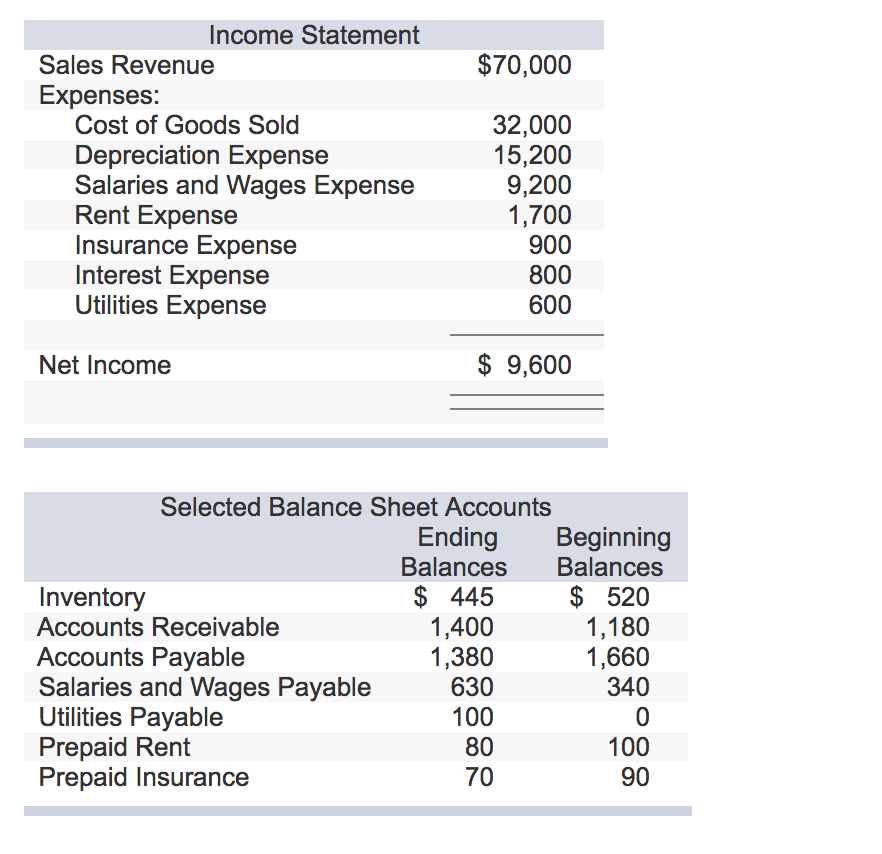

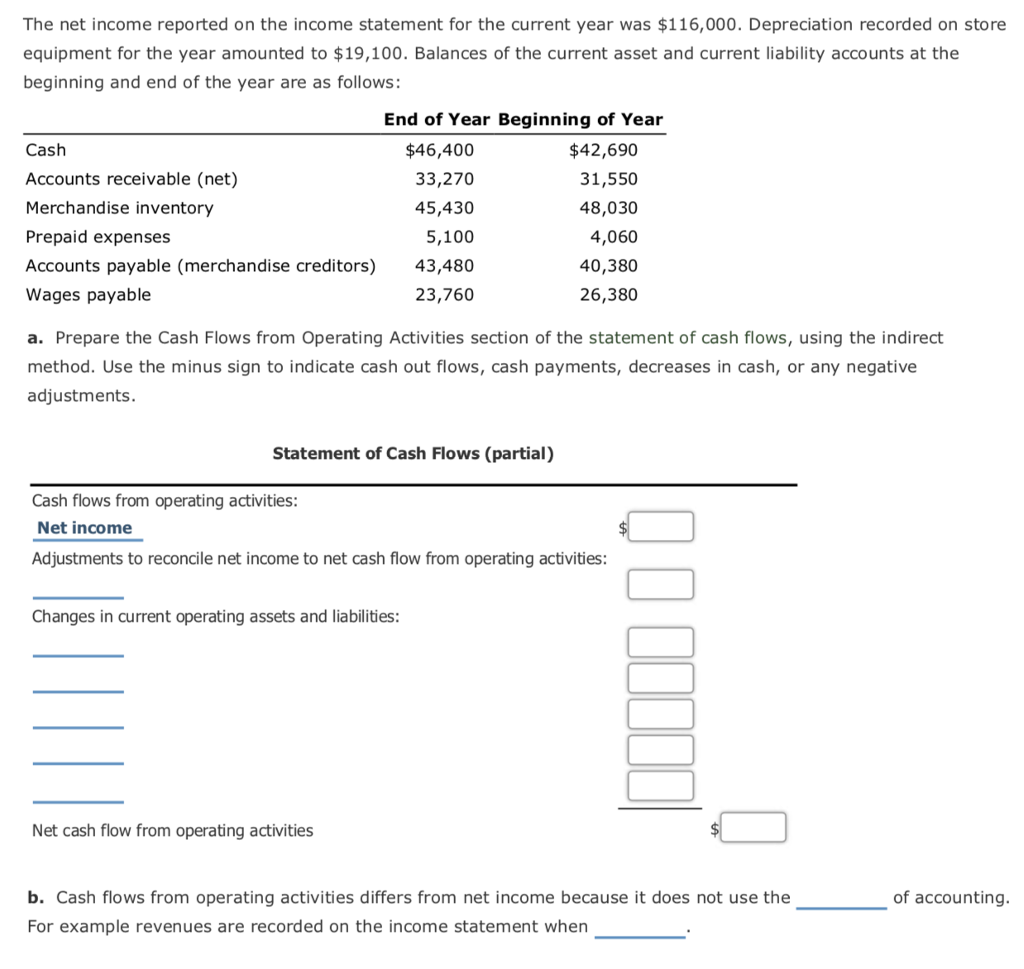

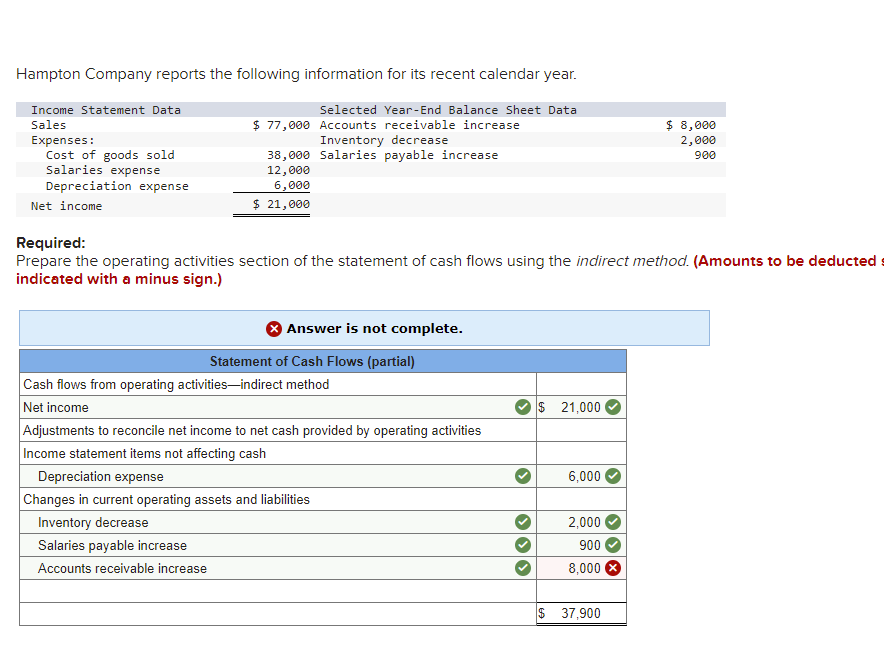

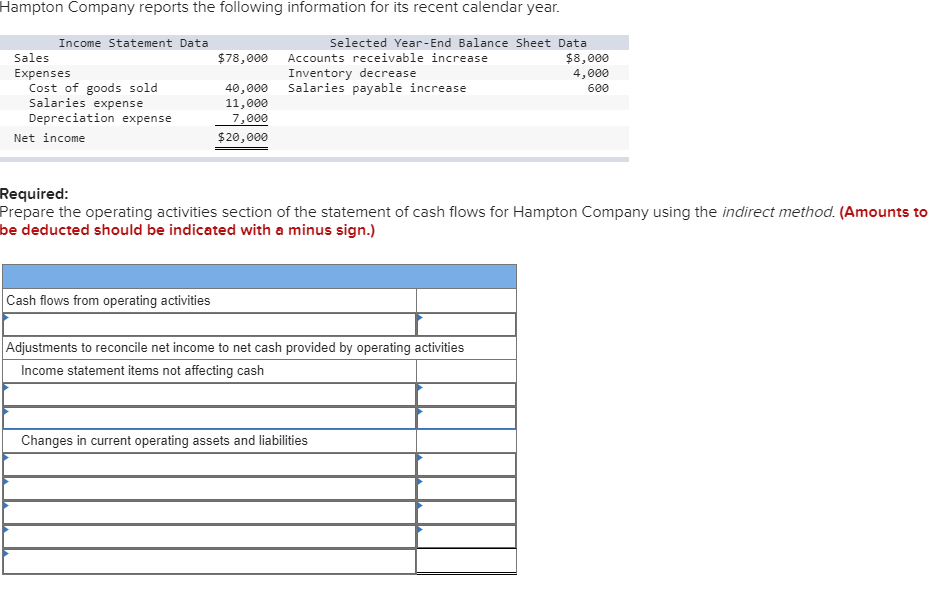

Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees remaining at the end of a reporting period.

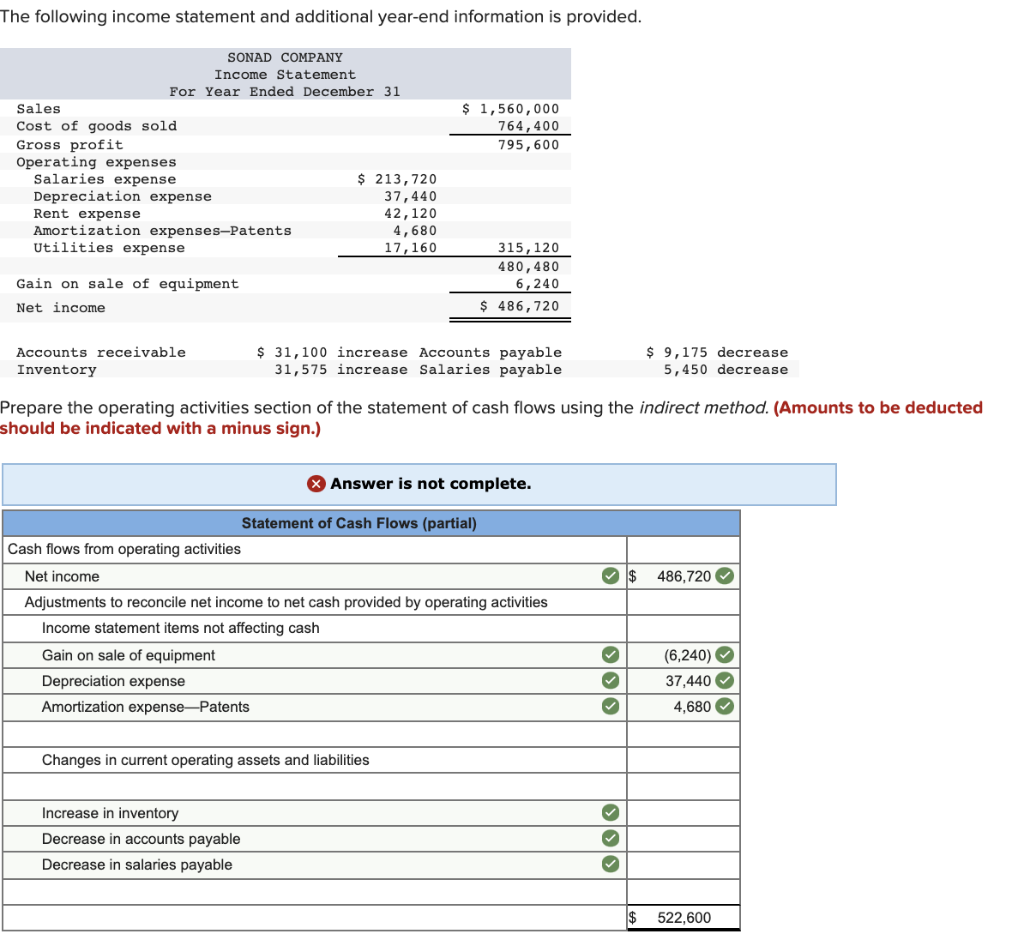

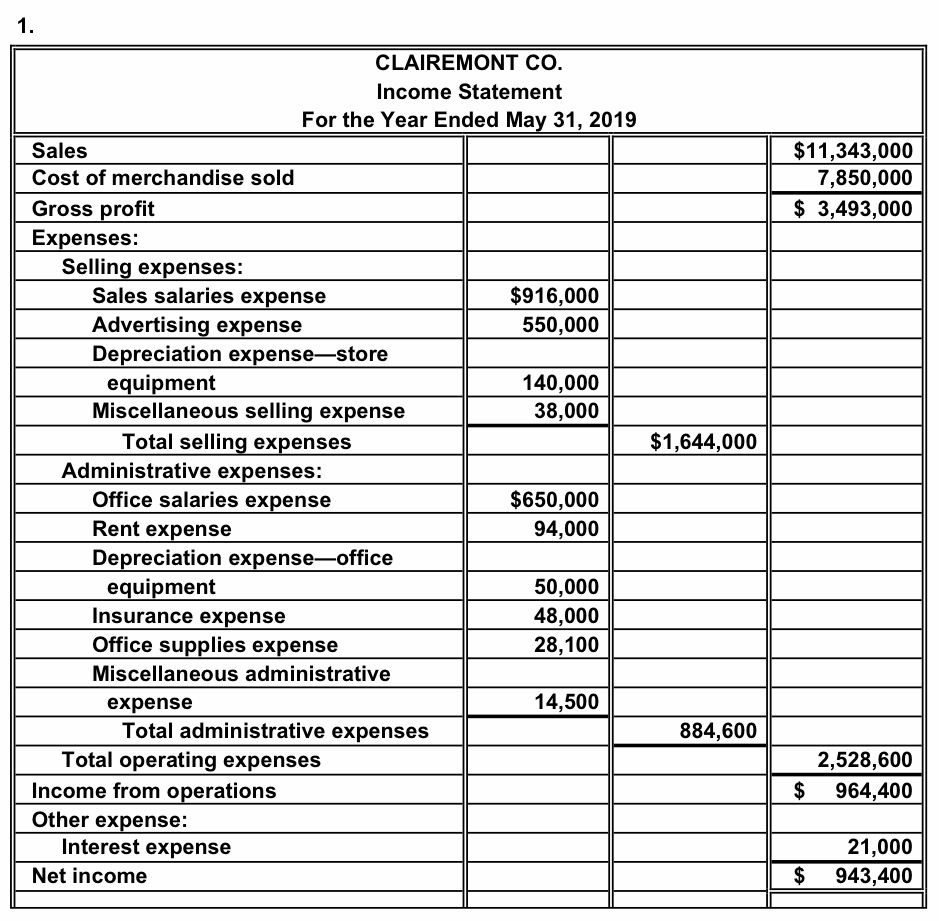

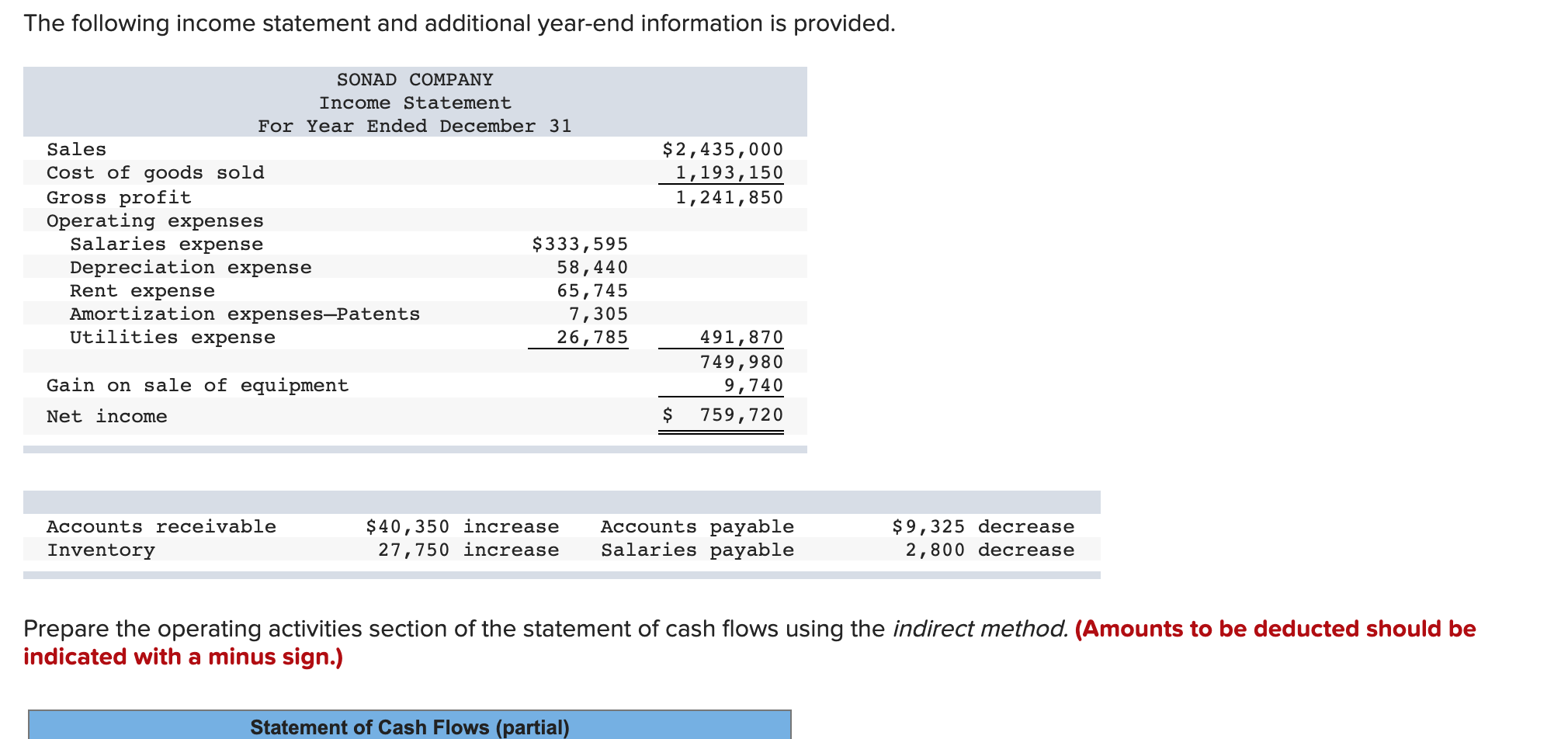

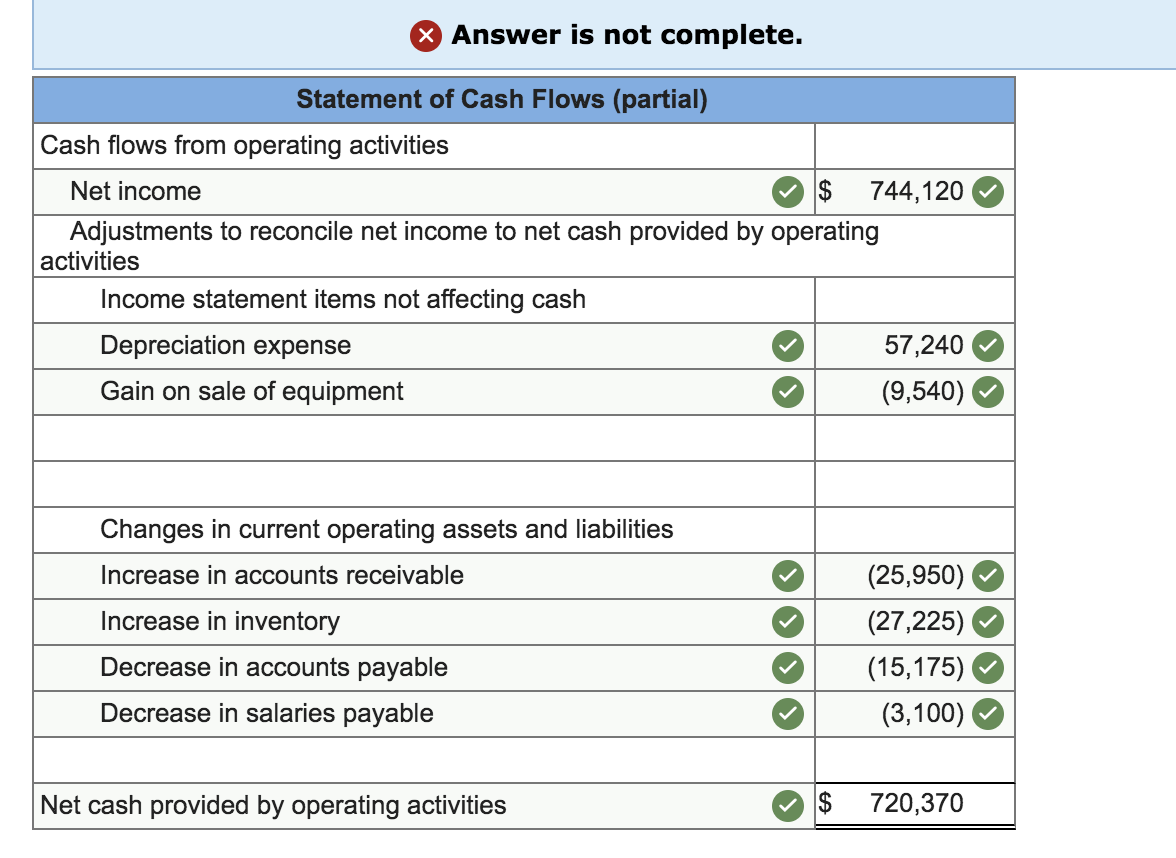

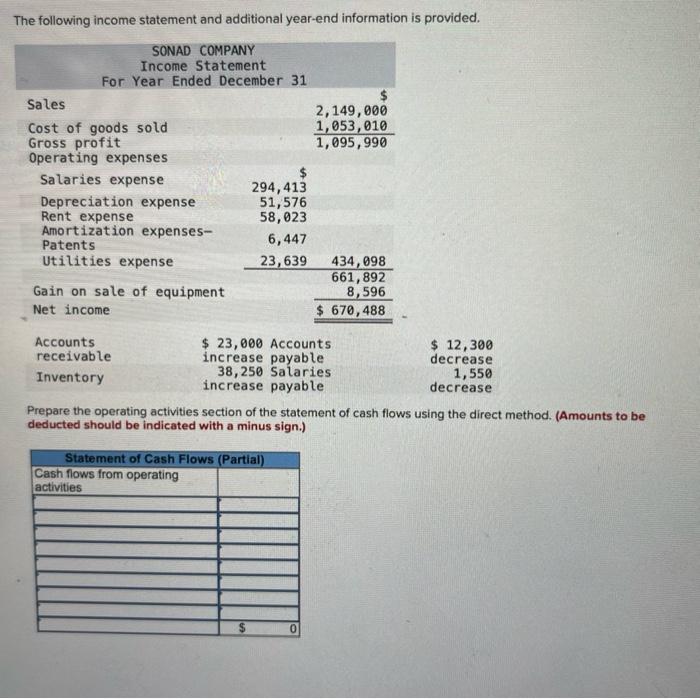

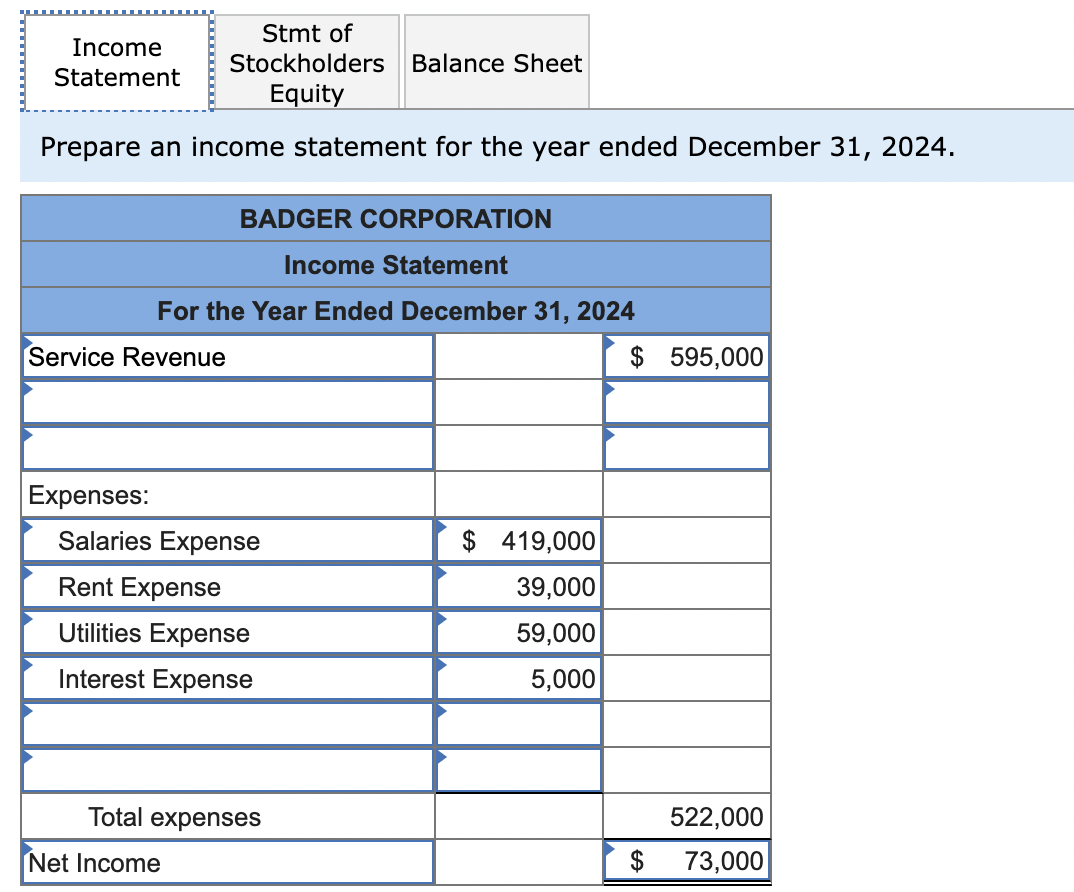

Salaries payable on income statement. When most employees work. By calculating the income statement equation, a company can. Salaries and wages are expenses, which are declared in the income statement.

The term “salary payable” refers to the liability created to account for the number of salaries owed to the employees that are yet to be paid. Wages payable is an accrual account, which means that. It goes on its balance sheet.

Salary and job outlook for an accounts payable clerk. In this article, we define accounts payable and income statements, explore the differences between expenses and accounts payable and provide an example. Salaries payable refers only to the amount of salary pay that employers have not yet distributed to employees.

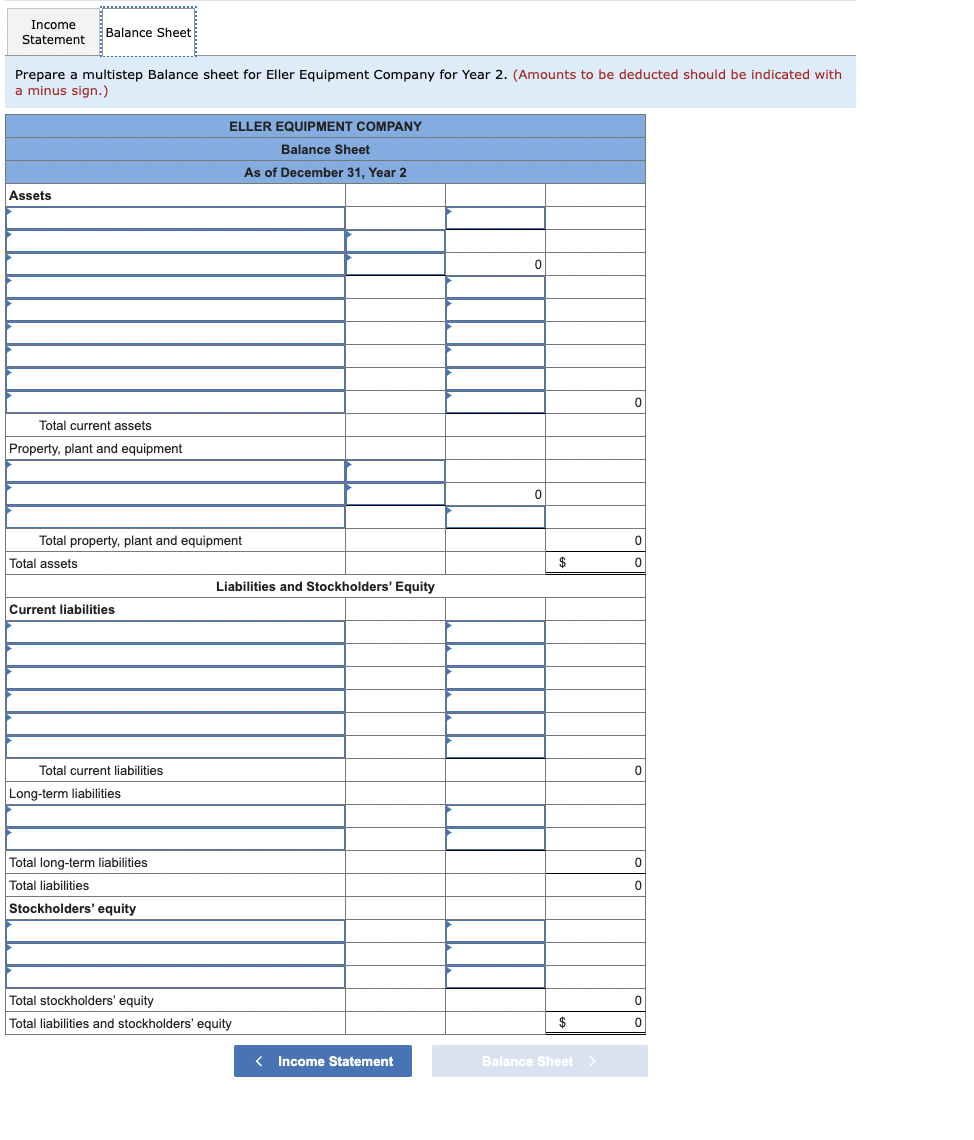

Balance sheet, statement of retained earnings, or income statement. Are reported directly on the current income statement as expenses in the period in which they were earned by the employees. While salaries payable changes based on.

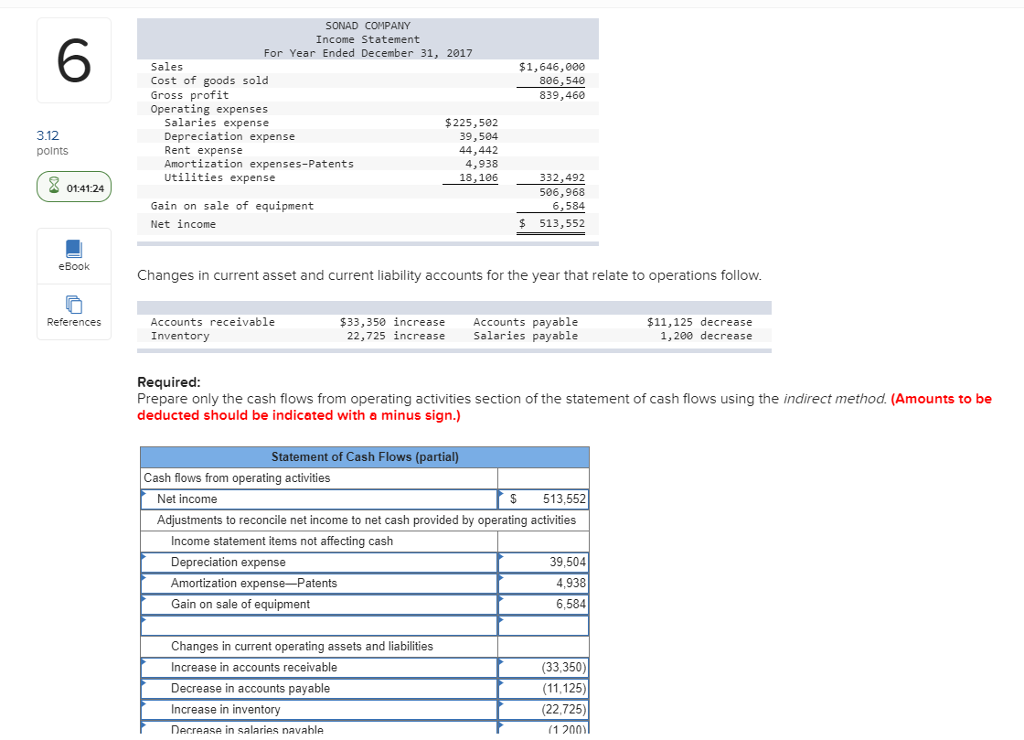

Cash payments for prepaid assets = + ending prepaid. This adjusting entry increases both the payroll expenses reported on the income statement and the accrued payroll expenses that appear as a liability on the. Accrued wages represent the unmet employee compensation remaining at the end of a reporting period, i.e.

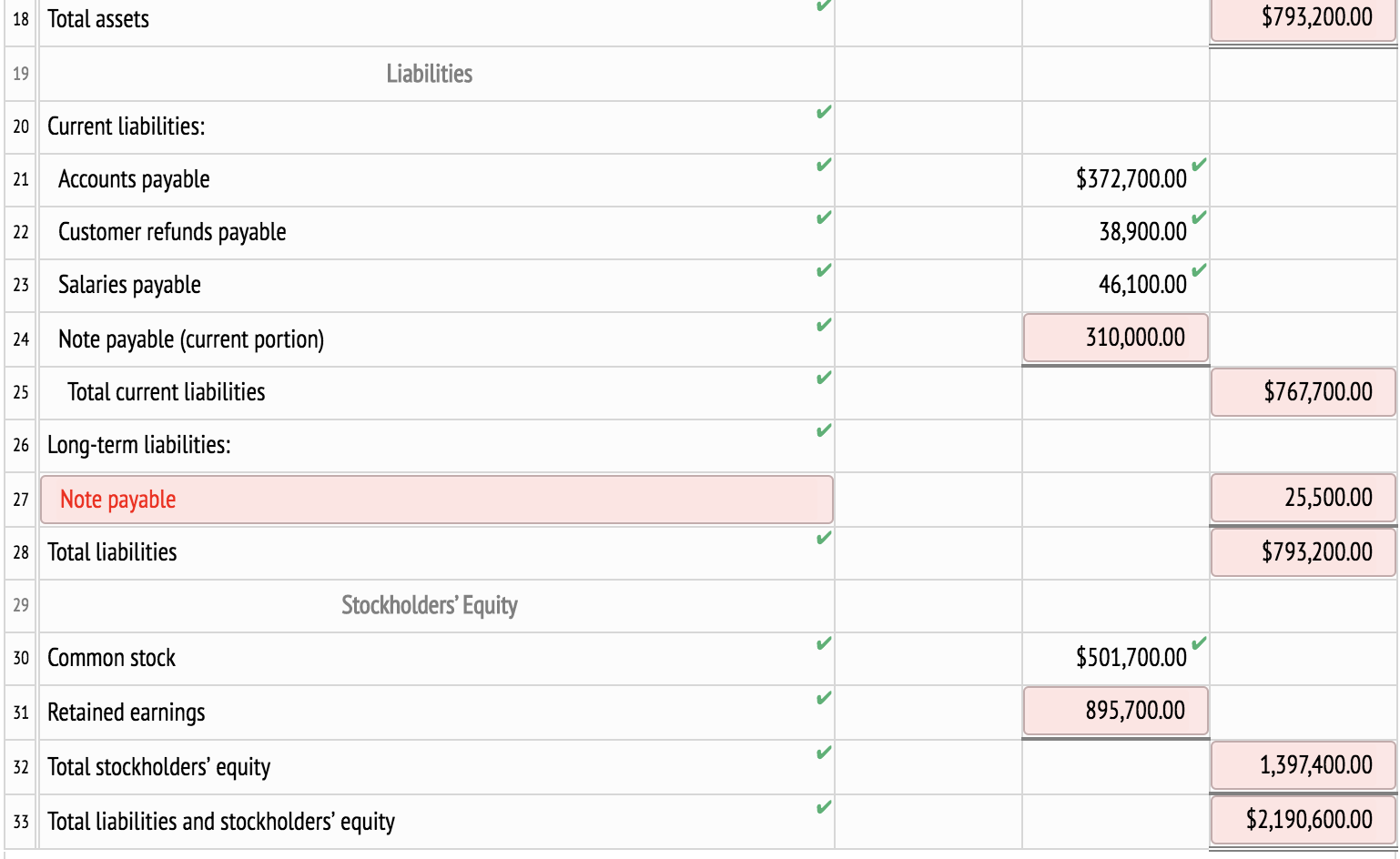

Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable,. The liability accumulates because the. The average salary of an accounts payable clerk in the united states is $39,755 according to data provided by.

Under the matching principle of accounting, all expenses for a current year should be matched with. Salaries payable is a liability account that contains the amounts of any salaries owed to employees, which have not yet been paid to them. Their daily toil gets accumulated in on the employers books as a liability to the business.

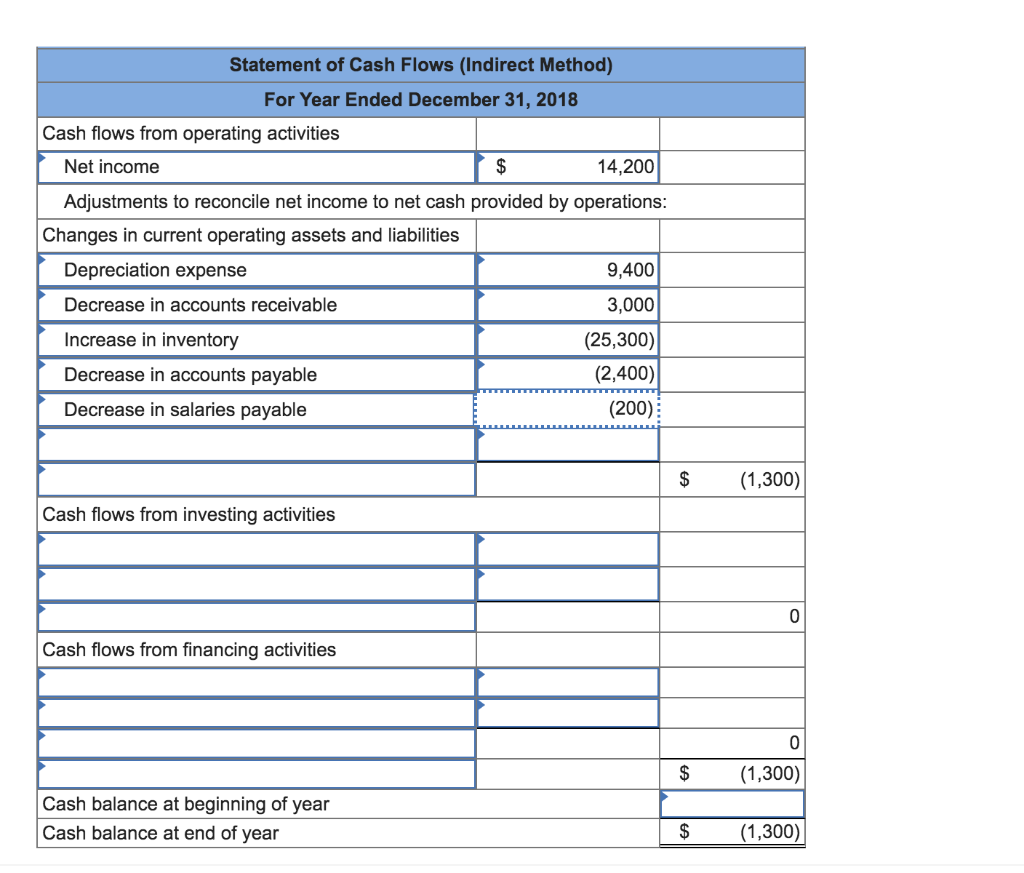

Salaries payable definition the current liability account which reports the amount of salaries earned by a company's employees, but which have not yet been paid by the. Propensity company had an increase in the current operating. Published on 26 sep 2017.

Identify which income statement each account will go on: Equity— the net worth (or net assets) of the organization. The statement of retained earnings includes.

The salaries and wages of people in the nonmanufacturing functions such as selling, general administrative, etc. The balance of unfulfilled payroll expenses. Investment by owners— cash or other assets provided to the organization in exchange for an ownership interest.

![[Solved] statement and balance sheet excerp SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1543/4/8/9/0145bffc5f6069c91543471535041.jpg)