Peerless Info About Generic Income Statement Annual Audit Report Of A Company

Repsol sa will increase its dividend by 29% and buy back more shares, following the trend set by most other major oil companies of rising shareholder returns.

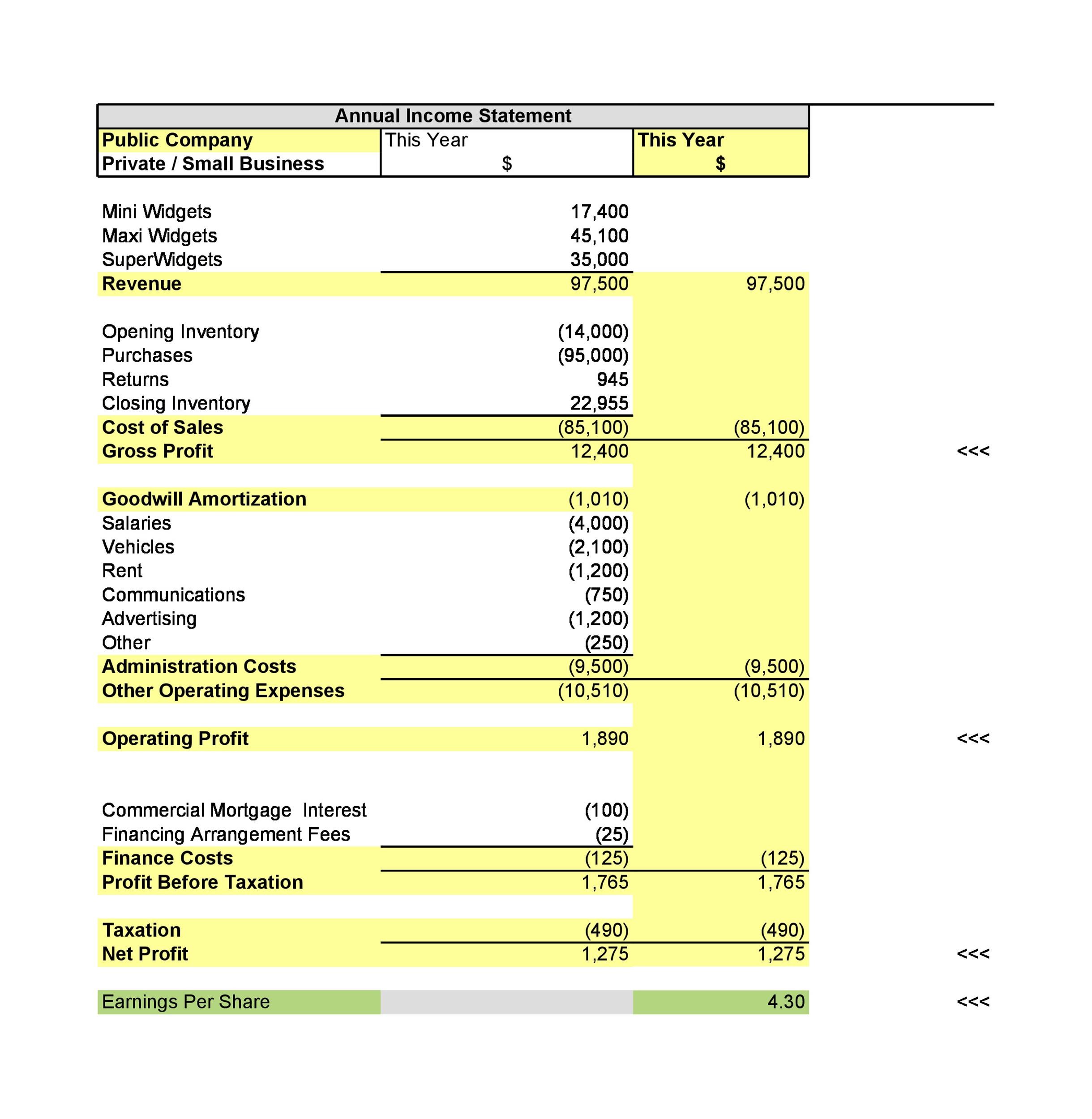

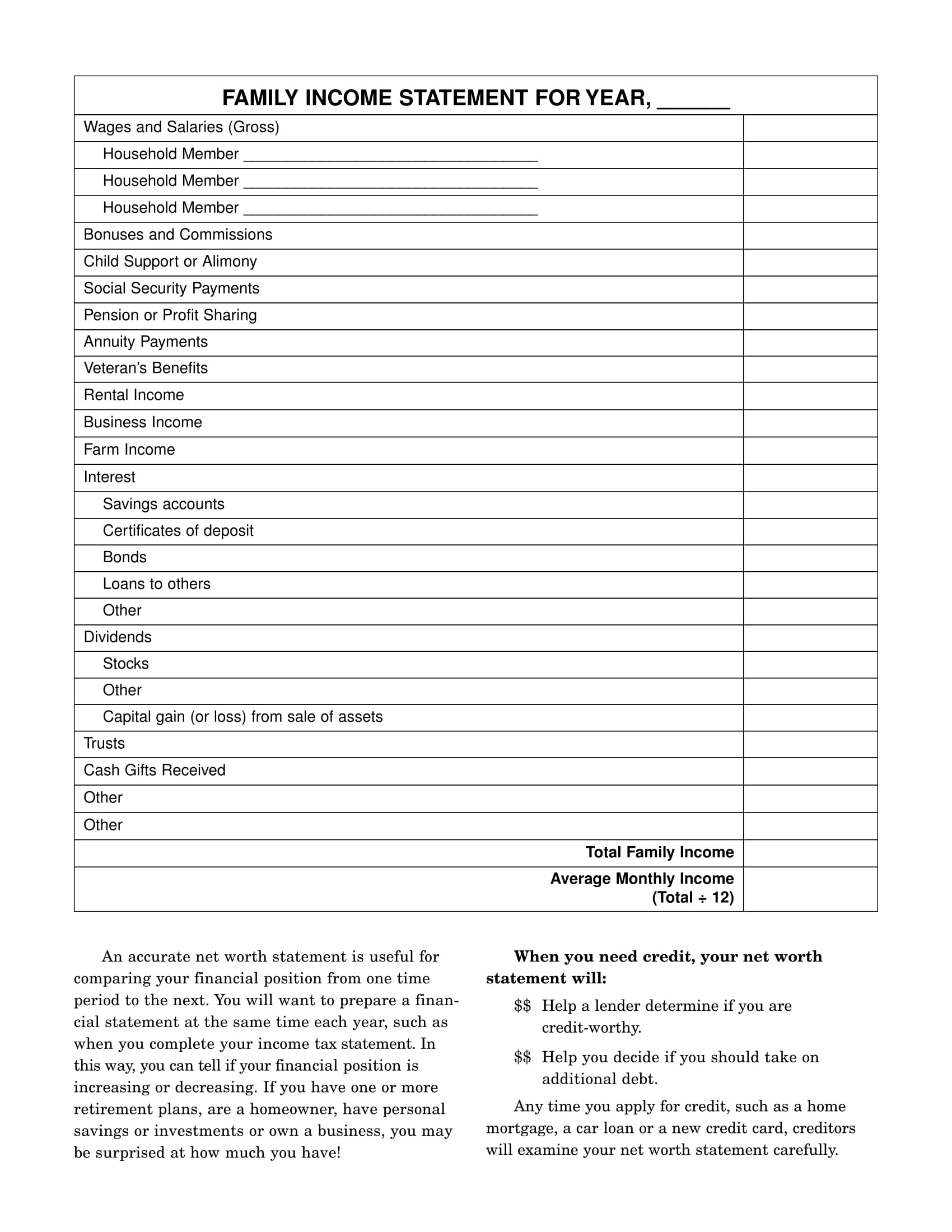

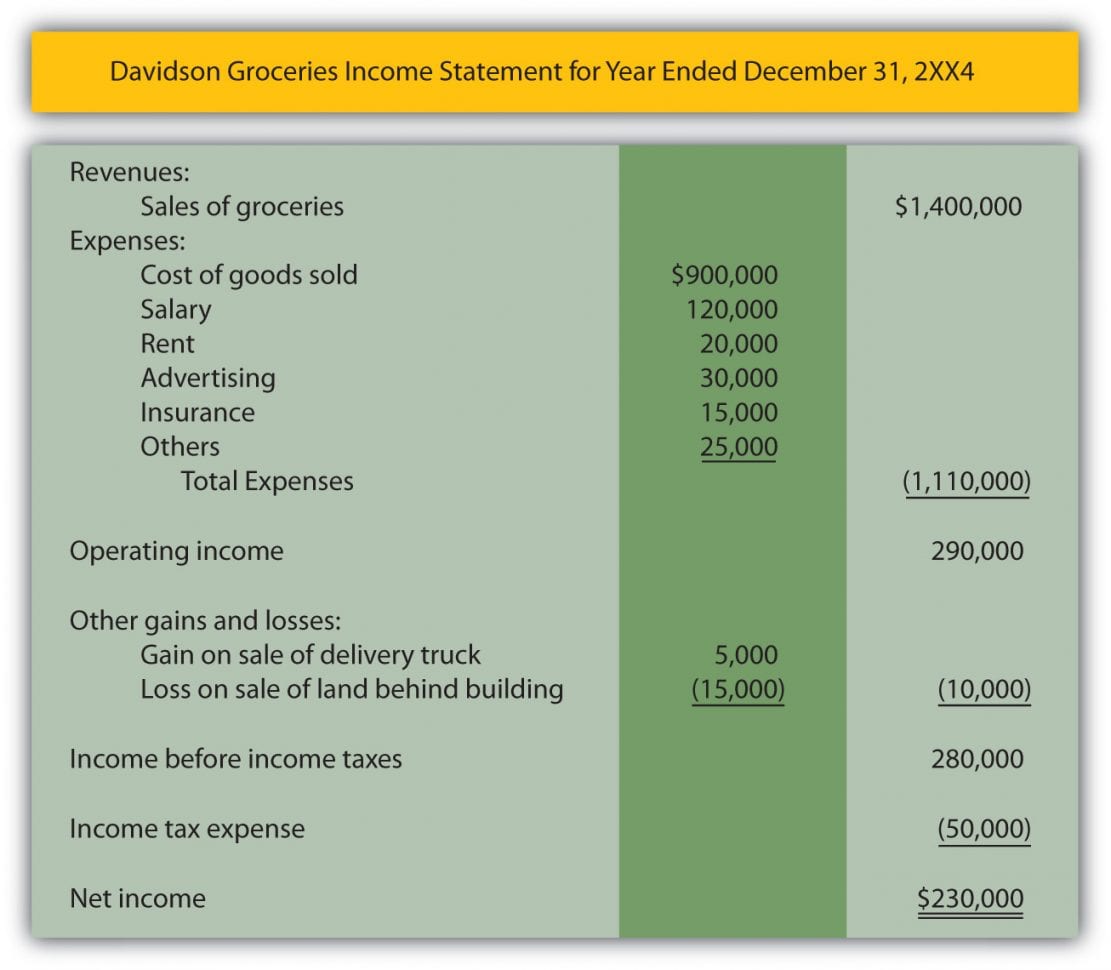

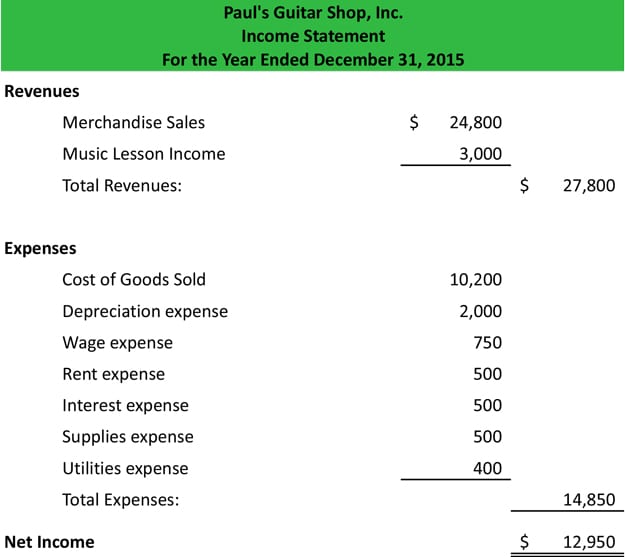

Generic income statement. Since an income statement tracks the income and expenses of a company over time, it usually includes sections that relate to. The income statement is a financial report that tells whether a company had made or lost money in a given period. A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year.it.

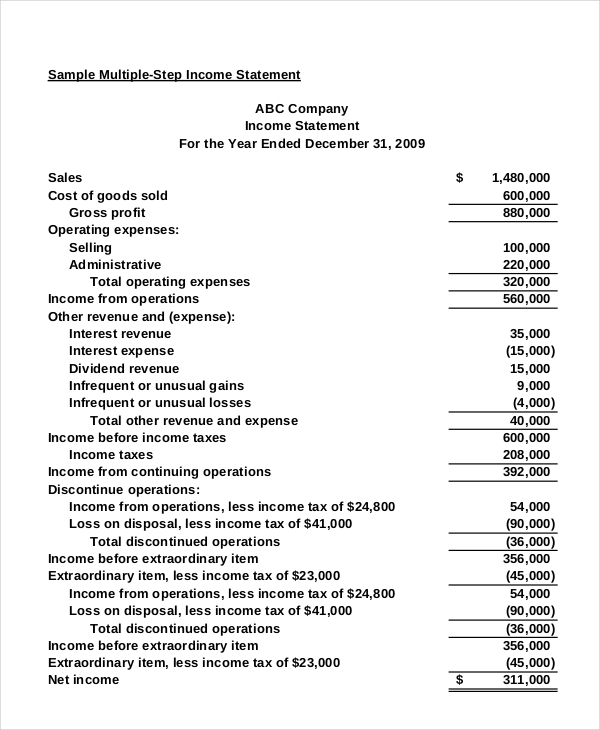

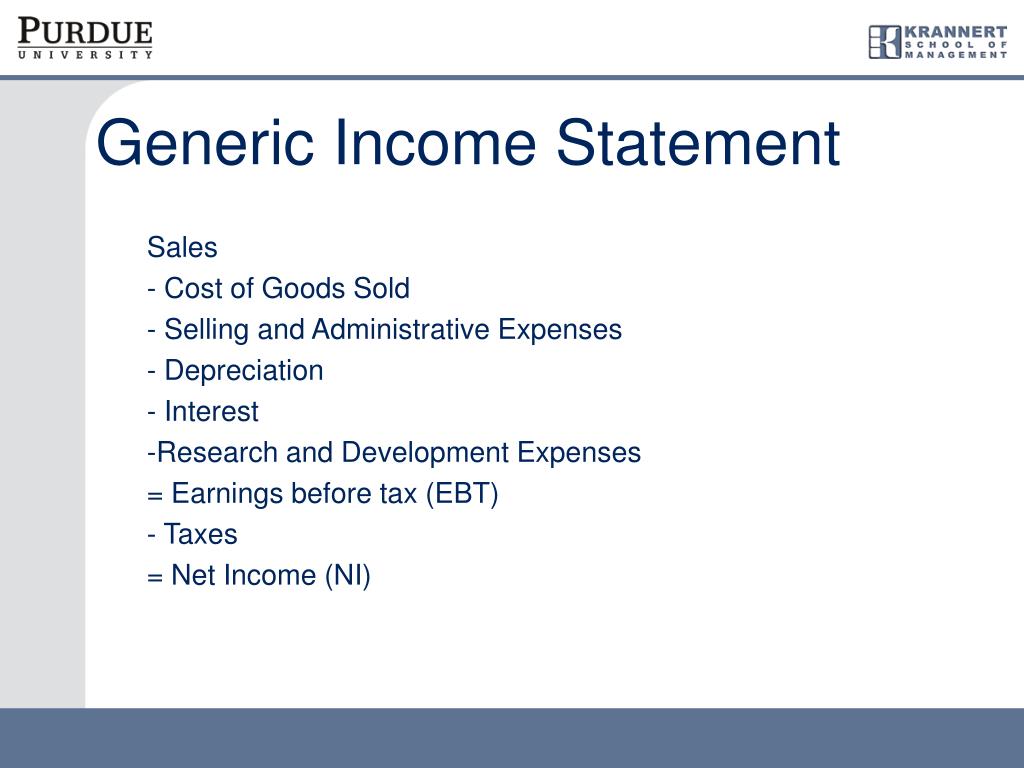

The term “income statement ” refers to one of the three primary financial statements the company uses to summarize its financial performance over the reporting period. The most common income statement. An income statement is a financial report detailing a company’s income and expenses over a reporting period.

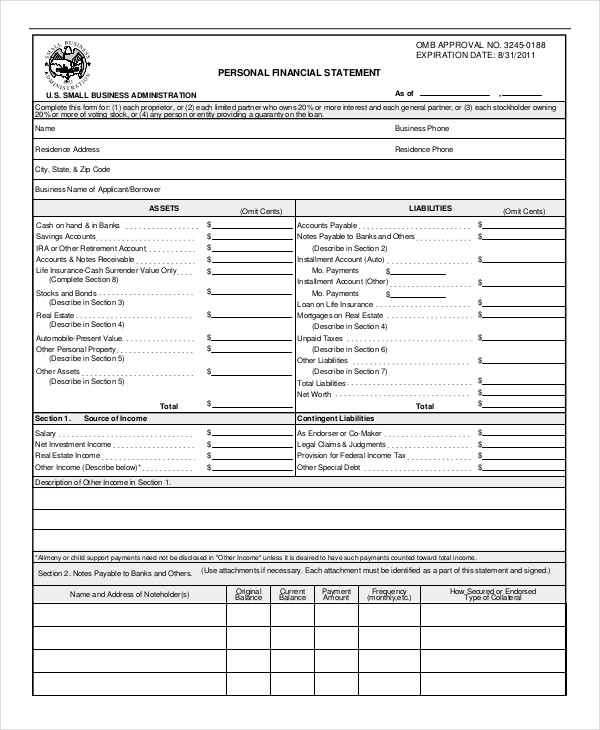

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. Here are seven different types of income statements: Elements of an income statement.

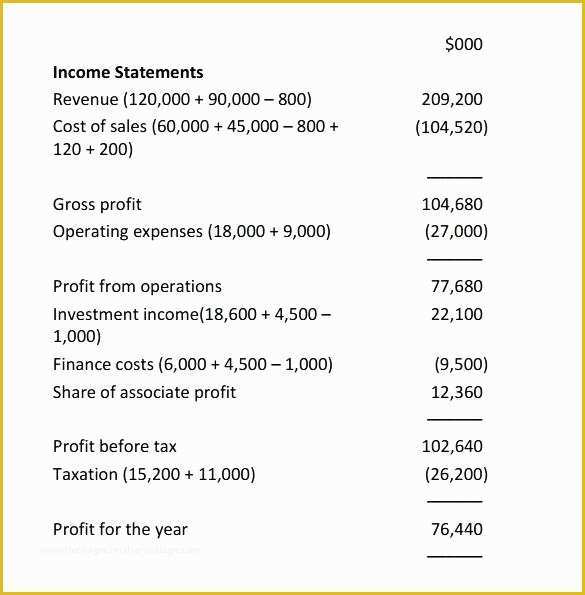

Income statements, also referred to as profit and loss (p&l) statements, provide a summary of your company’s income and expenses over a specific period. There are two ways of presenting an income statement. What is an income statement?

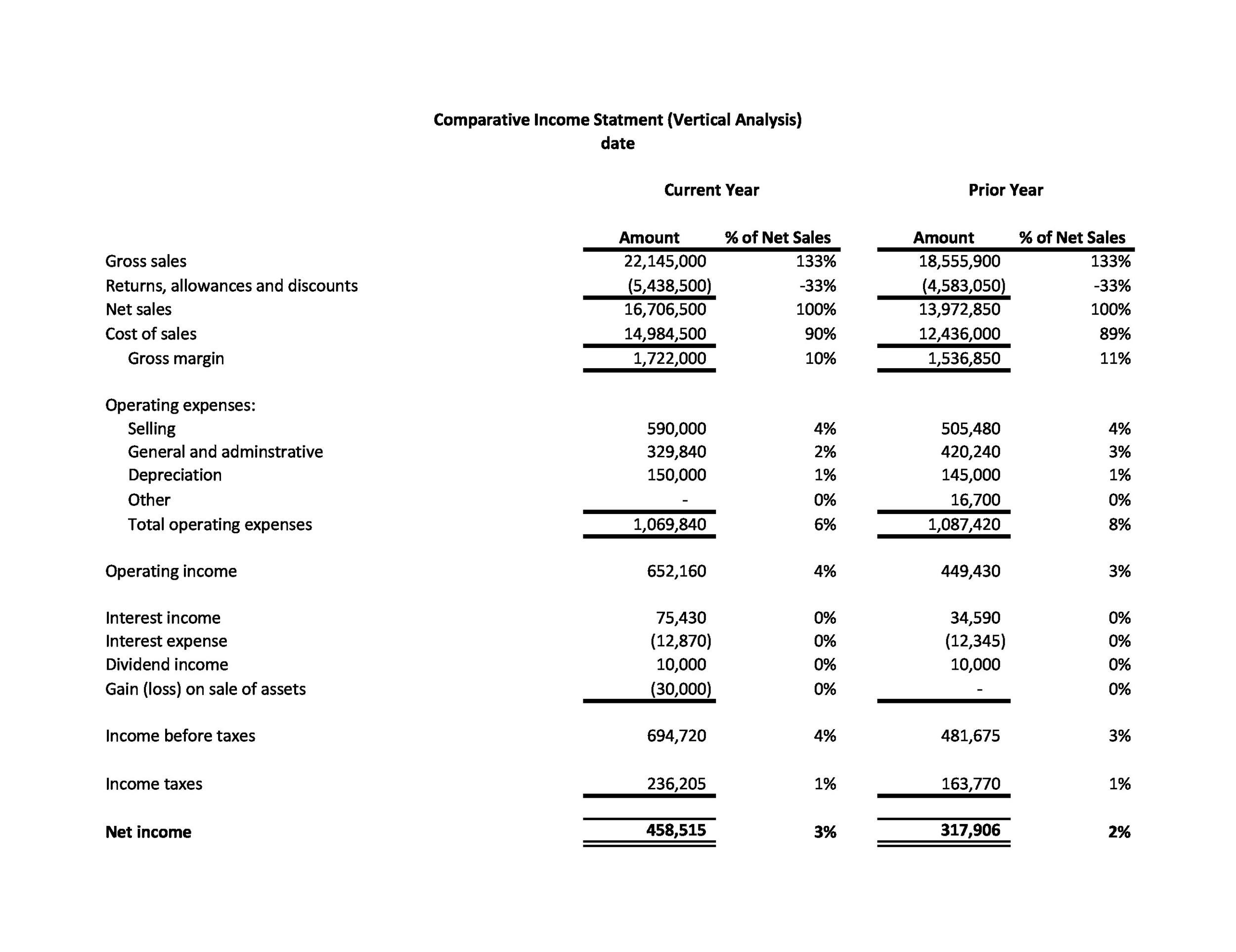

Generic sweden ab annual income statement. Year 2022 was 22.1% = gross profit of. There are several different types of income statements, each with its own purpose and information.

The income statement may have minor variations between different companies, as expenses and income will be dependent on the type of operations or business conducted. It also allows a business owner (or other. An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter.

However, there are several generic line items that are commonly seen in any income statement. It can also be referred to as a profit and loss (p&l).