Matchless Tips About Cash Flow Statement Depreciation Expense Pwc Cecl In Depth

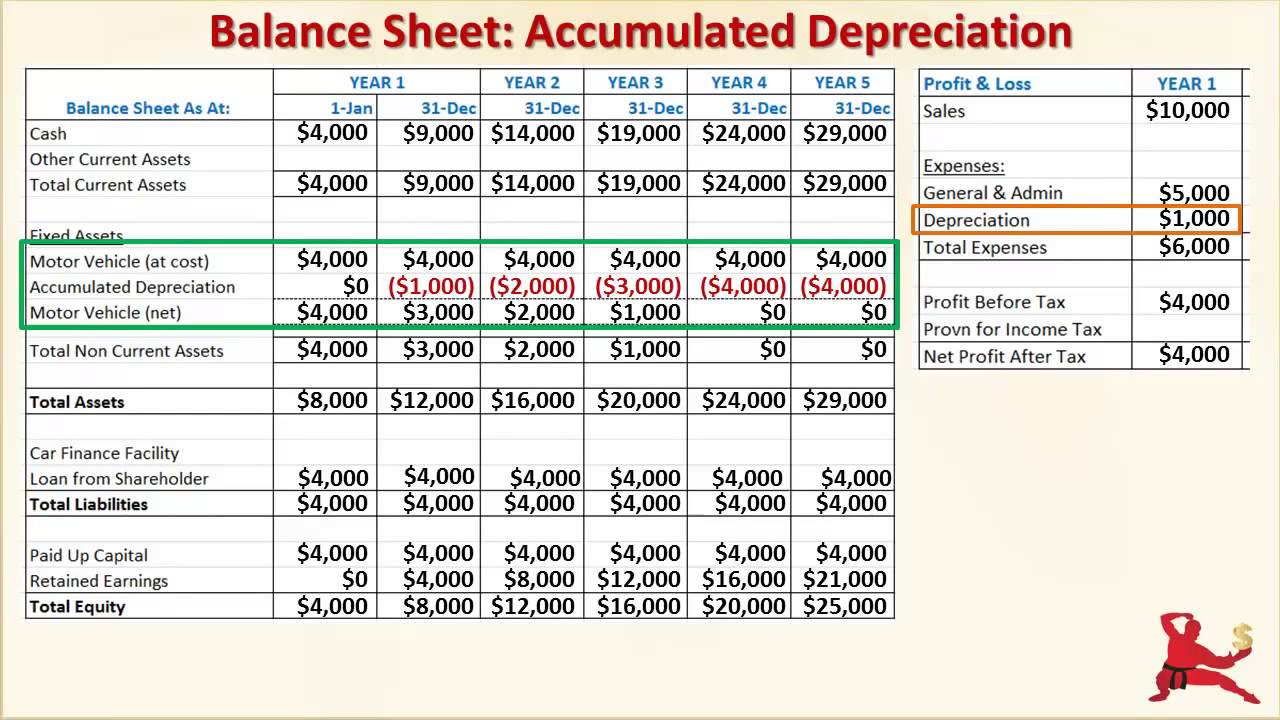

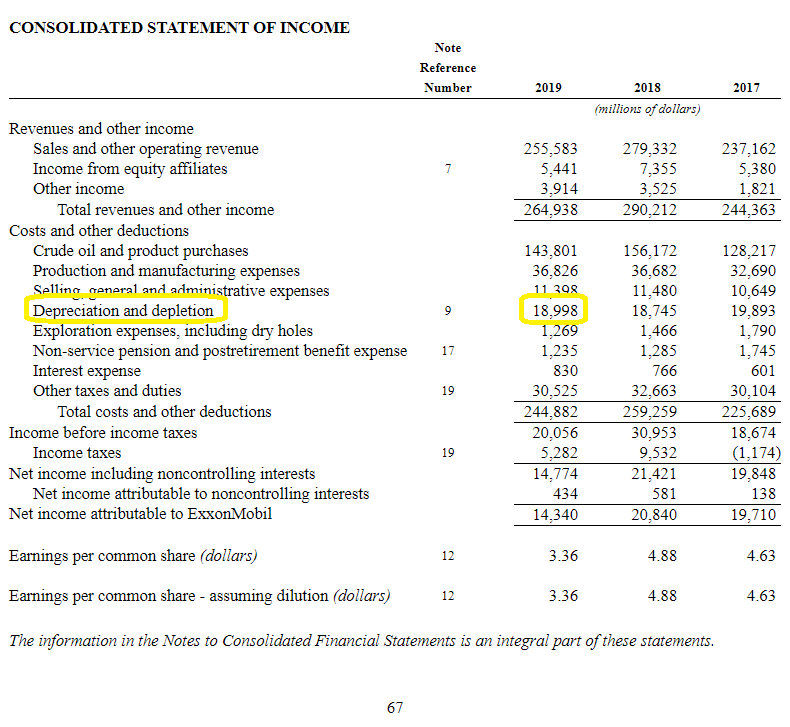

Understanding how depreciation expense is reported in the financial statements is essential for investors, creditors, and other stakeholders to assess a company’s profitability, financial position, and cash flow.

Cash flow statement depreciation expense. Depreciation expense on cash flow statement introduction. 12 years ago i was momentarily taken aback as well, and then suddenly remembered that it was a cash flow statement, not and income statement i was looking at. When companies prepare income tax returns, they list depreciation as an expense and reduce the.

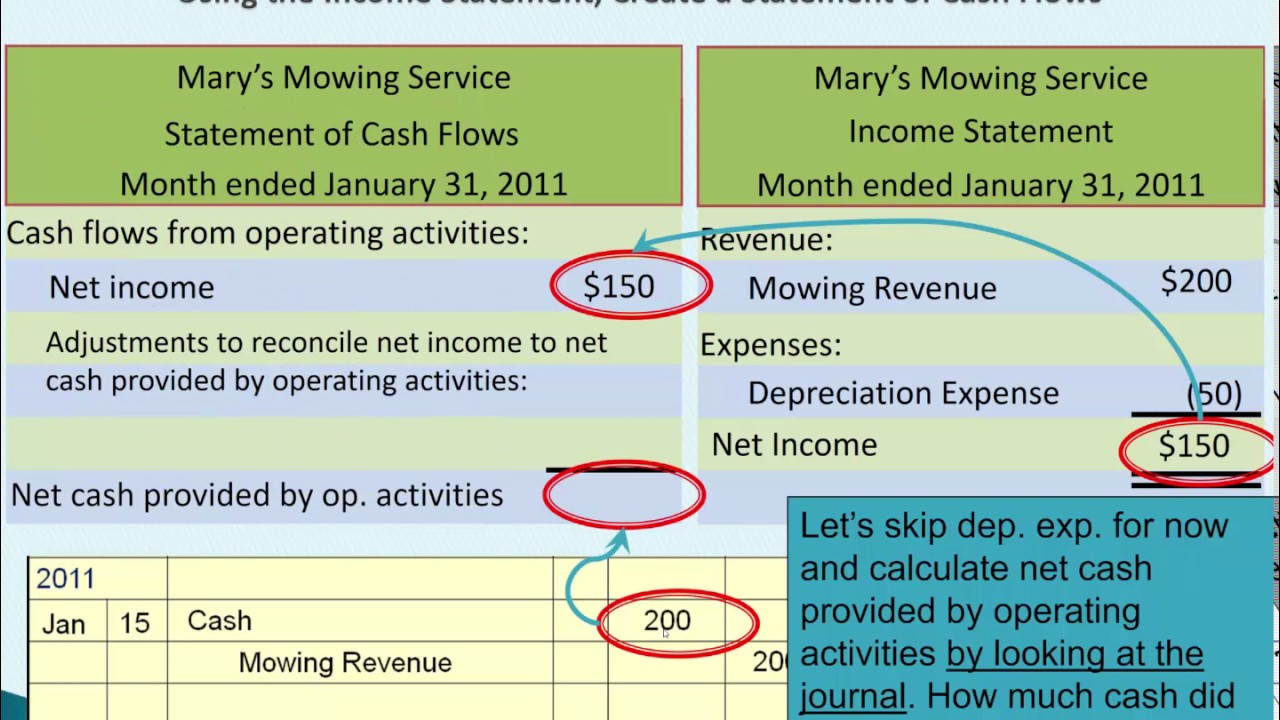

Net income for the seven months was $100. Because depreciation is in essence the recovery of funds over a year's time, it must be accounted for as an increase, even if a company sustains an operating loss for the period the cash flow. With the help of useful life of asset and the appropriate rate, the depreciation needs to be calculated each year and is debited to income statement like any other operating expenses.

Did you get it ⬇️🤔 question: Salvage value → the estimated value of the asset at the end of its useful life (“scrap value”) Also known as the statement of cash flows, the cfs helps its creditors determine how much cash is available (referred to as liquidity) for the company to fund its operating expenses and.

Depreciation helps pay for a lot of the capital expenditures of a company. Purchase price → the cost of acquiring the fixed asset (pp&e) on the original date of purchase. In other words, depreciation reduces net income on the income statement, but it does not reduce the company's cash that is reported on the balance sheet.

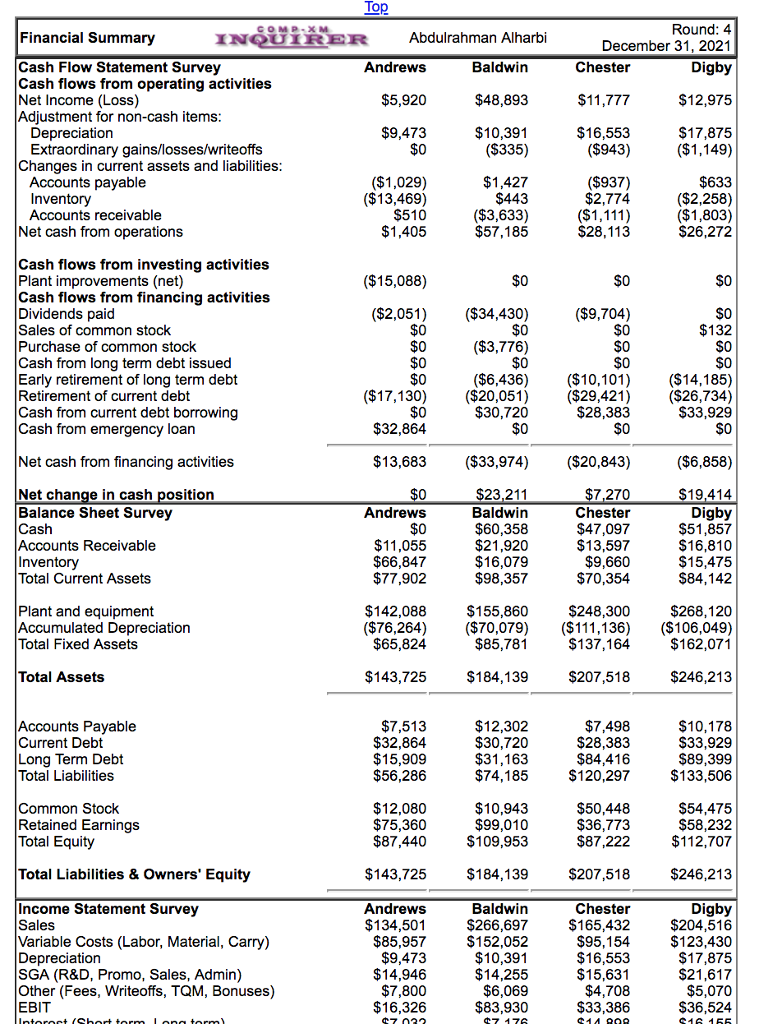

Likewise, there is no cash involved when we make the depreciation on the fixed asset. In simple terms, it's a deduction to expense found in calculating net income. Depreciation can only be presented in cash flow statement when it is prepared using indirect method.

The reason is depreciation and amortization expense reduced the company's net income, but it did not reduce the company's cash balance. Lo 5.1 identify whether each of the following accounts would be considered a permanent account (yes/no) and which financial statement it would be reported on (balance sheet; As you see, cash is not involved.

When you create a budget for cash flow, depreciation tends to be listed as a reduction from expenses, implying it has no impact on cash flows. You record it on a monthly basis in order to see how much it costs you to have the asset each month over the course of its useful life. Depreciation actually does not come under any of the categories of the cash flow statement, at least when you're using the direct method:

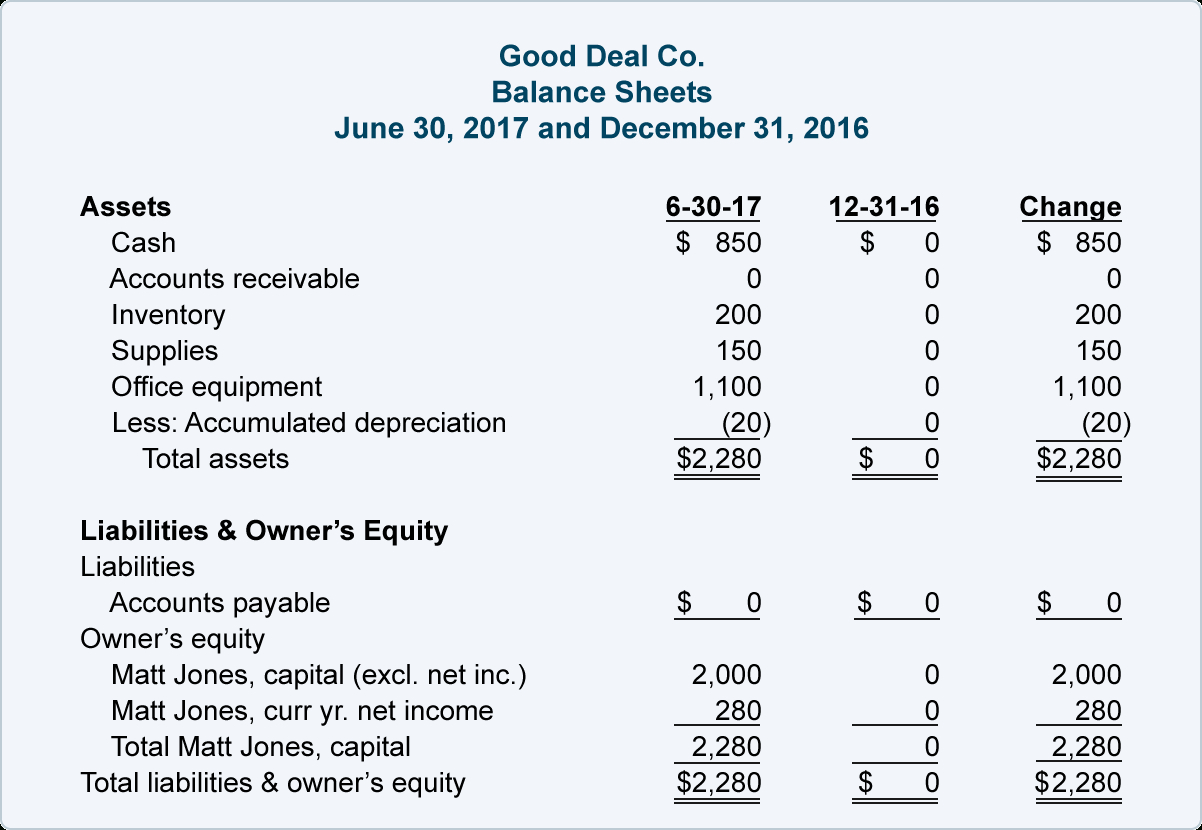

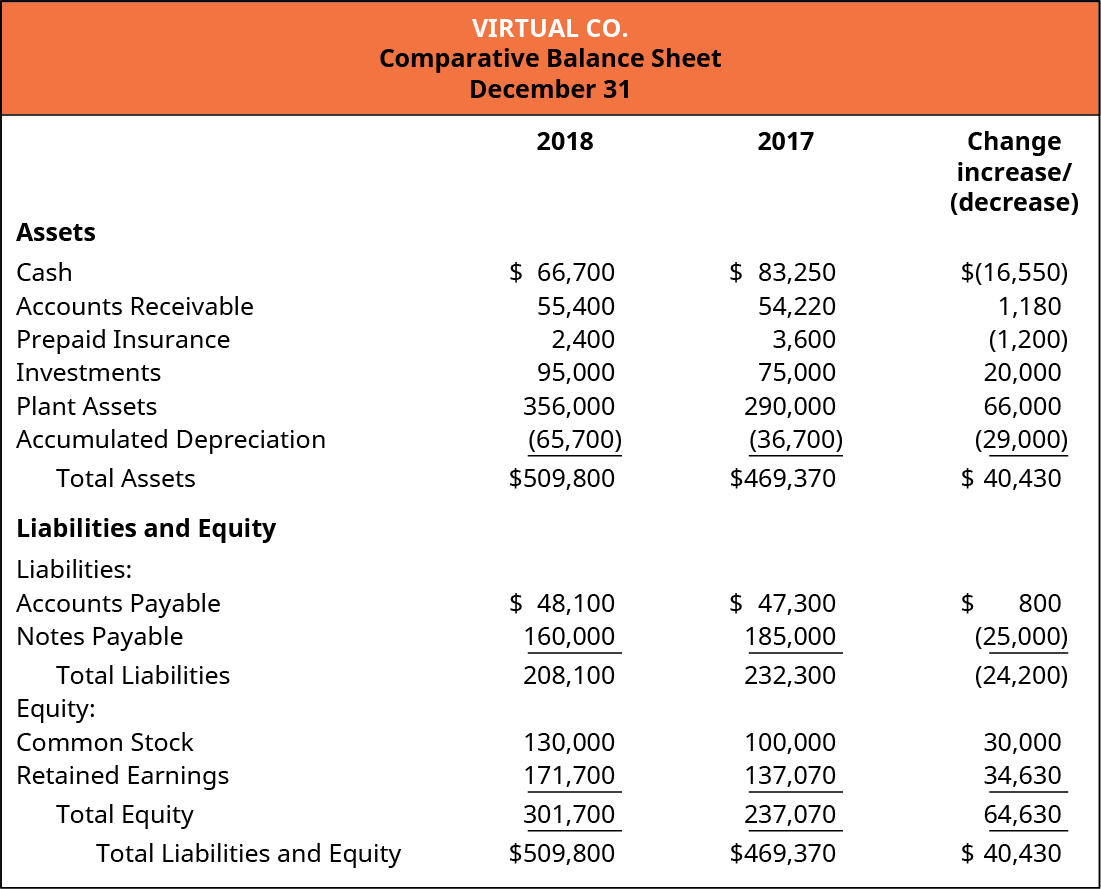

Let's review the cash flow statement for the seven months of january through july 2022: The table at the top is a very simplified income statement, so the depreciation expenses would reduce your operating profit. Companies have a few options when managing the carrying value of an asset on their books.

Included in the net income for the seven months is $20 of depreciation expense. Or retained earnings statement)_ accumulated depreciation insurance expense buildings prepaid insurance depreciation expense supplies. Did you get it ⬇️樂 question:

The time interval (period of time) covered in the scf is shown in its heading. This includes the company's revenues, gains, expenses, and losses. Depreciation is a type of expense that when used, decreases the carrying value of an asset.

:max_bytes(150000):strip_icc()/Walmart202010KIncomestatement-365d4a49671b4579a2e102762ada8029.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)