First Class Info About Types Of Ratios In Management Accounting Profit And Loss Statement Template Word

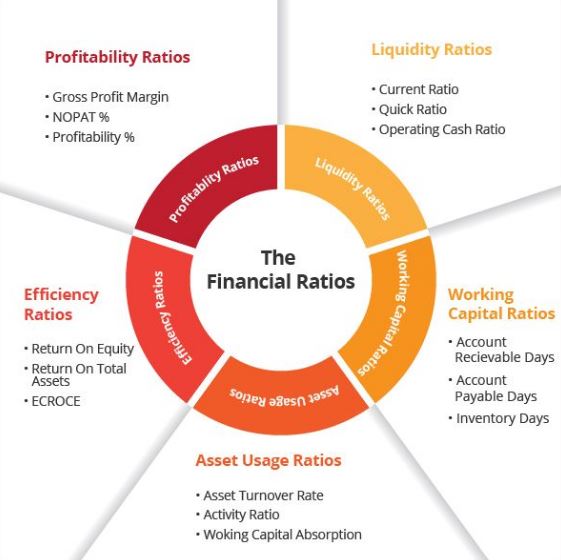

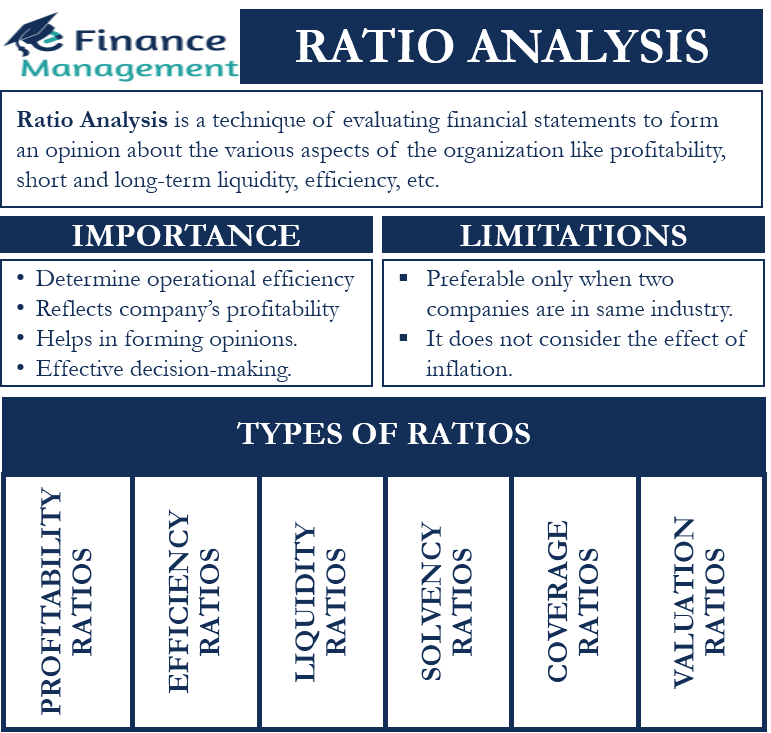

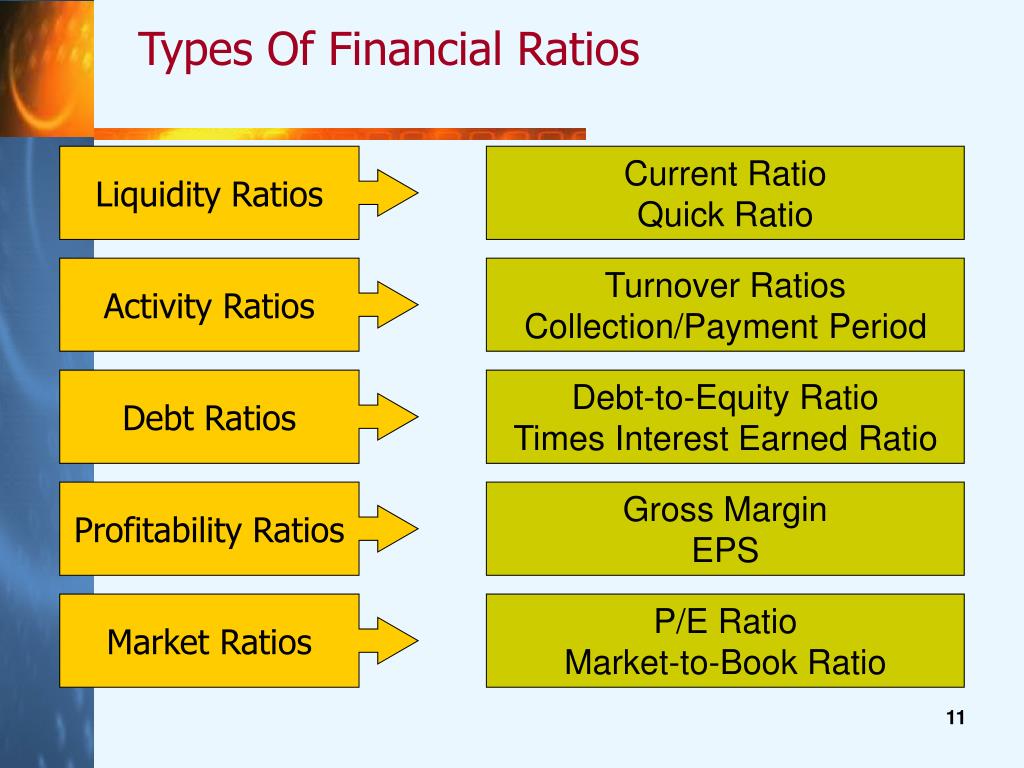

There are numerous financial ratios that are used for ratio analysis, and they are grouped into the following categories:

Types of ratios in management accounting. They need to understand how ratios are calculated and the key influences on ratios. Profitability, solvency, liquidity, turnover, coverage, and market prospects ratios. Such ratios can be used by management to identify and improve problem areas.

Three common liquidity ratios are the quick ratio, current ratio, and cash flow coverage ratio. There are various types of accounting. We will highlight some of the more common ratios in the table below that you may use as a handy reference:

This understanding can help managers when controlling the business, and when planning or making decisions about the future. Gross profit ratios, net profit ratios, and expense ratios, among others, provide a gauge of a company’s profitability. How to comment on accounting ratios?

Liquidity ratios measure a company’s ability to. Commonly used debt ratios and formulas. Liquidity ratios, activity ratios, solvency ratios, and profitability ratios.

Accounting ratio is the comparison of two or more financial data which are used for analyzing the financial statements of companies. Management accountants focus on the ratios that apply to the running of the business. Accounting ratios may be very useful for forecasting likely events in the future since past ratios indicate trends in costs, sales,.

Accounting ratios, also known as financial ratios signify the relationships between figures of the balance sheet and the profit & loss account. Organizations can conduct comparative ratio analysis with other competitive organizations to examine market gap in the industry. Uses of accounting ratios 2.

There exist many accounting ratios used throughout the industry, divided into subcategories like profitability ratios, debt ratios, and liquidity ratios, among others. Meaning, formula, significance and examples; This is called simple ratio.

They are also known as solvency ratios and measure the debt of a company relative to various other figures. The traditional classification is based on the financial statement to which the determinants belong. It indicates a company’s ability to pay its current liabilities without needing to.

Five ratios are commonly used. Ratios are classified into two types namely traditional classification and functional classification. If we explain different types of ratios in accounting or types of ratio in management accounting in detail then there are four types of ratios in accounting.

Meaning, formula, significance and examples Liquidity ratio solvency ratio profitability ratio activity ratio 1. They are an important subpart of financial ratios as they symbolise the speed at which the.