Painstaking Lessons Of Tips About Accounting Treatment For Provision Bad Debts Financial Status Of The Company At Any Given Time

This article sets out the accounting treatment for the impairment of trade receivables/debtors.

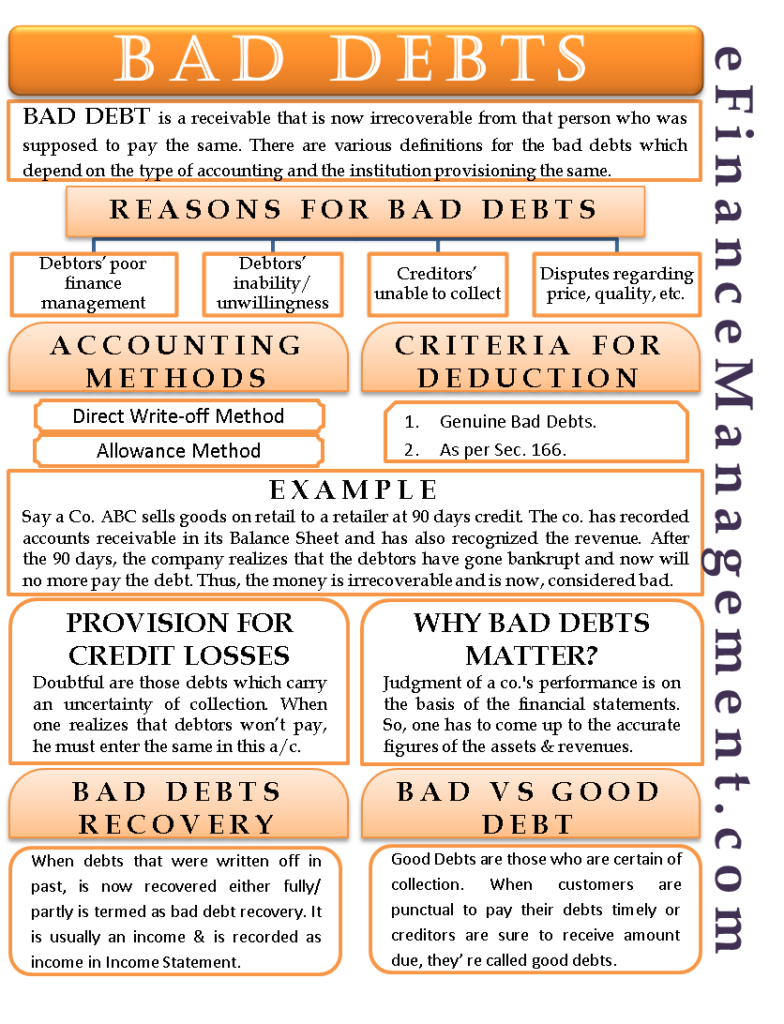

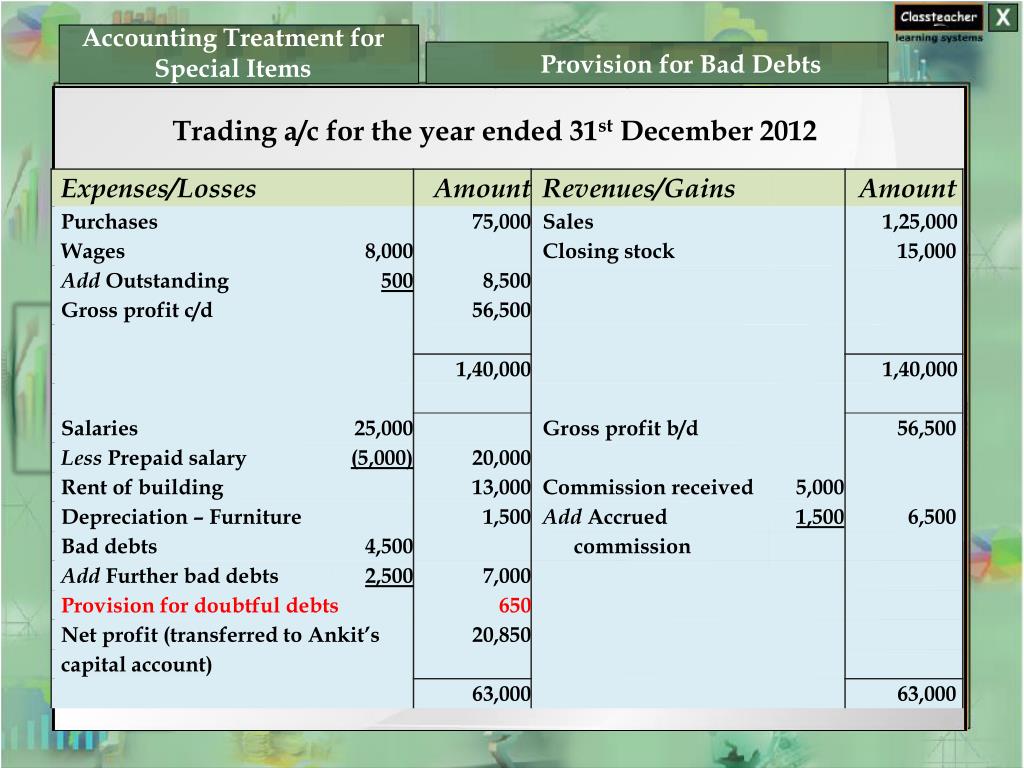

Accounting treatment for provision for bad debts. A provision for a bad debt account holds an amount, in addition to the actual written off bad debts during a year, that will be known to be due and payable in. There are two ways to account for a bad debt, which are noted below. The balance may be estimated using several different methods, and management should periodically evaluate the balance of the allowance account to.

Recording bad debts or doubtful debts is necessary to depict a business’s true and fair financial position. Accounting treatment for provision for doubtful debts: Ias 37 outlines the accounting for provisions (liabilities of uncertain timing or amount), together with contingent assets (possible assets) and contingent liabilities (possible.

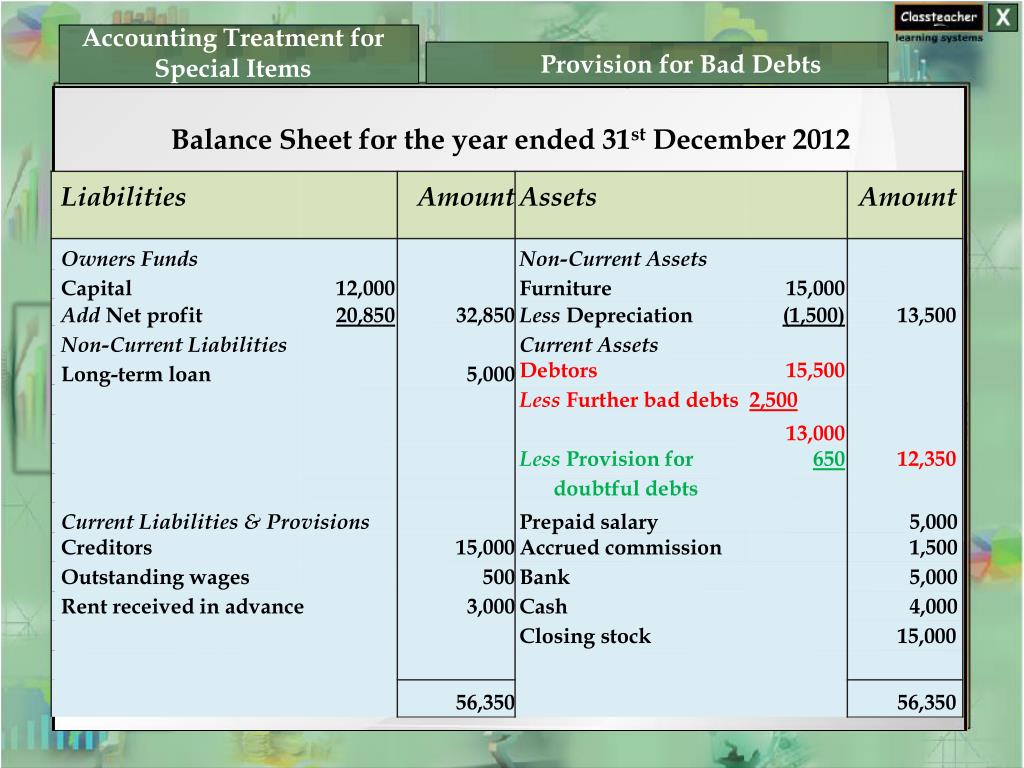

A bad debt provision is a reserve against the future recognition of certain accounts receivable as being uncollectible. Definition of provision for bad debts the provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for. Creating a provision for doubtful debts for the first time.

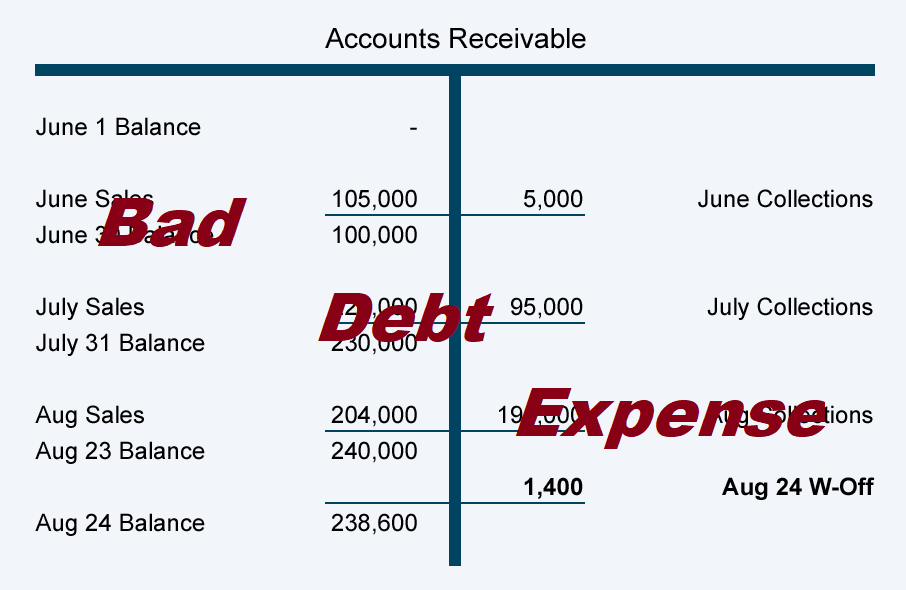

Cr provision for doubtful debts. Bad debt is basically an expense for the company, recorded under the heading of sales and general administrative expenses. This article explains how we do.

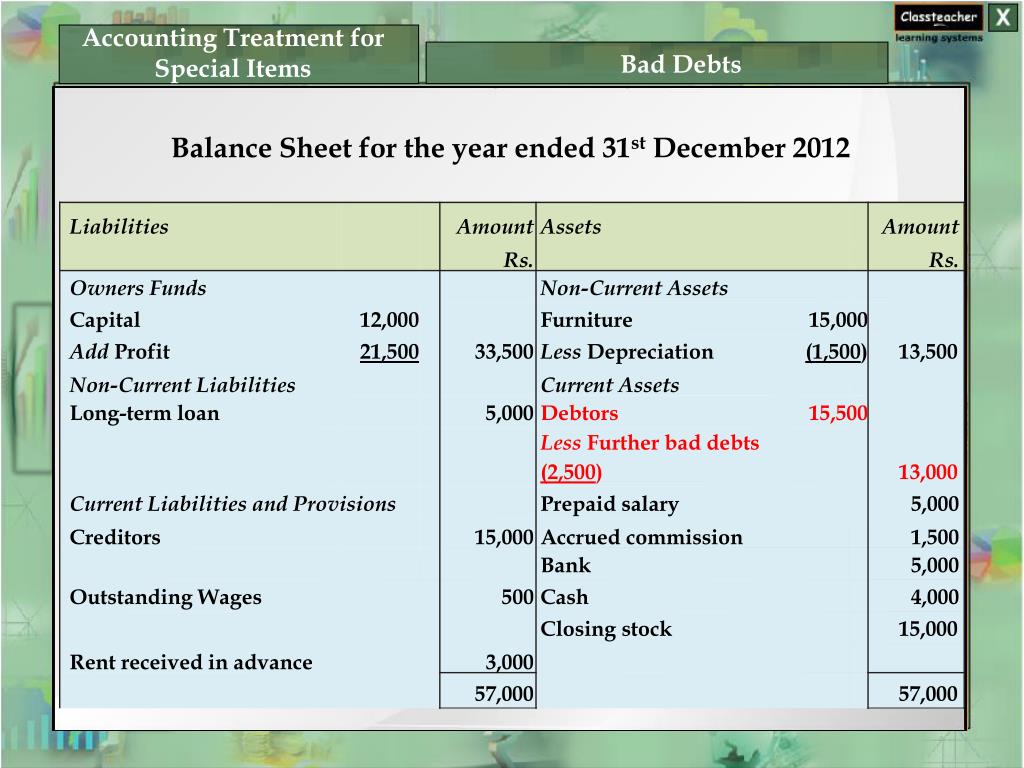

This way the matching principle of accounting is followed and no gaap is violated. If the actual bad debt was greater than the provision, the bad debt expense must be tracked on the income statement for the same accounting period during which. The credit entry reduces the receivable balance to nil as no amount is expected to be recovered from the receivable.

Accounting for the provision for doubtful debts a business typically estimates the amount of bad debt based on historical experience, and charges this. The provision for bad debts is now, in effect, governed by ias 39,. 17 january 2019 a business needs to account for a bad debt as soon as it knows it has gone bad, so it is not overstating its trade receivables.

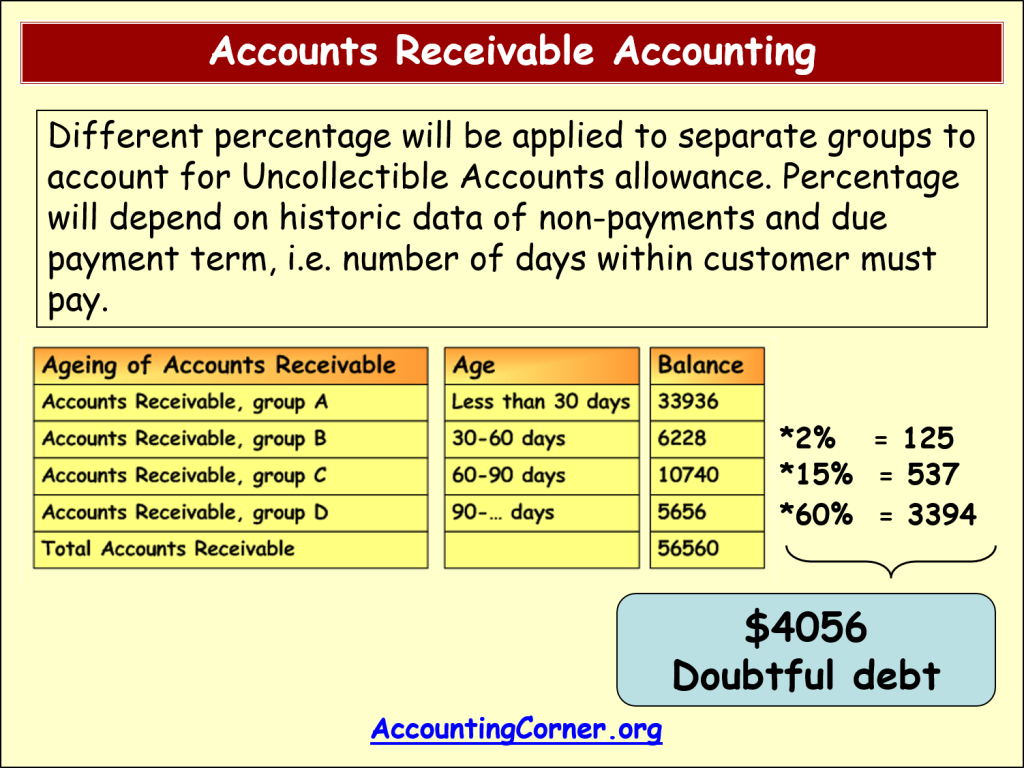

General provision is made as % of closing trade receivables and is usually made on the basis of past trend and future. It is simply a loss because. The provision for bad debt is estimated each year at the end of the accounting period.

But the bad debt provision. The difference between the treatment of a bad debt and a specific allowance for doubtful debt is that in the latter case, the receivable ledger of the specific debt is not removed in. In simple words, it amount of debt which is impossible to collect is called bad debts.

The event of bad debts must be recorded in the accrual accounting. November 08, 2023 what is a bad debt provision? Bad debts are the debts which are uncollectable or irrecoverable debt.

A bad debt provision is a reserve made to show the estimated percentage of the total bad and doubtful debts that need to be written off in the next year. Accounting entry required to write off a bad debt is as follows: Provision can be made in the following ways: