Impressive Tips About Commonly Used Financial Ratios Ind As 34

6 basic financial ratios and what they reveal 1.

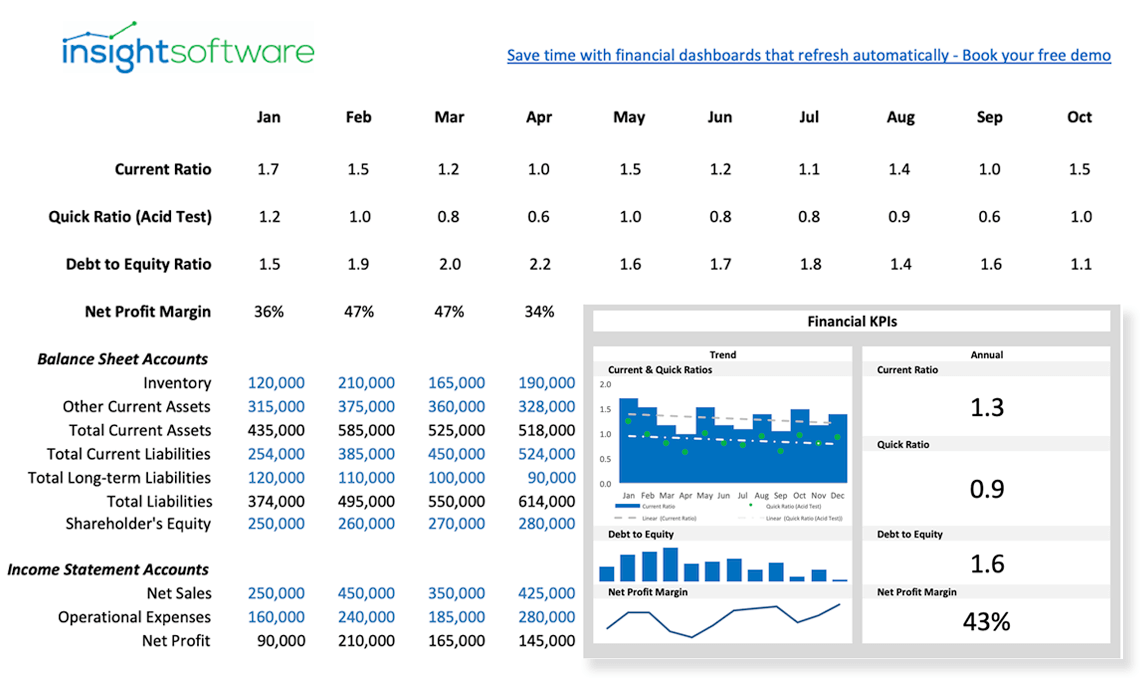

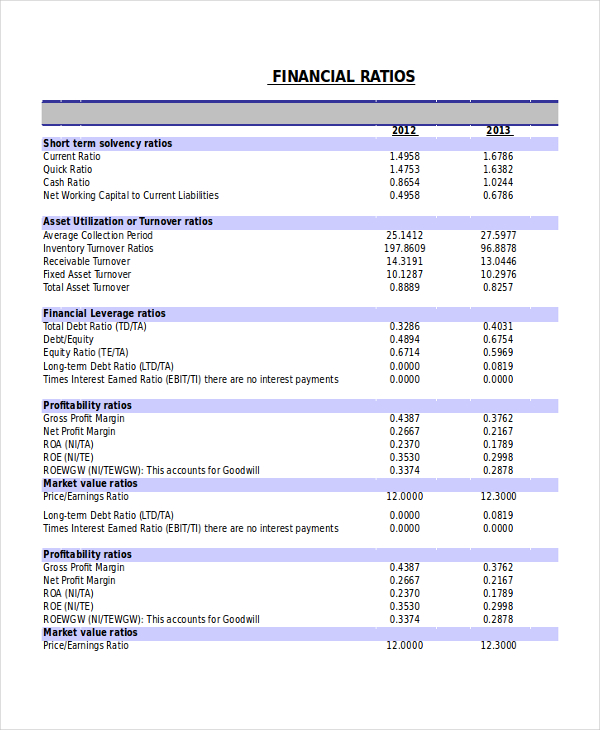

Commonly used financial ratios. Corporate finance ratios are quantitative measures that are used to assess businesses. Leverage ratios measure the amount of capital that comes from debt. Typically, ratios are not examined alone, but are looked at in combination with other performance indicators.

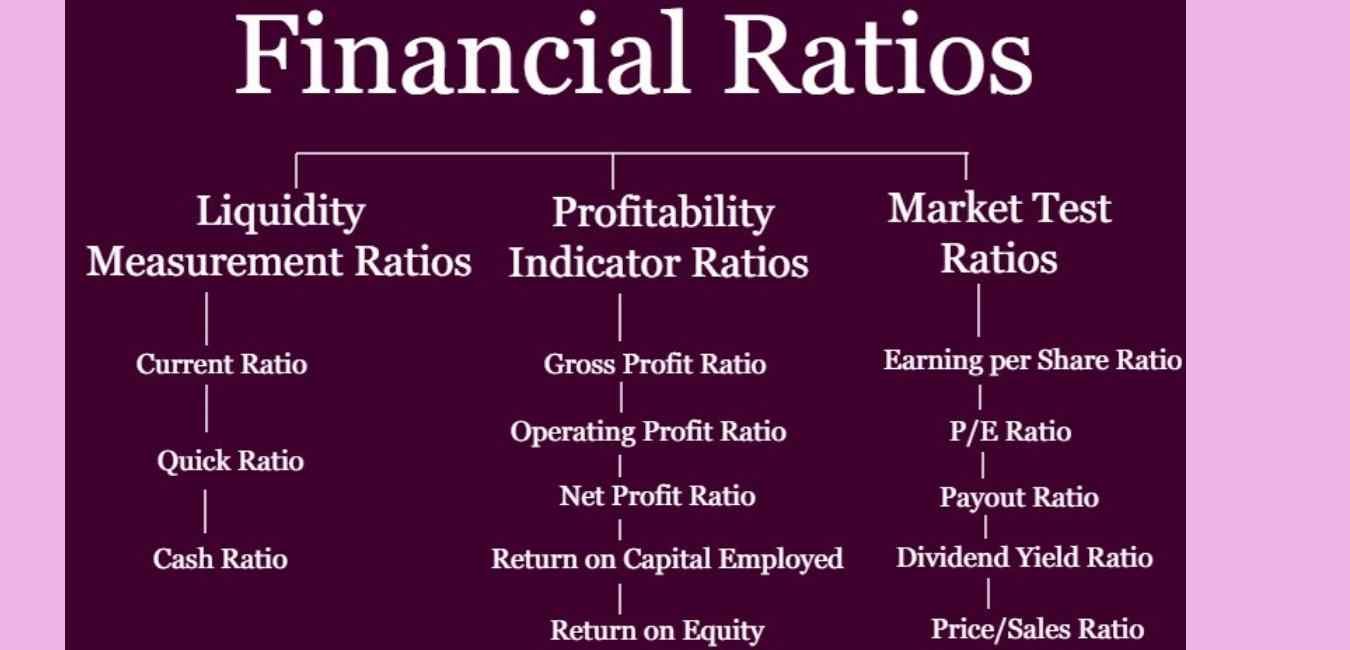

Liquidity ratios, leverage financial ratios, efficiency ratios, profitability ratios, and market value ratios. These are the most commonly used ratios in fundamental analysis. Eps = net profit / number of common shares to find net profit, you’d subtract total expenses from total revenue.

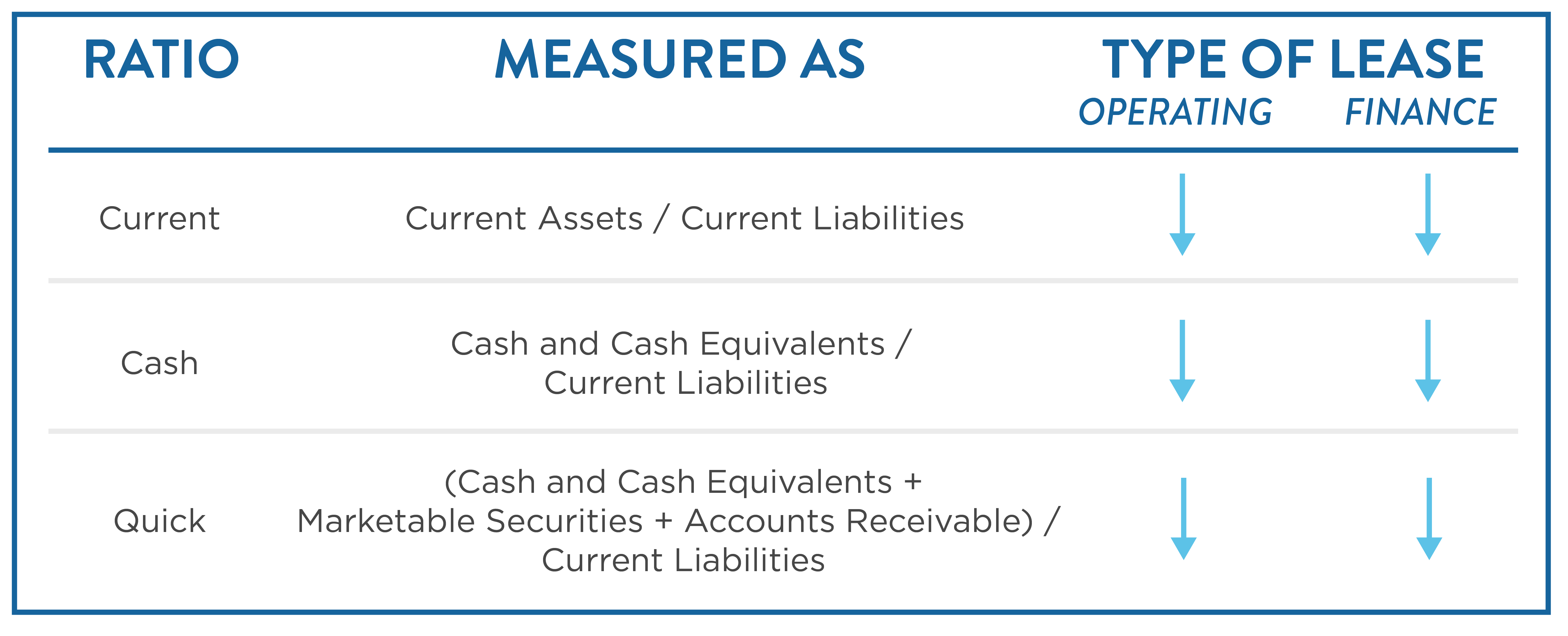

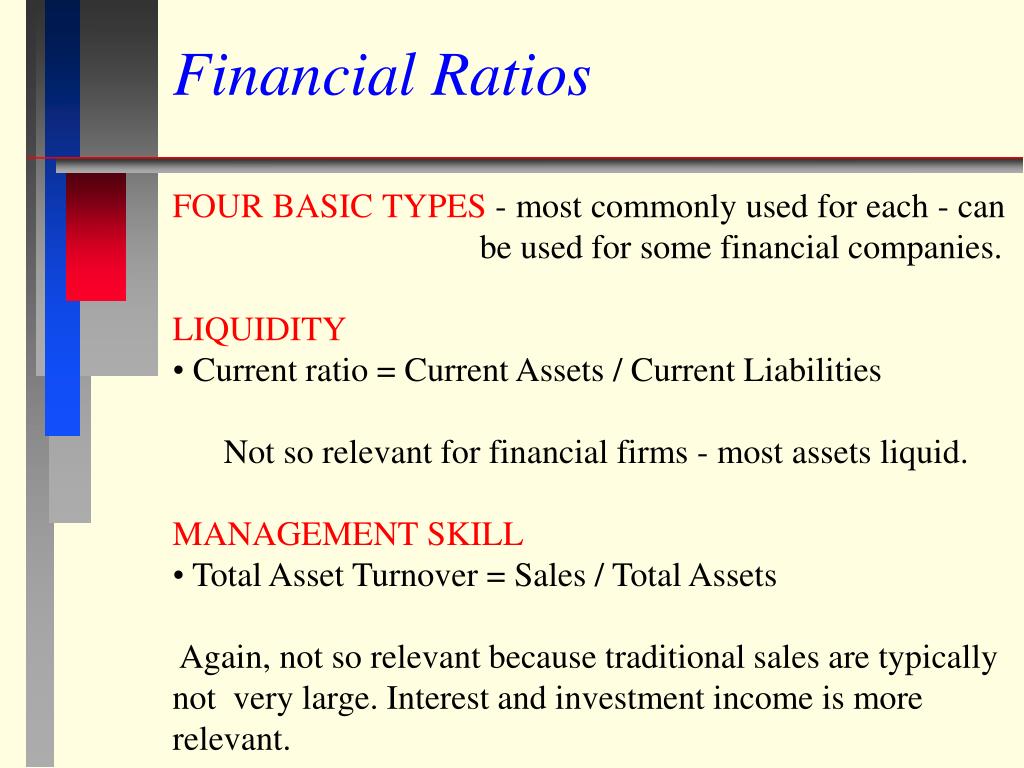

We calculated the current ratio as current assets over current. We present some commonly used financial ratios in this section to help you get started. Financial ratios are powerful tools to help summarize financial statements and the health of a company or enterprise.

Financial ratios are quantitative relationships between two or more numbers in financial statements. These ratios are used by financial analysts, equity research analysts, investors, and asset managers to evaluate the overall financial health of businesses, with the end goal of making better investment decisions. Learn the most useful financial ratios here.

To calculate it, we divide one financial statement item by another, expressed as a percentage or multiple. Commonly used ratios in this classification include: The formula is operating income, divided by sales.

3) profit margin profit margin is one. The ratios measure the amount of liquidity, namely cash and easily converted assets, for covering your debts, and provide a broad overview of your financial health. Below, we cover some key financial ratios used to assess business performance.

Data in financial statements can be simplified into various financial ratios to help investors better understand and review the various aspects of a company. Liquidity ratios are utilized by banks, lenders, and providers to decide whether a client can respect their monetary commitments. Profitability ratios are a class of financial metrics that are used to assess a business's ability to generate earnings relative to its revenue, operating costs, balance sheet assets, or.

The formula is the gross margin, divided by sales. The quick ratio is also called the acid test. This financial ratio measures the relative inventory size and influences the cash available to pay liabilities.

It is useful for evaluating the total profitability of a company’s products and services. (investors might also refer to net profit as net income.) eps example: So, assume a company has a net profit of $2 million, with 12,000,000 shares outstanding.

It's another measure of liquidity. 5 essential financial ratios for every business 1) liquidity ratios. What are financial ratios?