Neat Info About Another Name For Balance Sheet In Accounting Delta Corp

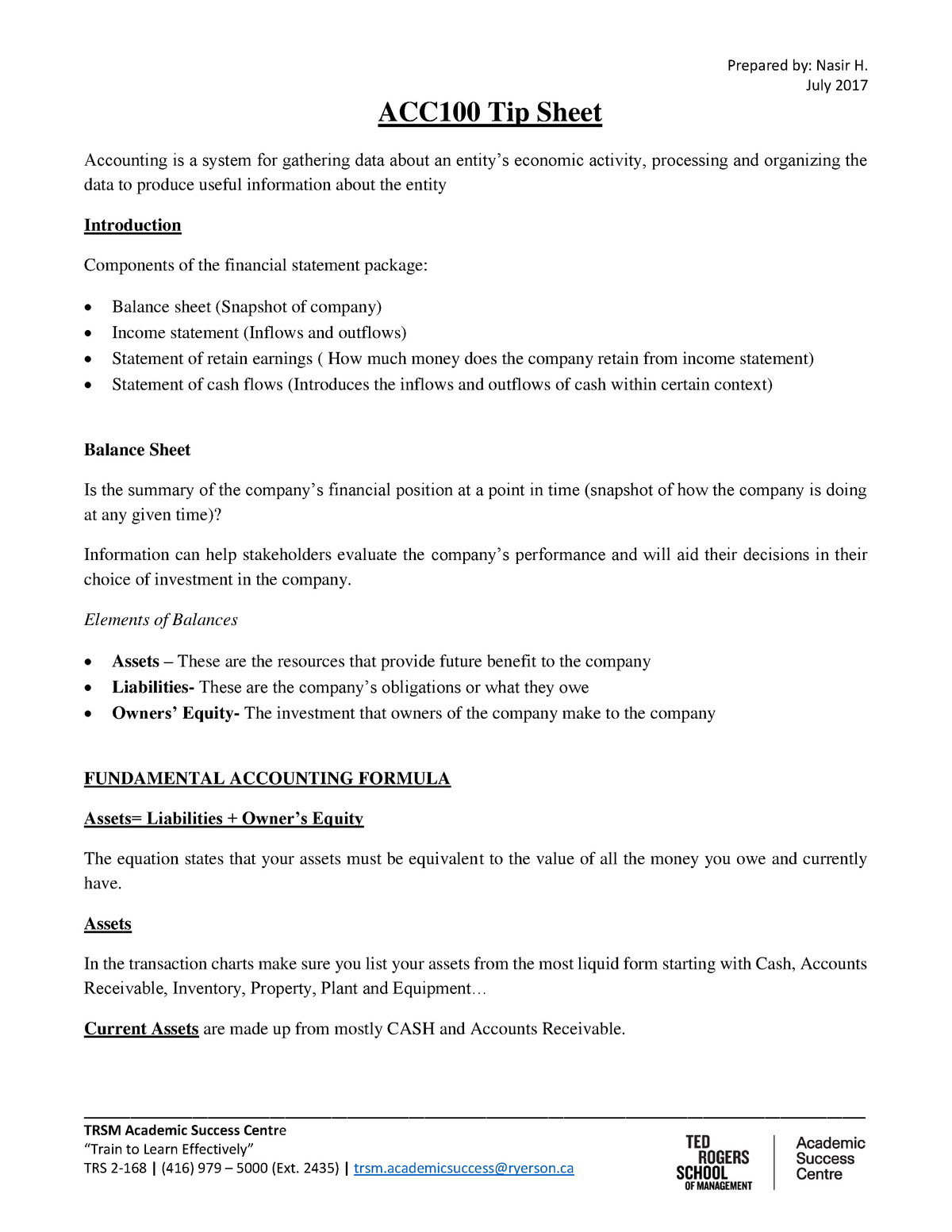

The three financial statements are:

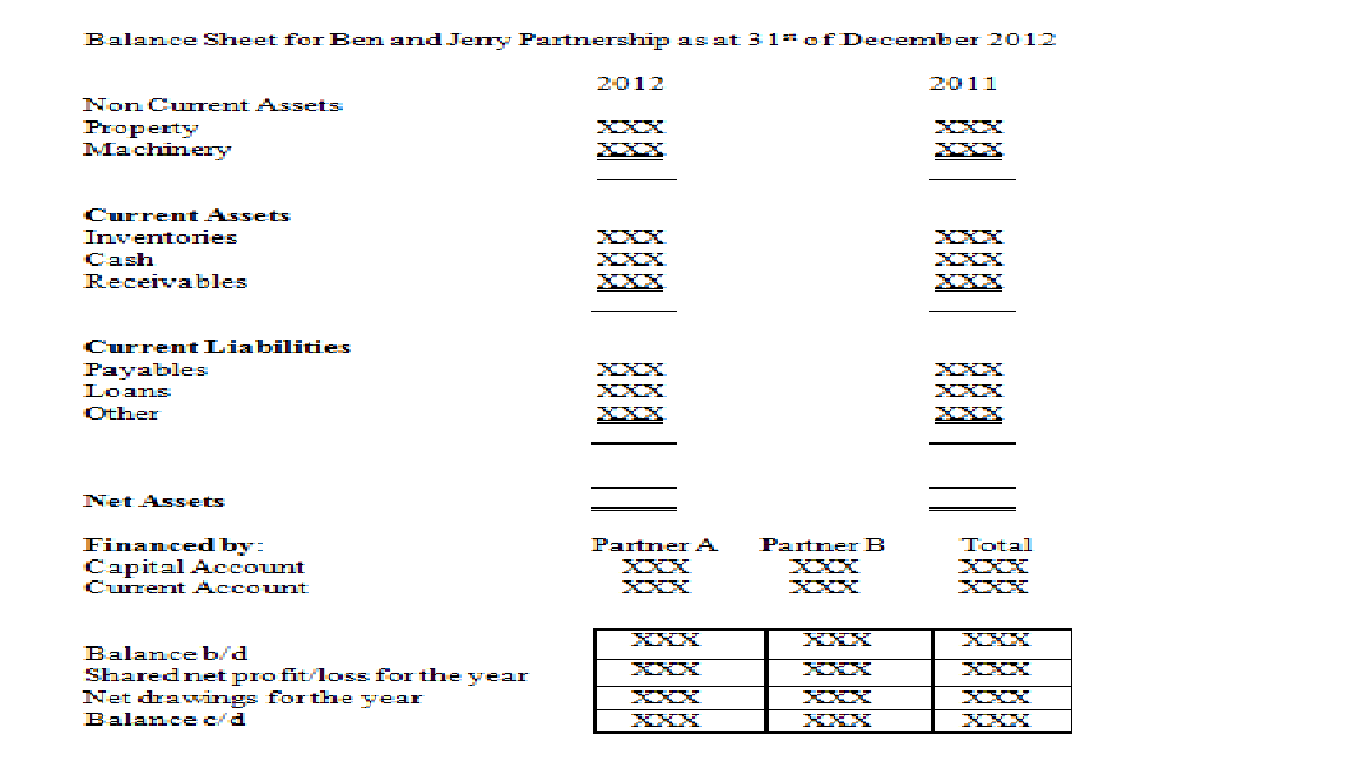

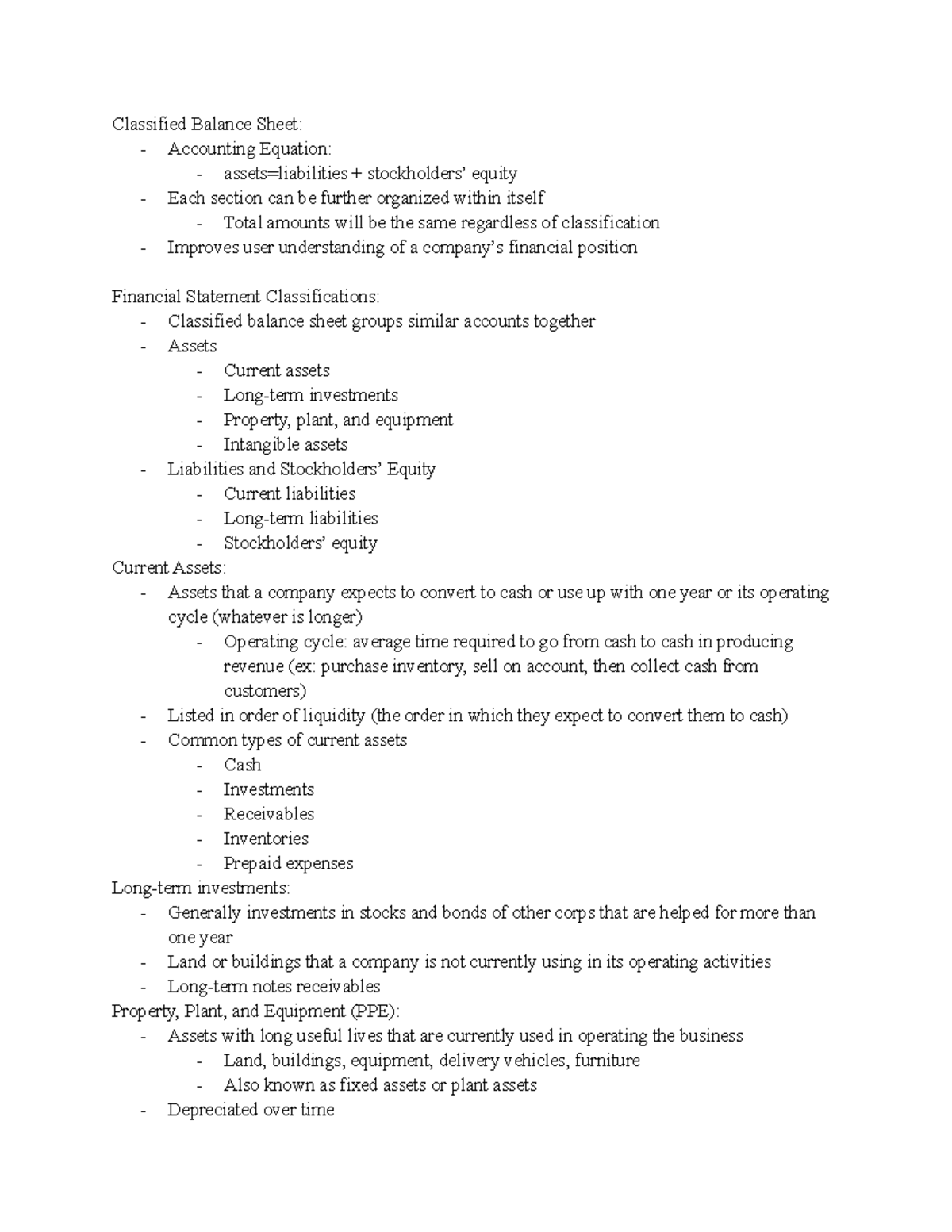

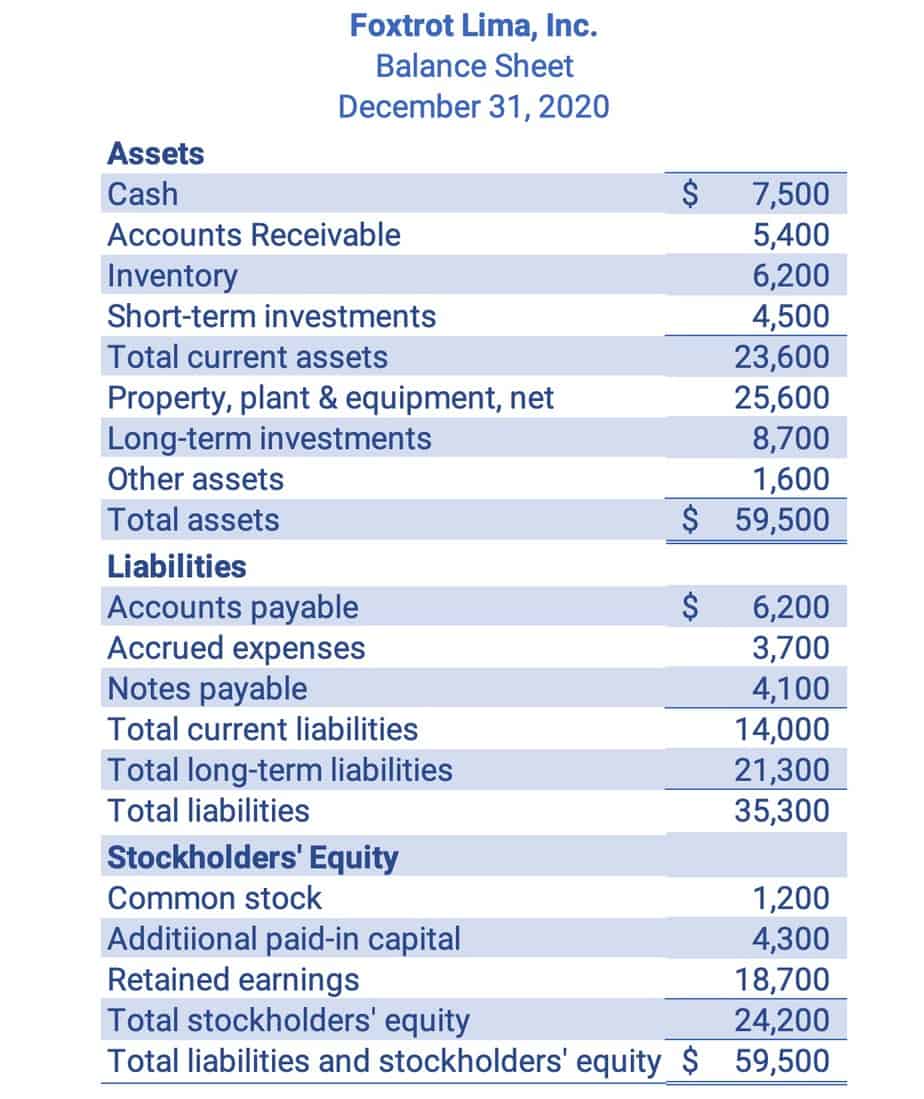

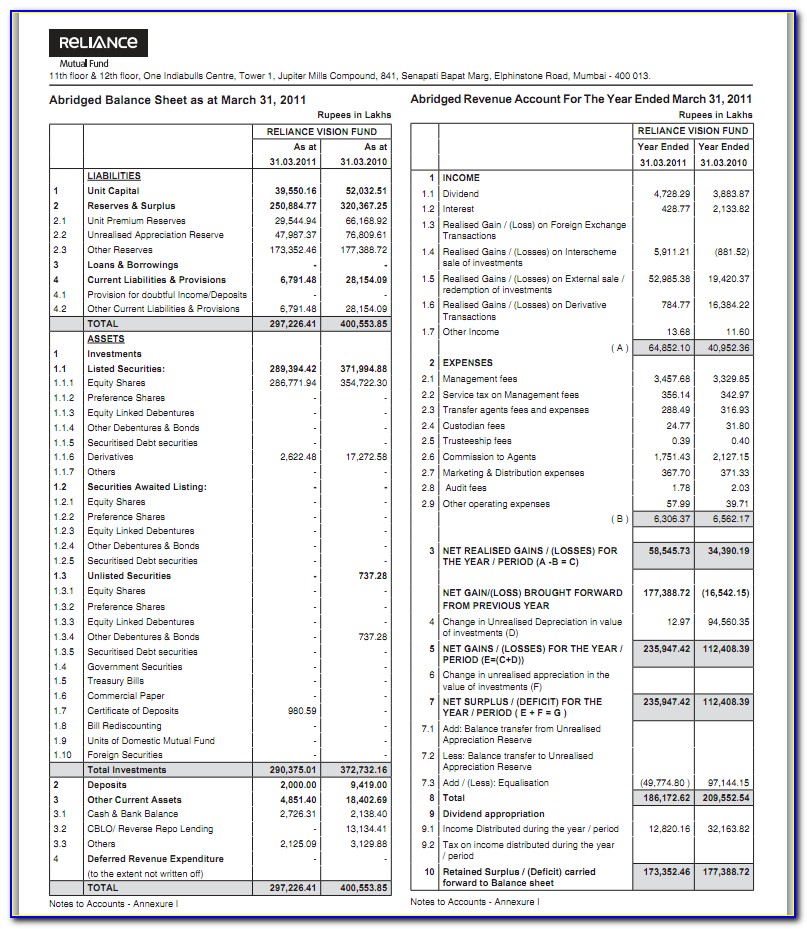

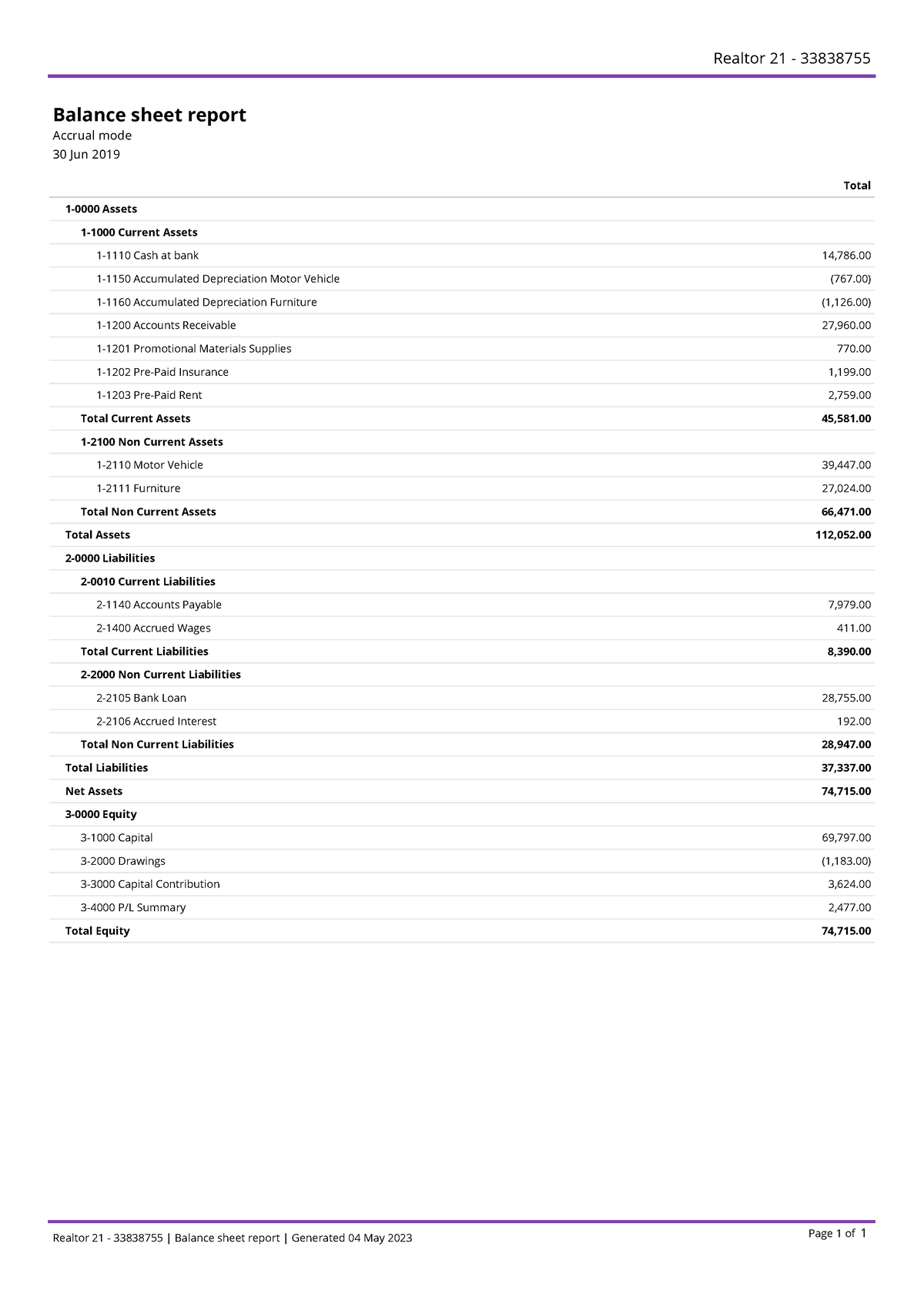

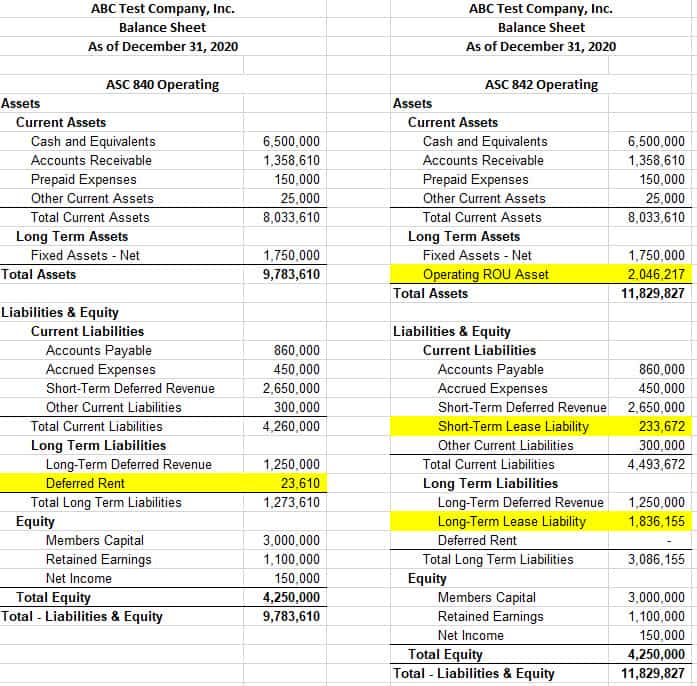

Another name for balance sheet in accounting. Another name for an accounting balance sheet is the statement of financial position. The balance sheet is a report that summarizes all of an entity's assets, liabilities, and equity as of a given point in time. It is based on a fundamental accounting equation which is;

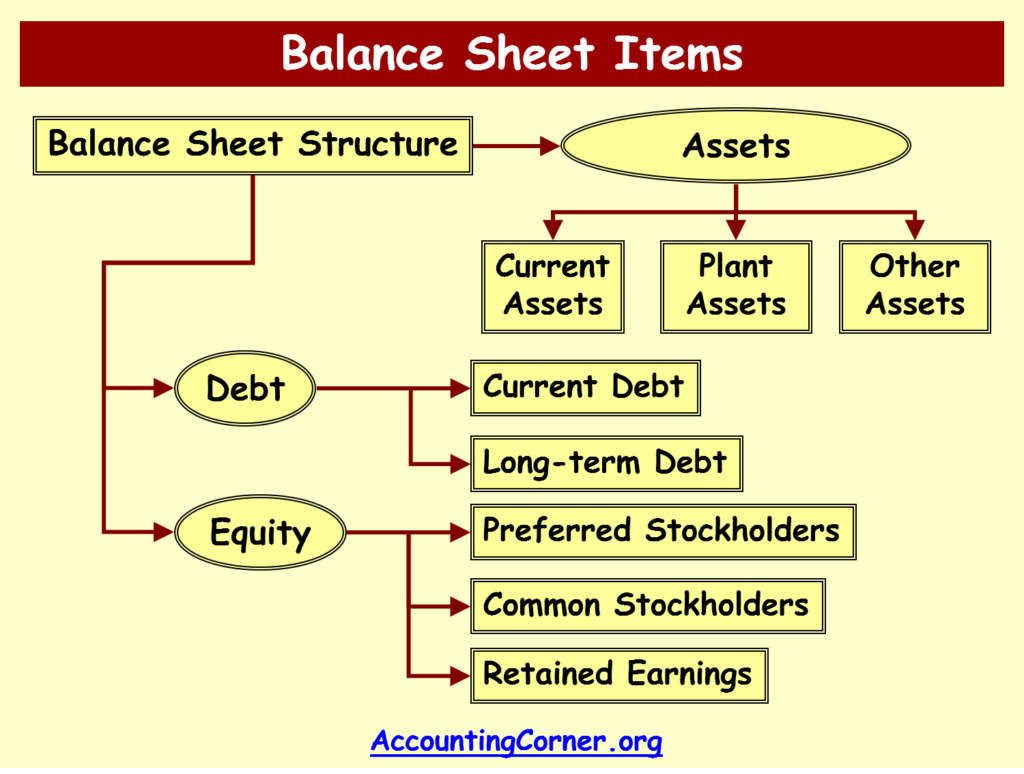

Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. Instead, they carry balances forward from year to year. Balance sheet accounts are used to create the balance sheet report.

The budgeted balance sheet is the same as your current balance sheet, except that it reflects an estimate for future budget periods. In accounting, the balance sheet is considered one of the main reports included in the financial statements, along with the income statement and the cash flow statement. A balance sheet is a financial statement that reports a company's assets, liabilities and shareholder equity at a specific point in time.

The balance sheet is based on the fundamental equation: It is typically used by lenders, investors, and creditors to estimate the liquidity of a business. Because it summarizes a business’s finances, the balance sheet is also sometimes called the statement of financial position.

A balance sheet account can be classified as either an asset , liability , or equity account. Assets = liabilities + equity the above equation means that at any point in time, a business’s assets should be equal to its liabilities and equity. It can also be referred to as a statement of net worth or a statement of financial position.

A balance sheet represents a company's financial position for one day at its fiscal year end, for example, the last day of its accounting period, which can differ from our more familiar calendar year. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. Assets = liabilities + equity.

(1) the income statement, (2) the balance sheet, and (3) the cash flow statement. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Therefore, it shows you where your balance sheet accounts will be at the end of future accounting periods, if you stick to your current budget.

On the balance sheet, we can find information about the assets, liabilities and shareholder’s equity of. Few other names of a balance sheet are statement of financial position, statement of financial condition or statement of net worth. Determine the reporting date and period.

The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Another term for balance sheet.

The income statement illustrates the profitability of a company under accrual accounting rules. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. There are several balance sheet formats available.

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)