Top Notch Tips About Meaning Of Provision For Doubtful Debts Daraz Financial Statements

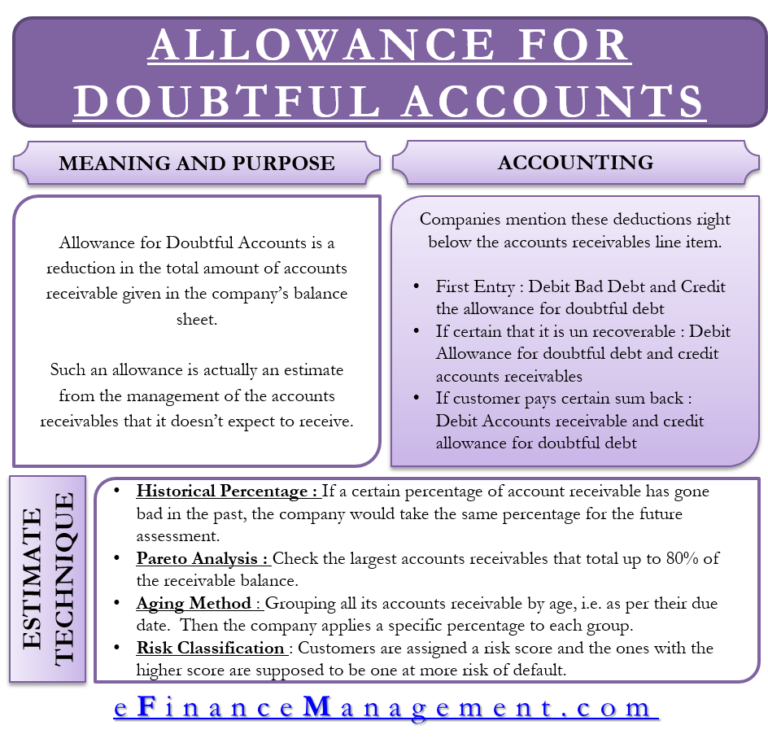

The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for.

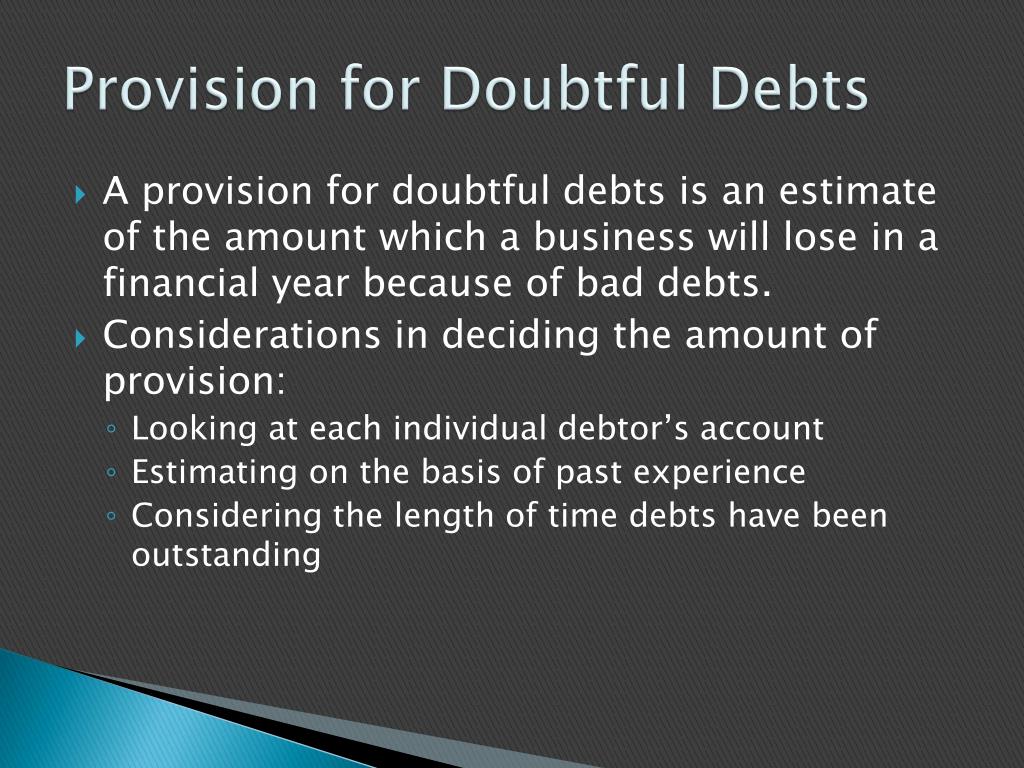

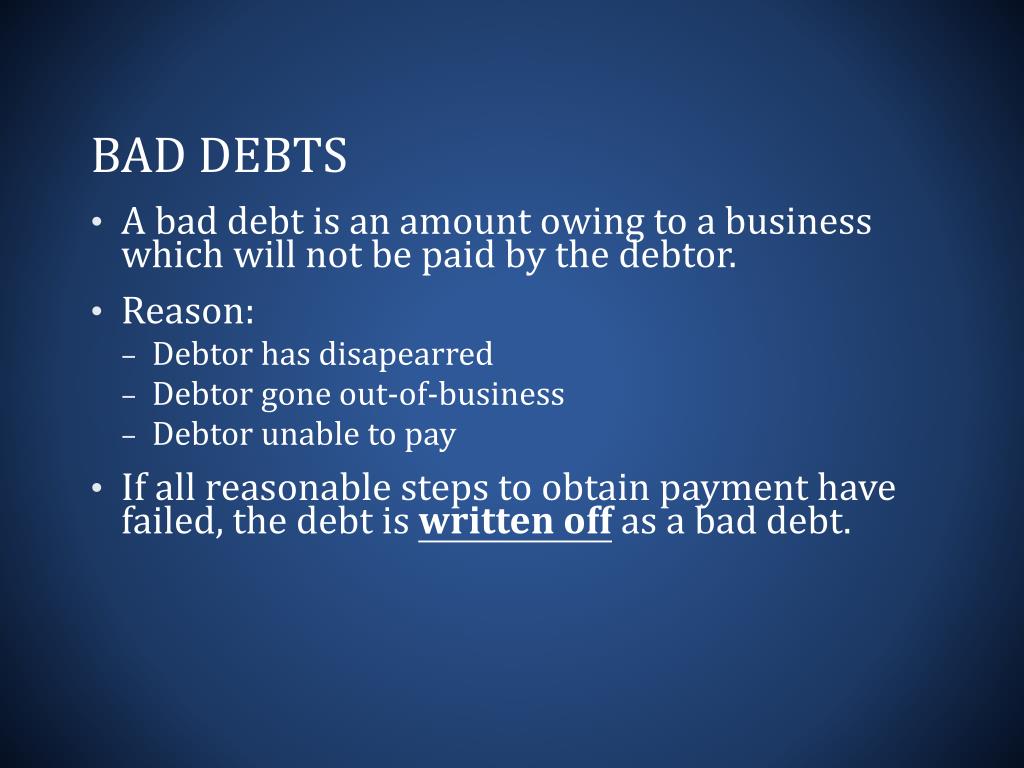

Meaning of provision for doubtful debts. The definition for the provision for bad debts, or otherwise known as doubtful debts, is the estimated amount of bad debt that will arise from the trade. Debt recovery the amount is credited. Provision for doubtful debt is created which is a charge against profit that may cover the loss if the doubtful debt turns out as bad debt.

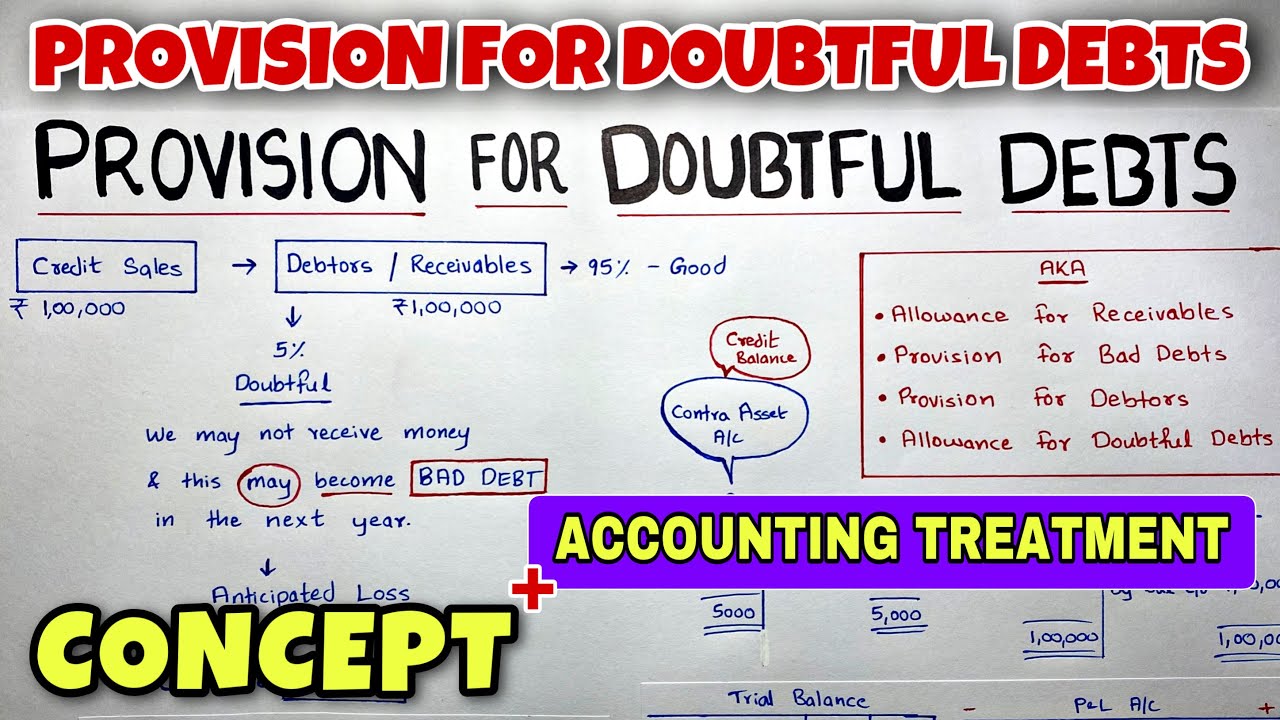

The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been. Accounting for doubtful debts. Provision for doubtful debts, on the one hand, is shown on the debit side of the profit.

The allowance for doubtful debts is created by. The term provision for doubtful debts refers to the estimated (or) predicted value of bad debts that arises from the sundry debtors that have been issued but have turned out to. The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of.

The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accounts. The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of. The amount of bad debt to result from issued but uncollected accounts.

Recoverability of some receivables may be doubtful although not definitely irrecoverable. The provision for doubtful debts is the estimated amount of bad debts which will be uncollectible in the future. Provision for doubtful debts let us first look at the provision of doubtful debts meaning.

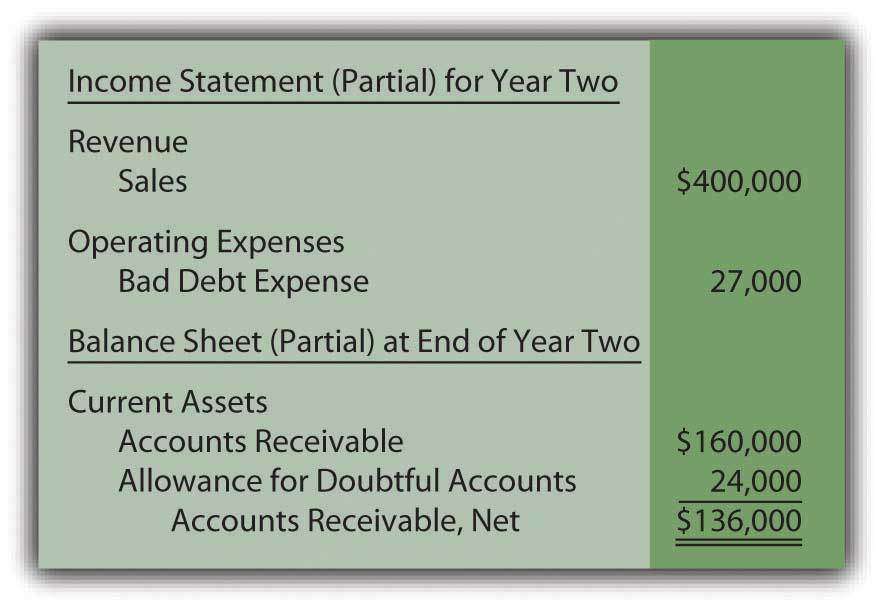

If a creditor has a bad debt on the books, it becomes uncollectible. New provision for bad debts is deducted from debtors in balance sheet. The provision for doubtful debt is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected.

During the first year, there is no need to worry about an increase or decrease in provision for doubtful debts. The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the. Bad debt is an amount of money that a creditor must write off if a borrower defaults on the loans.

When certain bad debts are to be written off and a provision for doubtful debts is to be made, the amount should be first debited against the existing balance of provision and. However, in any subsequent years, you will need to. If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as an.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)