The Secret Of Info About Prepaid Rent In Cash Flow Statement Hilton Hotel Financial Statements

December 31 2016 2015 trade debtors €34,130.

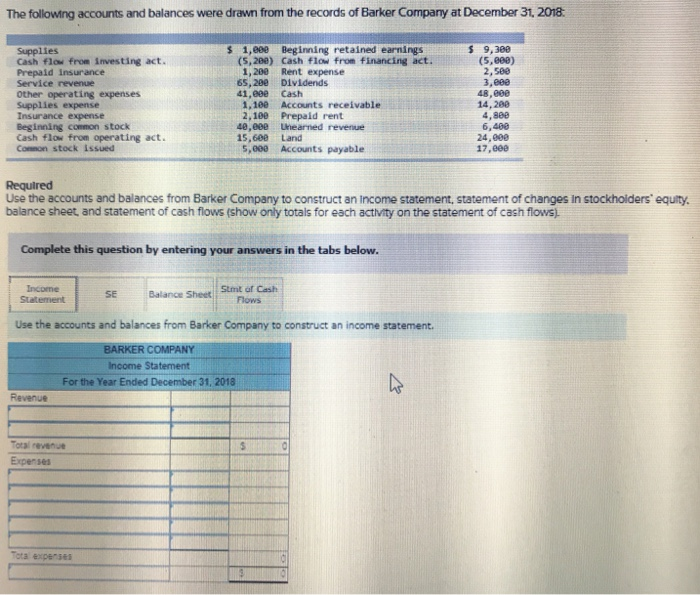

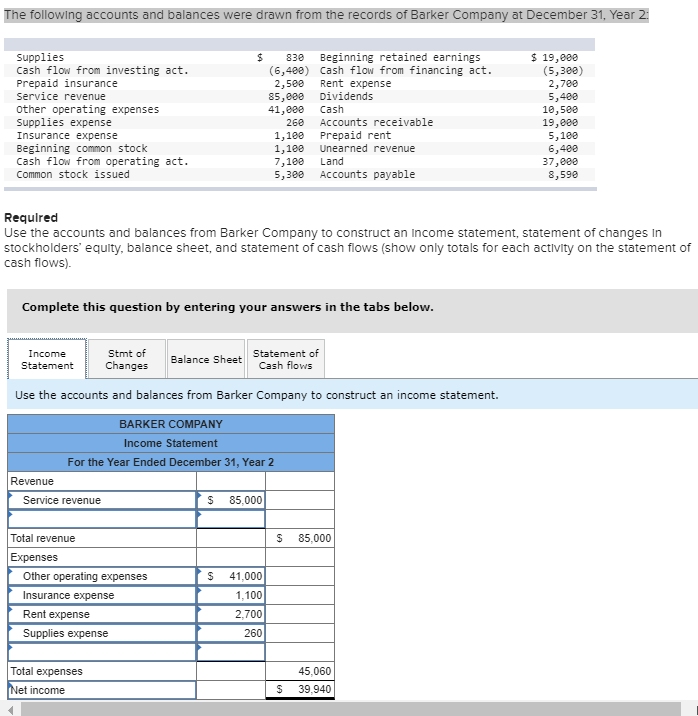

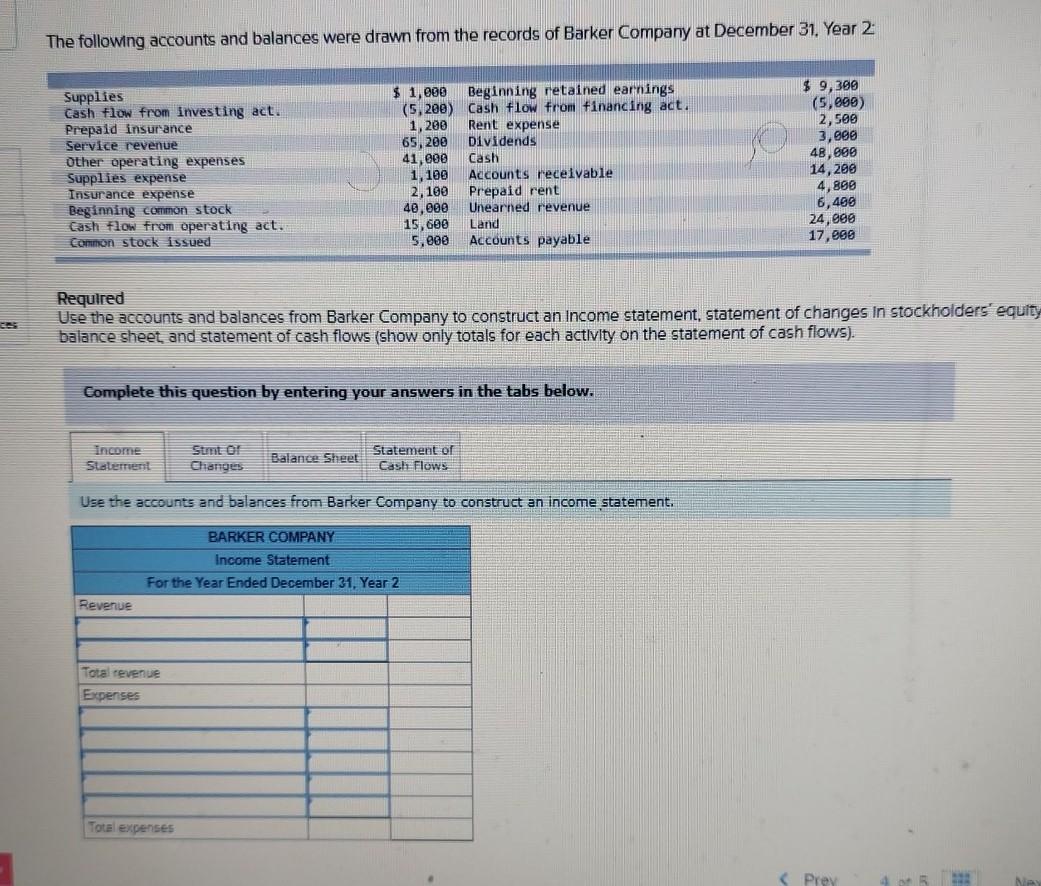

Prepaid rent in cash flow statement. 7 rows prepaid rent is the amount of cash paid to the landlord in advance. Cash flow from operations: December 01, 2023 overview of prepaid rent accounting prepaid rent is rent paid prior to the rental period to which it relates.

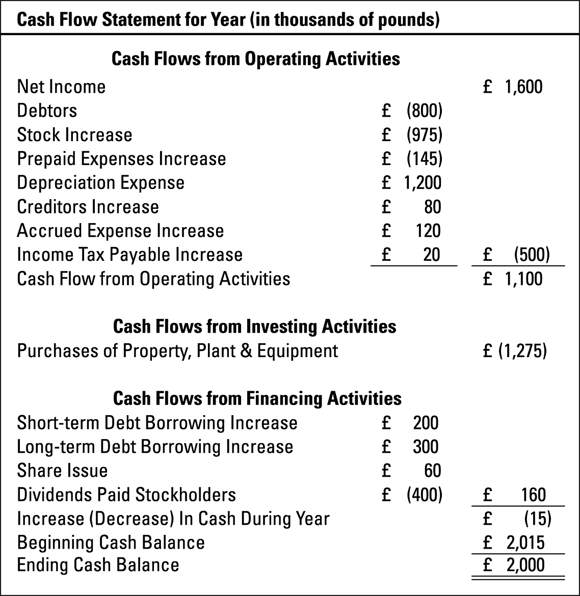

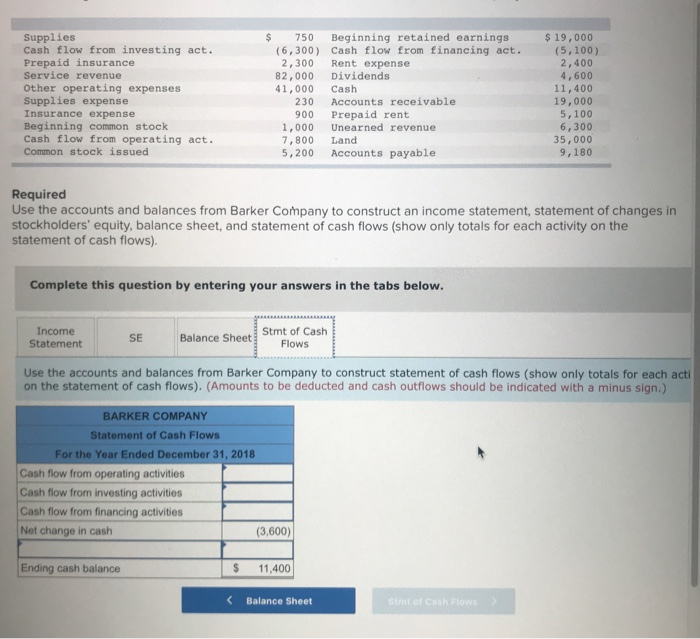

This connector account is an asset. The cash flow statement paints a picture as to how a company’s operations are running, where its money comes from, and how money is being spent. The second entry, however, does affect both the income statement and the balance sheet.

We will look at each section of the statement of cash flows and put them all together at the end. To arrive at the net cash flows from operating activities, the cash inflow or outflow relating to each must be determined. Prepaid expenses refer to advance payments for business expenses, while debts owed by a company in the course of its trade are called accounts payable.

Prepaid rents become a part of the cash flow statement when paid. Prepaid rent is rent paid in advance of the rental period. Income statement by crediting prepaid.

Adjusting journal entry as the. Prepaid rent refers to the advance payment made by a tenant to a landlord for renting a property. In particular, the gaap matching principle.

An increase in any prepaid expense shows that more of the asset was acquired during the year than was consumed. 16.3 prepare the statement of cash. Rent expense was reported as $30,000.

For payments made by a lessee that are accounted for as prepaid rent,. For example, there is no point in recording prepaid rent for a rent payment made at the beginning of the month but then utilized during the month—unless you issue. Preparing a statement of cash flow.

If the lessor reimburses the lessee for the lessor asset, it is recorded as a reduction to the prepaid rent. And as a result, we have a $5,300 increase in prepaid expenses and other changes as in the table below: Cash payments for prepaid assets = + ending prepaid rent, prepaid insurance etc.

Prepaid rent increased by $4,000 from the first of the year to the end. Prepare the cash flows from operating activities section of cash flow statement by direct method using the following information: The prepaid expense line item represents payments made in advance, so the current asset remains until the associated benefits are realized.

However, this payment must occur through cash and cash equivalent resources. The journal entries for prepaid rent are as follows: On the income statement, rent expense is recorded, which increases expenses, and in.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-04-59546336082445fa8db2dd9bbfcf58cb.jpg)