Top Notch Tips About Reserve For Doubtful Debts In Balance Sheet What Are Capital Expenditures On

The bad debt reserve is the amount of.

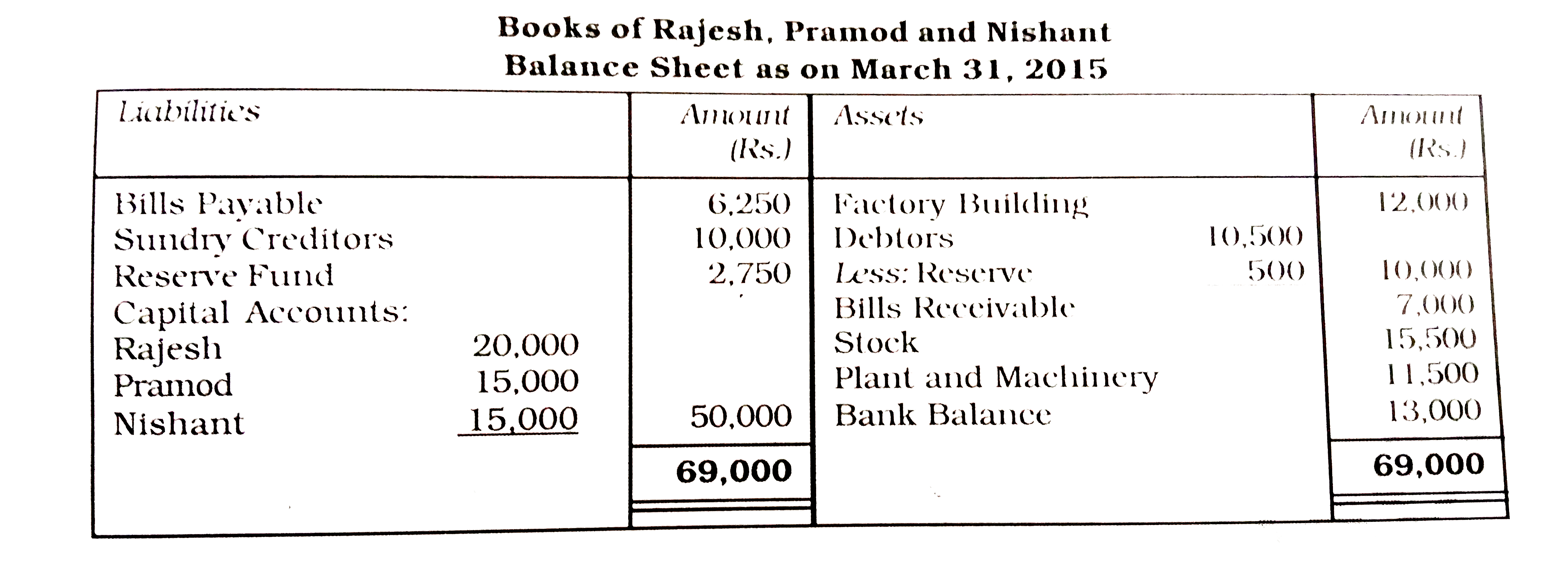

Reserve for doubtful debts in balance sheet. Enhance the value of land and building by 20% and fix the value of the goodwill at ₹. Bad debt reserve, also called an allowance for doubtful accounts (ada), is a reduction in a company's accounts receivable. Example show treatment of provision for doubtful debts in the balance sheet of abc ltd.

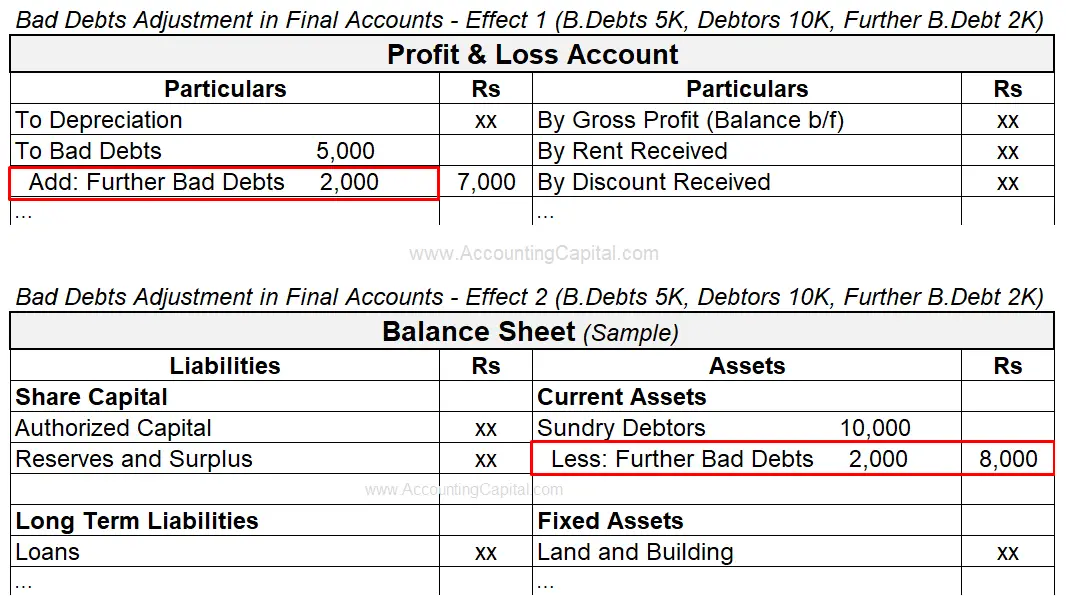

The bad debt reserve is designed to be an offset to the trade receivables account, with which it is paired on the balance sheet. Accountants now use allowance for doubtful accounts or allowance for bad debts instead of reserve for bad debts. The provision creating a bad debt reserve or allowance for doubtful accounts estimates the likely uncollectable payments from unpaid invoices.

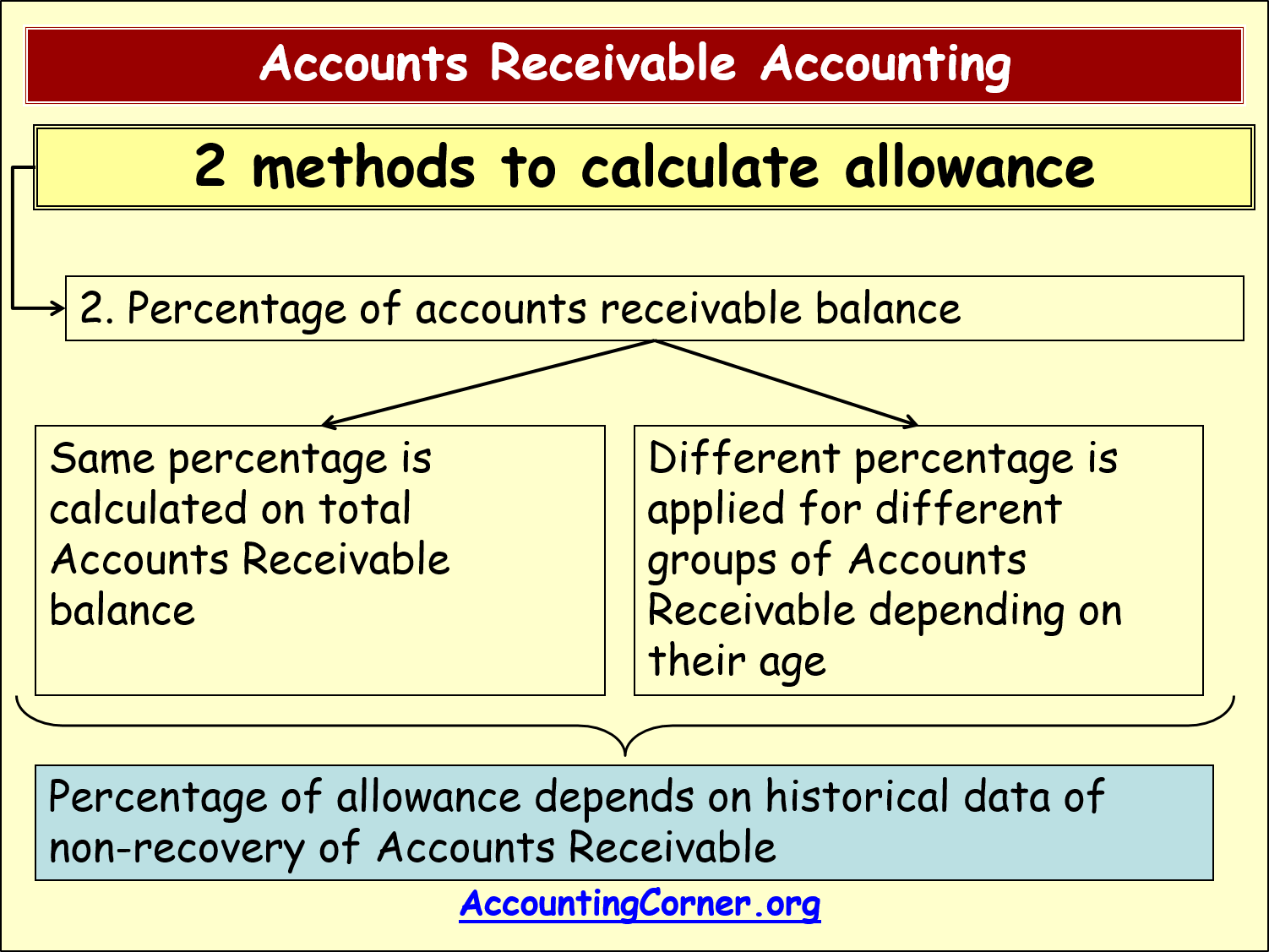

An allowance for doubtful accounts, also known as bad debt reserve, is money set aside by a company to cover receivables that might not be paid by their customers over a. The provision for doubtful debts is an accounts receivable contra account, so it should always have a credit balance, and is listed in the balance sheet directly below. It is deducted from the total accounts receivable on the balance sheet to show a more.

Reserve for bad and doubtful debts should be provided at 10% of the trade receivable. A bad debt reserve, also known as the allowance for doubtful accounts, is the amount of provision made by the company against the accounts receivable present in the books of. If the balance in the reserve is.

For a doubtful debt, create a reserve account (also known as a contra account) for accounts receivable that may eventually become bad debts, estimate the. The allowance for doubtful accounts, aka bad debt reserves, is recorded as a contra asset account under the accounts receivable account on a company’s balance. Allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet.

5% provision for doubtful debts is calculated on 500,000 (5% * 500,000 = 25,000) & deducted from sundry debtors. In the case of plant assets, accumulated depreciation is used. At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data.

The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s balance sheet.