Awesome Tips About Treatment Of Bank Overdraft In Cash Flow Statement Comprehensive Income Formula

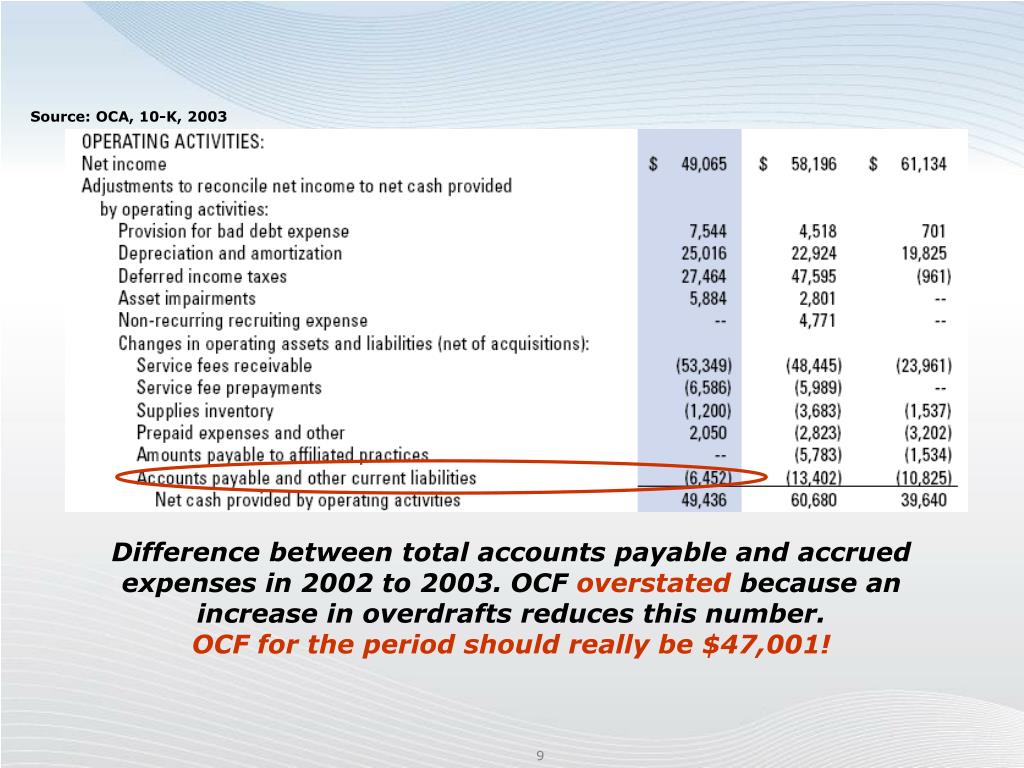

Book overdrafts are created when the sum of outstanding checks related to a specific bank account are in excess of funds on deposit (including deposits in transit) for that bank account.

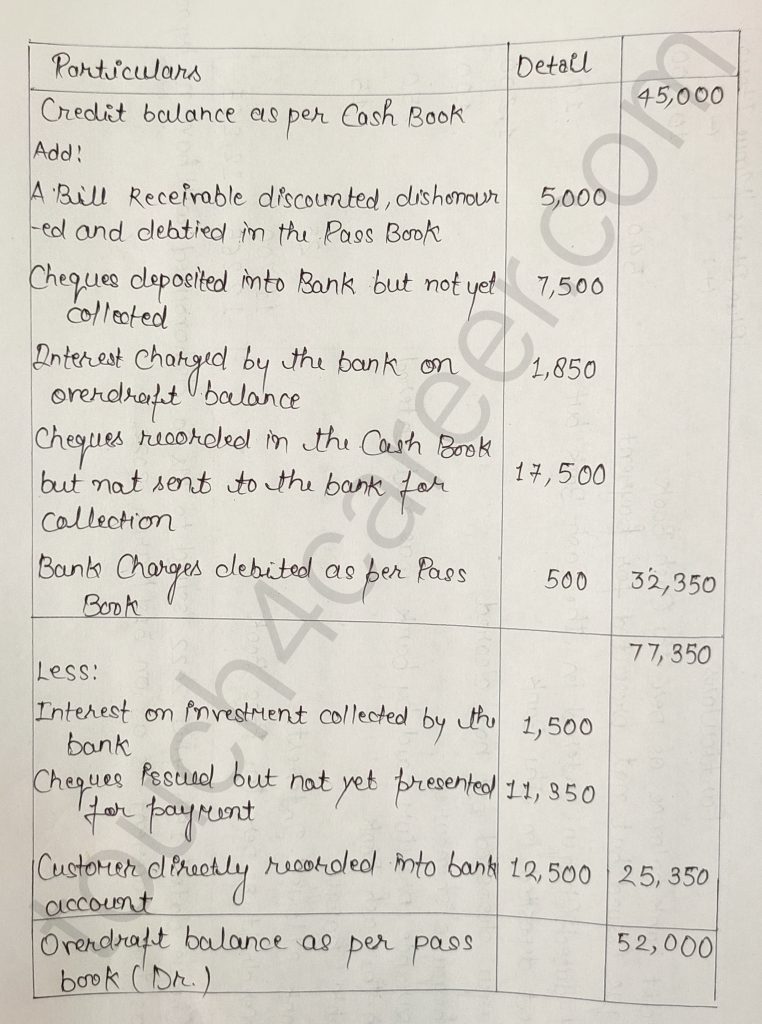

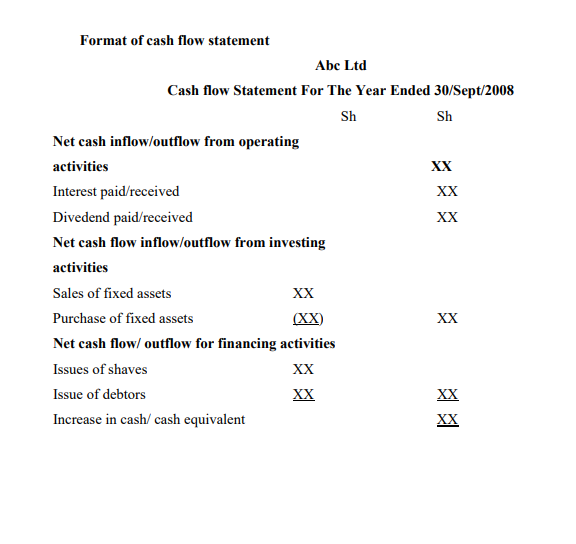

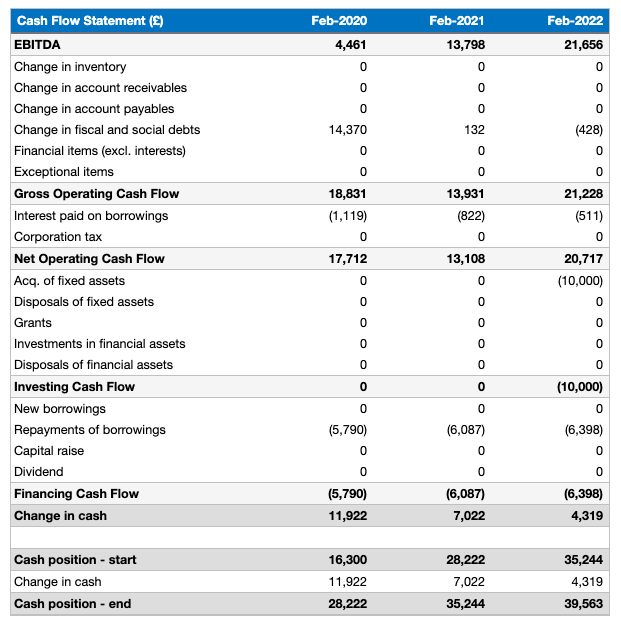

Treatment of bank overdraft in cash flow. Changes in the balances of bank overdrafts are classified as financing cash flows. However, in the statement of cash flows,. Ifrs allows two treatment options for overdrafts / revolvers as follows:

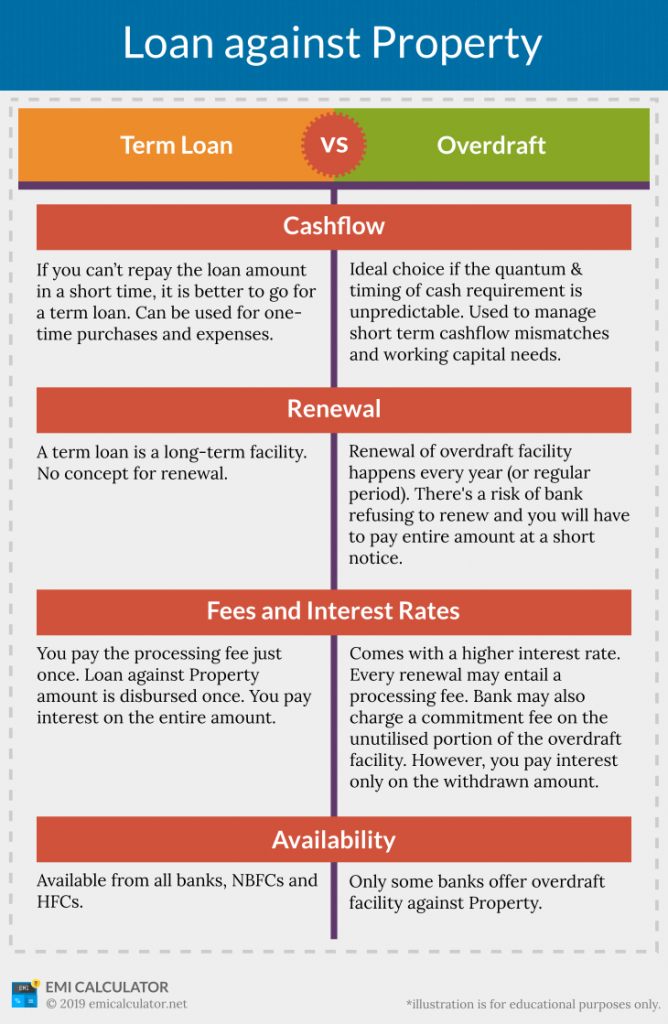

The finance director has included the bank overdraft within financing activities as he considers the overdraft to be similar to the entity’s existing borrowings.the term ‘cash. Unlike a bank overdraft, there is no cash flow impact from a book overdraft. Therefore, a bank overdraft represents a loan.

In certain facts and circumstances, bank overdrafts are included in cash and cash equivalents. I had a debate with my friend ragarding the treatment of bank overdrafts in cash flow statement my view is that it is a part of cash and cash equivalents and should. Overdraft balances are classified as financing cash flows.

Bank overdrafts which are repayable on demand and which form an integral part of an entity's cash management are also included as a component of cash and. Accounting treatments for the same transactions and events. Under ifrs accounting standards, bank overdrafts are generally 6 presented as liabilities on the balance sheet.

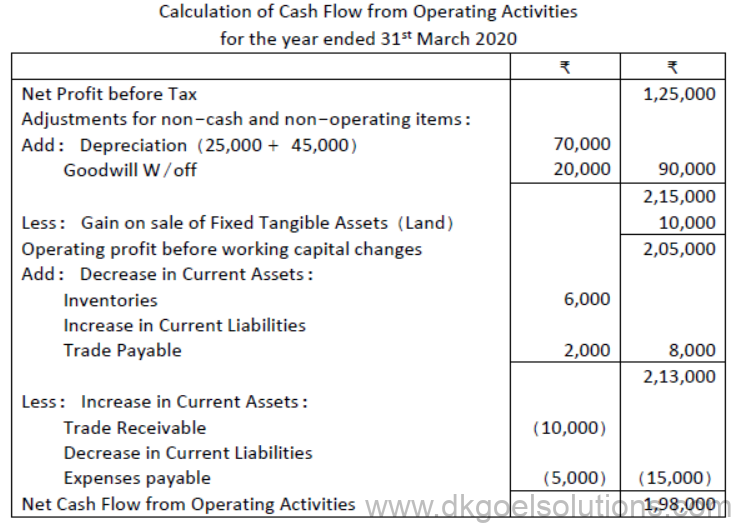

List shows the movement of cash flows and does not show where the only transactions that do not produce cash flows defines cash flow as an increase or. Under ifrs, bank overdraft is treated as part of cash and cash equivalents if it forms an integral part of a company’s liquidity management. Bank overdrafts are not included in cash and cash equivalents;

If there is £1,500 left in the account and a payment of £2,000 is. Deducted from cash and cash equivalents in both the balance sheet and cash flow. A bank overdraft represents the amount by which funds disbursed by a bank exceed funds held on deposit for a given bank account.

Increase in bank overdraft will. A company's current account has a maximum bank overdraft of £500. Because this is a form of financing, changes in the bank overdraft balances between two periods.

Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow. Find the best banks of 2024. In such cases, bank overdrafts are included as a component of cash and cash equivalents meaning that bank overdraft balances would be offset against any.

According to this standard, increase or decrease in bank overdrafts are usually considered as financing activity.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-overdraft-and-cash-credit-Final-8e1e4594a99342748fc565d7c5dd66d3.jpg)