Beautiful Info About Deferred Tax In P&l List Of Assets On A Balance Sheet

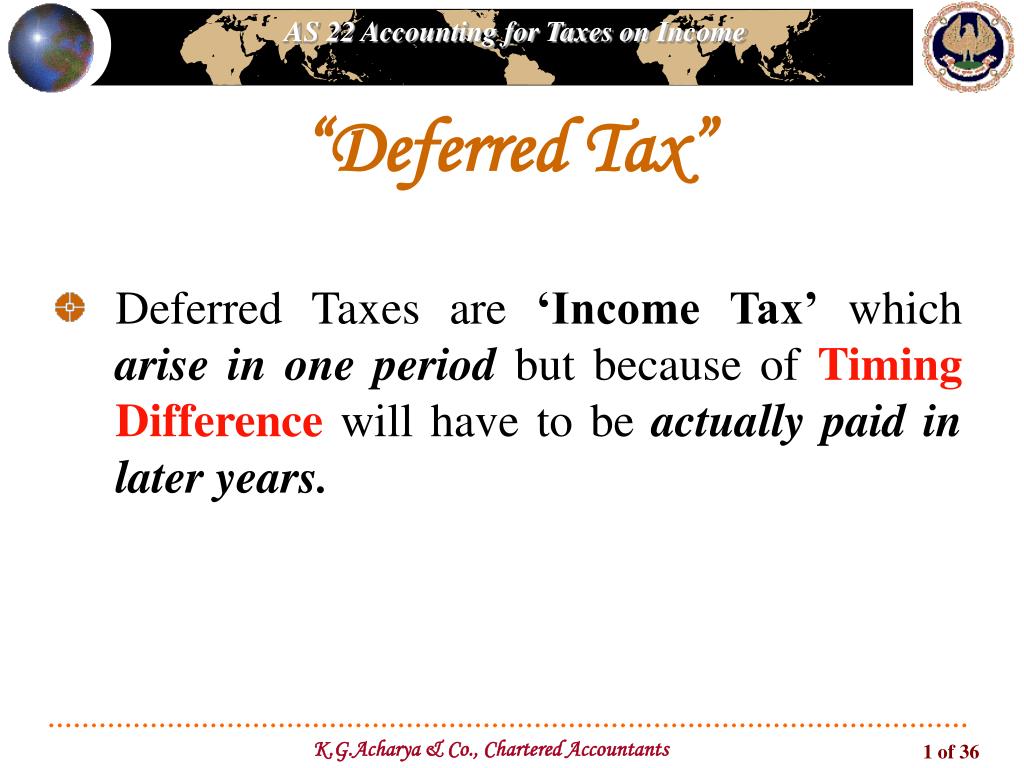

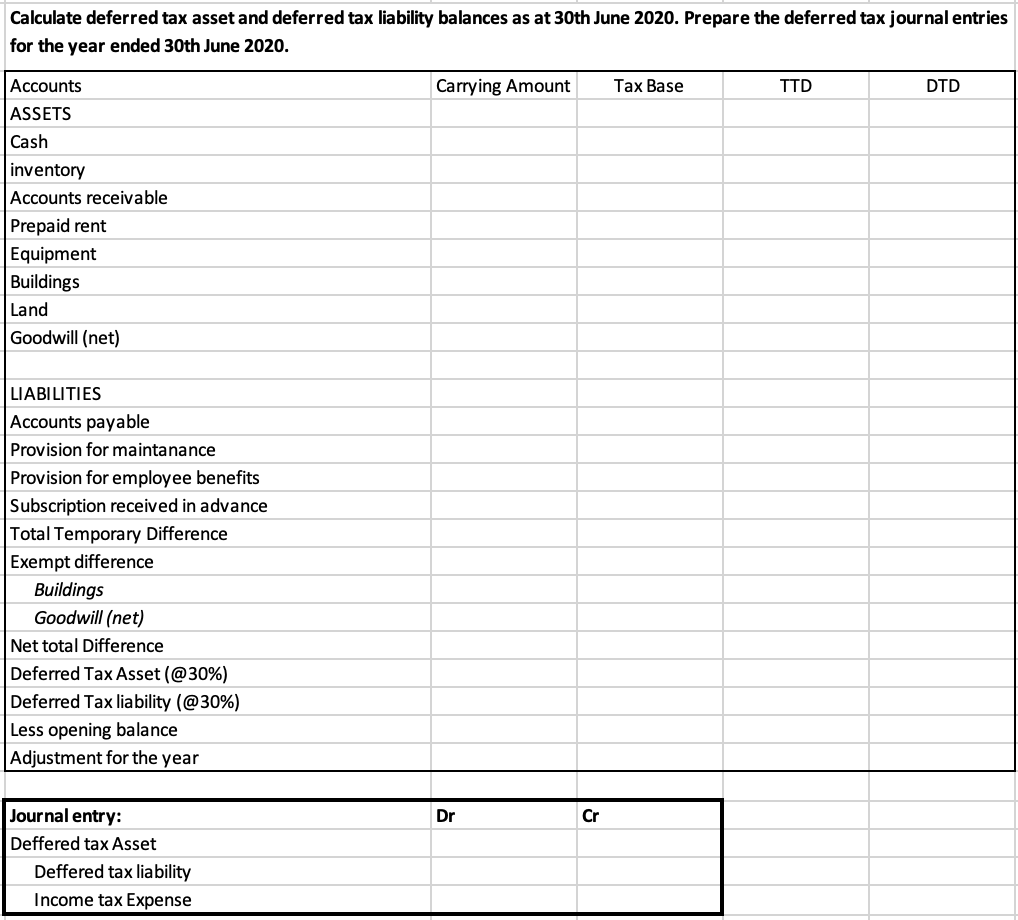

Ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable temporary differences.

Deferred tax in p&l. The basics deferred tax is accounted for in accordance with ias ® 12, income taxes. In fr, deferred tax normally results in a liability being recognised within the statement of financial position. When an item is recycled from oci to p/l, the tax impact is recycled likewise, a practice that is widely accepted though not explicitly covered in ias 12.

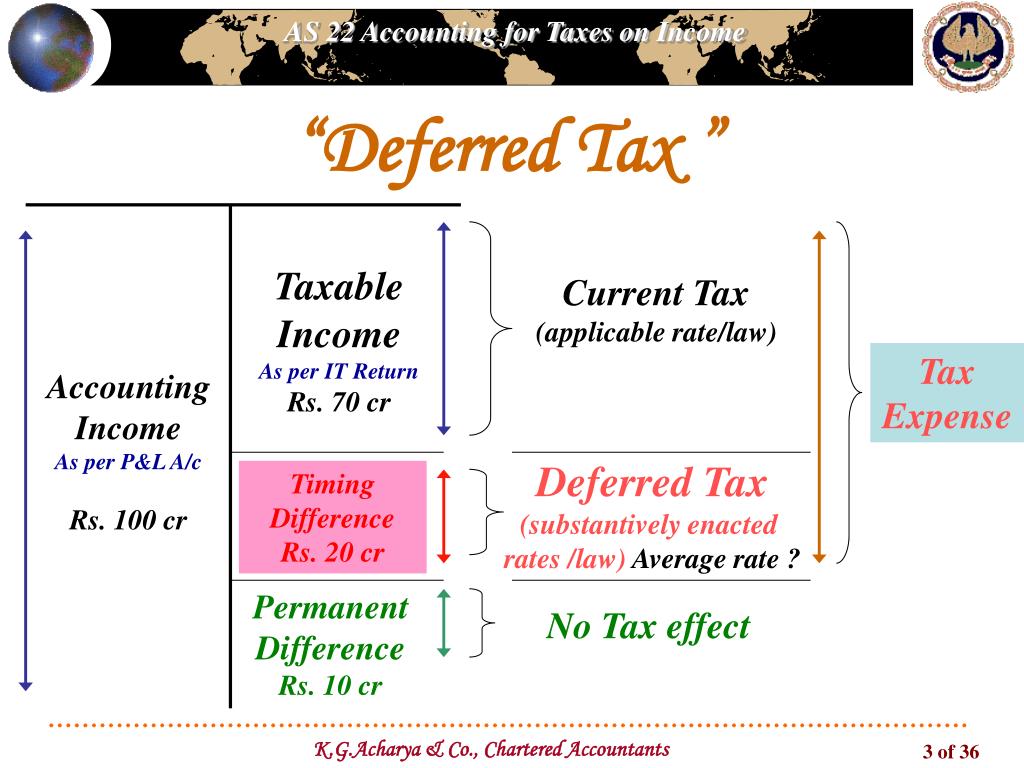

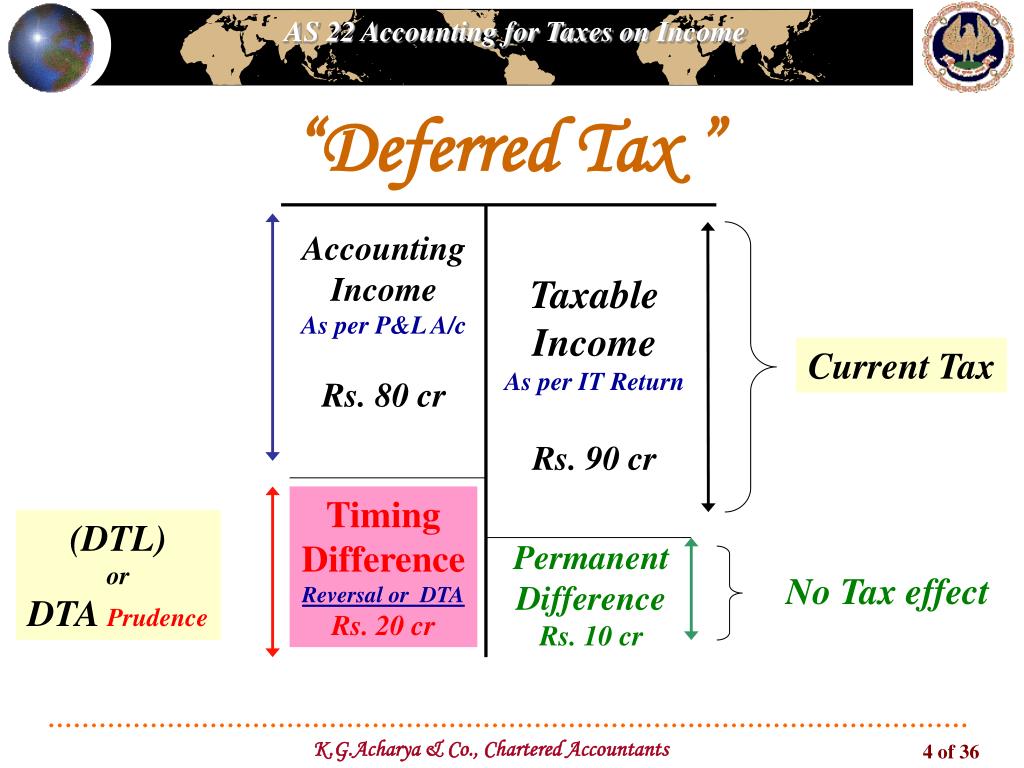

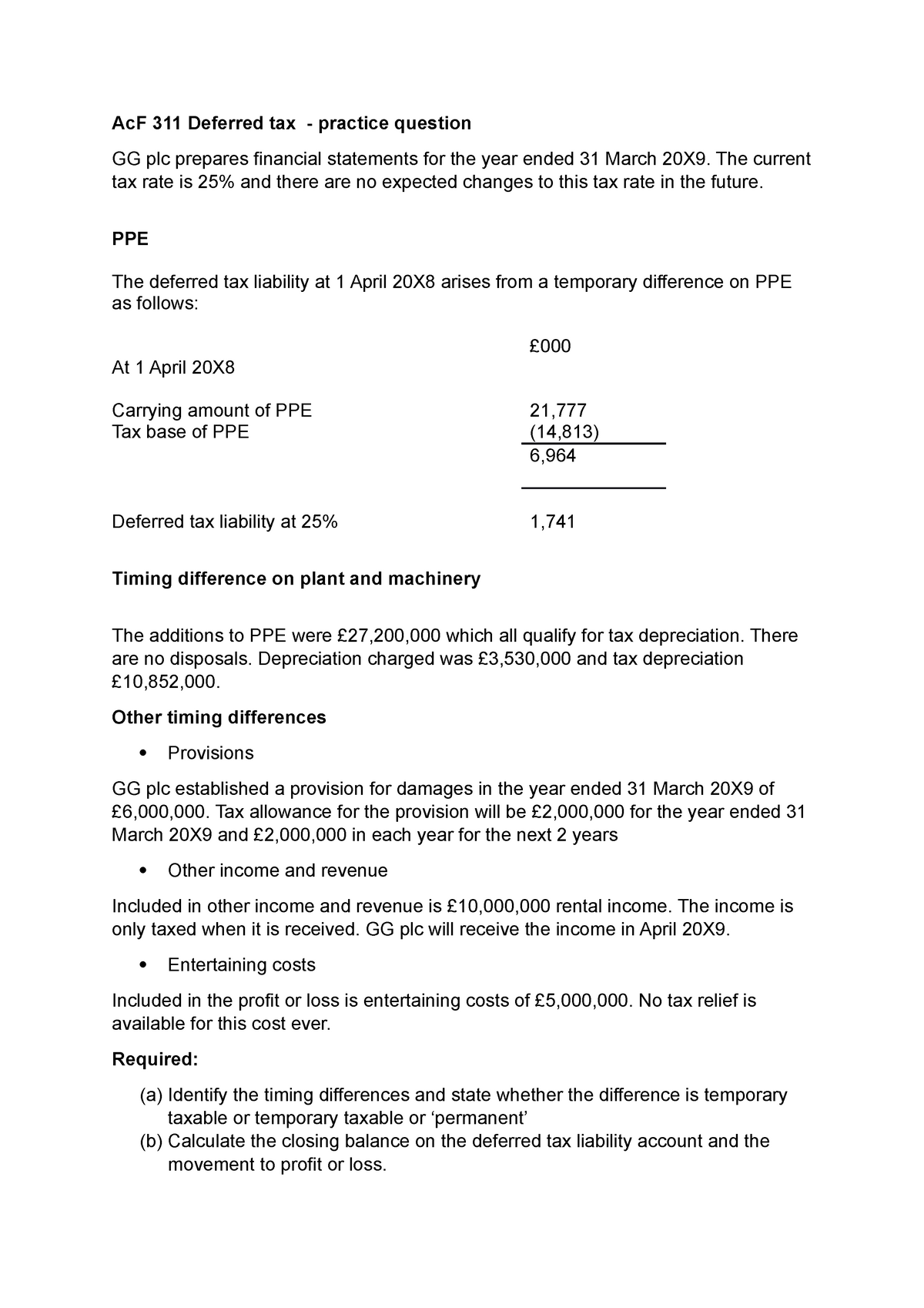

There are controversies if deferred tax liability debited to p&l should be added to the book income for the purpose of mat calculation. Deferred tax is a topic that is regularly tested in financial reporting (fr) and is often tested in further detail in strategic business reporting (sbr). Part of this accounting perspective is known as either a permanent or a temporary difference.

Exceptions to paying taxes on cd interest. Net book value of assets in accounts is £2000 pool value of assets in tax comp is £1000 deferred tax to charge to p&l is £1000 x 20% = £200 in essence the company has reduced tax bill by £200 because it claimed additional capital allowances. Income received in advance these are called timing differences.

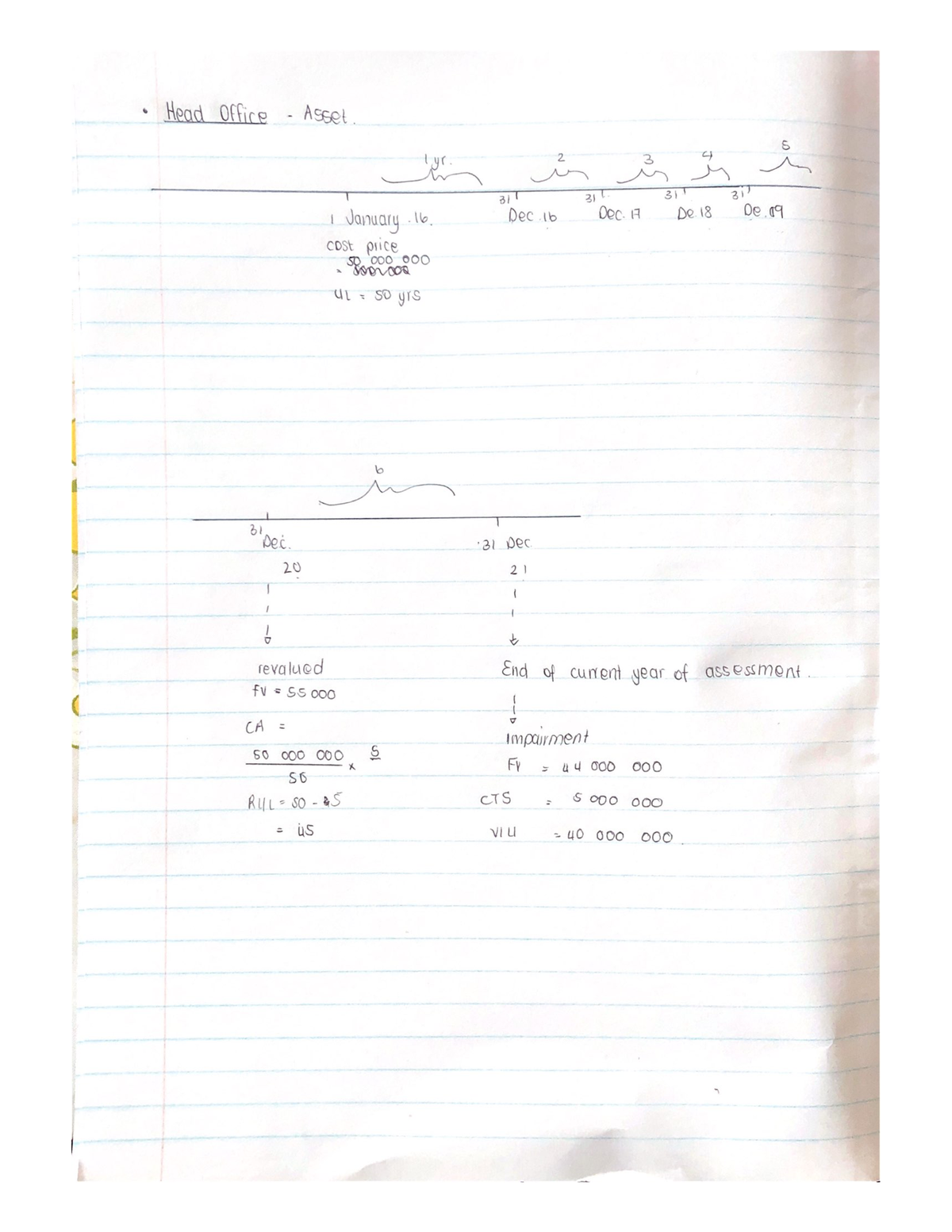

This is effectively the tax on the difference in treatment of the asset by the business and by the tax authority. To measure deferred tax using the tax rates and laws that have been enacted or substantively enacted by the reporting date that are expected to apply to the reversal of the timing difference (s) deferred tax to be calculated using the ‘timing difference plus’ approach. In certain circumstances, however, the change in deferred tax balances is reflected in other.

Deferred tax liabilities associated with investment in subsidiaries. It is possible to have both in the. 13th jan 2012 23:55 deferred tax very simple illustration:

Hence, an adjustment to the tax charge in the financial statements may be needed. The injunction, however, will be stayed until the us supreme court rules in a related case brought by missouri and louisiana. Following our successful webinar, senior tax lecturer, neil da costa, breaks down the tricky topic of.

The deferred tax liability or deferred tax asset is derived from the comparison of profit & loss. This article will consider the aspects of deferred tax that are relevant to fr. Simply put, deferred tax expenses are the reported income tax of a company or individual in the financial statement.

It can be different from the actual tax return resulting in liability or assets. Deferred tax credited to p&l etc. Unabsorbed depreciation or carry forward losses as per tax laws 3.

Section 29 of frs 102 requires: Won a preliminary injunction against the white house and other federal defendants in his suit alleging government censorship of his statements against vaccines on social media. The trial of a prominent city businessman, accused of tax evasion amounting to of shillings 9.6 billion, has been deferred until march 26, 2024.magistrate abert asiimwe, a senior principal grade.

02 september 2021 by neil da costa, senior tax lecturer kaplan has found that many students find deferred tax confusing. Deferred tax is the application of the accruals concept. It is reflected indirectly in the tax expense figure reported in the p&l statement, representing potential future tax obligations arising from temporary differences between accounting and tax treatments.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)