Outstanding Tips About Rental Profit And Loss Statement Definition Of Comprehensive Income

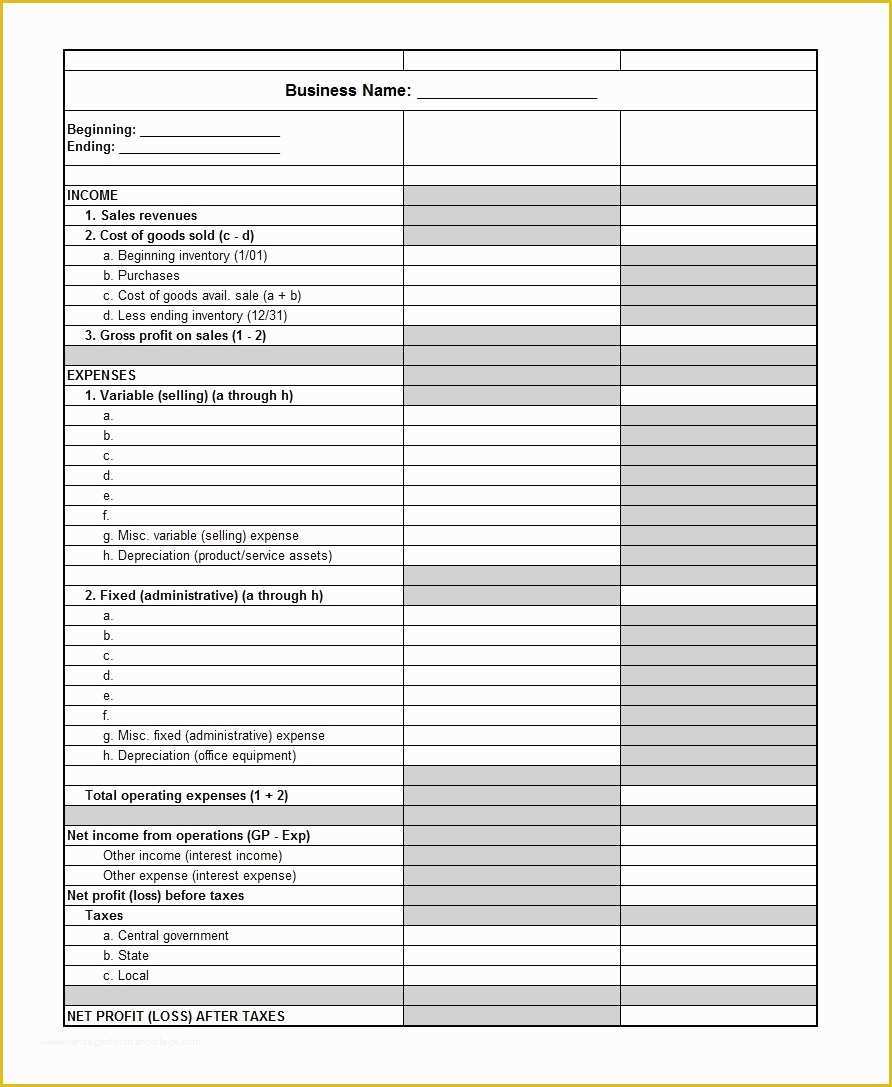

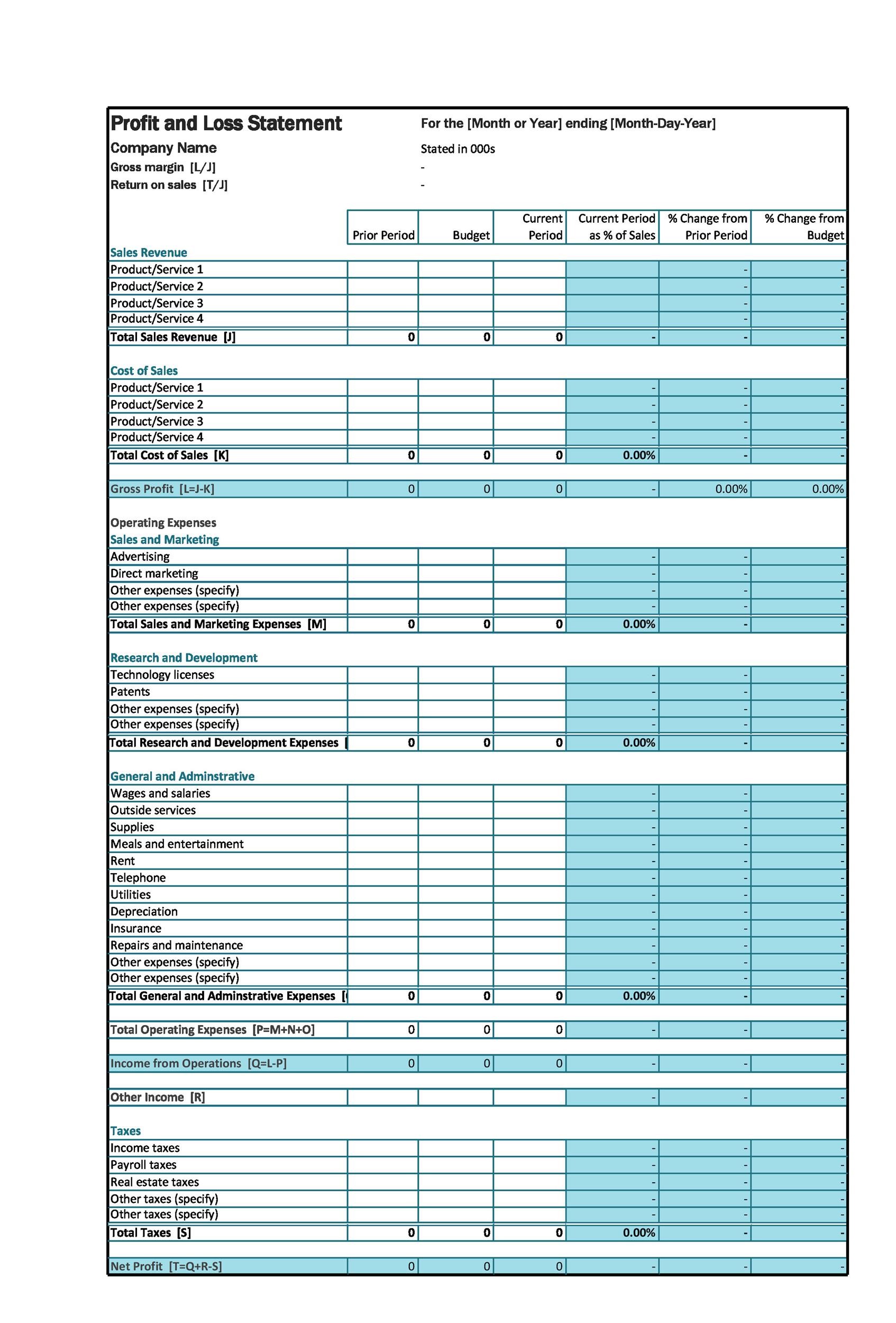

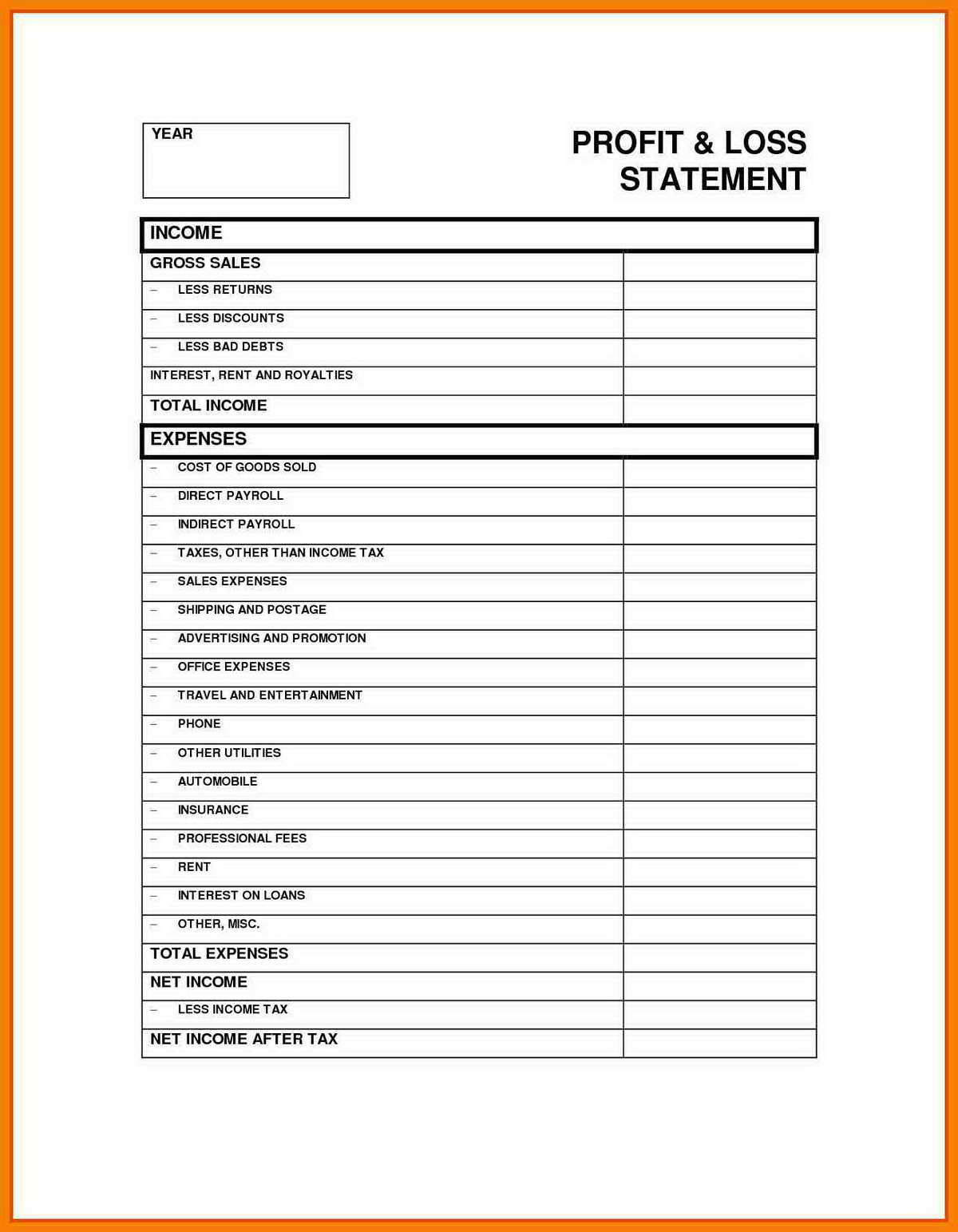

A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit.

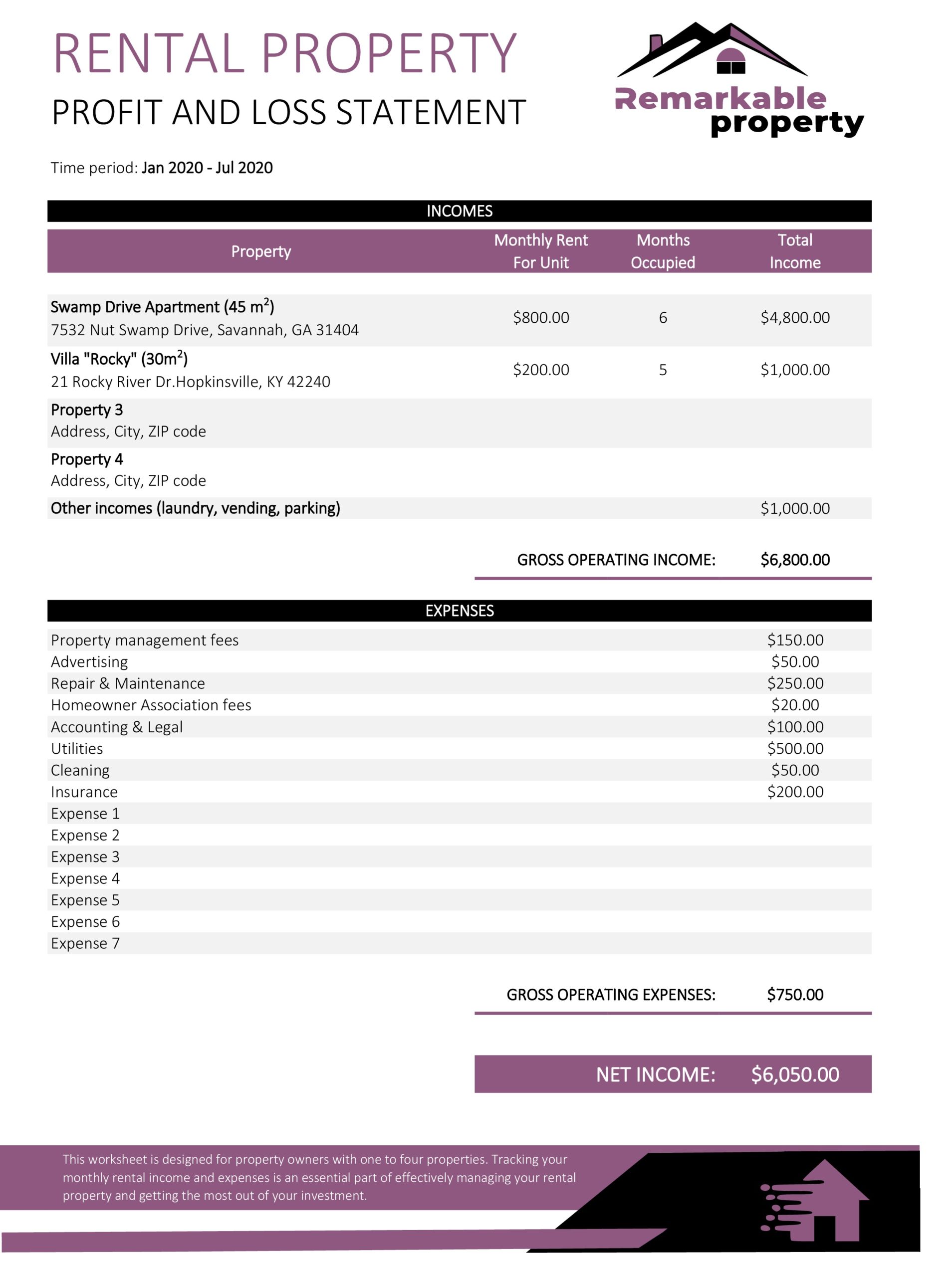

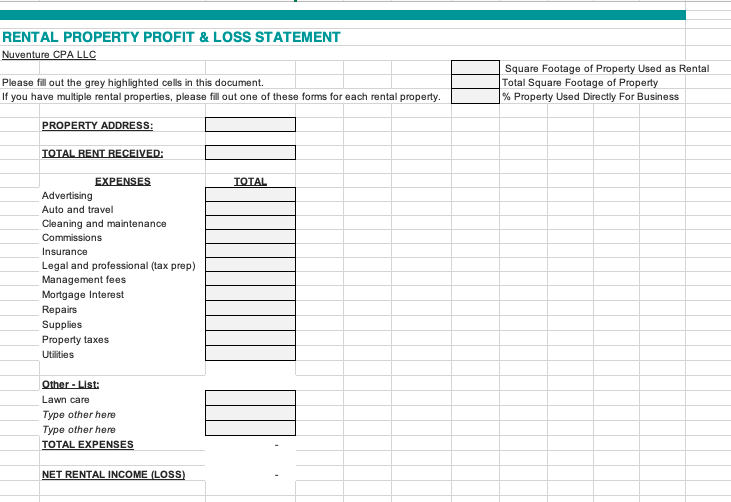

Rental profit and loss statement. A profit and loss statement for rental property is used by owners and property managers to track income and expenses and the corresponding profits (or losses). You’ll sometimes see profit and loss statements called an income. A profit and loss statement, often referred to as an income statement, is a fundamental financial document that every business, including rental property owners,.

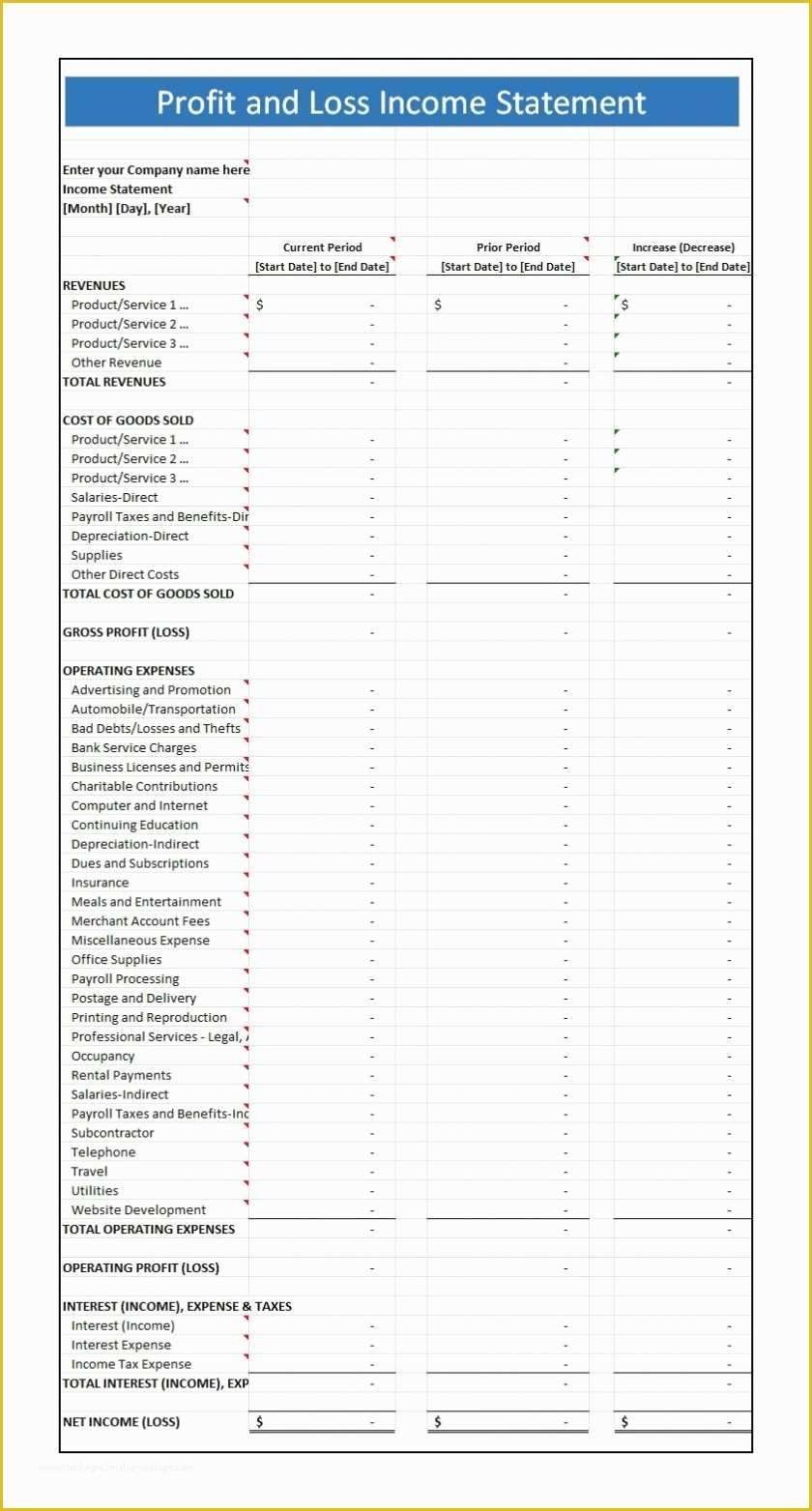

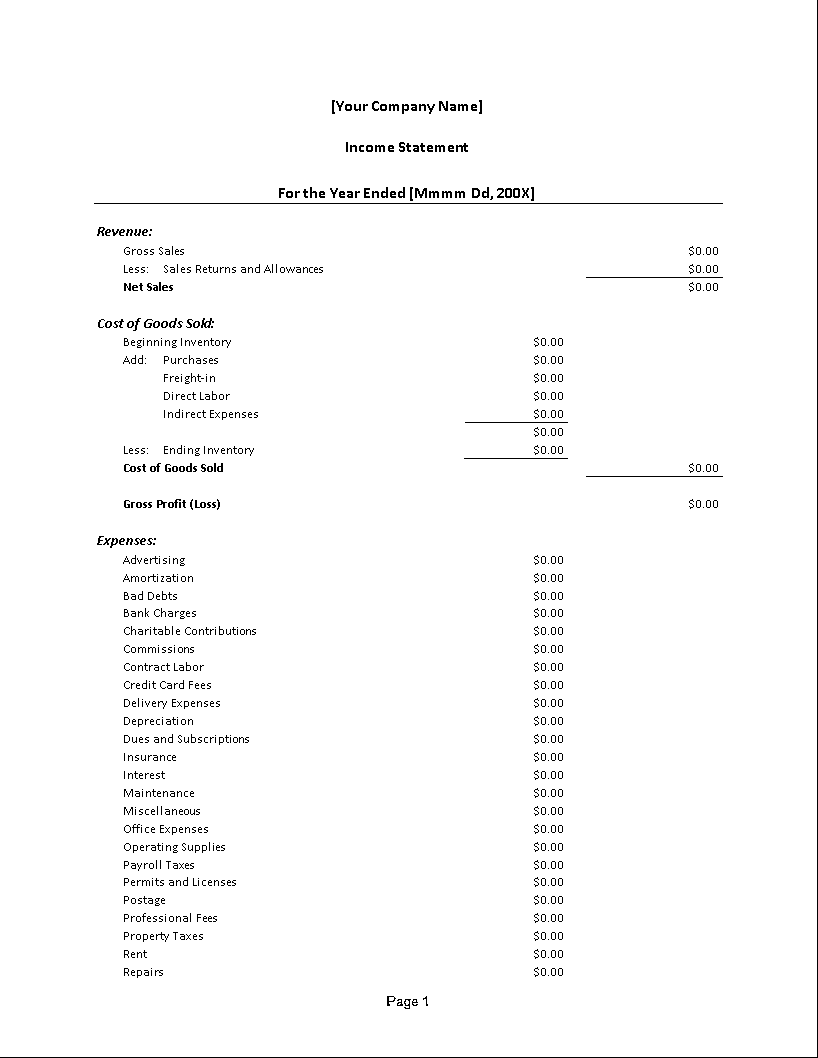

Let say the property manager is unable to lease units to future. Structure of the profit and loss statement. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

Mortgage interest insurance legal & professional. Rental property profit and loss statement. A profit and loss statement belongs a report that summarizes income, expenses, and web operating income over a specific spell of time.

The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income. Get started creating an income statement (profit & loss) for your rental property with our free downloadable and customizable template below. Download and complete this form if you are a sole trader, subcontractor or partner in a partnership that has started new employment or a new business.

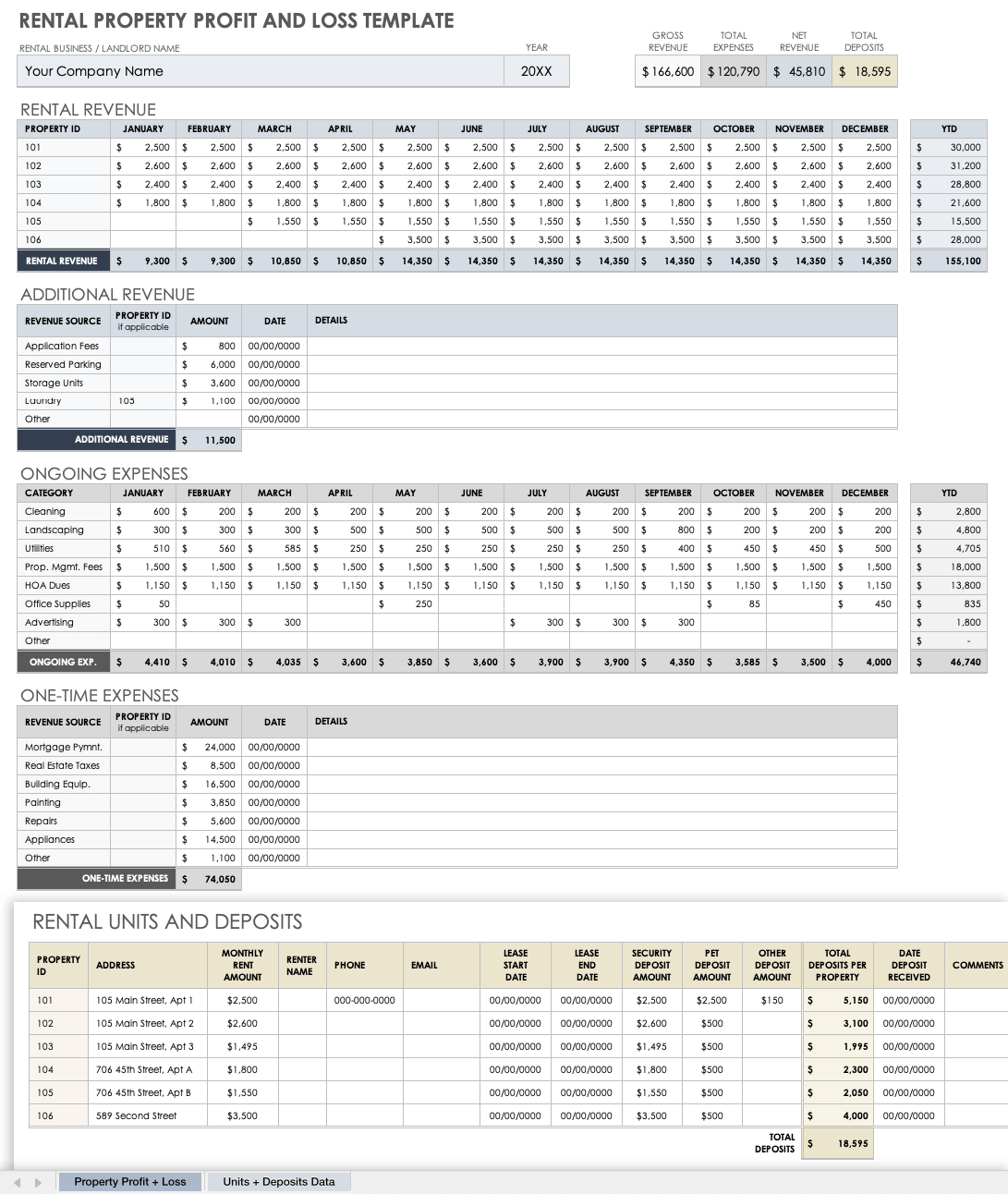

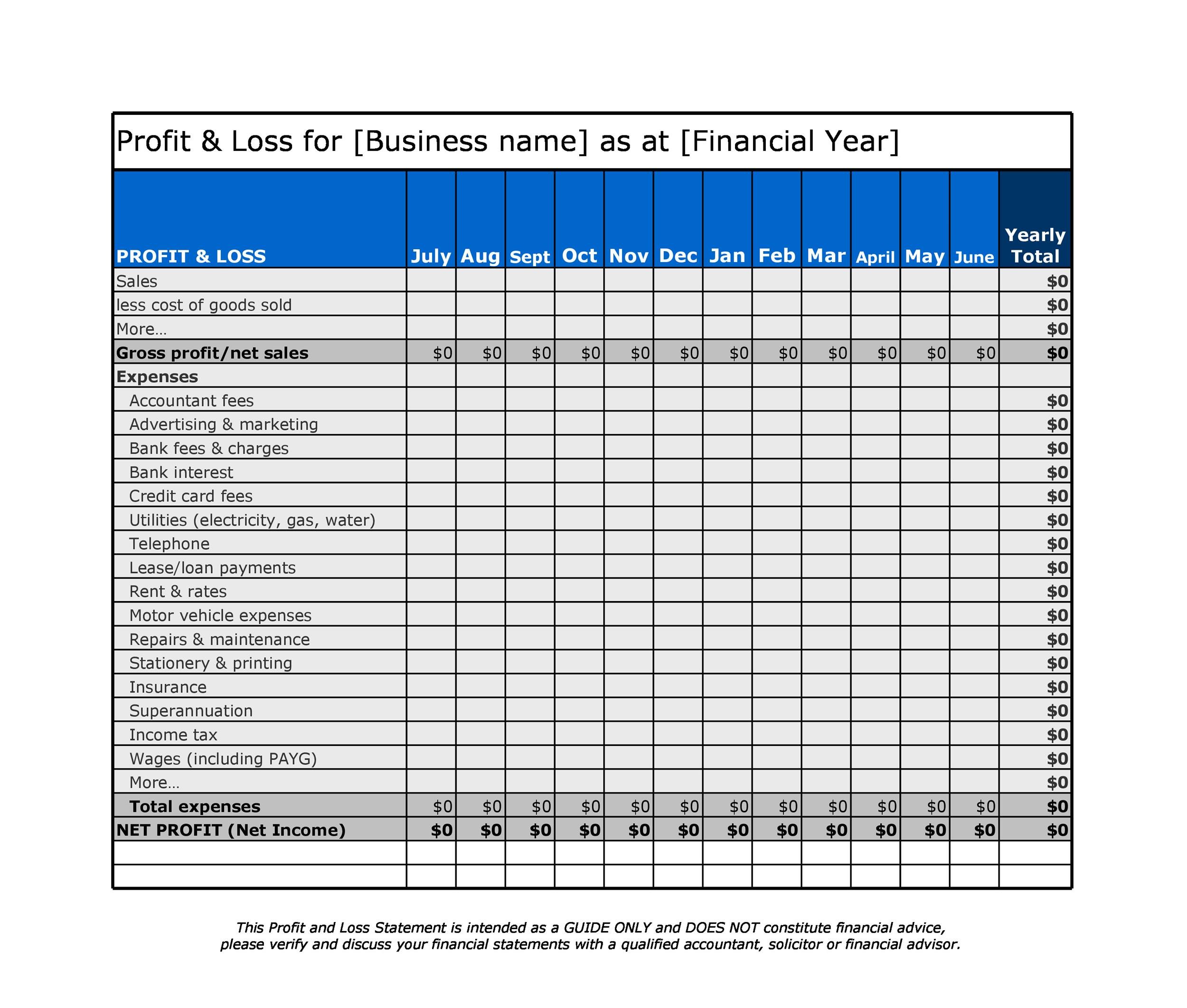

One way to track your finances is by creating a profit and loss statement for rental property. If the vacancy rate is 3%, the annual anticipated rental income is $240,000 x 97% = $232,800. About rental property profit and loss statement excel template.

Rental property profit & loss template this template is designed for rental property owners who are having trouble compiling accurate financial information. A company’s statement of profit and loss is portrayed over a period of time, typically a month, quarter, or fiscal year. Using this template, you can capture property wise rental revenue and number of months occupied.

The rental income statement (also known as a profit and loss or income expense statement) is a financial report used by landlords that shows a breakdown of all income. By tracking key components like income, expenses,. Analyze your profit and loss:

A profit and loss statement helps rental property owners evaluate the financial performance of their investments. Enter your rental property’s income and expenses into the respective sections. The rental property profit and loss statement is a report that summarizes revenues received and expenses incurred.

Making this statement isn't overly complex, but it's extremely helpful. A good profit and loss account will help. Input your data:

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Hotel-Profit-Loss-Statement-Template-TemplateLab-scaled.jpg)