Divine Info About Difference Between Statement Of Financial Position And Income Analysis Vertical Horizontal

Corporate finance financial statements cash flow statement vs.

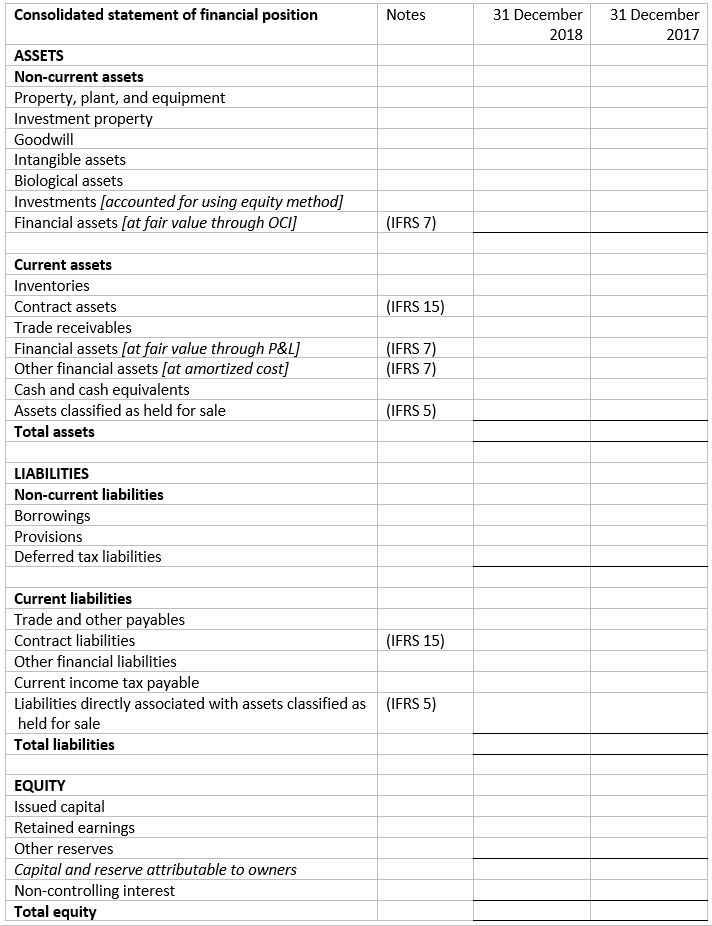

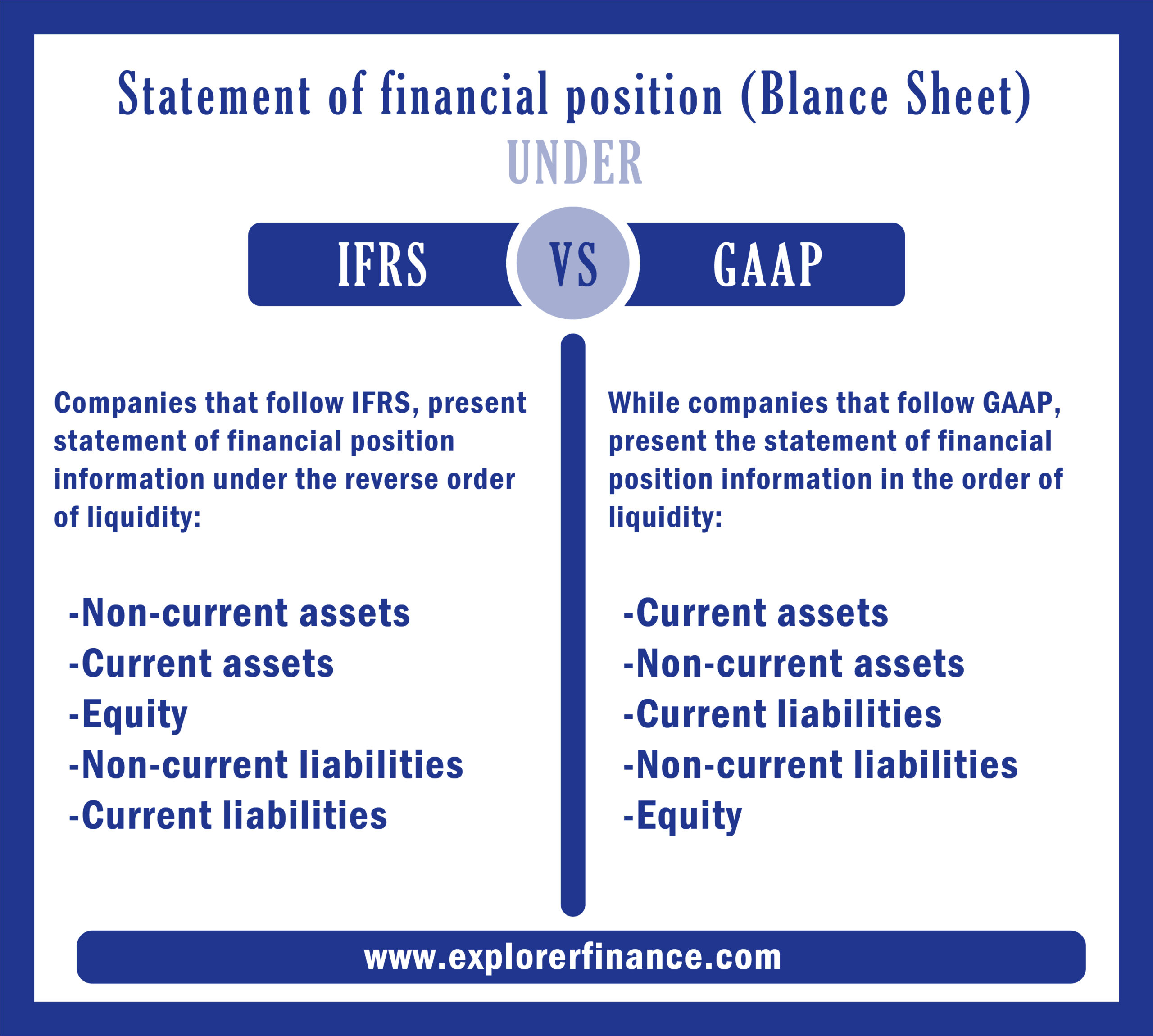

Difference between statement of financial position and income statement. They are linked over time with the income statement. Overview of the three financial statements 1. The four main types of financial statements are statement of financial position, income statement, cash flow statement and statement of.

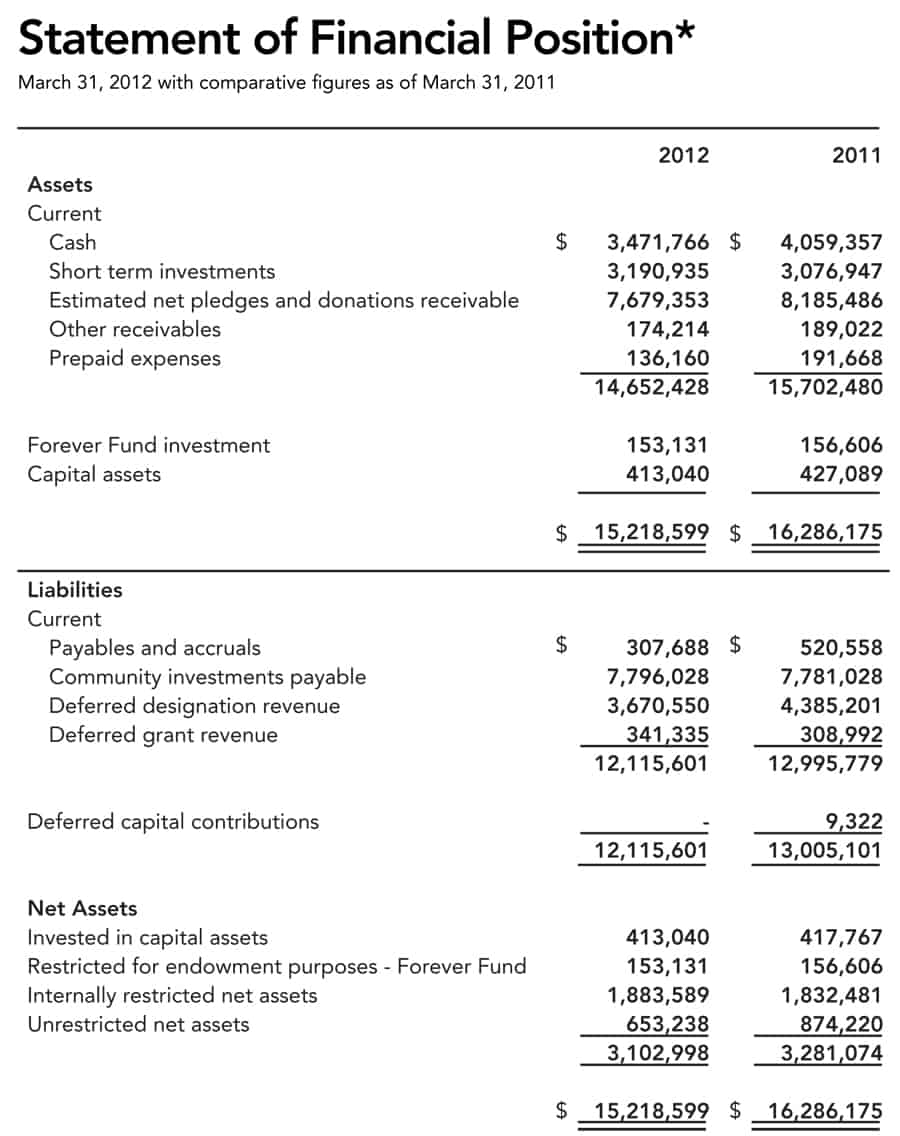

An income statement is one of the three major financial statements that report a company’s financial performance over a specific accounting period. Statement of financial position is a financial statement which shows the amount of owned assets, owed liabilities and the net capital (difference of assets and liabilities) of a business. A balance sheet lists assets and liabilities of the organiz.

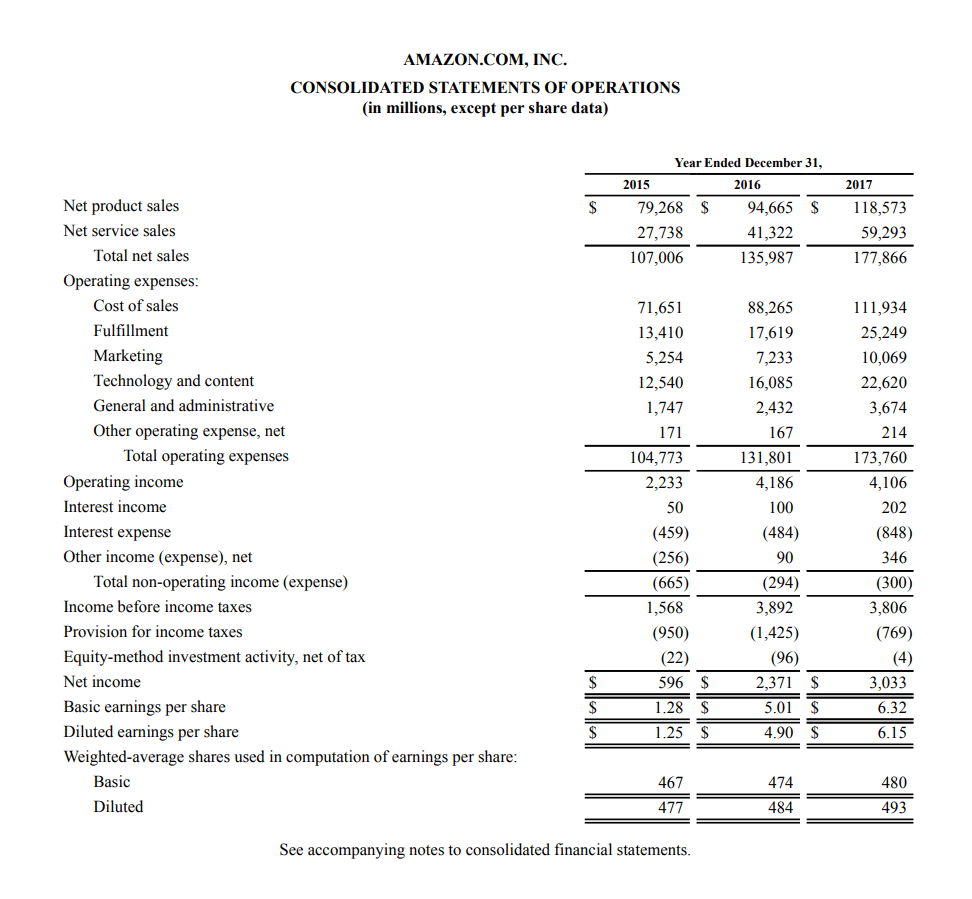

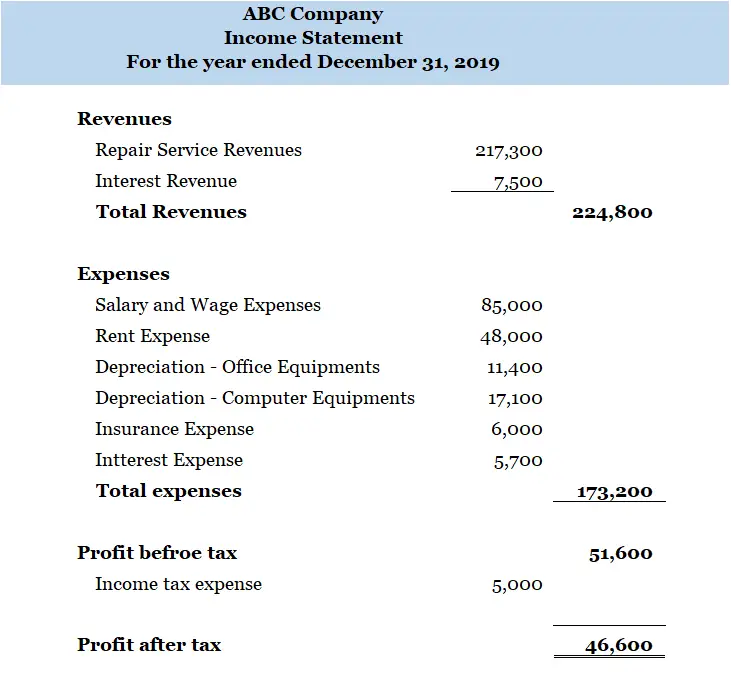

However, the balance sheet and the income statement are often recognized as the most important for small businesses. Starting with direct, the top line reports the level of revenue a company earned over a specific. Why do shareholders need financial statements?

The basic equation for a balance sheet is: What's the difference between balance sheet and income statement? The increase (or decrease) in net assets as a result of the net profit (or loss) reported in.

It is also called as balance sheet. In financial accounting, the balance sheet and income statement are the two most important types of financial statements (others being cash flow statement, and the statement of retained earnings). By evan tarver updated march 22, 2022 reviewed by somer anderson fact checked.

The statement of financial position are not isolated statements; Often, the first place an investor or analyst will look is the income statement. Key differences the biggest difference between a financial statement and a balance sheet is the scope of each.

Income statements focus on revenue and expenses. Vishal sanjay contributing writer at businessnewsdaily.com balance sheets and income statements are important tools to help you understand the finances and prospects of your business, but the. Other keys and noteworthy differences between these two financial statements include:

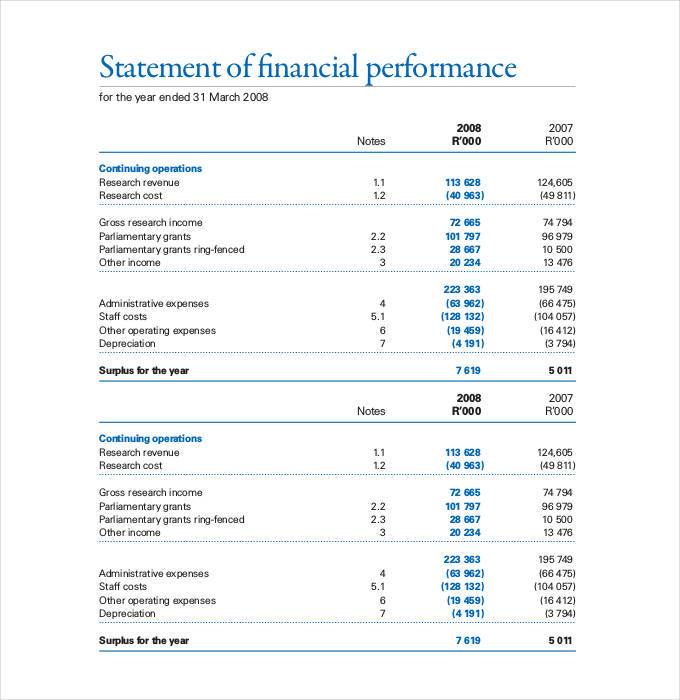

Showcase your skills with help from a resume expert financial statements vs. Income statements show whether a company is profitable during a specific period. It focuses on revenue, expenses, gains, and.

What’s the difference between a cash flow statement and an income statement? A statement of financial position is prepared at the end of an accounting period—which is typically 12 months—and provides a snapshot of the overall financial position of your company at a given time. Do dividends go on the balance sheet?

The income statement, often called the profit and loss statement, shows the revenues, costs, and expenses over a period which is typically a fiscal quarter or a fiscal year. The income statement shows the performance of the business throughout each period, displaying sales. Financial statements are written reports that quantify the financial strength, performance and liquidity of a company.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)