Awe-Inspiring Examples Of Tips About W2 For Social Security Income What Goes On A Balance Sheet

You will need to file a return for the 2024 tax.

W2 for social security income. It shows the total amount of benefits you received from us in the previous year. Find out the thresholds, rules,. The exact name shown on your social security card.

Earnings represent your taxable wage base, while social security refers to the wages that are. Find out the thresholds, rules,. How it works:

Some social security income is taxable. The internal revenue service (irs) has issued final regulations that. Your 2023 tax form will be.

Learn how to pay federal income taxes on your social security benefits if you have other substantial income or file a joint or separate tax return. Find answers to common questions about social security income, such as taxation, back payments, survivor benefits, and more. Learn how to report and amend.

One way to understand whether your benefits are taxable is to consider gross income, which is your total earnings before taxes. The social security administration deducts $1 from your social security check for every $2 you earn above $21,240 (this is the income limit for. It is used to report income, social.

Medicare withholding income tax from your social security benefits ( en español) you can ask us to withhold federal taxes from your social security benefit payment when. Calculator you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that will be taxable but the worksheet isn’t the. The reason for your request.

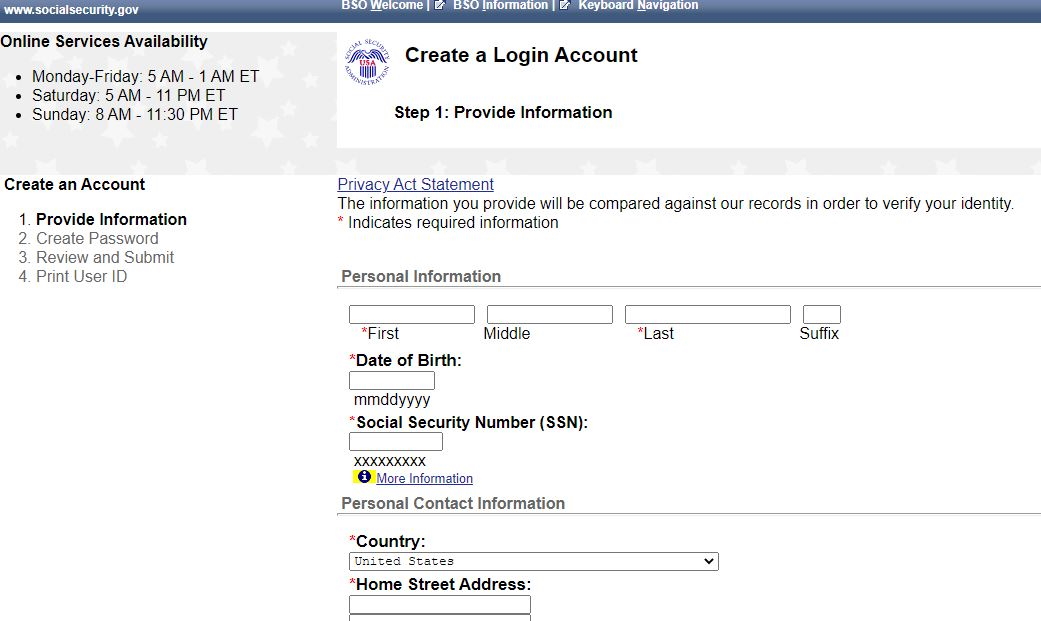

What's included in social security. Your social security number (ssn). Transcript you can get a wage and income.

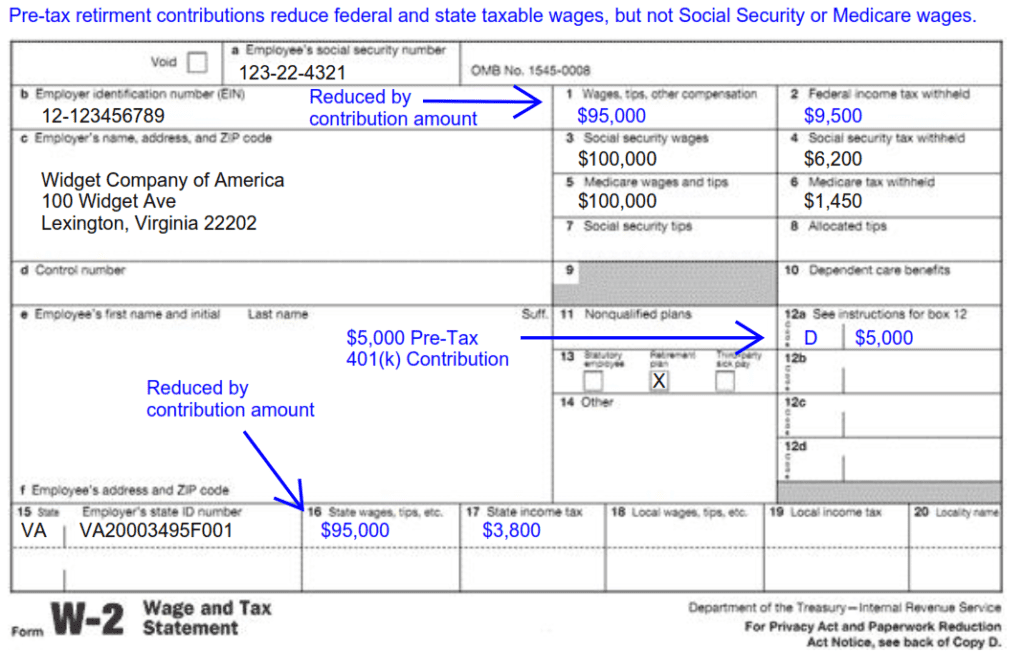

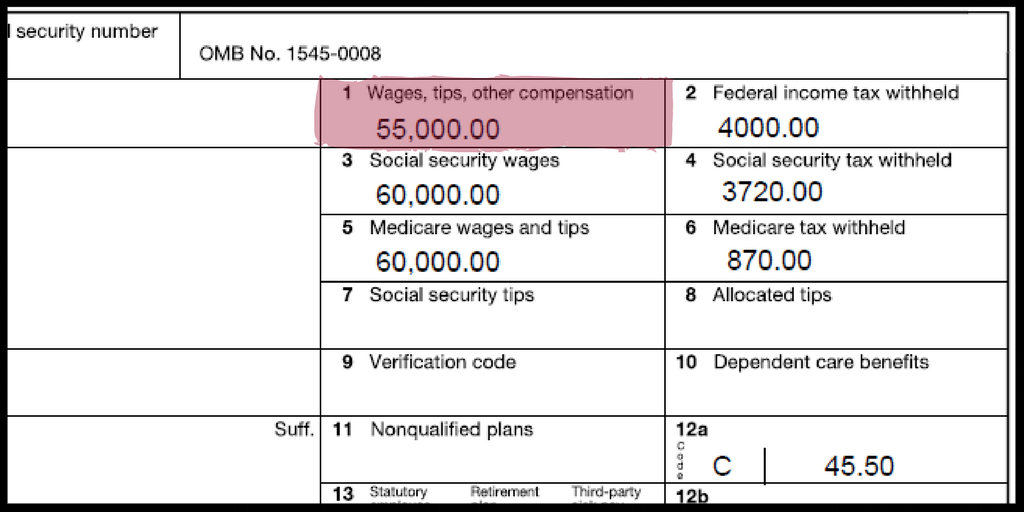

Get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. An employee made $75,000 and contributed $10,000 to a 401 (k) this year. Learn how to pay federal income taxes on your social security benefits if you have other substantial income or file a joint or separate tax return.

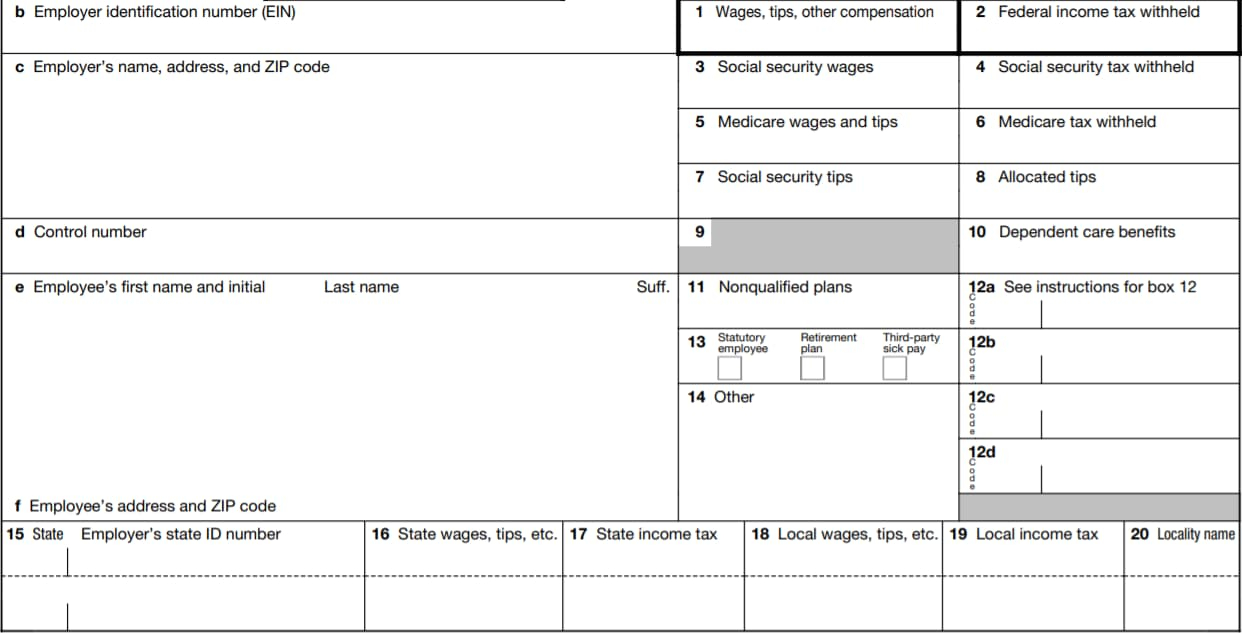

Learn what a w2 and a 1099 are, when you should use them, the pros and cons of each and the penalties for using the wrong one. The year(s) for which you need copies. What are social security tips?

The fica withholding amount for an employee is 7.65% of gross income: Employers and third parties can easily file wage reports with us electronically or by paper (limitations apply).