Marvelous Info About Formula For Calculating Cash Flow Sas 70 Report

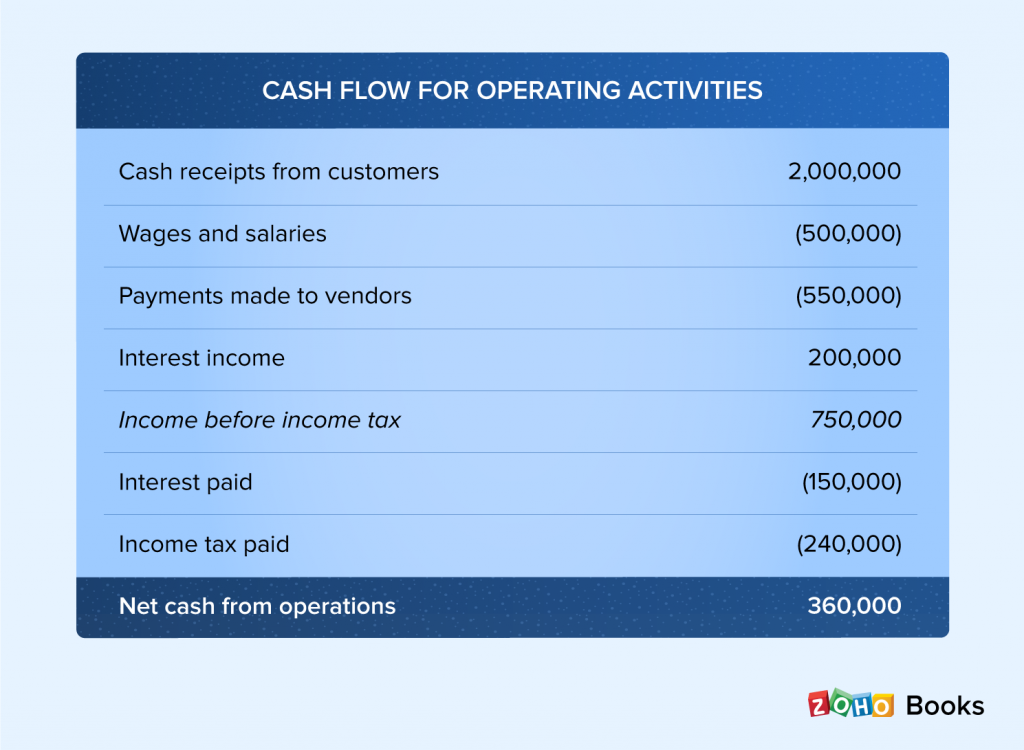

The direct method compares expenditure and income within a certain period of time.

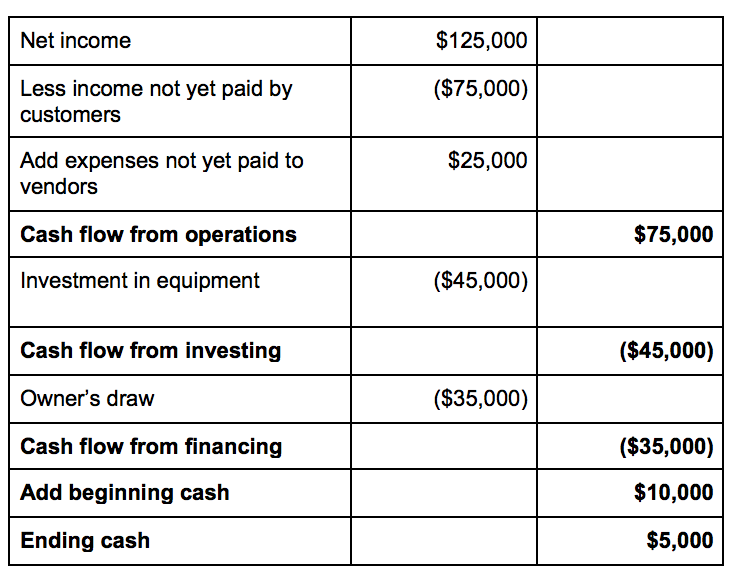

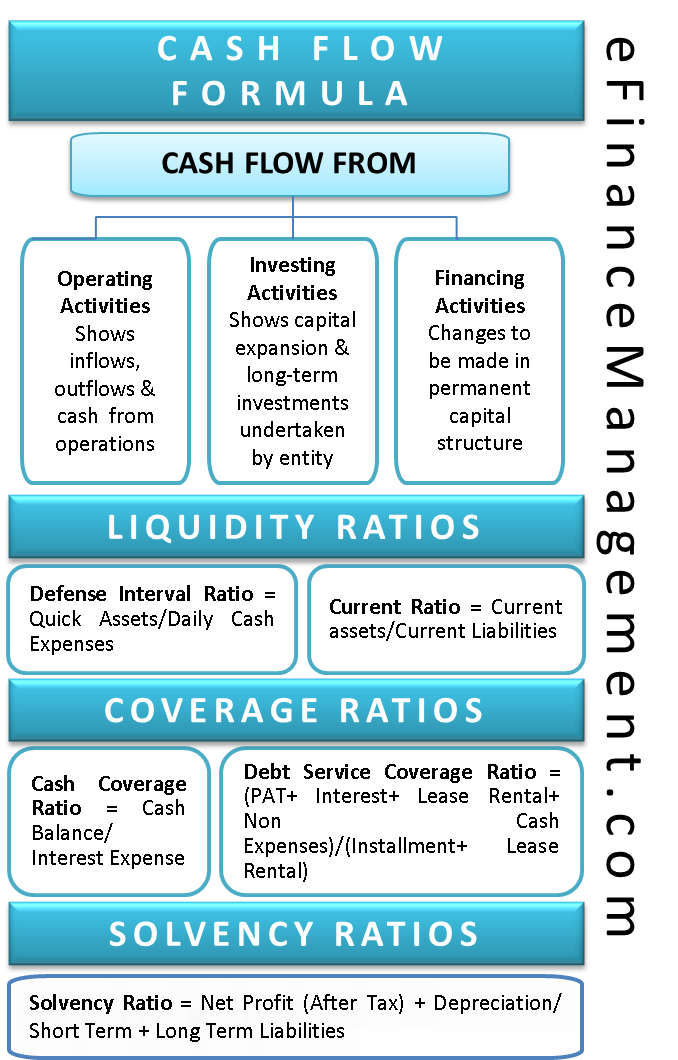

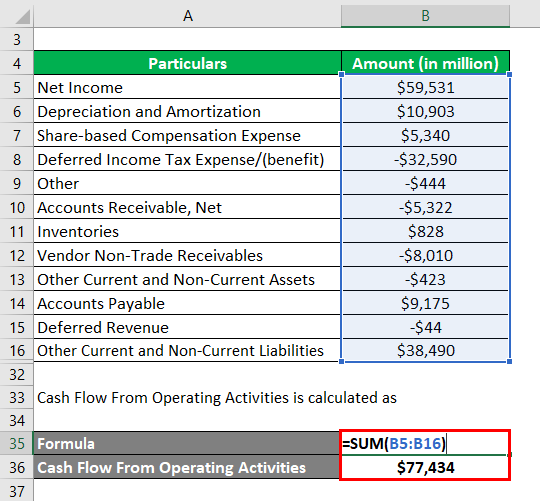

Formula for calculating cash flow. Calculating the cash flow from operations can be one of the most challenging parts of financial modeling in excel. The formula is: Net cash flow (ncf) = cash flow from operations (cfo) + cash flow from investing (cfi) + cash flow from financing (cff) the three sections of the cash flow statement (cfs) are added together, but it is still important to confirm the sign convention is correct, otherwise, the.

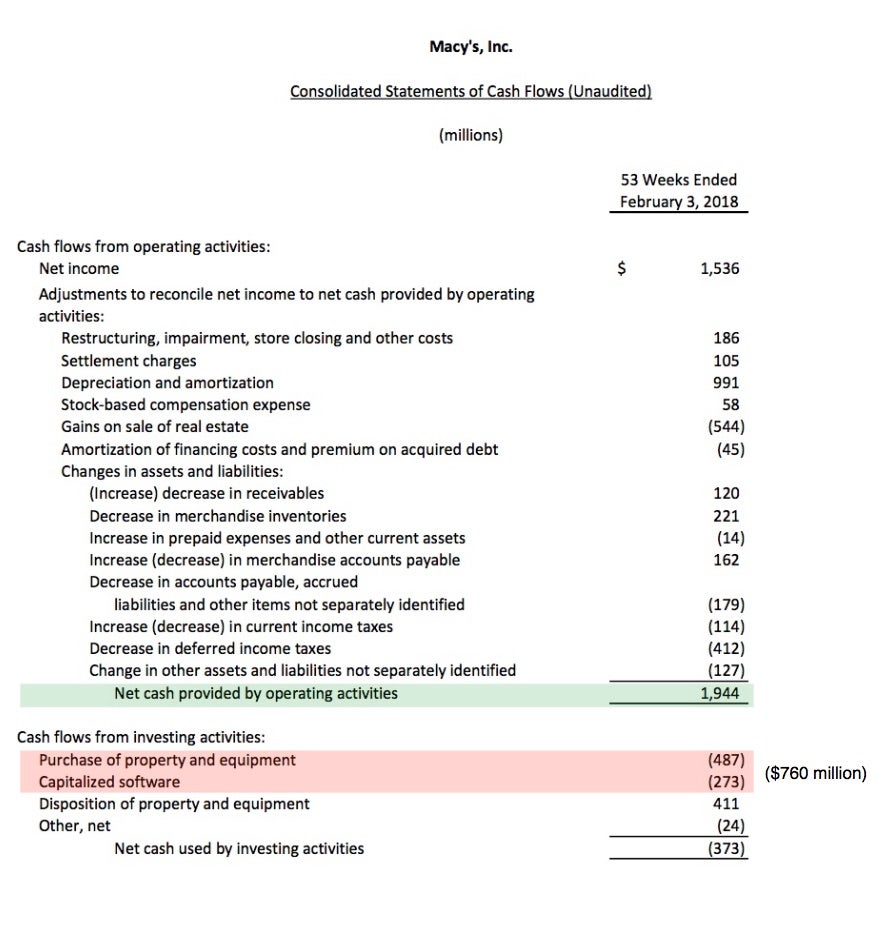

How the cash flow statement is used the cash flow statement paints a picture as to how a company’s. How to calculate cash flow. Formula to calculate and interpret it what you need to know about this measure of profitability by jason fernando updated january.

Here’s how this formula would work for a company with the following statement of cash: As the formula for free cash flow is: Actually, to apply the npv function firstly you have to find out the net cash flow.

Required investments in operating capital = year one total net. What is the formula for calculating free cash flow? Operating cash flow in financial modeling.

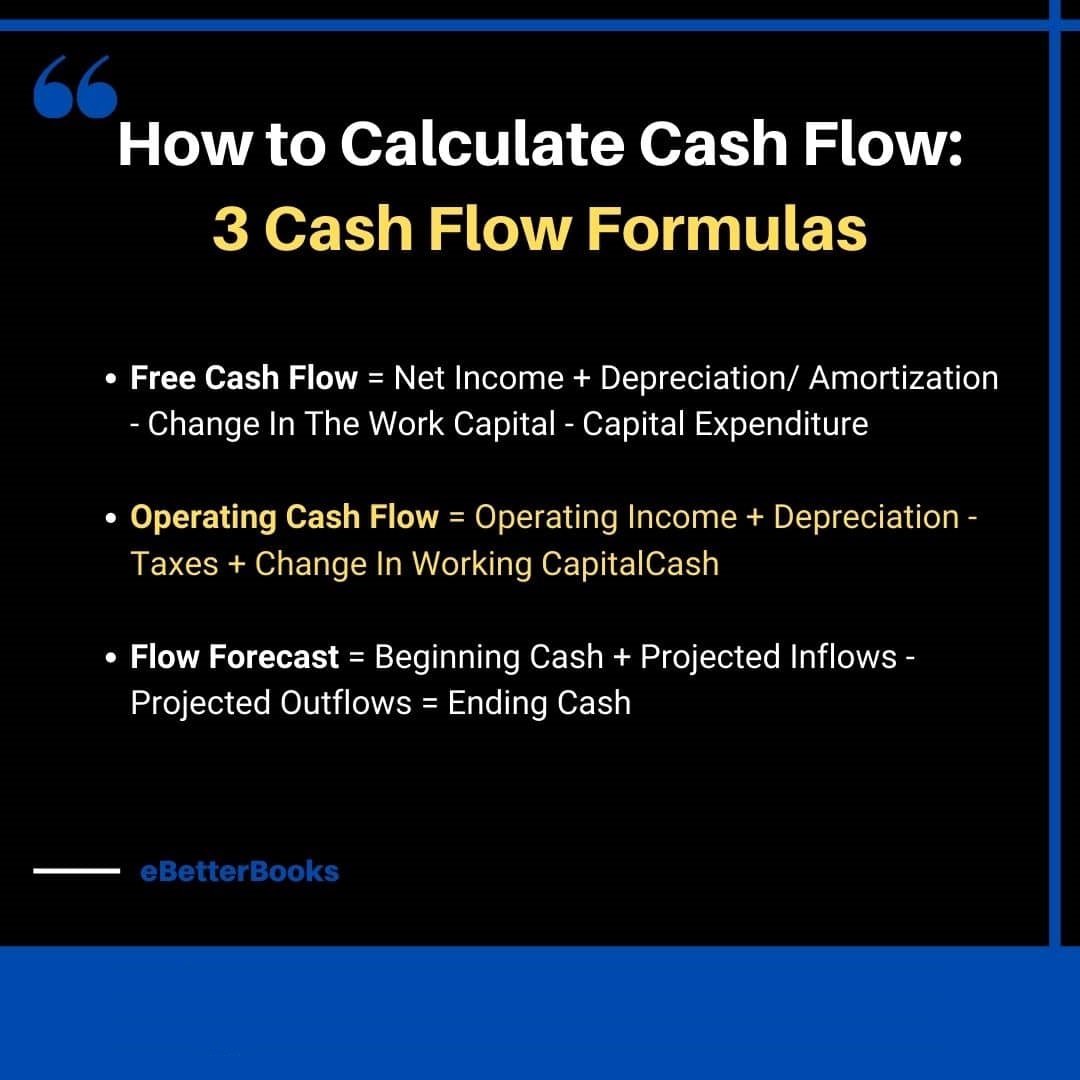

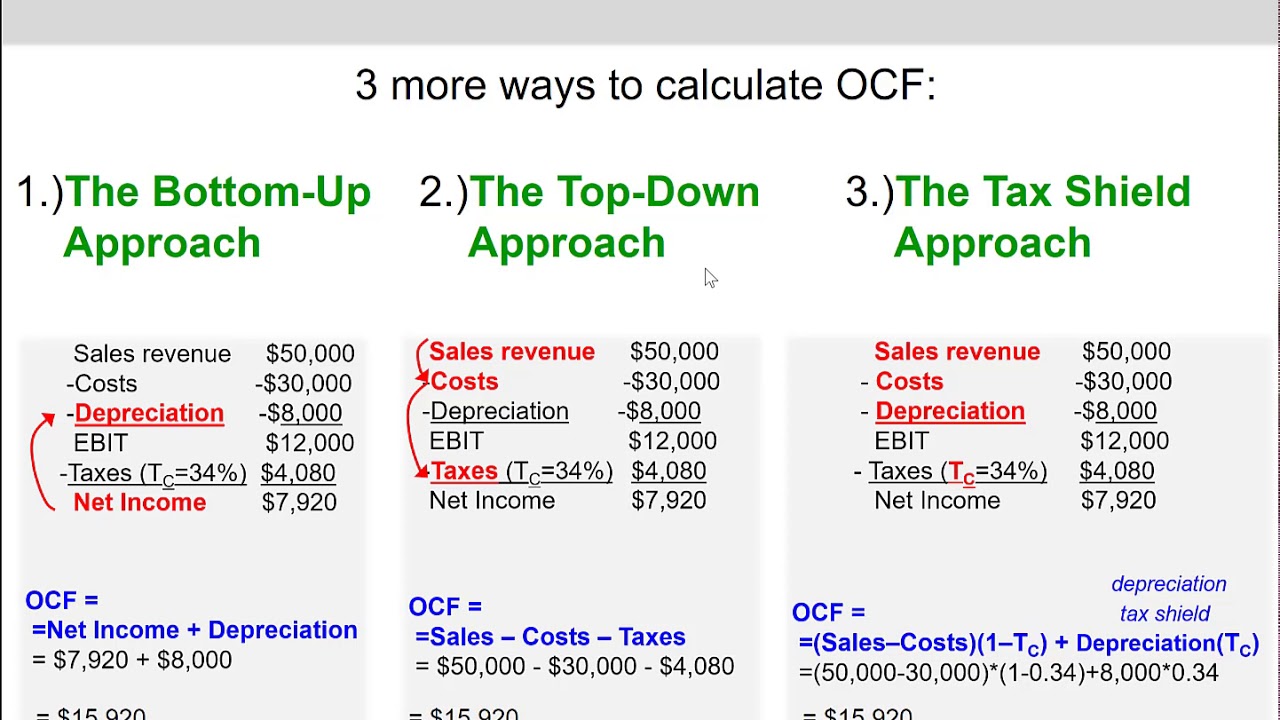

Free cash flow = sales revenue − (operating costs + taxes) − required investments in operating capital where: Industry average of 352% suggests maharashtra seamless' peers are currently trading at a higher premium to fair value. The two methods of calculating cash flow are the direct method and the indirect method.

The steps are given below. With ₹971 share price, maharashtra seamless appears to be trading close to its estimated fair value. Create columns for operating activities, financing activities, and investing activities.

Free cash flow would be £125,000. Your objective is to determine whether you had a positive or negative cash flow for this month. 1 create a spreadsheet.

Cash flow from operating activities (cfo) indicates the amount of cash a company generates from its ongoing, regular business activities. It shows the cash that a company can produce after deducting the purchase of assets such as property, equipment, and other major investments from its operating cash flow. The fcf formula is:

Direct method the cash flow formula according to the direct method is one way of calculating the cash flow balance so that other cash flow ratios can be determined later. A graphic designer has two checking accounts and a savings account. Cash flow from operations formula (indirect method) = $170,000 + $0 + 14,500 + $4000 = $188,500.

Don’t freak out if they look complicated! Cash flow formula: One checking account collects payments and covers operational expenses while the other is used to hire contractors that help on projects.