Impressive Info About Interest Paid On Debentures In Cash Flow Basic Statement Of Financial Position

The expense paid on the loans and bonds is an expense out through the.

Interest paid on debentures in cash flow. Suggested alternative classification for all entities Usually, it is a fixed rate set when the contract between two events begins. Dividend paid etc are part of investing.

The borrower receives funds from a lender in exchange for future reimbursement. The rate of interest on a particular debenture is specified before the name of such debenture as 8% debentures, 12% debentures, etc., and is always provided at the face value of the said debentures. Cash flow from investing activities:

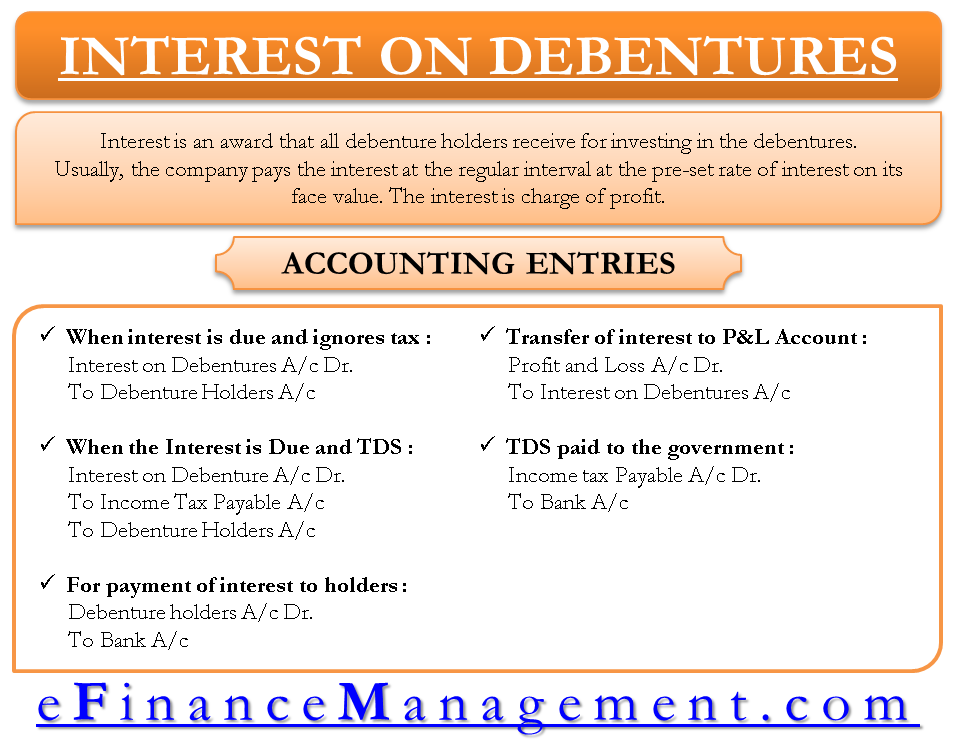

Specifically, debenture holder gatherings registered with the securities and exchange commission of brazil (cvm) increased by 33% in 2023 compared to 2022, to 317 from 238, according to valor’s analysis. Cash flow from investing activities is an item on the cash flow statement that reports the aggregate change in a company's cash position resulting from investment gains or losses and changes resulting from. When interest is due and we ignore tax:

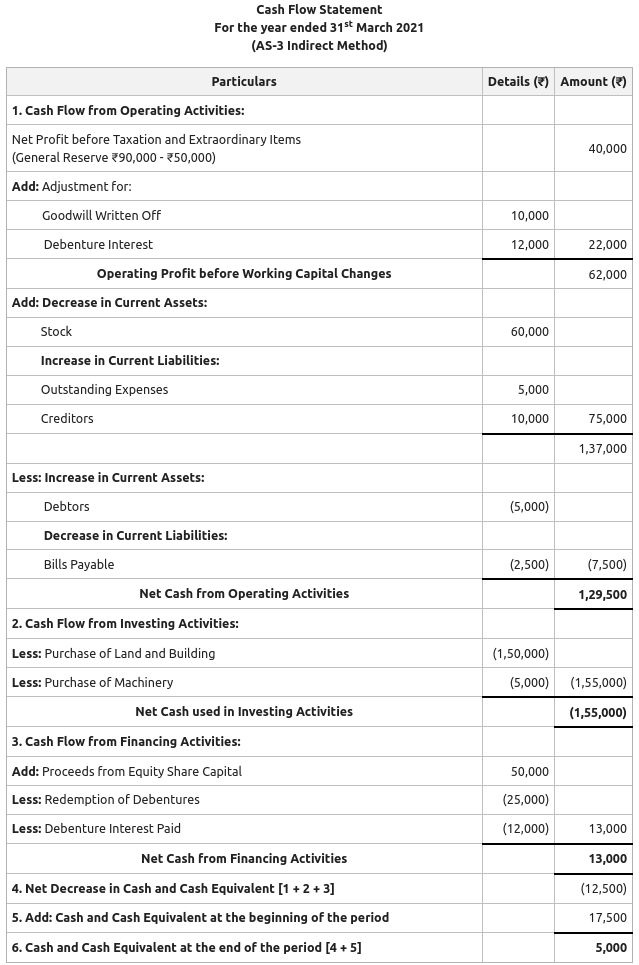

Cash flow from financing activities Transferred to the account of sinking fund. Asc 230 allows a reporting entity to prepare and present its statement of cash flows using either the direct or indirect method (see fsp 6.4.2), though asc.

How much amount (related to the above information) will be shown in the financing activity for cash flow statement prepared on 31st march 2020? Dividends paid to the shareholders of the company. The repayment of the principal is included as a cash flow from financing activities, because it is the same as the repayment of a debt.

At vórtx securitization firm, the number of meetings more than doubled from 2022 to 2023, jumping from 948 to 2,210. How will you treat payment of ‘interest on debentures’ while preparing a cash flow statement? While in the cash flow statement it is treated under the operating activities.

On that note, let’s check out how debenture interest is treated in the books of accounts. Usually, it is a fixed rate set when the contract between two parties begins. Cash flow from operating activities:

When interest is due and tax is deducted at source: The interest element is treated as a standard interest payment and is included as either a cash flow from operating activities or financing activities. Table 4 presents the classification of cash flows applying this approach.

From to following info, figure low cash flow from operating my and financing activities:additional information:i during the year additional debentures were issued at par on 1 st october and bank loan was repaid on the same fairvaluations.com dividend on equity shares @ 8 % was compensated on aperture fairvaluations.com income strain ¥. Interest paid is the amount of cash that company paid to the creditor. 34k views 2 years ago cash flow statement class 12th.

1.interest paid on debentures ₹ 19,000. #interestondebentures #cashflowstatement #accountingn this video i have discussed the treatment of interest on debentures in the chapter of cash flow stateme. Cash outflow from financing activities.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)