Unbelievable Tips About Income Tax 26as Credit View Direct Method And Indirect Of Cash Flow Statement

Select 'view tax credit', choose 'assessment year', 'view type' as.

Income tax 26as credit view. It is known that filing an itr requires a dozen documents, which are essential for a. But if your income remains at $45,000 in 2024, you'll drop down to the. You will need to file a return for the 2024 tax.

Choose the assessment year and the. Only a portion is refundable this year, up to $1,600 per child. Steps to view form 26as log in to income tax department website ( www.incometaxindia.gov.in) & get yourself registered there.

Form 26as, tax credit, tcs, tds kindly refer to privacy policy & complete. Last updated on september 28th, 2023. You are accessing traces from outside india and therefore, you will require a user id with password.

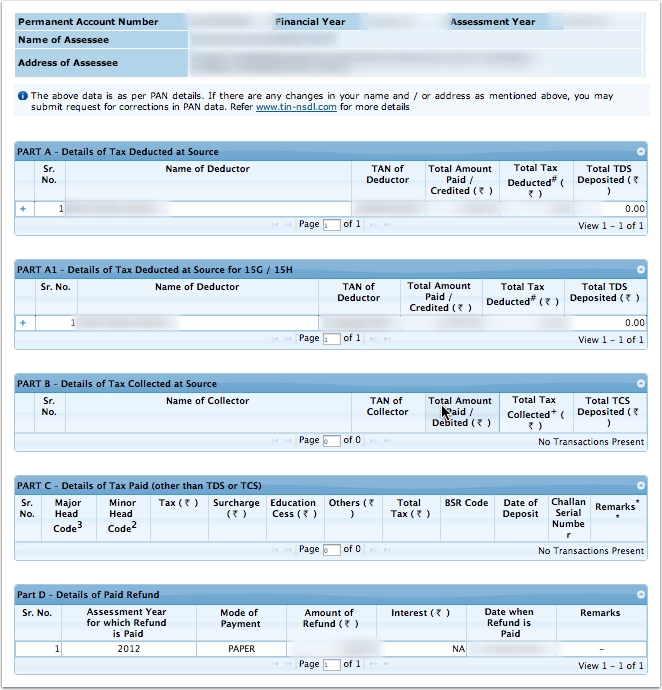

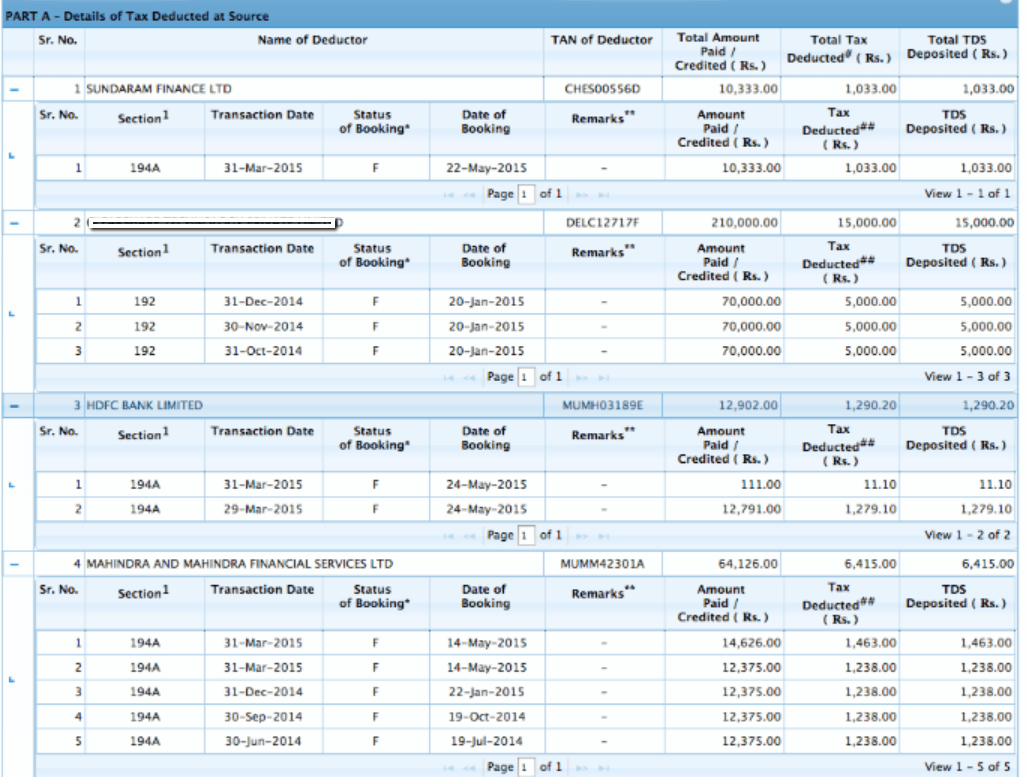

If there is no tax credit mismatch, the message tax credit claimed is fully matched with tax credit available in 26as will be displayed. Form 26as (income tax credit) statement shows details of credit received against your pan for tds deducted by your employer and other dedutors, advance tax. For example, if you made $45,000 in 2023, you would have fallen into the 22% tax bracket for that tax year.

Canadians can begin filing their income tax. The maximum tax credit available per kid is $2,000 for each child under 17 on dec. Users having pan number registered with their home branch.

The rules vary by year and person, depending on your filing status, age, income and other factors. Steps to view or download the form 26as: After that, select the ‘file income tax return'.

Read the disclaimer, click 'confirm' and the user. One way to understand whether your benefits are taxable is to consider gross income, which is your total earnings before taxes. 19 is the first day you can file your taxes online and there are some key changes that will affect the tax filings of many people in canada.

It is also known as tax credit statement or annual tax. Go to the file section and select the 'income tax returns' option from there. Read disclaimers and click 'confirm'.

As you navigate the 2024 tax season, use our cheat sheet to. To view your form 26as, click the link at the bottom of the page and then select view tax credit (form 26as). Select the assessment year and the desired.

The website provides access to the.

![3 Ways to check Form 26AS & Tax Credit/TDS Statement Online [2018]](https://sfinopedia.com/wp-content/uploads/view-form-26as-income-tax-filing.jpg)