Divine Info About Simple Balance Sheet And Income Statement What Is A P&l

Take the information from maggie's music shop adjusted trial balance and fill out an income statement.

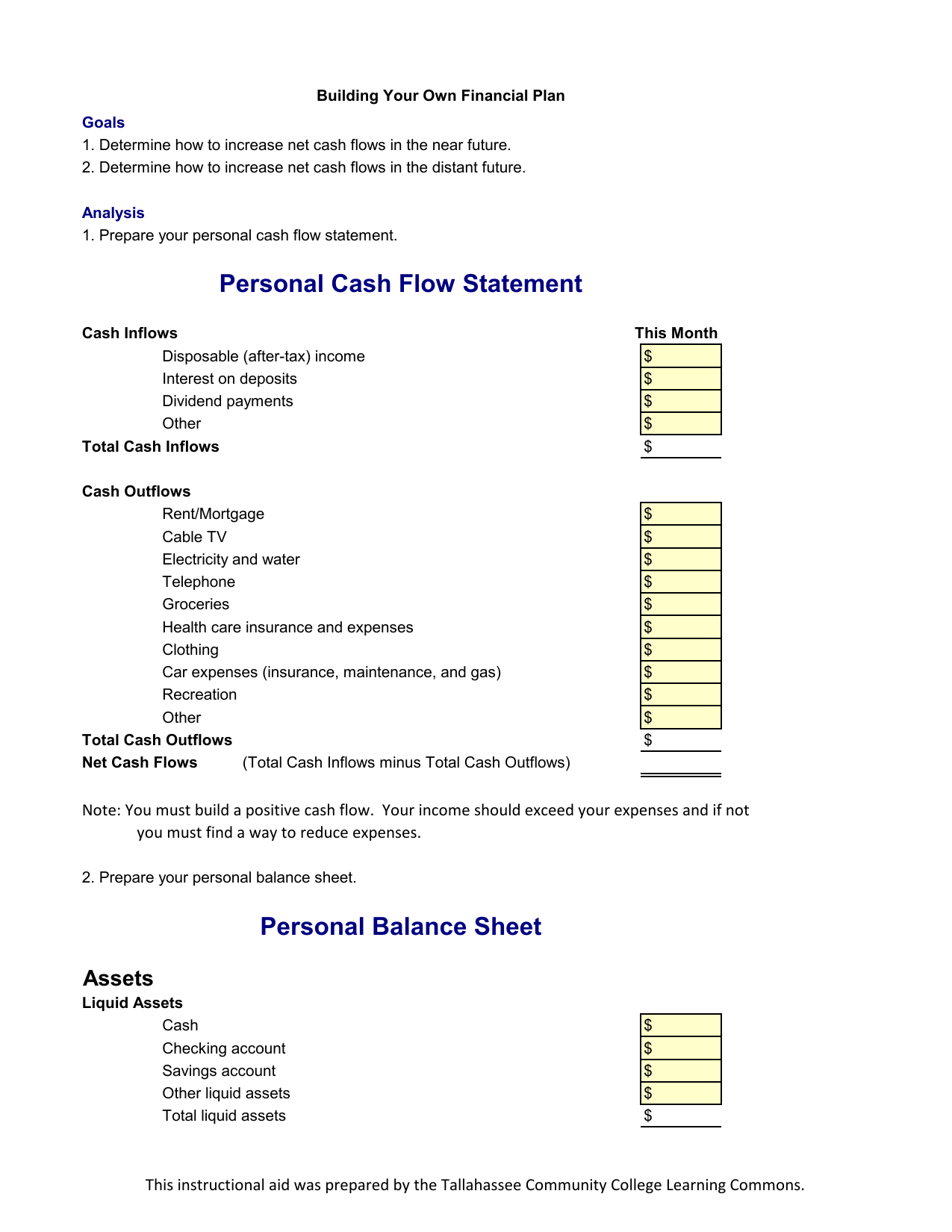

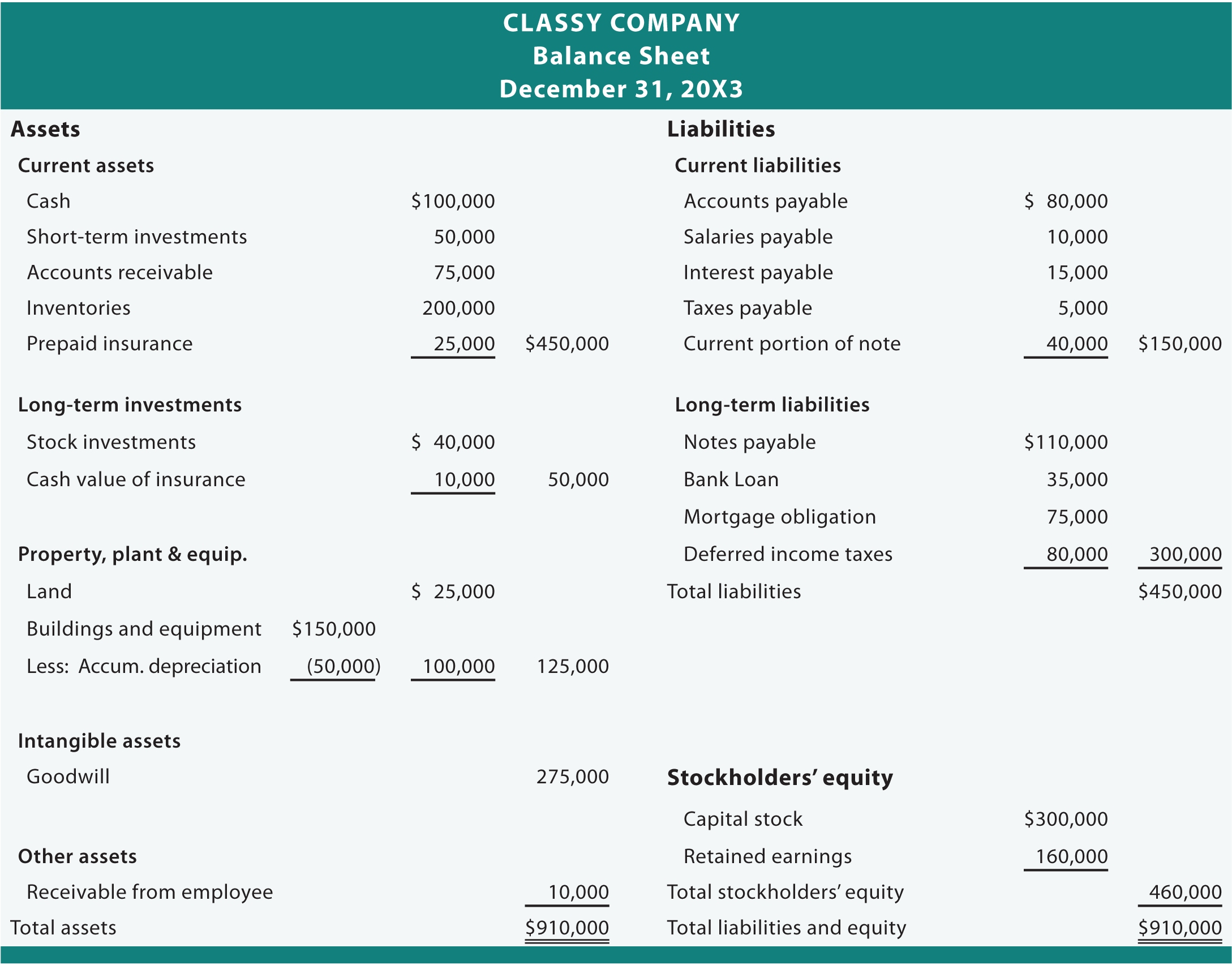

Simple balance sheet and income statement. Using the basic accounting equation, the balance sheet for cheesy chuck’s as of june 30 is shown in figure 2.9. Imagine if wafeq and other simple, effective accounting systems do not exist. Net income and retained earnings.

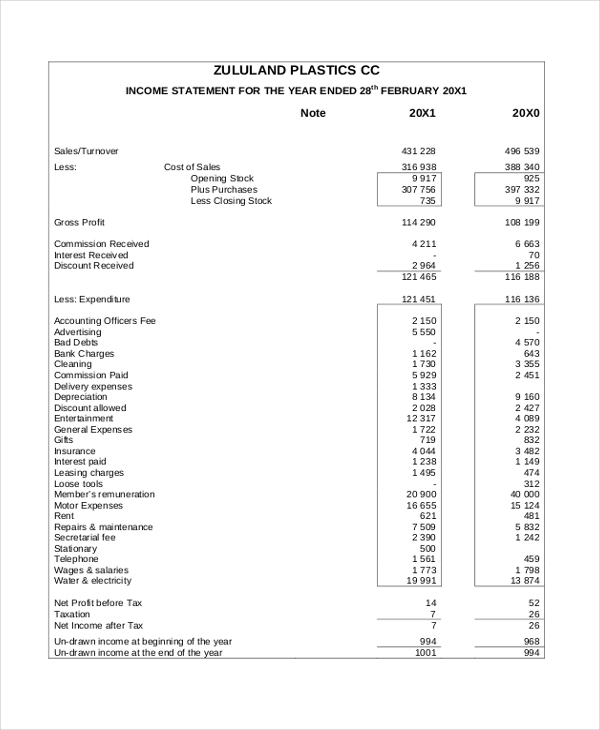

Purpose balance sheets are used to analyze the current financial position of a business. Completing a balance sheet and inferring net income carlos ramirez and camila garza organized new world book store as a corporation; Together, they’re a financial force to reckon with.

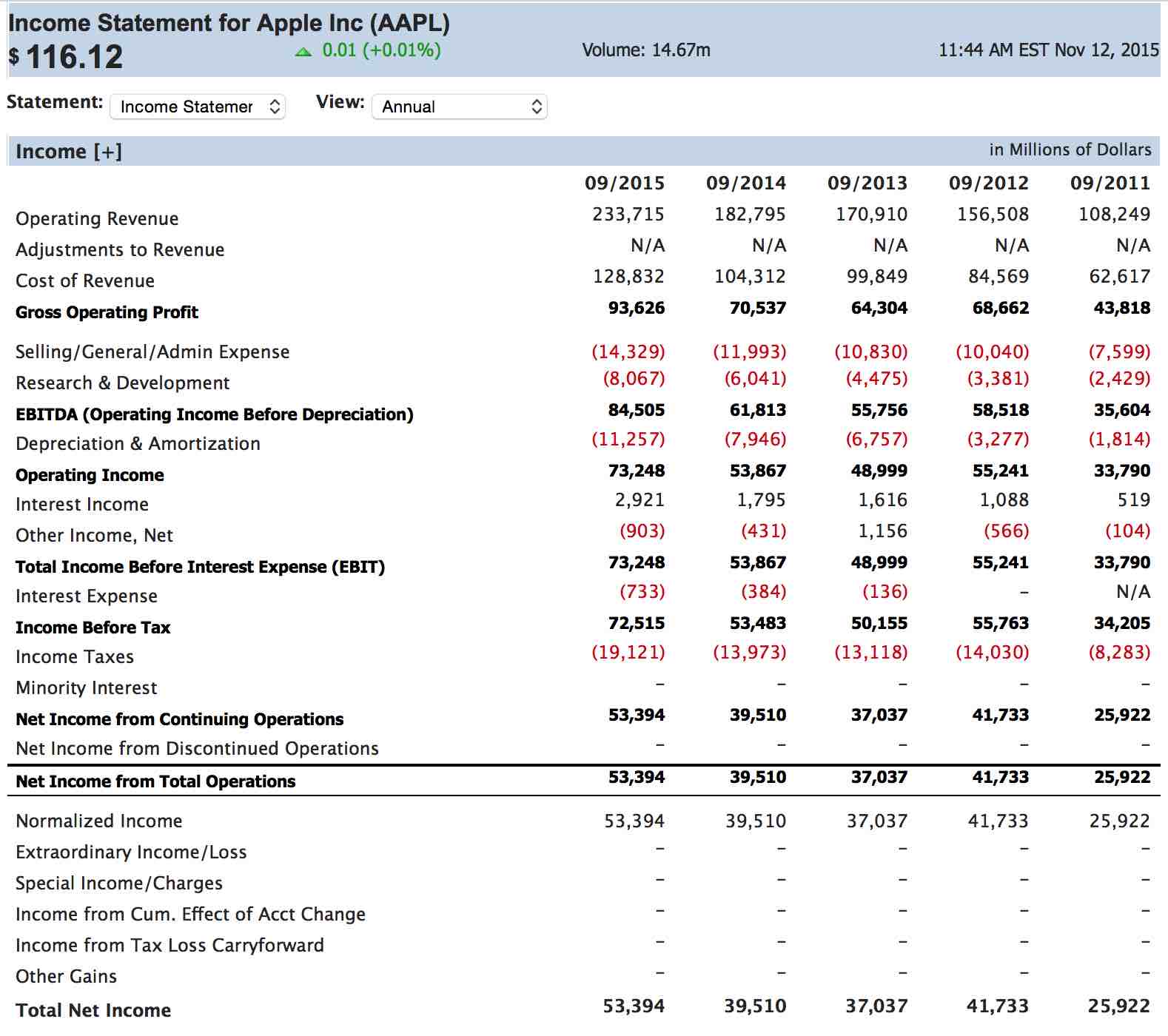

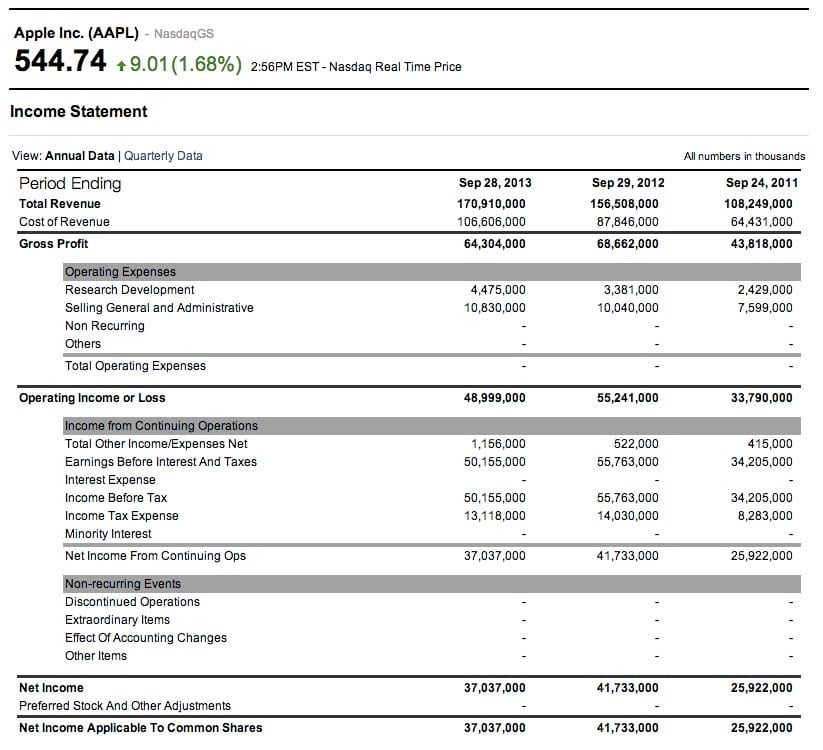

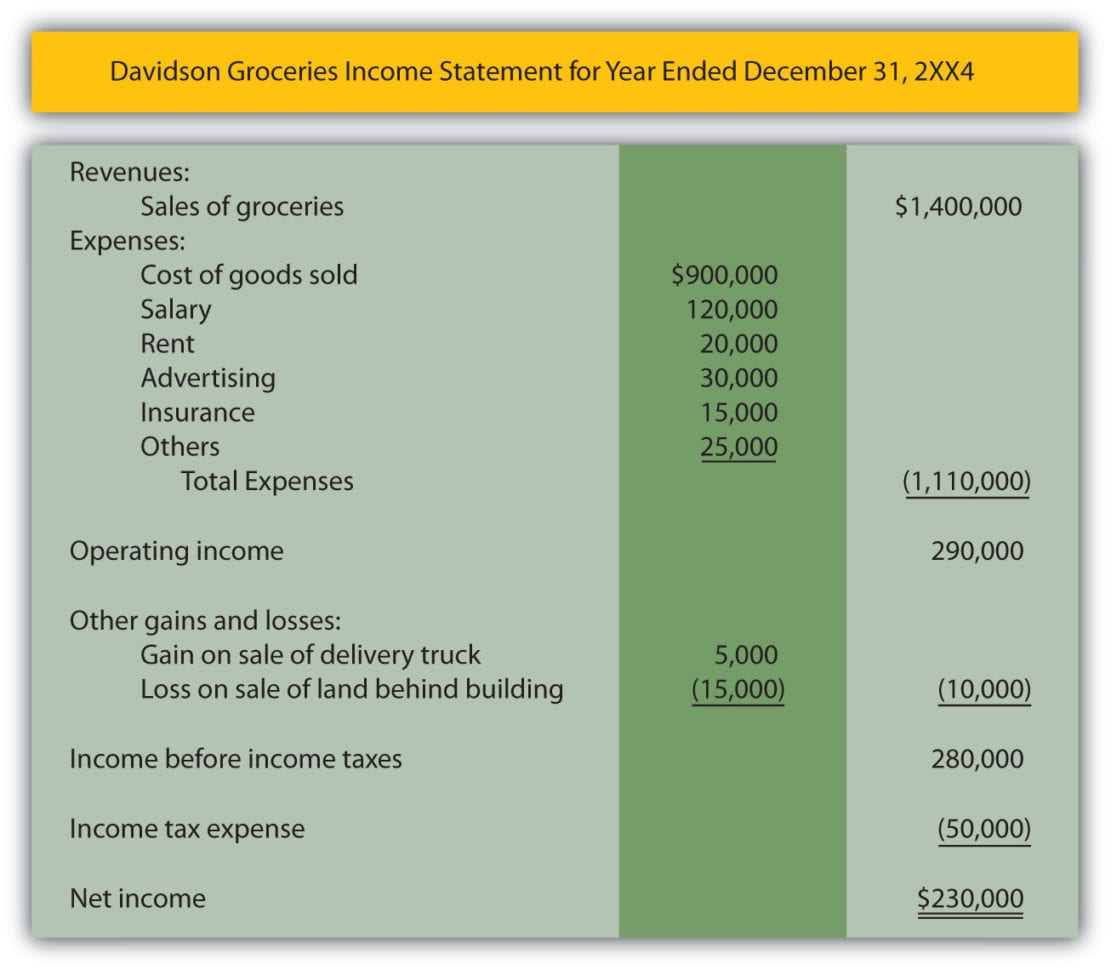

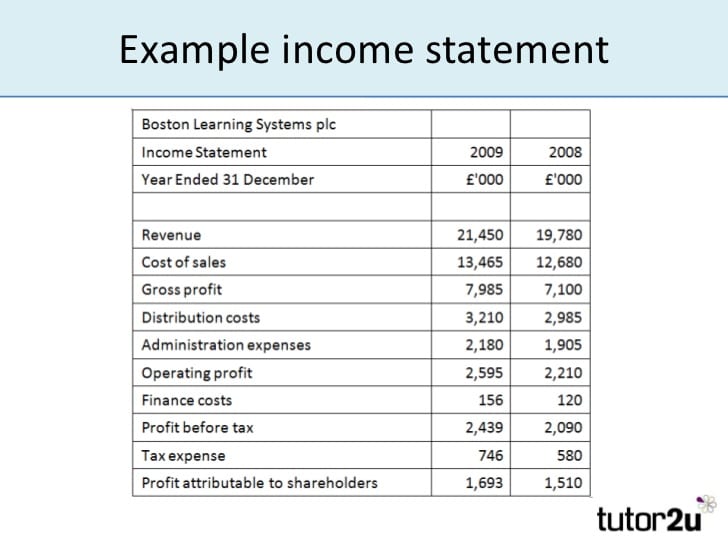

On the other hand, the income statement reports a company’s financial performance and has two primary components: Balance sheet investors and creditors analyze the balance sheet to determine how well. Why do shareholders need financial statements?

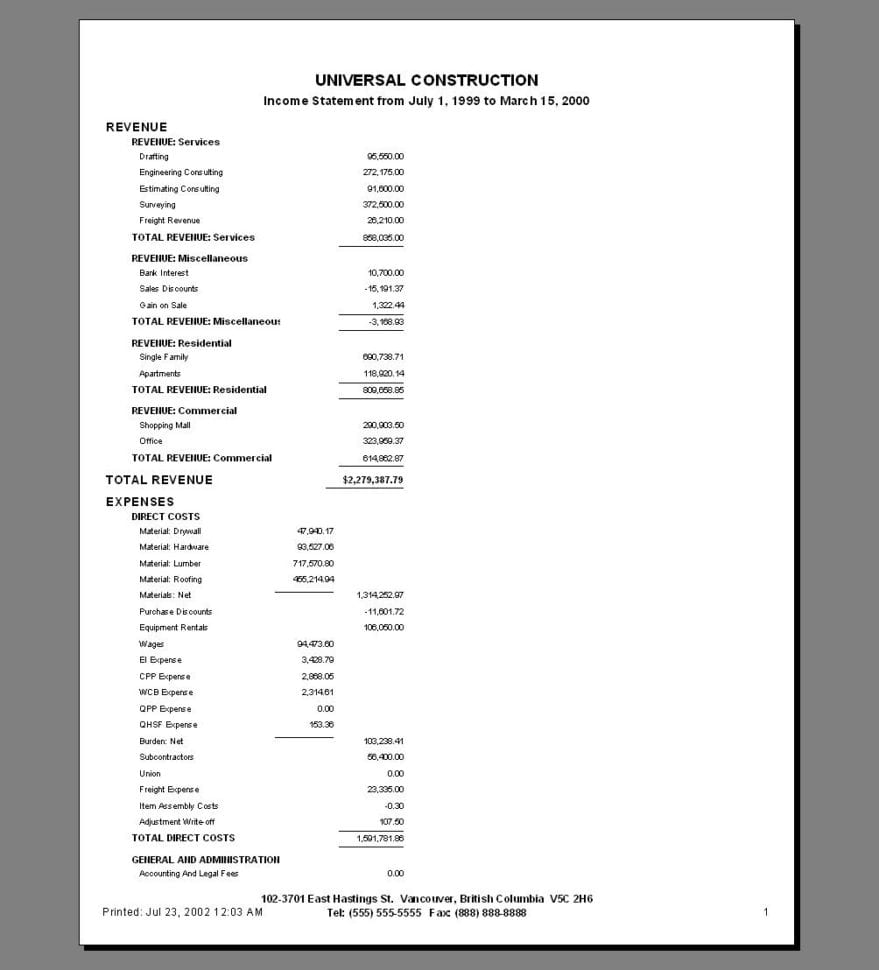

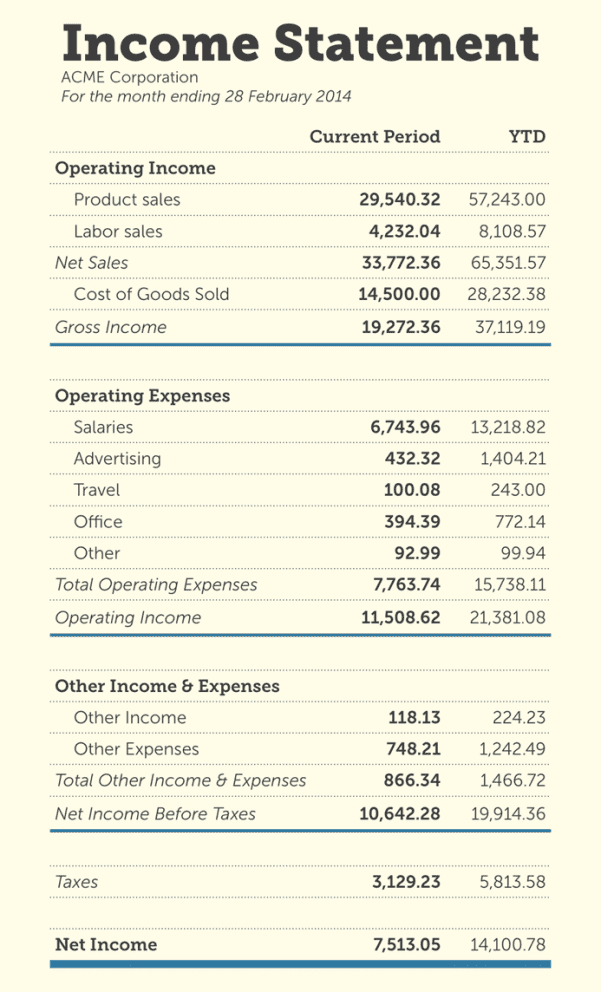

And the balance sheet gives you a snapshot of your assets and liabilities. But both documents are also distinct in a number of ways, including their content. The income statement is one of the most important financial statements because it details a company’s income and expenses over a specific period.

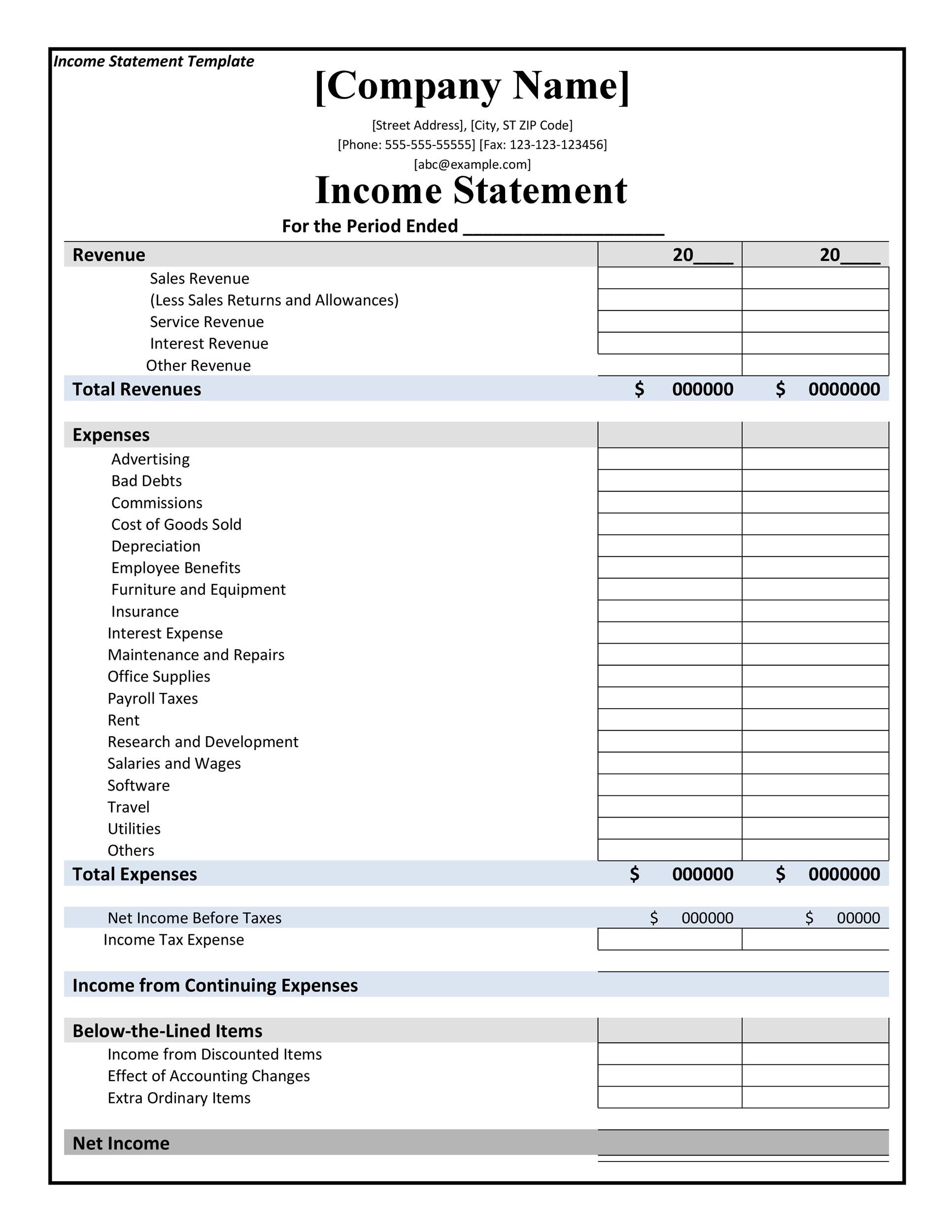

Use the financial information from the previous financial statements to create the statement of owner's equity (also known as a statement of retained earnings). Understanding income statements vs balance sheets. Click below to download a free sample template of each of these important financial statements.

It can be understood with a simple accounting equation: Each contributed $80,000 cash to start the business and received 4,000 shares of common stock. The income statement and balance sheet follow the same accounting cycle, with the balance sheet created right after the income statement.

They are both used in determining and organizing financial data. A balance sheet will show your: Finance and capital markets > unit 5 lesson 2:

This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees. A company’s balance sheet is one of the most important financial statements it produces—typically on a quarterly or even monthly basis (depending on the frequency of reporting). If the company reports profits worth $10,000 during a.

Assets include account balances across checking and savings, accounts retrievable from what people owe you, fixed assets like equipment, inventory, and intangible assets like copyrights. The income statement shows you how profitable your business is over a given time period. Your income statement and balance sheet are two of the most important documents you will create as a business owner.

As mentioned earlier, the financial statements are linked by certain elements and thus must be prepared in a certain order. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. Use the financial information from the previous financial.