Outrageous Tips About Normalized Income Statement Example Financial Report Analysis

Divide your total earnings by the number of years of the business cycle to calculate your normalized earnings.

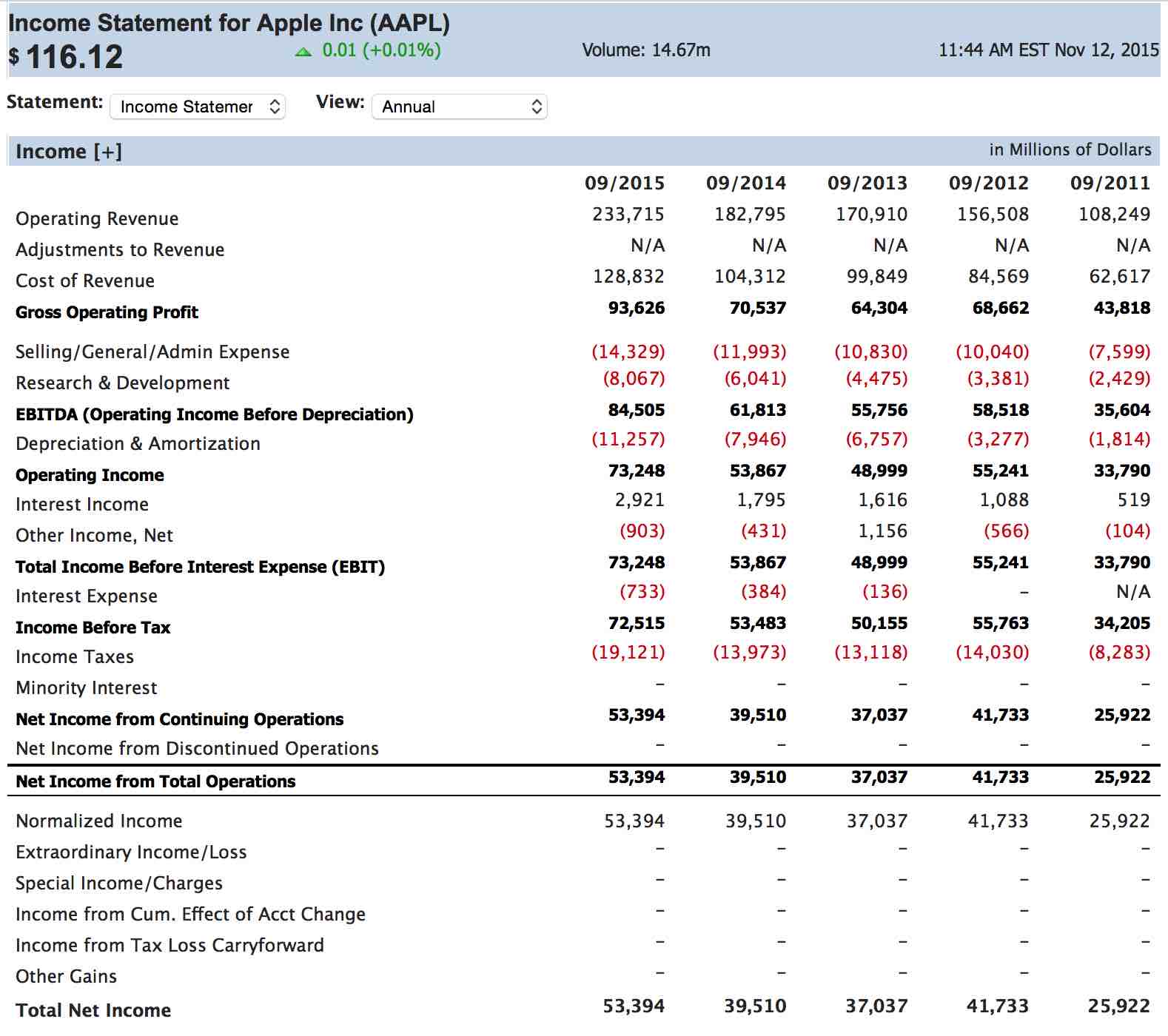

Normalized income statement example. We use the income statements from the previous year to calculate normalized earnings per share. When a company has high normalized earnings per share, it clearly shows. When a new york judge delivers a final ruling in donald j.

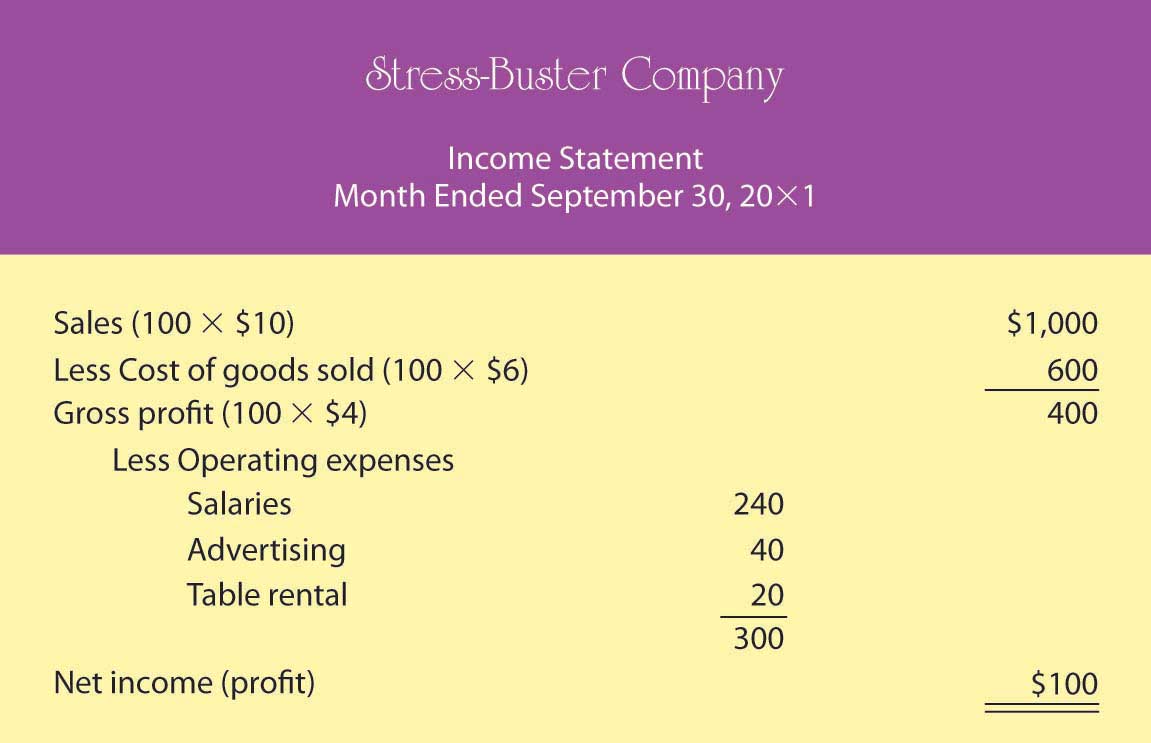

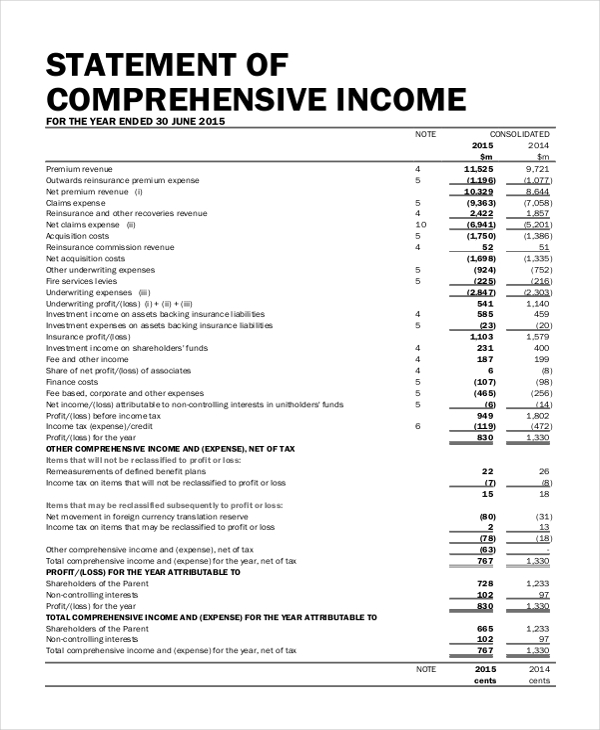

Normalized ebitda = ebit + d&a + adjustments. So, if your business was similar to the one used in our example, and your sde was. Is a $10 million sales company reporting operating profit of $300,000.

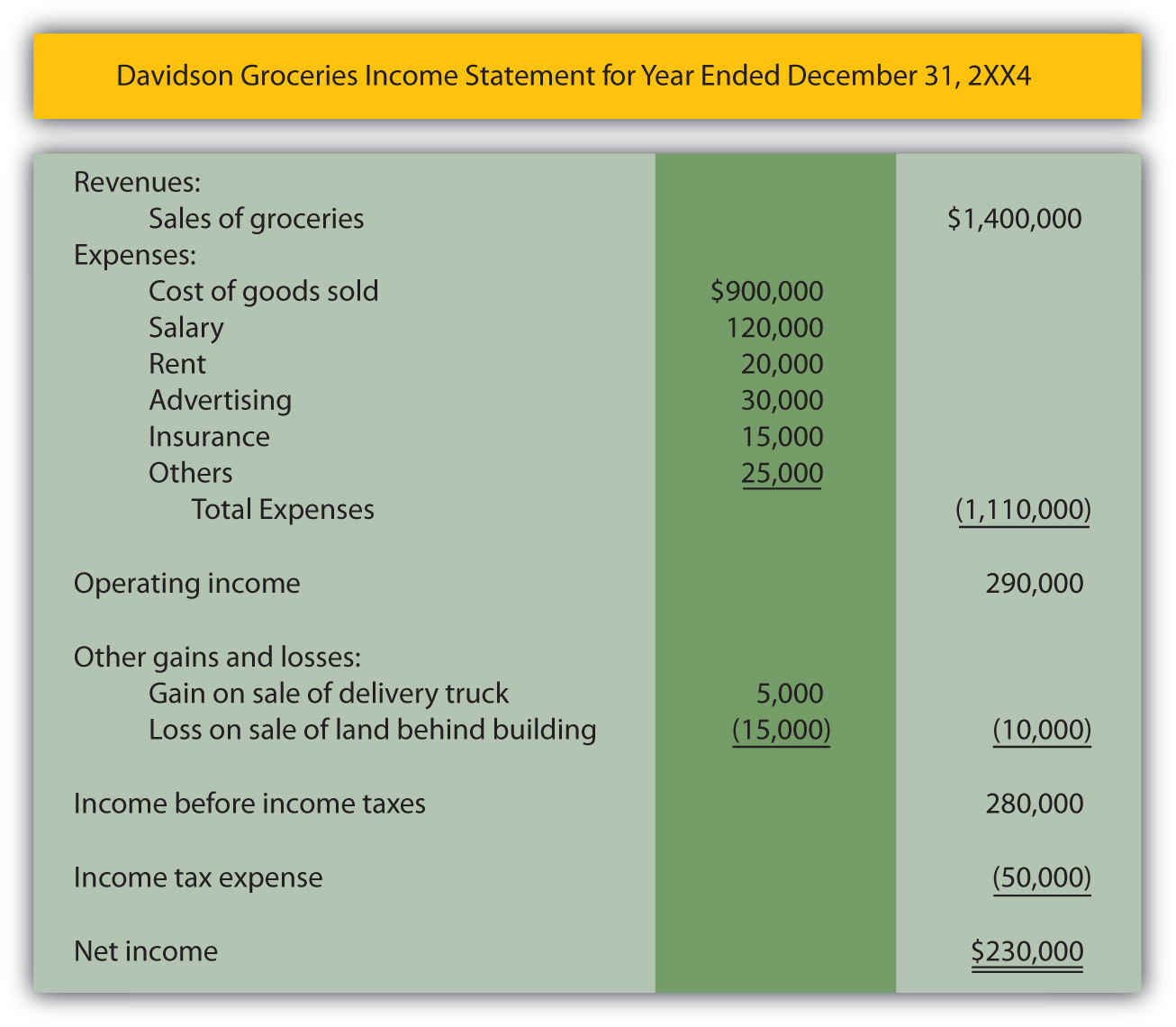

In the figure below, abc, inc. For example, laura johnson is the ceo and founder of x company, and now wants to sell it. Continuing the example, divide $430,000 by 5 to get $86,000 in.

$1,200,000 divided by $350,000 equals 3.42. Her current business generated over. The company announces dividends of $250,000.

For example, if the subject company has a gain (or loss) on the sale of assets in four of the past five years, and after discussing it with management, the. Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions. Consider a concrete example and relate it to the levels of value chart.

Cyclical or seasonal companies are great examples of businesses that benefit from normalizing their earnings. In short, normalized earnings best represent the most. For example, a business that reported $100,000 in annual earnings but paid $100,000 in annual capital expenditures had zero annual free cash flow.

The most common adjustment to get normalized earnings is when smoothening of the sales cycleis necessary or when revenues or expenses must be waded off, and it can be performed in two ways. Current normalization methods are manual and outdated we'll get into #1 soon, but let's start by walking through current methods. Total shares outstanding is at.

Earnings per share formula example. Revenue/sales sales revenue is the company’s revenue from sales or services, displayed at the very top of the statement. Normalized earnings are an organization’s reported profits, adjusted to remove the impact of seasonality, as well as unusual revenues and expenses.

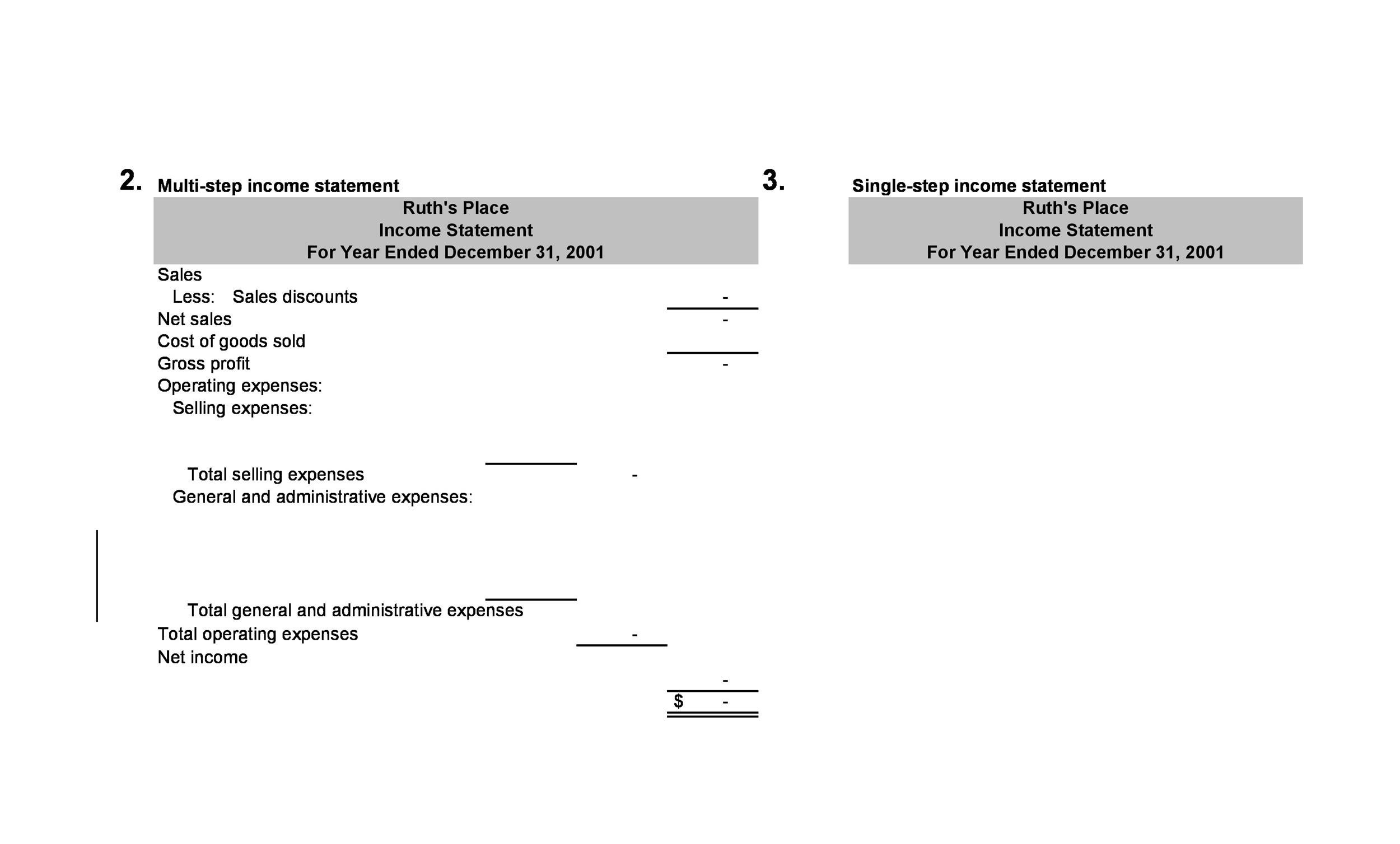

The most common income statement items include: Some common examples of three types of normalization adjustments include the following: A normalized statement reflects on the usual transaction of a company.

Normalization adjustments on the income statement help reflect a more accurate level of earnings and cash flow produced by operations. Following are some of the examples of how to normalize a financial statement. The first case is when a company in possession of a fleet of old vehicles replaces the depreciating assets with a new.